In the calm before what could be a stormy session, forex markets remained exceptionally quiet during Asian trading. Dollar managed a slight recovery overnight, bolstered by pullback in US equities, but the upward momentum has been notably weak. Traders are now laser-focused on Fed Chair Jerome Powell’s speech at the Jackson Hole Symposium, which might hopefully offer critical insights into Fed’s next moves.

Remarks from various Fed officials have solidified expectations for a September rate cut. However, the consensus appears to be leaning towards a cautious, incremental approach to loosening monetary policy. While some market participants are holding out hope for a 50 bps cut to kickstart the easing cycle, the odds are not in favor, with only about 25% chance priced in by fed fund futures. A more modest 25bps cut seems the more likely scenario, as Fed seeks to avoid overreacting while stay in guard against inflation resurgence.

Meanwhile, Yen is showing modest strength, though the gains are far from robust. Japan’s core inflation has ticked up for the third consecutive month, driven primarily by a temporary spike in energy prices. However, core-core inflation, which excludes both food and energy, continues to decelerate. In a special session of the Japanese parliament, BoJ Governor Kazuo Ueda reiterated the bank’s readiness to continue reducing monetary stimulus, despite recent market volatility. There is ongoing speculation that BoJ might consider another rate hike before the year ends, but such a decision will heavily depend on forthcoming economic data and the stability of financial markets.

Looking at the broader picture for the week, Dollar remains the weakest performer, followed by Canadian Dollar and Australian Dollar. On the flip side, Swiss Franc leads as the strongest currency, with New Zealand Dollar and Yen also showing solid performance. Euro and Sterling are positioned somewhere in the middle.

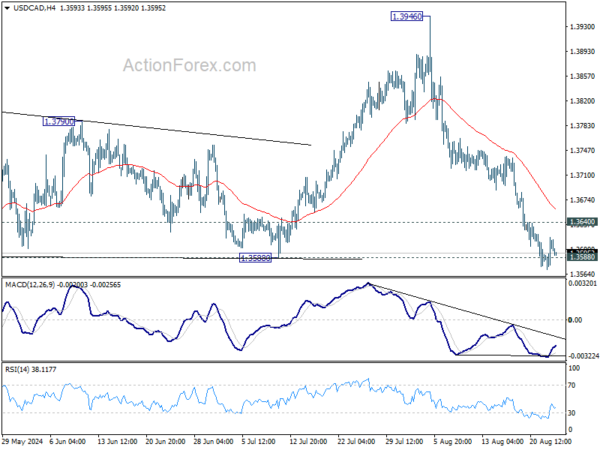

Technically, USD/CAD is still refusing to give up on defending 1.3588 structural support. Strong rebound from current level, followed by break of 1.3640 minor resistance, will argue that correction from 1.3946 has completed. That would also retain near term bullishness and set the stage for retesting 1.3946 high. However, sustained break of 1.3588 will be a near term bearish sign that should at least bring deeper correction. The next move could be heavily influenced by Powell’s remarks or upcoming Canadian retail sales data, which are expected later today.

In Asia, at the time of writing, Nikkei is up 0.50%. Hong Kong HSI is down -0.41%. China Shanghai SSE is down -0.05%. Singapore Strait Times is up 0.19%. Japan 10-year JGB yield is up 0.021 at 0.901. Overnight, DOW fell -0.43%. S&P 500 fell -0.89%. NASDAQ fell -1.67%. 10-year yield rose 0.0840 to 3.862.

BoJ’s Ueda ready to scale back easing despite market instability

In a special parliamentary session today, BoJ Governor Kazuo Ueda reiterated the central bank’s stance to its current monetary policy, even amidst recent market volatility. He emphasized that there is “no change to our basic stance to adjust the degree of monetary easing” should economic and price trends align with its forecasts.

Addressing concerns over the market turbulence observed in early August, Ueda attributed the instability to rising fears of a US recession, driven by weaker-than-expected economic data. He also noted that BoJ’s interest rate hike in July had triggered a sharp reversal in the “one-sided Yen falls”.

He stressed that BoJ would continue to monitor market movements closely, recognizing their potential impact on the central bank’s growth and price forecasts.

“Markets at home and abroad remain unstable, so we will be highly vigilant to market developments for the time being,” Ueda remarked.

Japan’s CPI core ticks up to 2.7% in Jul, but core-core falls to 1.9%

Japan’s CPI Core, which excludes food, rose slightly from 2.6% yoy to 2.7% yoy in July, aligning with expectations and marking the 28th consecutive month that core inflation has been at or above the BoJ 2% target.

However, CPI core-core, which excludes both food and energy, fell from 2.2% yoy to 1.9% yoy, dipping below the critical 2% threshold for the first time since September 2022.

Headline CPI remained steady at 2.8% yoy. Notably, electricity prices surged by 22% following the suspension of utility subsidies, which contributed to the overall inflation rate. In contrast, services inflation softened, dropping from 1.7% yoy to 1.4% yoy.

The uptick in core CPI largely reflects the phase-out of government subsidies aimed at reducing household utility costs. Excluding this factor, the broader inflation trend appears to be on a slowing path.

New Zealand retail sales volume falls -1.2% qoq in Q2

New Zealand’s retail sales volume fell -1.2% qoq in Q2, , well below the expected -0.1% drop. Retail sales value also decreased by -1.3% qoq. Notably, 11 out of 15 retail industries reported lower sales volumes compared to the previous quarter.

Total volume of retail sales per person fell by -1.5%, marking the tenth consecutive quarter of decline after adjustments for seasonal effects and price inflation.

Ricky Ho, Business Financial Statistics Manager, highlighted the severity of this trend, noting, “Retail sale volumes per person have been falling for the last two-and-a-half years. The last time we saw several quarters of consistent falls was between 2007 and 2009, which coincided with the global financial crisis.”

Looking ahead

The European economic calendar is empty today. Canada will release retail sales while US will publish new home sales. But all attention will be on Fed Chair Jerome Powell’s Jackson Hole speech.

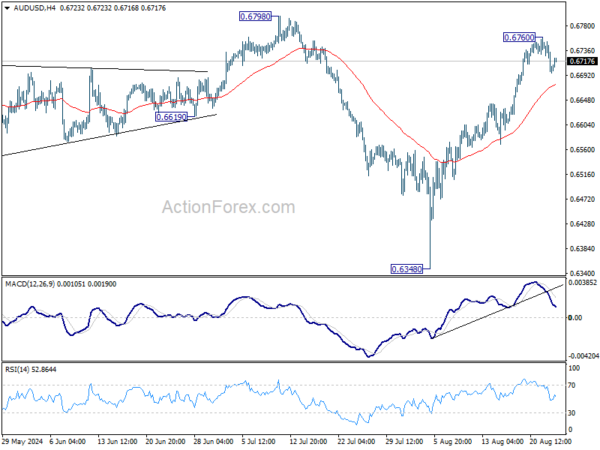

AUD/USD Daily Report

Daily Pivots: (S1) 0.6683; (P) 0.6719; (R1) 0.6740; More...

Intraday bias in AUD/USD remains neutral as consolidations continue below 0.6760 temporary top. Downside of retreat should be contained by 55 4H EMA (now at 0.6676) to bring rebound. Above 0.6760 will target 0.6798 resistance next. Firm break there will argue that larger rise from 0.6269 is ready to resume through 0.6870 resistance. However, sustained break of 55 4H EMA will confirm short term topping, and turn bias back to the downside for 55 D EMA (now at 0.6633) and possibly below.

In the bigger picture, overall, price actions from 0.6169 (2022 low) are seen as a medium term corrective pattern. Rise from 0.6340 is likely developing into another rising leg. Firm break of 0.6798/6870 resistance zone will target 0.7156 resistance. In case of another fall, strong support should be seen from 0.6169/6361 to bring rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Retail Sales Q/Q Q2 | -1.20% | -1.00% | 0.50% | 0.40% |

| 22:45 | NZD | Retail Sales ex Autos Q/Q Q2 | -1.00% | -0.80% | 0.40% | 0.30% |

| 23:01 | GBP | GfK Consumer Confidence Aug | -13 | -11 | -13 | |

| 23:30 | JPY | National CPI Y/Y Jul | 2.80% | 2.80% | ||

| 23:30 | JPY | National CPI Core Y/Y Jul | 2.70% | 2.70% | 2.60% | |

| 23:30 | JPY | National CPI Core-Core Y/Y Jul | 1.90% | 2.20% | ||

| 12:30 | CAD | Retail Sales M/M Jun | -0.30% | -0.80% | ||

| 12:30 | CAD | Retail Sales ex Autos M/M Jun | -0.40% | -1.30% | ||

| 14:00 | USD | New Home Sales Jul | 630K | 617K |