As the US session gets underway, both Yen and Swiss Franc are beginning to recover, aided by the slight pullback in benchmark Treasury yields in the US and Europe. This recovery comes after a tough week for the two safe-haven currencies, which have been the worst performers amid broad risk-on sentiment. Despite today’s gains, Yen and Swiss Franc still face an uphill battle to reverse their losses and end the week on a positive note.

British Pound, on the other hand, continues to show strength, particularly against Dollar and Euro. Sterling was supported by data showing rebound in retail sales, even that slightly missed expectations. Overall, this week’s slew of data didn’t add too much evidence to convince BoE to continue with another rate cut at next meeting. Meanwhile, commodity currencies like the Australian and Canadian Dollars have had a more subdued performance.

The final positions for these currencies as the week closes may be influenced by the upcoming University of Michigan consumer sentiment and inflation expectation data, and their impact of risk sentiment.

In Europe, at the time of writing, FTSE is down -0.62%. DAX is up 0.33%. CAC is flat. UK 10-year yield is down -0.0119 at 3.914. Germany 10-year yield is down -0.036 at 2.229. Earlier in Asia, Nikkei surged 3.64%. Hong Kong HSI rose 1.88%. China Shanghai SSE rose 0.07%. Singapore Strait Times rose 1.12%. Japan 10-year JGB yield rose 0.0372 to 0.875.

Eurozone goods exports fall -6.3% yoy in Jun, goods imports down -8.6% yoy

Eurozone goods exports fell -6.3% yoy to EUR 236.7B in June. Goods imports fall -8.6% yoy to EUR 214.3B. Trade balance showed a EUR 22.3B surplus. Intra-Eurozone trade fell -8.5% yoy to EUR 214.5B.

In seasonally adjusted term, goods exports fell -0.2% mom to EUR 236.2B. Goods imports fell -2.4% mom to EUR 218.7B. Trade surplus widened from EUR 12.4B in the prior month to EUR 17.5B, larger than expectation of EUR 14.5B. Intra-Eurozone trade rose 0.4% mom to EUR 210.7B.

UK retail sales rises 0.5% mom in Jul, vs exp 0.6% mom

UK retail sales volumes rose by 0.5% mom in July, slightly below market expectations of 0.6% increase. On a broader scale, sales volumes in the three months leading up to July saw a 1.1% rise compared to the previous three months ending in April.

Breaking down the data, non-food stores—which include department, clothing, household, and other non-food stores—saw a notable 1.4% increase in sales volumes. Non-store retail sales, which encompass online and other forms of retail not conducted in physical stores, rose by 0.7%, driven primarily by a rebound in retailers other than mail order services. However, the overall growth was tempered by a -1.9% decline in automotive fuel sales volumes.

RBA’s Bullock dismisses near-term rate cut expectations

In her remarks to the House of Representatives’ economics committee, RBA Governor Michele Bullock emphasized the careful balancing act in managing inflation while minimizing harm to the labor market. Bullock reiterated that the Board believes current monetary policy is “sufficiently restrictive” to bring inflation down over a reasonable timeframe without causing undue damage to employment.

Despite financial markets anticipating a rate cut by the end of the year, Bullock was clear in her message that it is “premature to be thinking about rate cuts” at this stage. She pointed out that inflation remains too high and, in underlying terms, is not expected to fall back within the target range until the end of next year.

While acknowledging that economic circumstances could change, Bullock firmly stated that, based on the current outlook, the Board “does not expect that it will be in a position to cut rates in the near term.”

RBNZ confident in inflation outlook, emphasizes measured approach to further rate cuts

In a speech today, RBNZ Governor Adrian Orr expressed a “very strong level of confidence” that forward indicators are pointing to a return to low and stable inflation, within the target range of 1% to 3%. Orr emphasized the importance of keeping inflation expectations and pricing intentions “anchored” as the central bank continues to monitor economic conditions.

Assistant Governor Karen Silk, speaking in a separate interview, noted that RBNZ is observing a continued decline in price and wage-setting behaviors. Silk mentioned that if this adjustment occurs more rapidly than anticipated, it could open the door for the central bank to consider a different, potentially faster path for rate cuts.

Earlier this week, RBNZ lowered the OCR by 25 bps to 5.25% and projected that it would fall below 4% by the end of 2025. Silk reiterated that RBNZ is taking a “measured approach” to policy loosening and remains committed to a data-dependent strategy.

New Zealand BNZ manufacturing rises to 44, 17th month of contraction

New Zealand’s manufacturing sector showed a slight improvement in July, with the BusinessNZ Performance of Manufacturing Index rising from 41.2 to 44.0. Despite this rebound, the sector remains deeply entrenched in contraction, marking its 17th consecutive month below the expansion threshold. The current level is still significantly below the long-term average of 52.6.

Breaking down the data, production saw an uptick, increasing from 35.7 to 43.4, while new orders also rose, moving from 39.0 to 42.5. However, employment in the sector continued to decline, slipping from 44.0 to 43.1. Finished stocks decreased from 47.7 to 46.5, and deliveries fell slightly from 44.8 to 44.3.

Despite the relative improvement in activity, the proportion of negative comments from respondents remained high, though it eased slightly to 71.1% in July from 76.3% in June. Businesses cited ongoing issues such as a lack of orders, customers, and sales, which have been persistent concerns in recent months.

BNZ’s Senior Economist Doug Steel commented that “manufacturing activity will turn when the broader economy turns.” He added that easing monetary conditions, including a lower OCR, could help stimulate a general pick-up in sales, but emphasized that this recovery would take time.

USD/JPY Mid-Day Outlook

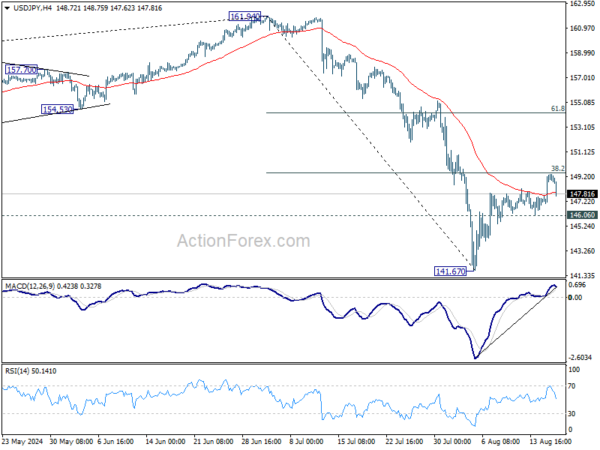

Daily Pivots: (S1) 147.76; (P) 148.58; (R1) 150.09; More…

Intraday bias in USD/JPY is turned neutral as it retreated after failing to break through 38.2% retracement of 161.94 to 141.67 at 149.41. On the downside, break of 146.06 minor support will suggest rejection by 149.91, and turn intraday bias back to the downside for retesting 141.67 low instead. On the upside, sustained break of 149.41 will extend the rebound to 61.8% retracement at 154.19, as the second leg of the corrective pattern from 161.94.

In the bigger picture, fall from 161.94 medium term is seen as correcting whole up trend from 102.58 (2021 low). Deeper decline could be seen to 38.2% retracement of 102.58 to 161.94 at 139.26, which is close to 140.25 support. In any case, risk will stay on the downside as long as 55 W EMA (now at 149.77) holds. Nevertheless, firm break of 55 W EMA will suggest that the range for medium term corrective pattern is already set.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | NZD | Business NZ PMI Jul | 44 | 41.1 | 41.2 | |

| 22:45 | NZD | PPI Input Q/Q Q2 | 1.40% | 0.50% | 0.70% | |

| 22:45 | NZD | PPI Output Q/Q Q2 | 1.10% | 0.60% | 0.90% | 0.80% |

| 04:30 | JPY | Tertiary Industry Index M/M Jun | -1.30% | 0.30% | -0.40% | 0.60% |

| 06:00 | GBP | Retail Sales M/M Jul | 0.50% | 0.60% | -1.20% | |

| 09:00 | EUR | Eurozone Trade Balance (EUR) Jun | 17.5B | 14.5B | 12.3B | 12.4B |

| 12:15 | CAD | Housing Starts Jul | 280K | 245K | 242K | |

| 12:30 | CAD | Manufacturing Sales M/M Jun | -2.10% | -2.50% | 0.40% | |

| 12:30 | USD | Building Permits Jul | 1.40M | 1.44M | 1.45M | |

| 12:30 | USD | Housing Starts Jul | 1.24M | 1.34M | 1.35M | |

| 14:00 | USD | Michigan Consumer Sentiment Index Aug P | 67.3 | 66.4 |