Australian Dollar strengthened during Asian session today, buoyed by stronger-than-expected employment growth data. This positive surprise offered some support to Aussie, though gains were limited, failing to push the currency above yesterday’s high. The labor market report, which showed a modest increase in unemployment rate, suggests some loosening in employment conditions. While this development might be welcomed by RBA as a sign of easing pressures in the labor market, it is unlikely to influence the central bank’s policy in the near term. RBA has been clear that it is not considering rate cuts this year and remains focused on monitoring disinflation before deciding on further rate hikes.

Looking at the currency market, the Euro has emerged as the strongest performer of the week so far, followed by Aussie, and then Sterling. Conversely, Japanese Yen is struggling, marking the weakest performance, despite Japan’s stronger-than-expected GDP data. Swiss Franc also underperformed, likely due to improving risk sentiment, which tends to reduce demand for safe-haven assets. The US Dollar has similarly been on the back foot, positioning as the third weakest currency. Kiwi is having a mixed week, largely stabilizing despite RBNZ’s surprising dovish rate cut. Canadian Dollar is also holding a middle ground.

British Pound is struggling to find a clear direction, caught between conflicting economic signals. While the strong jobs report initially provided support, this was counterbalanced by lower-than-expected inflation reading, muddied the outlook. The upcoming GDP data could be crucial in providing the Pound with a firmer sense of direction.

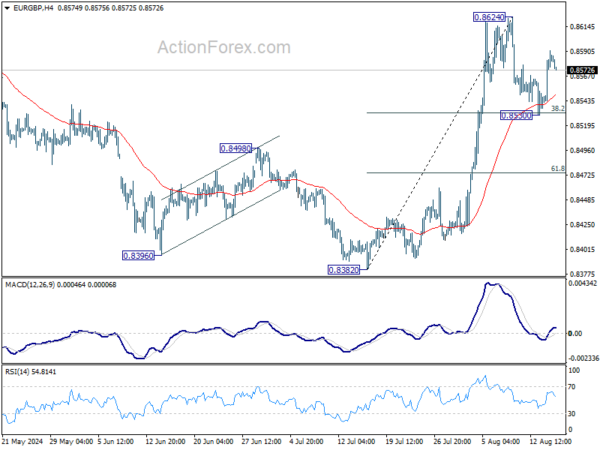

Technically, EUR/GBP’s strong rebound from 38.2% retracement of 0.8382 to 0.8624 at 0.8532 keep its near term outlook bullish. Focus is now on whether EUR/GBP could break through 0.8624 to resume the rally from 0.8382.

In Asia, at the time of writing, Nikkei is up 0.60%. Hong Kong HSI is up 0.14%. China Shanghai SSE is up 0.83%. Singapore Strait Times is up 0.93%. Japan 10-year JGB yield is up 0.0231 at 0.837. Overnight, DOW rose 0.61%. S&P 500 rose 0.38%. NASDAQ rose 0.03%. 10-year yield fell -0.032 to 3.820.

Japan’s Q2 GDP grows 0.8% qoq on strong consumption and capital spending

Japan’s economy showed stronger-than-expected growth in Q2, with real GDP rising by 0.8% qoq, surpassing the anticipated 0.6% qoq increase. On an annualized basis, GDP surged by 3.1%, well above the expected 2.1%. This marks a significant rebound after the sharp contraction experienced in Q1, and it is the first increase in two quarters.

The recovery was largely driven by a notable rise in private consumption, which increased by 1.0%. This is particularly significant as it follows four consecutive quarters of decline, a losing streak not seen since the aftermath of the 2008 financial crisis. Additionally, capital spending grew by 0.9%, marking its first gain in two quarters.

On a nominal basis, GDP increased by 1.8% in Q2, translating to an annualized rate of 7.4%. This growth pushed Japan’s GDP above JPY 600T for the first time, a milestone attributed to the ongoing inflationary pressures driven by the weakening Yen.

Australia’s employment surges 58.2k while unemployment rate ticks up

Australia’s labor market showed robust growth in July, with employment rising by 58.2k, significantly surpassing expectations of 26.5k. This increase was driven by a strong gain in full-time employment, which rose by 60.5k, while part-time employment saw a slight decline of -2.3k.

Unemployment rate ticked up from 4.1% to 4.2%, slightly higher than the expected 4.1% and marking the highest level since November 2021. This increase in the unemployment rate comes alongside a rise in the participation rate, which climbed from 66.9% to a record high of 67.1%. Additionally, the employment-to-population ratio edged up by 0.1% to 64.3%, just shy of the historical high of 64.4% set in November of last year. Monthly hours worked also increased by 0.4% mom.

Kate Lamb, ABS head of labour statistics, noted that while the unemployment rate has increased by 0.1 percentage point in each of the past two months, the record high participation rate and near-record employment-to-population ratio indicate that “there continues to be a high number of people in jobs, and looking for and finding jobs.”

RBNZ’s Orr signals careful and measured rate reductions

RBNZ Governor Adrian Orr outlined the central bank’s approach to its recent monetary policy shift in an interview with Bloomberg TV today. Following the unexpected rate cut that initiated the easing cycle yesterday, Orr emphasized that RBNZ intends to lower interest rates toward a more neutral setting at a “careful and measured pace.” This strategy is aimed at ensuring that inflation expectations remain firmly anchored at the 2% target, which Orr stated is the central bank’s “single focus.”

Orr expressed confidence in the central bank’s course of action, noting that key indicators of inflation pressures are moving in the right direction. RBNZ has been closely monitoring “price-setting behavior,” “inflation expectations,” and “domestic homegrown inflation components.” According to Orr, all these factors are now aligned with the goal of restoring “low and stable inflation” over the next couple of years.

Furthermore, Orr highlighted that various economic indicators are pointing toward a positive outlook for growth. “We see positive economic growth coming and we can be easing interest rates,” he said, expressing optimism that New Zealand could achieve “growth without the inflation.”

China’s industrial production slows while retail sales beat expectations

China’s economic data for July revealed a mixed picture, with industrial production growth continuing to decelerate while retail sales showed unexpected strength. Industrial production rose by 5.1% yoy, down from 5.3% in June and missing the expected 5.2%. This also marks the third consecutive month of slowing growth.

On a more positive note, retail sales increased by 2.7% yoy, accelerating from the previous month’s 2.0% and exceeding expectations of 2.6%.

However, fixed asset investment growth also disappointed, rising by 3.6% year-to-date compared to the same period last year, below the anticipated 3.9%.

Looking ahead

UK will release GDP, production and trade balance in European session. Swiss will publish PPI. Later in the day, a slew of economic data from the US will be featured, including jobless claims, retail sales, Empire state manufacturing, Philly Fed manufacturing, import prices, industrial production, business inventories and NAHB housing index.

AUD/USD Daily Report

Daily Pivots: (S1) 0.6596; (P) 0.6617; (R1) 0.6655; More...

A temporary top should be in place at 0.6642 in AUD/USD with the current retreat and intraday bias is turned neutral for some consolidations. Further rally is expected as long as 0.6506 support holds. Above 0.6442 will extend the rebound from 0.6348 to 0.6798 resistance next.

In the bigger picture, overall, price actions from 0.6169 (2022 low) are seen as a medium term corrective pattern, with fall from 0.6798 as another falling leg. Deeper fall could be seen to the lower side of the range between 0.6169/6361. But strong support should be seen there to contain downside. Meanwhile, break of 0.6798 will target upper side of the range at 0.7156.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | GDP Q/Q Q2 P | 0.80% | 0.60% | -0.50% | |

| 23:50 | JPY | GDP Deflator Y/Y Q2 P | 3.00% | 2.60% | 3.40% | |

| 01:00 | AUD | Consumer Inflation Expectations Aug | 4.50% | 4.30% | ||

| 01:30 | AUD | Employment Change Jul | 58.2K | 26.5K | 50.2K | 52.3K |

| 01:30 | AUD | Unemployment Rate Jul | 4.20% | 4.10% | 4.10% | |

| 02:00 | CNY | Industrial Production Y/Y Jul | 5.10% | 5.20% | 5.30% | |

| 02:00 | CNY | Retail Sales Y/Y Jul | 2.70% | 2.60% | 2.00% | |

| 02:00 | CNY | Fixed Asset Investment YTD Y/Y Jul | 3.60% | 3.90% | 3.90% | |

| 04:30 | JPY | Industrial Production M/M Jun F | -3.60% | -3.60% | ||

| 06:00 | GBP | GDP M/M Jun | 0.10% | 0.40% | ||

| 06:00 | GBP | GDP Q/Q Q2 P | 0.60% | 0.70% | ||

| 06:00 | GBP | Industrial Production M/M Jun | 0.10% | 0.20% | ||

| 06:00 | GBP | Industrial Production Y/Y Jun | -2.10% | 0.40% | ||

| 06:00 | GBP | Manufacturing Production M/M Jun | 0.10% | 0.40% | ||

| 06:00 | GBP | Manufacturing Production Y/Y Jun | -2.40% | 0.60% | ||

| 06:00 | GBP | Goods Trade Balance (GBP) Jun | -16.0B | -17.9B | ||

| 06:30 | CHF | Producer and Import Prices M/M Jul | 0.20% | 0.00% | ||

| 06:30 | CHF | Producer and Import Prices Y/Y Jul | -1.70% | -1.90% | ||

| 12:30 | CAD | Wholesale Sales M/M Jun | -0.60% | -0.80% | ||

| 12:30 | USD | Initial Jobless Claims (Aug 9) | 239K | 233K | ||

| 12:30 | USD | Retail Sales M/M Jul | 0.30% | 0.00% | ||

| 12:30 | USD | Retail Sales ex Autos M/M Jul | 0.10% | 0.40% | ||

| 12:30 | USD | Import Price Index M/M Jul | 0% | 0% | ||

| 12:30 | USD | Empire State Manufacturing Index Aug | -5.9 | -6.6 | ||

| 12:30 | USD | Philadelphia Fed Survey Aug | 6.6 | 13.9 | ||

| 13:15 | USD | Industrial Production M/M Jul | 0.10% | 0.60% | ||

| 13:15 | USD | Capacity Utilization Jul | 78.60% | 78.80% | ||

| 14:00 | USD | Business Inventories Jun | 0.30% | 0.50% | ||

| 14:00 | USD | NAHB Housing Market Index Aug | 43 | 42 | ||

| 14:30 | USD | Natural Gas Storage | 43B | 21B |