Australian Dollar rose broadly in the Asian session following the release of stronger-than-expected inflation data. The slight slowdown in inflation wasn’t as pronounced as markets had anticipated, reinforcing RBA’s stance that it is not yet ready to cut interest rates. While the data does reduce the urgency for another rate hike, it still supports the view that RBA will maintain its current policy stance for the foreseeable future.

RBA’s attention now turns to the upcoming Q2 GDP data, scheduled for release on September 4. This data will provide crucial insights ahead of its next meeting on September 23-24. However, with inflationary pressures remaining elevated, RBA is expected to hold rates steady. The real test will come with Q3 inflation data, due on October 30, which will play a significant role in RBA’s full policy review at its November 4-5 meeting.

On the global stage, Swiss Franc continues to be the strongest performer of the week so far, underpinned by heightened geopolitical tensions in the Middle East. Canadian Dollar follows closely, driven by a rally in oil prices, which is also linked to the geopolitical situation. Sterling is currently the third strongest currency.

In contrast, Euro is facing significant pressure, making it the weakest currency this week at this point. This week’s business and consumer sentiment data from Germany have exacerbated concerns about a recession in the Eurozone’s largest economy. Yen is also underperforming, weakened by the rebound in benchmark yields in the US and Europe. US Dollar is struggling to regain its footing after last week’s Jackson Hole Symposium, making it the third weakest currency.

In the cryptocurrency market, Ethereum had a sharp sell-off during the Asian session, attributed to reported massive long liquidations. Technically, the strong break of 2531.80 supported should confirm that corrective rebound from 2084.51 has completed at 2819.10 already, after rejection by 2797.60 support turned resistance. Down trend from 3973.10 also remains intact with the rebound capped well below falling 55 D EMA. Retest of 2084.51 low should be seen next. The question is whether there is strong enough selling to push Ethereum to 61.8% projection of 3561.65 to 2084.51 from 2819.10 at 1906.22.

In Asia, at the time of writing, Nikkei is down -0.23%. Hong Kong HSI is down -0.88%. China Shanghai SSE is down -0.11%. Singapore Strait Times is down -0.41%. Japan 10-year JGB yield is up 0.0101 at 0.890. Overnight, DOW rose 0.02%. S&P 500 rose 0.16%. NASDAQ rose 0.16%. 10-year yield rose 0.015 to 3.833.

Australia’s monthly CPI slows to 3.5% in Jul, slightly above expectations

Australia’s monthly CPI inflation slowed from 3.8% yoy in June to 3.5% yoy in July, above the expected 3.4% yoy. CPI excluding volatile items and holiday travel also eased, dropping from 4.0% yoy to 3.7% yoy. Additionally, the annual trimmed mean CPI, a measure that smooths out irregular price fluctuations, decreased from 4.1% yoy to 3.8% yoy.

The most significant contributors to the price increases were housing (+4.0%), food and non-alcoholic beverages (+3.8%), alcohol and tobacco (+7.2%), and transport (+3.4%). These sectors continue to exert upward pressure on inflation, despite the overall slowing trend.

BoJ’s Himino signals readiness for further rate hikes if economic confidence grows

BoJ Deputy Governor Ryozo Himino reaffirmed the central bank’s commitment to adjusting its monetary policy if confidence in the economic outlook strengthens. In a speech, Himino stated that if BoJ gains “growing confidence” in its economic and price forecasts, it “will adjust the degree of monetary accommodation,” signaling readiness for rate hikes ahead.

Himino outlined the baseline scenario for fiscal 2025 and 2026, describing it as a “reasonably balanced state” where inflation aligns with the price stability target, and economic growth “slightly above cruising speed”. However, he cautioned against two risk scenarios: one where inflation remains above 2% and another where it falls well below 2% and fails to recover.

Addressing recent financial market volatility, Himino noted that Yen’s appreciation might ease the import cost pressures faced by small and medium-sized enterprises, though it could reduce yen-denominated profits for export industries. He reassured that Japanese firms have developed competitive strengths. Stock price volatilities, while influential, should not significantly undermine business sentiment.

Looking ahead

Swiss UBS economic expectations and Eurozone M3 money supply will be released in European session. US will release weekly crude oil inventories.

AUD/USD Daily Report

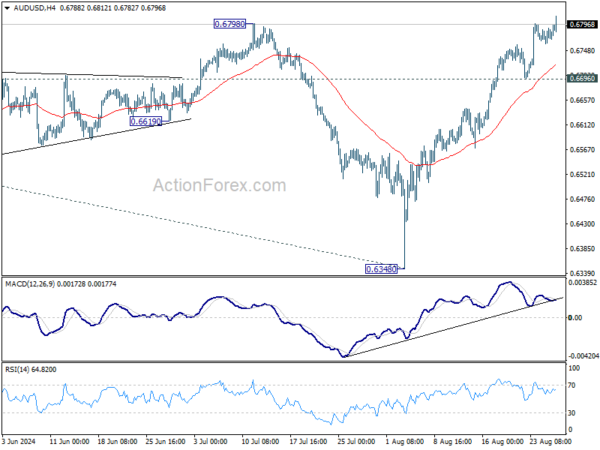

Daily Pivots: (S1) 0.6771; (P) 0.6784; (R1) 0.6805; More...

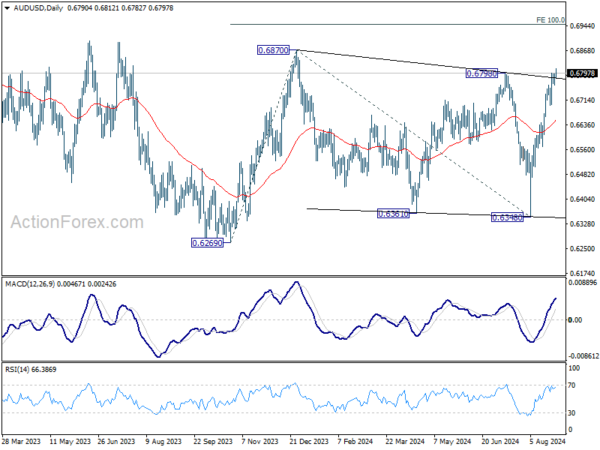

AUD/USD edges higher as rise from 0.6348 continues today. Intraday bias stays on the upside despite some loss of momentum as seen in 4H MACD. Next target is 0.6870. Firm break there will target 100% projection of 0.6269 to 0.6870 from 0.6348 at 0.6949. Near term outlook will stay bullish as long as 0.6696 support holds, in case of retreat.

In the bigger picture, overall, price actions from 0.6169 (2022 low) are seen as a medium term corrective pattern, with rise from 0.6269 as the third leg. Firm break of 0.6798/6870 resistance zone will target 0.7156 resistance. In case of another fall, strong support should be seen from 0.6169/6361 to bring rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | AUD | Construction Work Done Q2 | 0.10% | 0.70% | -2.90% | |

| 01:30 | AUD | Monthly CPI Y/Y Jul | 3.50% | 3.40% | 3.80% | |

| 08:00 | CHF | UBS Economic Expectations Aug | 9.4 | |||

| 08:00 | EUR | Eurozone M3 Money Supply Y/Y Jul | 2.80% | 2.20% | ||

| 14:30 | USD | Crude Oil Inventories | -2.7M | -4.6M |