Trading activity was notably subdued in the final Asian session of the week and August, but with a busy economic calendar ahead, volatility could pick up soon. Euro remains the weakest performer of the week, as the broad slowdown in inflation, reflected in data from Germany, Spain, Belgium, and Ireland, points towards another ECB rate cut in September. This trend is expected to be further confirmed by today’s Eurozone CPI flash report.

Currently, economists are still anticipating that ECB will continue to cut interest rates at a quarterly pace, with reductions in September and December. However, the faster-than-expected decline in inflation is raising the possibility of a more aggressive easing path by ECB. If Germany’s economy deteriorates further into recession and the temporary boost from the Olympics fades quickly in France, ECB may be compelled to act more forcefully.

Meanwhile, Dollar is attempting to recover this week, but it is struggling to find clear momentum, especially against commodity currencies. Yesterday’s data showed an upward revision of US Q2 GDP to a 3% annualized rate, easing some recession fears. However, Dollar’s gains have been capped by resilient risk sentiment, highlighted by DOW reaching another record high. Investors are now focused on today’s release of the PCE core price index, Fed’s preferred inflation gauge, which could offer more insights into the pace of the anticipated easing cycle beginning in September.

For the week overall, New Zealand Dollar is the strongest performer, followed by Canadian Dollar and Swiss Franc. British Pound, the second worst, is trailing just ahead of Euro, while Yen is also on the weaker side. Dollar and Australian Dollar are positioned in the middle of the performance chart.

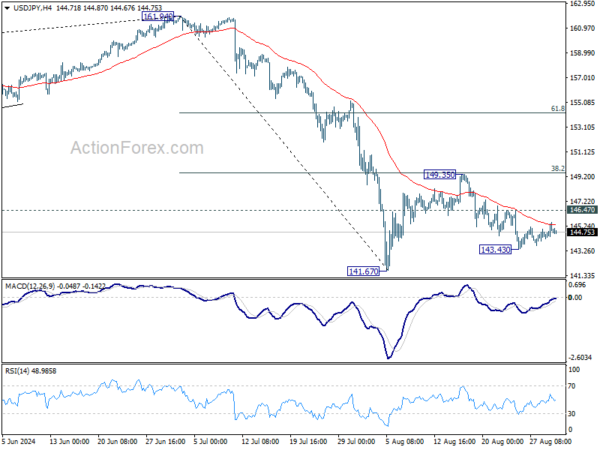

Technically, USD/JPY’s decline from 149.35 remains alive despite weak downside momentum. Break of 143.43 will bring deeper fall to retest 141.67 low. Further break there will resume whole fall from 161.94. Nevertheless, break of 146.47 minor resistance will bring stronger rebound towards 149.35 resistance, with prospect of resuming the rise from 141.67 low. The next significant move could depend on the market’s reaction to today’s US PCE data, particularly its impact on treasury yields.

In Asia, at the time of writing, Nikkei is up 0.58%. Hong Kong HSI is up 1.48%. China Shanghai SSE is up 1.25%. Singapore Strait Times is up 0.60%. Japan 10-year JGB yield is up 0.0167 at 0.907. Overnight, DOW rose 0.59% S&P 500 fell -0.00%. NASDAQ fell -0.23%. 10-year yield rose 0.026 to 3.867.

SNB’s Jordan: Strong Franc and weak European demand squeeze Swiss industry

SNB Chairman Thomas Jordan, who is set to step down at the end of September, highlighted the challenges facing Swiss industry due to the recent strength of the Swiss Franc and weak demand in Europe. Speaking at an event overnight, Jordan emphasized the difficulties these factors pose for Swiss industrial goods, particularly given that Germany and Europe are the primary markets for the country’s industry.

“Germany and Europe are the main markets for industry. If the growth is weak there, this automatically affects demand for our industrial goods,” Jordan stated. He also acknowledged that the strong exchange rate adds further pressure, noting, “The exchange rate … does not make the situation easier. It makes it difficult for the industry.”

Jordan reaffirmed SNB’s commitment to maintaining price stability, defined as an inflation rate of 0-2%, which he described as a “crucial precondition for prosperity.” He reiterated that interest rates remain SNB’s main tool for achieving this stability, though interventions in currency markets are also on the table if needed.

Looking ahead, markets are currently pricing in a 70% chance of a 25bps rate cut by SNB at their next meeting on September 26, with a 30% probability of a more aggressive 50bps cut.

ECB’s Nagel warns against cutting rates too quickly

Bundesbank President Joachim Nagel delivered a strong message overnight, cautioning that a timely return to price stability cannot be taken for granted.” He emphasized that ECB must tread carefully and “must not lower policy rates too quickly,”

“We are not there yet. While our 2% target is in sight, we have not reached it,” he added.

Nagel highlighted concerns that inflation, although nearing 2% target in late summer, is likely to rebound and remain above target well into 2025 due to persistent increases in service costs.

Addressing the differing views within ECB’s Governing Council, Nagel acknowledged the “intense” debates that typically accompany “turning points in the interest-rate cycle”.

However, he sought to dispel any notion of broader disagreement, stating, “When making their decisions, monetary policymakers are always faced with some degree of uncertainty. That is why a certain diversity of opinion among them as well as scope for their own judgment are considered features, not bugs.”

Japan’s Tokyo inflation accelerates in Aug as production and retail sales miss estimates in Jul

Japan’s Tokyo CPI data for August shows further acceleration in inflation, with core inflation (excluding food) rising to 2.4% yoy, above the expected 2.2%. CPI core has been climbing steadily every month since hitting a bottom of 1.6% yoy in March.

Core-core CPI, which excludes both food and energy, also ticked up to 1.6% from 1.5%, while headline CPI surged to 2.6% from 2.2%.

These figures are often seen as a leading indicator for nationwide trends. Some economists noted that rise in prices growth was primarily driven by the phase-out of government subsidies on utility bills and a spike in rice prices. Underlying inflation trends may moderate in the coming months as these one-time factors dissipate.

Also released today, Japan’s industrial production rose by 2.8% mom in July, slightly below the expected 3.3%. Looking ahead, manufacturers surveyed by the Ministry of Economy, Trade, and Industry anticipate 2.2% increase in output for August, followed by -3.3% contraction in September.

Retail sales growth also slowed to 2.6% yoy in July, down from 3.7% in June, and below the expected 2.9%.

Additionally, the unemployment rate rose to 2.7% from 2.5%, surpassing expectations of it remaining steady at 2.5%. The jobs-to-applicants ratio, however, edged slightly higher to 1.24.

Australia’s retail sales stagnate in Jul as spending momentum stalls

Australia’s retail sales turnover for July showed no growth on a monthly basis, falling short of the expected 0.2% mom increase. This flat result comes after consecutive 0.5% mom increases in both June and May, driven by mid-year sales events.

According to Ben Dorber, head of retail statistics at the Australian Bureau of Statistics, “After rises in the past two months boosted by mid-year sales activity, the higher level of retail turnover was maintained in July.”

However, the detailed breakdown reveals a mixed picture across industries, with most sectors either seeing declines or remaining flat. The only industry to post an increase was food retailing, which managed a modest 0.2% rise.

Looking ahead

The economic calendar is rather busy today. Eurozone CPI flash will be the main highlight in European session, while unemployment rate will also be released. Germany will publish import prices, retail sales and unemployment rate. France consumer spending, Swiss KOF economic barometer, and UK M4 money supply will be published too.

Later in the day, Canada will release monthly GDP. US will release personal income and spending, PCE inflation, and Chicago PMI.

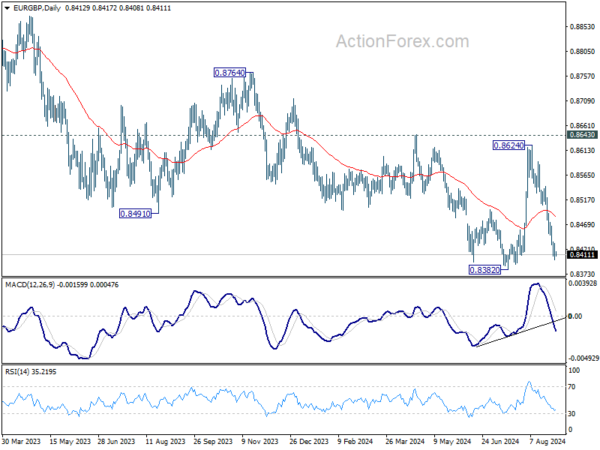

EUR/GBP Daily Outlook

Daily Pivots: (S1) 0.8399; (P) 0.8417; (R1) 0.8430; More….

EUR/GBP’s fall from 0.8624 is still in progress and intraday bias stays on the downside for retesting 0.8382 low. Strong support could be seen from there to bring rebound on first attempt. Above 0.8449 minor resistance will turn intraday bias neutral first. But risk will stay on the downside as long as 55 D EMA (now at 0.8484) holds. Firm break of 0.8382 will confirm larger down trend resumption.

In the bigger picture, while the rebound from 0.8382 is strong, there is no confirmation of trend reversal yet. As long as 0.8643 resistance holds, down trend from 0.9267 could still resume through 0.8382 at a later stage towards 0.8201 (2022 low). However, firm break of 0.8643 will indicate that such down trend has completed, and turn outlook bullish for 0.8764 resistance next.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Building Permits M/M Jul | 26.20% | -13.80% | -17.00% | |

| 23:30 | JPY | Tokyo CPI Y/Y Aug | 2.60% | 2.20% | ||

| 23:30 | JPY | Tokyo CPI core Y/Y Aug | 2.40% | 2.20% | 2.20% | |

| 23:30 | JPY | Tokyo CPI core-core Y/Y Aug | 1.60% | 1.50% | ||

| 23:30 | JPY | Unemployment Rate Jul | 2.70% | 2.50% | 2.50% | |

| 23:50 | JPY | Industrial Production M/M Jul P | 2.80% | 3.30% | -4.20% | |

| 23:50 | JPY | Retail Trade Y/Y Jul | 2.60% | 2.90% | 3.70% | |

| 01:30 | AUD | Retail Sales M/M Jul | 0.00% | 0.20% | 0.50% | |

| 01:30 | AUD | Private Sector Credit M/M Jul | 0.50% | 0.40% | 0.60% | |

| 05:00 | JPY | Housing Starts Y/Y Jul | -1.10% | -6.70% | ||

| 06:00 | EUR | Germany Import Price Index M/M Jul | 0.00% | 0.40% | ||

| 06:00 | EUR | Germany Retail Sales M/M Jul | 0.00% | -1.20% | ||

| 06:45 | EUR | France Consumer Spending M/M Jul | 0.60% | -0.50% | ||

| 06:45 | EUR | France GDP Q/Q Q2 | 0.30% | 0.30% | ||

| 07:00 | CHF | KOF Leading Indicator Aug | 100.6 | 101 | ||

| 07:55 | EUR | Germany Unemployment Change Aug | 61K | 18K | ||

| 07:55 | EUR | Germany Unemployment Rate Aug | 6% | 6% | ||

| 08:30 | GBP | Mortgage Approvals Jul | 61K | 60K | ||

| 08:30 | GBP | M4 Money Supply M/M Jul | 0.50% | 0.50% | ||

| 09:00 | EUR | CPI Y/Y Aug P | 2.20% | 2.60% | ||

| 09:00 | EUR | CPI Core Y/Y Aug P | 2.80% | 2.90% | ||

| 09:00 | EUR | Eurozone Unemployment Rate Jul | 6.50% | 6.50% | ||

| 12:30 | CAD | GDP M/M Jun | 0.10% | 0.20% | ||

| 12:30 | USD | Personal Income M/M Jul | 0.20% | 0.20% | ||

| 12:30 | USD | Personal Spending Jul | 0.50% | 0.30% | ||

| 12:30 | USD | PCE Price Index M/M Jul | 0.20% | 0.10% | ||

| 12:30 | USD | PCE Price Index Y/Y Jul | 2.60% | 2.50% | ||

| 12:30 | USD | Core PCE Price Index M/M Jul | 0.20% | 0.20% | ||

| 12:30 | USD | Core PCE Price Index Y/Y Jul | 2.70% | 2.60% | ||

| 13:45 | USD | Chicago PMI Aug | 44.6 | 45.3 | ||

| 14:00 | USD | Michigan Consumer Sentiment Index Aug F | 67.8 | 67.8 |