The August US non-farm payroll report has been interpreted as largely dovish by the markets. Job growth showed clear signs of slowing, but the slight decrease in the unemployment rate has helped ease immediate recession fears. As a result, market expectations for a 50 bps rate cut by Fed this month have now risen above 50%. Dollar is broadly sold off in response, and 10-year Treasury has a notable decline.

Nevertheless, while the data points to a cooling labor market, it wasn’t severe enough to suggest a sharp economic downturn. Hence, the drop in US stock futures has been mild, indicating that investor sentiment remains cautious but not overly negative. There is indeed prospect of a strong bounce in major stock indexes during the rest of the session.

As the week comes to a close, Japanese Yen has solidified its position as the strongest performer. It is likely to maintain its lead unless US yields stage a sharp rebound. Swiss Franc is the second strongest, slightly outperforming the Euro.

On the other hand, Australian and New Zealand Dollars continue to struggle as the worst performers for now. Canadian Dollar has seen a notable rally, after release of domestic job data, which has pushed the greenback down to the third-worst performer. If US stock markets manage to stage a rally and recover more of this week’s losses, there is potential for Dollar to end as the weakest currency of the week.

US NFP grows 142k in Aug, unemployment rate ticks down to 4.2%

US non-farm payroll employment rose 142k in August, missing expectation of 163k. Growth was also well below the average monthly gain of 202k over the prior 12 months. Previous month’s growth was revised down from 114k to 89k.

Unemployment rate ticked down from 4.3% to 4.2%, matched expectations. Participation rate was unchanged at 62.7%.

Average hourly earnings rose 0.4% mom, above expectation of 0.2% mom.

Canada’s employment rises 22.1k in Aug, unemployment rate jumps to 6.6%

Canada’s employment grew 22.1k in August, below expectation of 25.0k. The 66k gains in part-time work were offset by -44k decline in full-time work.

Unemployment rate rose from 6.4% to 6.6%, above expectation of 6.5%, marking the highest level since May 2017 outside of the pandemic period. Employment rate fell -0.1% to 60.8%.

Average hourly wages rose 5.0% yoy, slowed from July’s 5.2% yoy.

Japan’s household spending rises only 0.1% in Jul, lagging expectations despite wage growth

Japan’s household spending edged up by 0.1% yoy in July, falling well short of the expected 1.2% yoy increase. While this marked the first annual rise in three months, the modest growth suggests that households are still holding back on spending due to inflationary pressures.

The increase was driven by a 17.3% yoy surge in housing outlays, with more people undertaking home renovations such as installing new kitchens and bathtubs, according to the Ministry of Internal Affairs and Communications. Entertainment spending also grew by 5.6% yoy, supported by purchases of televisions for the Paris Olympics. Expenditures on domestic and overseas package tours saw significant jumps of 47.0% yoy and 62.6% yoy, respectively.

Despite the tepid spending growth, the average monthly income of salaried households with at least two people rose by 5.5% yoy in real terms, marking the third consecutive monthly increase after 3.1% yoy and 3.0% yoy gains in June and May.

A ministry official noted that “spending has not increased as much as wages grew,” suggesting that some households might be saving part of their higher incomes. The ministry plans to continue monitoring how rising wages impact consumption going forward.

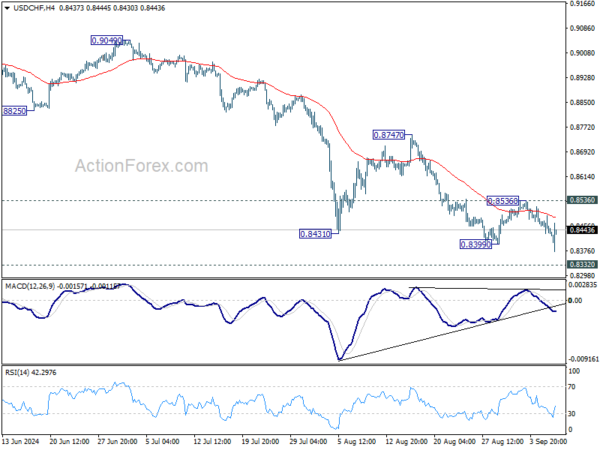

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.8419; (P) 0.8455; (R1) 0.8476; More…

USD/CHF’s fall from 0.9223 resumed by breaching 0.8399 support. Intraday bias is back on the downside for retesting 0.8332 low. decisive break there will indicate larger down trend resumption. However, break of 0.8536 resistance will now confirm short term bottoming, and turn bias back to the upside for 0.8747 resistance.

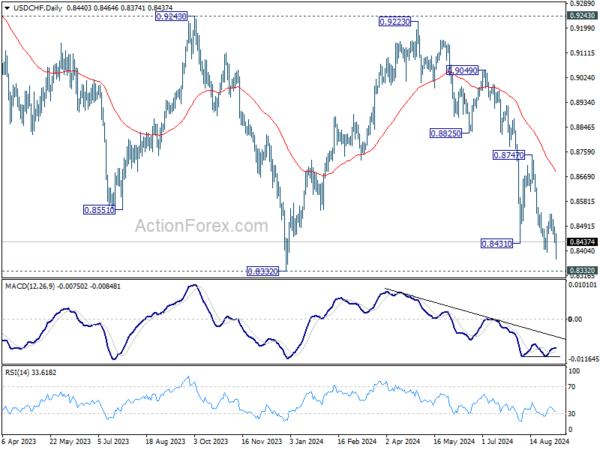

In the bigger picture, price actions from 0.8332 (2023 low) are currently seen as a medium term corrective pattern, with fall from 0.9223 as the second leg. Strong support could be seen from 0.8332 to bring rebound. Yet, overall outlook will continue to stay bearish as long as 0.9243 resistance holds. Firm break of 0.8332, however, will resume larger down trend from 1.0146 (2022 high).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Overall Household Spending Y/Y Jul | 0.10% | 1.20% | -1.40% | |

| 05:00 | JPY | Leading Economic Index Jul P | 109.5 | 109.4 | 109 | |

| 06:00 | EUR | Germany Industrial Production sM/M Jul | -2.40% | -0.20% | 1.40% | |

| 06:00 | EUR | Germany Trade Balance (EUR) Jul | 16.8B | 21.2B | 20.4B | |

| 06:45 | EUR | France Trade Balance (EUR) Jul | -5.9B | -5.7B | -6.1B | |

| 06:45 | EUR | France Industrial Output M/M Jul | -0.50% | -0.20% | 0.80% | -6.0B |

| 07:00 | CHF | Foreign Currency Reserves (CHF) Aug | 694B | 704B | ||

| 09:00 | EUR | Eurozone GDP Q/Q Q2 | 0.20% | 0.30% | 0.30% | |

| 12:30 | USD | Nonfarm Payrolls Aug | 142K | 163K | 114K | 89K |

| 12:30 | USD | Unemployment Rate Aug | 4.20% | 4.20% | 4.30% | |

| 12:30 | USD | Average Hourly Earnings M/M Aug | 0.40% | 0.30% | 0.20% | -0.10% |

| 12:30 | CAD | Net Change in Employment Aug | 22.1K | 25.0K | -2.8K | |

| 12:30 | CAD | Unemployment Rate Aug | 6.60% | 6.50% | 6.40% | |

| 14:00 | CAD | Ivey PMI Aug | 55.3 | 57.6 |