Dollar softened across the board in today’s Asian session, dragged down by extended in US Treasury yields. Investors appear to be setting aside the first presidential debate between Kamala Harris and Donald Trump, focusing instead on the highly anticipated US CPI report, which might hopefully provide clearer direction on Fed’s upcoming interest rate cut.

Market expectations suggest that headline CPI will ease from 2.9% to 2.6% in August. However, core CPI, which excludes volatile food and energy prices, is forecast to remain unchanged at 3.2%. This would indicate that disinflationary momentum may be losing steam again, with services and shelter costs keeping core inflation elevated.

A downside surprise in today’s report could shift the odds toward a larger 50bps rate cut by the Fed at next week’s meeting. But the market reaction could be complicated: a significant undershoot in inflation could, at the same time, signal weakening demand, raising concerns about a broader economic slowdown.

As of now, futures markets are pricing in a 33% chance of a 50bps rate cut, with the majority (67%) betting on a smaller 25bps cut. Looking further ahead, markets are already pricing in a total of 75bps in cuts by year-end, with 90% chance of 100bps in reductions and 53% chance of 125bps.

In terms of market performance, Yen is the standout performer so far this week, buoyed by the drop in Treasury yields. Dollar and Swiss Franc follow closely behind. Euro is the weakest, with New Zealand Dollar and British Pound also underperforming, while Australian and Canadian Dollars are trading in the middle of the pack.

Technically, Gold will be monitored for confirming Dollar’s next move in reaction to US CPI release. Consolidation from 2531.52 is still extending for now, but outlook remains bullish as long as 2470.76 support holds. Decisive break of 2531.52 will confirm larger up trend resumption. Next target will be 61.8% projection of 2364.18 to 2531.52 from 2471.76 at 2575.17.

In Asia, at the time of writing, Nikkei is down -0.81%. Hong Kong HSI is down -1.41%. China Shanghai SSE is down -0.86%. Singapore Strait Times is up 0.44%. Japan 10-year JGB yield is down -0.030 at 0.865. Overnight, DOW fell -0.23%. S&P 500 rose 0.45%. NASDAQ rose 0.84%. 10-year yield fell -0.51 to 3.646.

RBA’s Hunter anticipates slow cooling of Australia’s labor market

In a speech today, RBA Assistant Governor Sarah Hunter highlighted that while conditions in the Australian labor market have eased since late 2022, the market remains “tight relative to full employment.”

Looking ahead, Hunter expects labor demand to slow in comparison to labor supply, which should bring the market “into better balance” over the coming quarters. She noted that part of this adjustment is likely to come through a “decline in average hours” worked rather than sharp cuts to overall employment.

Employment growth is expected to persist but at a slower pace, lagging behind population growth. As a result, underutilization measures, including the unemployment rate, are projected to “continue rising gradually.” This rise is expected to stabilize once GDP growth returns to a level more consistent with Australia’s underlying economic trend.

Hunter’s comments underscore RBA’s outlook on the labor market, and the hawkish stance that it’s not nearing the start of rates reduction cycle yet.

BoJ’s Nakagawa signals more rate hikes if economic outlook met

In a speech today, BoJ board member Junko Nakagawa indicated that the central bank will raise interest rates further if the economic outlook aligns with their forecasts. Nevertheless, she also emphasized the need to carefully consider how such moves might impact the broader economy and price stability.

“Given real interest rates are currently very low, we will adjust the degree of monetary support, from the standpoint of sustainably and stably achieving our 2% inflation target, if our economic and price forecasts are met,” she noted.

Nakagawa acknowledged Japan’s tight labor market and rising import prices as upside risks to the inflation outlook. While affirming that Japan’s economic fundamentals remain strong, she highlighted the importance to “look back upon market developments” following July’s rate hike before making any further rate adjustments.

Looking ahead

UK GDP and production are the main highlight in European session. Later in the day, US CPI will be the main event.

USD/JPY Daily Outlook

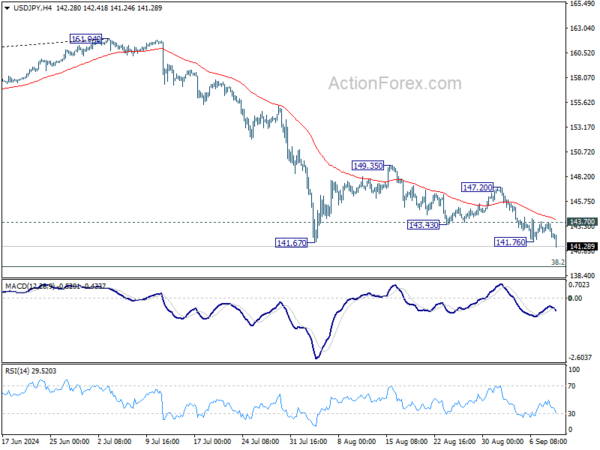

Daily Pivots: (S1) 141.86; (P) 142.79; (R1) 143.37; More…

USD’s fall from 161.94 resumed by breaking through 141.76 temporary low. Intraday bias is back on the downside for 140.25 support, and possibly further to 139.26 fibonacci level too. On the upside, above 143.70 minor resistance will turn intraday bias neutral first. But outlook will stay bearish as long as 147.20 resistance holds, in case of recovery.

In the bigger picture, fall from 161.94 medium term top is seen as correcting whole up trend from 102.58 (2021 low). Deeper decline could be seen to 38.2% retracement of 102.58 to 161.94 at 139.26, which is close to 140.25 support. Strong support could be seen there to bring rebound. But in any case, risk will stay on the downside as long as 55 W EMA (now at 148.93) holds. Sustained break of 139.26 would open up deeper medium term decline to 61.8% retracement at 125.25.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 06:00 | GBP | GDP M/M Jul | 0.20% | 0.00% | ||

| 06:00 | GBP | Industrial Production M/M Jul | 0.30% | 0.80% | ||

| 06:00 | GBP | Industrial Production Y/Y Jul | -0.20% | -1.40% | ||

| 06:00 | GBP | Manufacturing Production M/M Jul | 0.20% | 1.10% | ||

| 06:00 | GBP | Manufacturing Production Y/Y Jul | -0.10% | -1.50% | ||

| 06:00 | GBP | Goods Trade Balance (GBP) Jul | -18.0B | -18.9B | ||

| 12:30 | USD | CPI M/M Aug | 0.20% | 0.20% | ||

| 12:30 | USD | CPI Y/Y Aug | 2.60% | 2.90% | ||

| 12:30 | USD | CPI Core M/M Aug | 0.20% | 0.20% | ||

| 12:30 | USD | CPI Core Y/Y Aug | 3.20% | 3.20% | ||

| 14:30 | USD | Crude Oil Inventories | 0.9M | -6.9M |