Dollar is trading with a slightly firm tone this week, though overall forex market activity has been relatively subdued. It’s worth noting that last month’s sharp selloff in US stocks was actually started with disappointing ISM manufacturing data, which was then exacerbated by the non-farm payrolls report. Given this backdrop, today’s release could trigger volatility if there are any surprises.

The US manufacturing sector has been contracting since late 2022, as indicated by the ISM index. The brief uptick to 50.3 in March, which signaled a return to expansion, turned out to be short-lived, with the index subsequently falling for four consecutive months, reaching a low of 46.8 in July. For August, a modest recovery to 47.8 is anticipated, but any negative surprise could reignite fears of a recession and lead to renewed market jitters.

In Europe, attention will be on Swiss CPI and GDP figures. Outgoing SNB Chair Thomas Jordan recently expressed concerns over the impact of a strong Swiss Franc and weak European demand on the Swiss industry. If today’s GDP data disappoints, it could heighten concerns at the SNB, while a lower-than-expected inflation reading might provide the central bank with the flexibility to consider a 50 bps rate cut this month, rather than the widely anticipated 25bps.

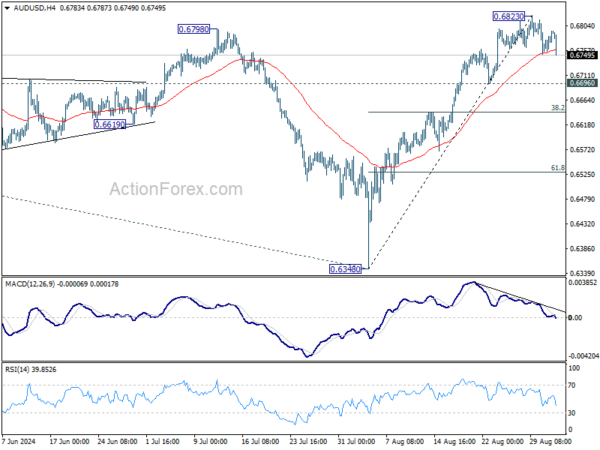

Technically, AUD/USD is extending the retreat from 0.6823. While further fall cannot be ruled out, strong support should be seen from 0.6696 to bring rebound, and then resumption of whole rise from 0.6348. However, firm break of 0.6696 will indicate that deeper correction is underway for 38.2% retracement of 0.6348 to 0.6823 at 0.6642 and possibly below. The pair’s next move will largely depend on the overall risk sentiment in the market as traders digest the upcoming economic data.

In Asia, at the time of writing, Nikkei is up 0.22%. Hong Kong HSI is down -0.38%. China Shanghai SSE is down -0.50%. Singapore Strait Times is up 0.25%. Japan 10-year JGB yield is up 0.0077 at 0.919.

NZIER expects Oct RBNZ rate cut, further easing hinges on demand recovery

The New Zealand Institute of Economic Research indicated today that it expects RBNZ to implement another interest rate cut during its October meeting. This follows RBNZ’s decision in August to bring forward its easing cycle in response to “deterioration in economic outlook.” However, NZIER notes that the pace of further easing remains highly uncertain, with a potential pause in November depending on how quickly demand recovers.

Weaker demand has become a significant concern for businesses, with 61% of firms identifying it as the primary constraint on their operations. This declining demand is also having an impact on the labor market, where there is now more slack as companies reduce hiring in response to the softer economic environment.

Looking ahead, NZIER forecasts GDP growth to remain subdued over the next year, contributing to further decline in inflation. The institute predicts that annual CPI inflation will fall back within RBNZ’s target band by the end of this year, which underpins its expectation for another Official OCR cut in October.

However, the uncertainty surrounding the economic recovery suggests that any further rate cuts after October will be closely tied to the extent of demand recovery, with the November meeting likely to be a key decision point.

New Zealand’s terms of trade improve in Q2 despite decline in export volumes

New Zealand’s terms of trade saw a solid improvement in the second quarter of 2024, rising by 2.0%. This increase was driven by a 5.2% rise in export prices, which outpaced the 3.1% increase in import prices. However, the value of exports decreased by -1.5% to NZD 16.6 billion, largely due to a -4.3% drop in export volumes, even as higher prices provided some support.

Dairy products played a significant role in the export dynamics, with prices rising by 8.0%. Despite this, dairy export volumes fell sharply by -10%, leading to an 8-.0% decline in the overall value of dairy exports. The meat sector, on the other hand, performed better, with prices rising by 7.3%, volumes increasing by 4.1%, and the total value of meat exports up by 6.5%.

On the import side, the total value rose by 4.0% to NZD 18.9B, supported by a 3.2% increase in import volumes. Petroleum and petroleum products were notable contributors, with prices up by 4.0%. However, petroleum volumes declined by -8.0%, leading to a -4.4% decrease in the overall value of these imports.

Looking ahead

Swiss CPI and GDP are the two main focuses in European session. Later in the day, US ISM manufacturing will take center stage.

USD/CHF Daily Outlook

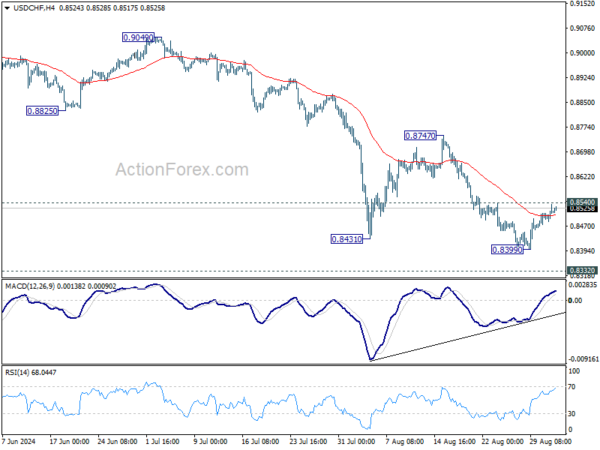

Daily Pivots: (S1) 0.8489; (P) 0.8513; (R1) 0.8542; More…

Intraday bias in USD/CHF remains neutral at this point and more consolidations could be seen above 0.8399. Further decline is expected as long as 0.8540 resistance holds. Break of 0.8339 will resume the fall from 0.9223 and target 0.8332 low. However, considering bullish convergence condition in 4H MACD, firm break of 0.8540 will confirm short term bottoming, and turn bias back to the upside for 0.8747 resistance instead.

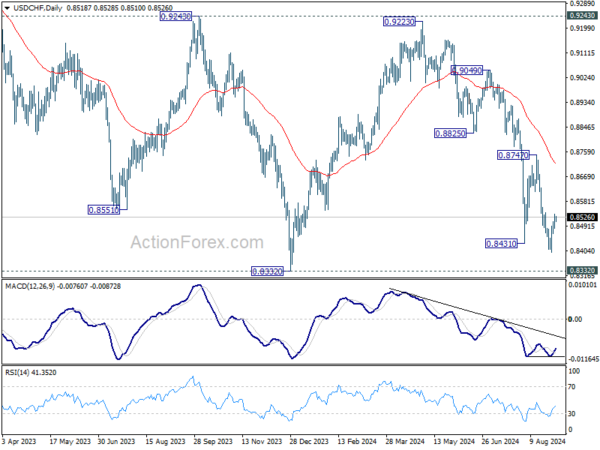

In the bigger picture, price actions from 0.8332 (2023 low) are currently seen as a medium term corrective pattern, with fall from 0.9223 as the second leg. Strong support could be seen from 0.8332 to bring rebound. Yet, overall outlook will continue to stay bearish as long as 0.9243 resistance holds. Firm break of 0.8332, however, will resume larger down trend from 1.0146 (2022 high).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Terms of Trade Index Q2 | 2.00% | 2.80% | 5.10% | |

| 23:50 | JPY | Monetary Base Y/Y Aug | 0.60% | 0.60% | 1.00% | |

| 01:30 | AUD | Current Account (AUD) Q2 | -10.7B | -5.5B | -4.9B | -6.3B |

| 06:30 | CHF | CPI M/M Aug | 0.10% | -0.20% | ||

| 06:30 | CHF | CPI Y/Y Aug | 1.20% | 1.30% | ||

| 07:00 | CHF | GDP Q/Q Q2 | 0.60% | 0.50% | ||

| 13:30 | CAD | Manufacturing PMI Aug | 47.8 | |||

| 13:45 | USD | Manufacturing PMI Aug F | 48 | 48 | ||

| 14:00 | USD | ISM Manufacturing PMI Aug | 47.8 | 46.8 | ||

| 14:00 | USD | ISM Manufacturing Prices Paid Aug | 52.5 | 52.9 | ||

| 14:00 | USD | ISM Manufacturing Employment Aug | 43.4 | |||

| 14:00 | USD | Construction Spending M/M Jul | 0.10% | -0.30% |