Euro fell notably in European session today, as inflation data from both Germany and Spain significantly underperformed expectations. The rapid deceleration in price pressures strengthens the argument for a September rate cut by ECB. With inflation slowing faster than anticipated, there is growing speculation that ECB could have the flexibility to implement two additional rate cuts this year, totaling 100 basis points, to provide much-needed support to the faltering economies of major Eurozone nations like Germany and France.

Despite Euro’s struggles, Swiss Franc has emerged as the day’s weakest performer for the day so far, followed by the Yen, while the common currency is just the third worst. Australian Dollar, on the other hand, has reversed earlier losses against New Zealand Dollar to become the strongest performer of the day. Kiwi also remains buoyant, bolstered by robust business confidence data, making it the second-best performer, with Canadian Dollar trailing in third place. Meanwhile, US Dollar and British Pound are holding steady in middle positions.

In the broader market, US risk sentiment appears to be recovering, with stock futures pointing to a positive market open. The initial jitters caused by Nvidia’s earnings report and its cautious forecast have subsided. Focus is now back on whether DOW can break to new record highs and power through 41376 resistance cleanly. Or, if momentum fades, the index might reverse and test the 40584.47 support to confirm short-term topping by the end of the week.

In Europe, at the time of writing, FTSE is up 0.44%. DAX is up 0.64%. CAC is up 0.75%. UK 10-year yield is up 0.0053 at 3.990. Germany 10-year yield is up 0.016 at 2.277. Earlier in Asia, Nikkei fell -0.02%. Hong Kong HSI rose 0.53%. China Shanghai SSE fell -0.50%. Singapore Strait Times rose 0.40%. Japan 10-year JGB yield fell -0.0047 to 0.890.

US goods trade deficit at USD -102.7B in Jul

US goods exports fell -0.0% mom to USD 172.9B in July. Goods imports fell -3.2% mom to USD 275.6B. Trade balance reported USD -102.7B deficit, larger than expectation of USD -97.1B.

Wholesale inventories rose 0.3% mom to USD 904.9B. Retail inventories rose 0.8% mom to USD 811.4B.

US initial jobless claims fall to 231k, vs exp 234k

US initial jobless claims fell -2k to 231k in the week ending August 24, slightly below expectation of 234k. Four-week moving average of initial claims fell -5k to 232k.

Continuing claims rose 13k to 1868k in the week ending August 17. Four-week moving average of continuing claims fell -250 to 1863k.

ECB’s Lane signals confidence in inflation control with slower wage growth ahead

ECB Chief Economist Philip Lane noted at a conference today that while the second half of this year will still witness “plenty of wage increases,” the momentum is expected to taper off significantly.

Lane emphasized that “the catch-up is peaking now,” suggesting that the pace of wage hikes will slow substantially over the next two years.

Lane highlighted the “lot of progress” made in reducing underlying price pressures, pointing out the rising optimism surrounding the anticipated deceleration in wage growth. “This is where the confidence in returning to target comes from,” he added.

Eurozone economic sentiment rises to 96.6, EU up to 96.9

Eurozone Economic Sentiment Indicator rose from 96.0 to 96.6 in August. Employment Expectations Indicator rose from 97.9 to 99.2. Economic Uncertainty Indicator fell from 17.9 to 17.2.

Eurozone industry confidence rose from -10.4 to -9.7. Services confidence rose from 5.0 to 6.3. Consumer confidence fell from -13.0 to -13.5. Retail trade confidence rose from -9.1 to -8.1. Construction confidence rose from -9.1 to -8.1.

EU Economic Sentiment Indicator rose from 96.5 to 96.9. Employment Expectations Indicator rose form 98.7 to 99.6. Economic Uncertainty Indicator fell from 17.1 to 6.6.

For the largest EU economies, the ESI improved strikingly for France (+4.3). It also improved significantly for Spain (+1.3) and the Netherlands (+0.9), while for Poland the ESI recorded only a slight increase (+0.3). The ESI deteriorated for Germany (-1.7) and Italy (-1.2).

NZ ANZ business confidence hits decade high, activity outlook at 7-yr peak

New Zealand’s ANZ Business Confidence surged in August, reaching 50.6, the highest level in a decade, up from 27.1 in July. This sharp increase was accompanied by a notable rise in the own activity outlook, which jumped from 16.3 to a seven-year high of 37.1.

Breaking down the data, investment intentions climbed from -1.4 to 6.9, while employment intentions improved from -3.6 to 11.9. Profit expectations also saw a positive shift, moving from -3.6 to 8.0.

Cost expectations remained elevated, ticking up slightly from 68.2 to 68.3, and pricing intentions rose from 37.6 to 41.0. On a positive note, inflation expectations fell from 3.20% to 2.92%, finally falling within the RBNZ’s target band.

ANZ highlighted that the significant increases in confidence and activity expectations were already evident at the beginning of August. The responses collected after RBNZ’s Official Cash Rate cut did not significantly alter the overall results.

EUR/USD Mid-Day Outlook

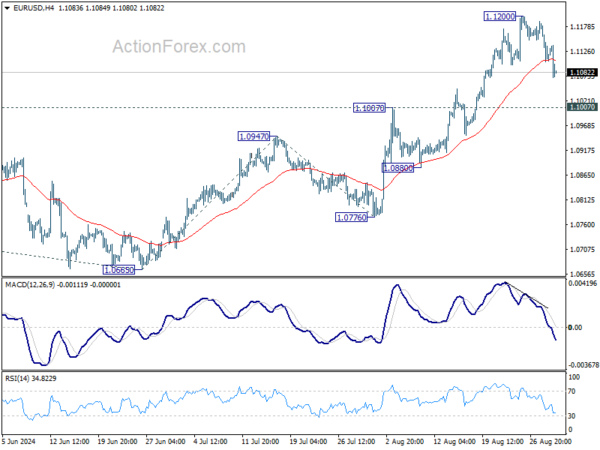

Daily Pivots: (S1) 1.1087; (P) 1.1138; (R1) 1.1170; More….

EUR/USD’s retreat from 1.1200 extends lower today, but stays well above 1.1007 resistance turned support. Intraday bias remains neutral and larger rally is still expected to continue. On the upside, break of 1.1200 will resume recent rally to 161.8% projection of 1.0665 to 1.0947 from 1.0776 at 1.1232, and then 1.1274 high.

In the bigger picture, break of 1.1138 resistance indicates that corrective pattern from 1.1274 has completed at 1.0665 already. Decisive break of 1.1274 (2023 high) will confirm whole up trend from 0.9534 (2022 low). Next target will be 61.8% projection of 0.9534 to 1.1274 from 1.0665 at 1.1740. This will now be the favored case as long as 1.0947 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:00 | NZD | ANZ Business Confidence Aug | 50.6 | 27.1 | ||

| 01:30 | AUD | Private Capital Expenditure Q2 | -2.20% | 1.10% | 1.00% | 1.90% |

| 05:00 | JPY | Consumer Confidence Index Aug | 36.7 | 37.1 | 36.7 | |

| 09:00 | EUR | Eurozone Economic Sentiment Indicator Aug | 96.6 | 95.9 | 95.8 | 96 |

| 09:00 | EUR | Eurozone Industrial Confidence Aug | -9.7 | -10.6 | -10.5 | -10.4 |

| 09:00 | EUR | Eurozone Services Sentiment Aug | 6.3 | 5.1 | 4.8 | 5 |

| 09:00 | EUR | Eurozone Consumer Confidence Aug F | -13.5 | -13.4 | -13.4 | |

| 12:00 | EUR | Germany CPI M/M Aug P | -0.10% | 0.00% | 0.30% | |

| 12:00 | EUR | Germany CPI Y/Y Aug P | 1.90% | 2.10% | 2.30% | |

| 12:30 | CAD | Current Account (CAD) Q2 | -8.5B | -6.0B | -5.4B | |

| 12:30 | USD | Initial Jobless Claims (Aug 23) | 231K | 234K | 232K | 233K |

| 12:30 | USD | GDP Annualized Q2 P | 3.00% | 2.80% | 2.80% | |

| 12:30 | USD | GDP Price Index Q2 P | 2.50% | 2.30% | 2.30% | |

| 12:30 | USD | Goods Trade Balance (USD) Jul P | -102.7B | -97.1B | -96.6B | -96.6B |

| 12:30 | USD | Wholesale Inventories Jul P | 0.30% | 0.20% | 0.20% | |

| 14:00 | USD | Pending Home Sales M/M Jul | 0.20% | 4.80% | ||

| 14:30 | USD | Natural Gas Storage | 33B | 35B |