The market’s initial reaction to US CPI data has been relatively subdued. While both headline and core CPI readings slowed in July, they remain elevated. This ongoing disinflation is a positive sign for the Fed, but the pace is not rapid enough to justify a larger rate cut in September. As a result, US stock futures are treading water, and 10-year Treasury yield is ticking up slightly.

In the currency markets, Euro has emerged as the clear winner today, bolstered in part by its rebound against the British Pound. Sterling is losing momentum following lower-than-expected UK CPI data, which now makes a BoE rate cut in September a closer call. Dollar is the second strongest currency today, although it remains within a tight range against most majors, showing noticeable movement only against Euro and New Zealand Dollar.

On the other hand, Kiwi continues to be the worst performer, holding onto most of its losses from the RBNZ’s surprise rate cut. With RBNZ beginning its easing cycle earlier than anticipated, there is room for one or even two more rate cuts this year. Yen, Australian Dollar, British Pound, Swiss Franc, and Canadian Dollar are mixed, trading without clear direction.

Technically, an immediate focus is on whether DOW could break through 39807.45 support turned resistance today. If realized, that would indicate that correction from 41376.00 has completed already. More importantly, successful defense of 38000.96 cluster support (38.2% retracement of 32327.20 to 41376 at 37979.35) would keep the near term up trend intact for upside breakout, sooner rather than later.

In Europe, at the time of writing, FTSE is up 0.17%. DAX is up 0.41%. CAC is up 0.40%. UK 10-year yield is down -0.0315 at 3.861. Germany 10-year yield is up 0.019 at 2.208. Earlier in Asia, Nikkei rose 0.58%. Hong Kong HSI fell -0.35%. China Shanghai SSE fell -0.60%. Singapore Strait Times rose 0.85%. Japan 10-year JGB yield fell -0.0337 to 0.814.

US CPI falls to 2.9% yoy in Jul, core CPI down to 3.2% yoy

US CPI rose 0.2% mom in July, matched expectations. CPI core (all items less food and energy) rose 0.2% mom, matched expectations. Energy prices were unchanged over the month while food prices increased 0.2% mom.

For the 12-month period, CPI slowed from 3.0% yoy to 2.9% yoy, below expectation of 3.0% yoy. Headline CPI reading was the lowest since March 2021. CPI core slowed from 3.3% yoy to 3.2% yoy, matched expectations. CPI core reading was the lowest since April 2021. Energy prices rose 1.1% yoy while food prices rose 2.2% yoy.

Eurozone industrial production falls -0.1% mom in Jun, EU down -0.1% mom

Eurozone industrial production fell -0.1% mom in June, much worse than expectation of 0.4% mom rise. Industrial production increased by 0.7% for intermediate goods, 1.9% for energy, 0.9% for capital goods, and 3.8% for durable consumer goods. Production decreased by -2.5% for non-durable consumer goods.

EU industrial production fell -0.1% mom. Among Member States for which data are available, the largest monthly decreases were recorded in Ireland (-7.8%), Belgium (-6.5%), Croatia and Portugal (both -3.7%). The highest increases were observed in Romania (+4.0%), Finland (+3.6%) and Slovakia (+2.1%).

UK CPI rises to 2.2% in Jul, core down to 3.3%, both below expectations

UK CPI rose from 2.0% yoy to 2.2% yoy in July, below expectation of 2.3% yoy. Core CPI (excluding energy, food, alcohol and tobacco) slowed from 3.5% yoy to 3.3% yoy, below expectation of 3.4% yoy. Core CPI reading was the lowest since September 2021.

CPI goods annual rate rose from -1.4% yoy to negative 0.6% yoy. CPI services annual rate fell from 5.7% yoy to 5.2% yoy.

On a monthly basis, CPI fell by -0.2% mom.

RBNZ surprises with rate cut, signals another reduction this year

In an unexpected move, RBNZ lowered its Official Cash Rate by 25bps to 5.25% today, catching markets off guard. The central bank also unveiled new economic projections, which indicate the possibility of another rate cut later this year, followed by a total of 100bps in cuts throughout 2025.

RBNZ emphasized that the “pace of further easing” will hinge on confidence that pricing behavior remains aligned with a low-inflation environment and that inflation expectations stay anchored around the 2% target.

The minutes of the meeting reveal that “recent indicators give confidence that inflation will return sustainably to target within a reasonable time frame.” The Committee agreed that with headline CPI inflation expected to return to the target band by the September quarter and growing excess capacity supporting a continued decline in domestic inflation, there was room to “temper the extent of monetary policy restraint.”

The new economic projections suggest that OCR could drop further to 4.9% by Q4 2024, 3.8% by the end of 2025, and eventually reach 3.0% by mid-2027. Annual CPI inflation is forecasted to hover between 2.2% and 2.4% before settling at 2.0% by Q2 2026.

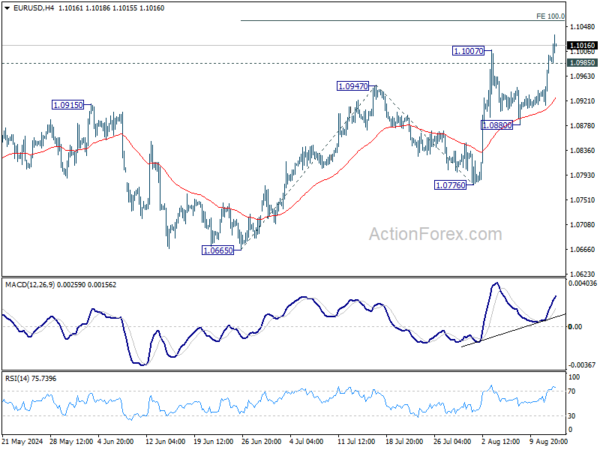

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0938; (P) 1.0969; (R1) 1.1024; More…..

EUR/USD’s break of 1.1007 confirms resumption of whole rally from 1.0665. Intraday bias is staying on the upside for 100% projection of 1.0665 to 1.0947 from 1.0776 at 1.1058. Decisive break there could prompt upside acceleration through 1.1138 resistance to 161.8% projection at 1.1232. On the downside, below 1.0985 minor support will turn intraday bias neutral first. But outlook will stay bullish as long as 1.0880 support holds.

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern that’s could still extend. Break of 1.1138 resistance will be the first signal that rise from 0.9534 (2022 low) is ready to resume through 1.1274 (2023 high). However, break of 1.0776 support will extend the correction with another falling leg back towards 1.0447 support.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 02:00 | NZD | RBNZ Rate Decision | 5.25% | 5.50% | 5.50% | |

| 03:00 | NZD | RBNZ Press Conference | ||||

| 06:00 | GBP | CPI M/M Jul | -0.20% | 0.10% | ||

| 06:00 | GBP | CPI Y/Y Jul | 2.20% | 2.30% | 2.00% | |

| 06:00 | GBP | Core CPI Y/Y Jul | 3.30% | 3.40% | 3.50% | |

| 06:00 | GBP | RPI M/M Jul | 0.10% | 0.20% | ||

| 06:00 | GBP | RPI Y/Y Jul | 3.60% | 3.30% | 2.90% | |

| 06:00 | GBP | PPI Input M/M Jul | -0.10% | -0.40% | -0.80% | -0.40% |

| 06:00 | GBP | PPI Input Y/Y Jul | 0.40% | -0.40% | 0.00% | |

| 06:00 | GBP | PPI Output M/M Jul | 0.00% | 0.20% | -0.30% | -0.70% |

| 06:00 | GBP | PPI Output Y/Y Jul | 0.80% | 1.20% | 1.40% | 1.00% |

| 06:00 | GBP | PPI Core Output M/M Jul | 0.00% | 0.10% | ||

| 06:00 | GBP | PPI Core Output Y/Y Jul | 1.00% | 1.10% | 1.10% | |

| 09:00 | EUR | Eurozone GDP Q/Q Q2 P | 0.30% | 0.30% | 0.30% | |

| 09:00 | EUR | Eurozone Employment Change Q/Q Q2 P | 0.20% | 0.20% | 0.30% | |

| 09:00 | EUR | Eurozone Industrial Production M/M Jun | -0.10% | 0.40% | -0.60% | |

| 12:30 | USD | CPI M/M Jul | 0.20% | 0.20% | -0.10% | |

| 12:30 | USD | CPI Y/Y Jul | 2.90% | 3.00% | 3.00% | |

| 12:30 | USD | CPI Core M/M Jul | 0.20% | 0.20% | 0.10% | |

| 12:30 | USD | CPI Core Y/Y Jul | 3.20% | 3.20% | 3.30% | |

| 14:30 | USD | Crude Oil Inventories | -1.9M | -3.7M |