Euro took a sharp dive today following disappointing PMI data that fueled fresh speculation about ECB potentially moving up its anticipated rate cut. Markets had been bracing for a December cut, timed with the release of new economic forecasts. However, the mounting risks of stagnation and even recession in the Eurozone have prompted discussions that ECB could pull the trigger as early as October. Despite this, there’s still a chance ECB might hold off in November but make a more aggressive 50bps cut in December. The situation remains fluid, and markets are bracing for volatility as incoming data could quickly shift expectations.

In the broader currency markets, Australian Dollar remains the strongest performer of the day, though it’s showing sign of fatigue against Dollar. New Zealand Dollar follows closely behind while Yen has recovered from earlier losses as risk appetite in Europe turned cautious. Euro, under pressure from weak PMI figures, is now one of the day’s worst performers, dragging down the British Pound in its wake. Dollar is the third weakest, as it struggles to find firm direction. Meanwhile, Swiss Franc and Canadian Dollar remain relatively stable, with no major moves in either direction.

In the upcoming Asian session RBA is widely expected to keep its interest rate unchanged at 4.35%. The RBA is expected to maintain its cautiously hawkish stance, keeping all options open, ruling nothing in or out. Overall, this meeting may prove uneventful. The real pivot one is November’s when the central bank will have access to Q3 CPI data and updated economic projections. A clearer picture could be seen about whether RBA will be ready to initiate rate cuts in February next year.

Technically, AUD/CAD is trying to resume the up trend from 0.8562 but has yet to defeat 0.9262 resistance with conviction. Nevertheless, further rise will remain in favor as long as 0.9195 resistance turn support holds. Sustained trading above 0.9262 will target 100% projection of 0.8851 to 0.9195 from 0.9016 at 0.9427.

In Europe, at the time of writing, FTSE is up 0.01%. DAX is up 0.63%. CAC is down -0.07%. UK 10-year yield is up 0.028 at 3.930. Germany 10-year yield is down -0.034 at 2.176. Earlier in Asia, Japan was on holiday. Hong Kong HSI fell -0.06%. China Shanghai SSE rose 0.44%. Singapore Strait Times rose 0.38%.

Fed’s Bostic justifies 50bps rate cut amid faster inflation progress, labor market weakness

In a speech today, Atlanta Fed President Raphael Bostic shed light on his support for last week’s 50bps rate cut, citing faster-than-expected improvements in inflation and labor market cooling.

“Progress on inflation and the cooling of the labor market have emerged much more quickly than I imagined at the beginning of the summer,” Bostic remarked. He now sees a path to normalizing monetary policy sooner than anticipated.

Bostic acknowledged that his “residual concern” about inflation could have led him to favor a smaller reduction. However, a 25bps cut “would belie growing uncertainty about the weakening of the labor market,” he added.

Fed’s Kashkari backs 50bps cut, shifts focus to labor market weakness

In an essay, Minneapolis Fed President Neel Kashkari provided insight into his support for last week’s 50bps rate cut, despite not having a vote on the decision.

“We have made substantial progress bringing inflation back down toward our 2 percent target, and the labor market has softened,” he said. Kashkari noted that the balance of risks has “shifted away from higher inflation” and toward risk of further weakening of the labor market, justifying the need for a lower federal funds rate.

He acknowledged that even after the substantial 50bps reduction, “the overall stance of monetary policy remains tight.”

Kashkari further pointed out that the economy’s unexpected resilience despite high policy rates might indicate a temporary or even structural rise in the neutral rate. “The longer this economic resilience continues, the more signal I take that the temporary elevation of the neutral rate might in fact be more structural,” he explained.

Looking ahead, Kashkari highlighted that future policy decisions would depend on incoming data related to economic activity, labor markets, and inflation.

UK PMI composite falls slightly to 52.9, soft landing and further BoE cut in sight

UK’s economic growth showed signs of moderation in September, with PMI Manufacturing slipping from 52.5 to 51.5, while PMI Services declined from 53.7 to 52.8. Consequently, PMI Composite also dropped to 52.9 from 53.8, indicating a slight deceleration in overall activity.

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, noted that the data brings “encouraging news,” pointing to robust economic growth alongside a cooling in inflationary pressures. He highlighted that the UK economy appears to be heading for a “soft landing” as inflation seems to be easing without the need for further significant rate hikes by BoE.

While output growth slowed in both manufacturing and services, Williamson downplayed concerns, stating that the survey data is still consistent with GDP growth of around 0.3% in Q3, aligning with BoE forecasts. The cooling in services inflation, now at its lowest level since February 2021, is particularly notable. This progress brings the BoE’s 2% inflation target closer within reach and supports the possibility of further rate cuts before the end of 2024.

Eurozone PMI composite falls to 48.9, Oct ECB rate cut on the table

Eurozone economic activity showed further signs of weakness in September as both manufacturing and services sectors struggled. PMI Manufacturing Index dropped from 45.8 to 44.8, a nine-month low, while PMI Services fell from 52.9 to 50.5, a seven-month low. As a result, PMI Composite slid back into contraction, dropping farm 51.0 to 48.9—its lowest in eight months.

Cyrus de la Rubia, Chief Economist at HCOB expressed growing concerns that Eurozone is “heading towards stagnation.” The decline in the Composite PMI in September marked the largest drop in 15 months. This weakening momentum is particularly worrying as both new orders and order backlogs are rapidly decreasing, signaling that further economic deterioration is likely.

The manufacturing sector, in particular, is in a prolonged slump, with the recession now stretching into its 27th consecutive month. Job cuts in the manufacturing sector have accelerated, with layoffs occurring at the fastest pace since August 2020. Even the services sector, which had been a bright spot for growth, is now showing signs of cooling, with employment growth nearly flat for the fourth straight month.

Input and output price inflation have eased, particularly in the services sector. With ongoing economic contraction, the possibility of a rate cut in October is “very well be on the table”, de la Rubia noted.

Germany’s PMI Manufacturing fell from 42.4 to 40.3 in September, marking a 12-month low. PMI Services dropped to from 51.2 to 50.6, a six-month low. PMI Composite PMI declined from 48.4 to 47.2, a seven-month low.

France PMI Services dropped significantly from 55.0 to 48.3, marking a six-month low. The broader PMI Composite also fell from 53.1 to 47.4, an eight-month low, signaling a shift back to contraction. While PMI Manufacturing saw a slight uptick from 43.9 to 44.0, it remains in contractionary territory.

Australian PMI manufacturing hits 52-month low, composite in contraction

Australia’s economic activity continued to slow in September, with the Judo Bank Manufacturing PMI dropping to 46.7, its lowest in 52 months, down from 48.5 in August. The Services PMI also declined, slipping to 50.6 from 52.5, while the Composite PMI fell back into contraction, down from 51.7 to 49.8, marking an 8-month low.

Matthew De Pasquale, Economist at Judo Bank, noted that the recent PMI weakness suggests households are saving more of the government stimulus than anticipated. He added that “the economy is gradually bringing supply and demand into balance,” supporting the case for maintaining the current cash rate rather than hiking it later this year.

Employment growth also showed signs of slowing, with the employment index barely in expansion at 50.8. Additionally, output price index, which tracks businesses raising consumer prices, hit its lowest level since January 2021. Although input prices dropped, they remain above pre-pandemic averages, signaling lingering inflationary pressures.

New Zealand’s exports fell -0.1% yoy in Aug, imports down -1.0% yoy

New Zealand’s goods trade balance posted deficit of NZD -2.2B, substantially larger than the expected deficit of NZD -155m. This widening gap is attributed to a slight decrease in both goods exports and imports. Goods exports fell by NZD -6.1m, or 0.1% yoy, to NZD 5.0B, while goods imports decreased by NZD -70m, or -1.0% yoy, to NZD 7.2B.

The decline in exports was primarily due to weaker trade with China, New Zealand’s largest trading partner. Exports to China fell by NZD -195m, or 16% yoy. In contrast, exports to other key markets saw gains. Shipments to Japan jumped by 39% yoy, while exports to the US and the EU rose by 3.1% yoy and 5.9% yoy, respectively.

On the import side, China, the EU, and Australia all saw notable declines in the value of goods imported by New Zealand, with China down -6.4% yoy, the EU down -8.2% yoy, and Australia down -12% yoy. However, imports from the US and South Korea surged. Goods from the US increased by NZD 154m (24% yoy), and imports from South Korea were up by a substantial NZD 185m (39% yoy).

EUR/GBP Mid-Day Outlook

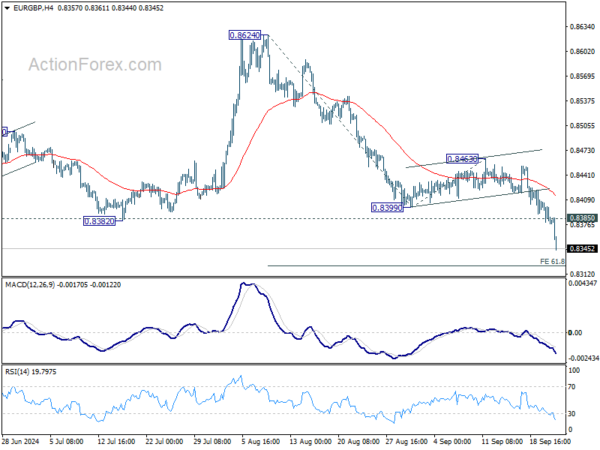

Daily Pivots: (S1) 0.8367; (P) 0.8390; (R1) 0.8403; More…

EUR/GBP’s decline accelerates to as low as 0.8344 so far and intraday bias stays on the downside for 61.8% projection of 0.8624 to 0.8399 from 0.8463 at 0.8324. Firm break there will target 100% projection at 0.8237 next. On the upside, above 0.8385 minor resistance will turn intraday bias neutral and bring consolidations. But outlook will stay bearish as long as 0.8463 resistance holds, in case of recovery.

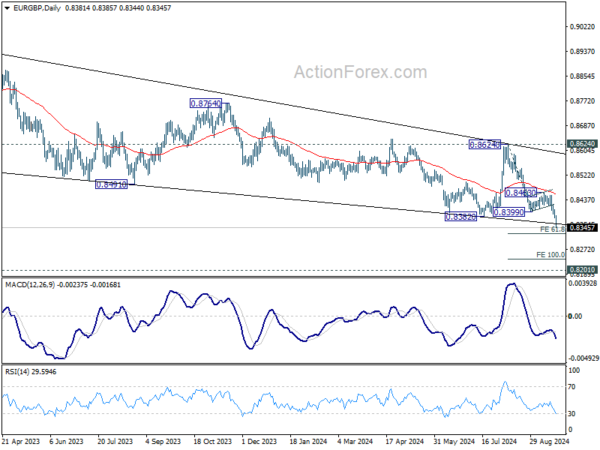

In the bigger picture, down trend from 0.9267 (2022 high) is resuming. Next target is 0.8201 (2022 low), but strong support should be seen there to bring rebound. Outlook will remain bearish as long as 0.8624 resistance holds even in case of strong rebound.

Economic Indicators Update

| GMT | CCY | EVENTS | ACT | F/C | PP | REV |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Trade Balance (NZD) Aug | -2203M | -155M | -963M | -1016M |

| 23:00 | AUD | Manufacturing PMI Sep P | 46.7 | 48.5 | ||

| 23:00 | AUD | Services PMI Sep P | 50.6 | 52.5 | ||

| 07:15 | EUR | France Manufacturing PMI Sep P | 44.0 | 44.3 | 43.9 | |

| 07:15 | EUR | France Services PMI Sep P | 48.3 | 53 | 55 | |

| 07:30 | EUR | Germany Manufacturing PMI Sep P | 40.3 | 42.4 | 42.4 | |

| 07:30 | EUR | Germany Services PMI Sep P | 50.6 | 51.1 | 51.2 | |

| 08:00 | EUR | Eurozone Manufacturing PMI Sep P | 44.8 | 45.7 | 45.8 | |

| 08:00 | EUR | Eurozone Services PMI Sep P | 50.5 | 52.3 | 52.9 | |

| 08:30 | GBP | Manufacturing PMI Sep P | 51.5 | 52.3 | 52.5 | |

| 08:30 | GBP | Services PMI Sep P | 52.8 | 53.5 | 53.7 | |

| 12:30 | CAD | New Housing Price Index M/M Aug | 0.10% | 0.20% | ||

| 13:45 | USD | Manufacturing PMI Sep P | 48.6 | 47.9 | ||

| 13:45 | USD | Services PMI Sep P | 55.3 | 55.7 |