New Zealand Dollar plunged today after RBNZ unexpectedly cut interest rates by 25bps, marking the first reduction in this easing cycle. This move came much earlier than the market’s anticipation of a rate cut in October or November. The selloff gained further momentum after RBNZ Governor Adrian Orr disclosed that a 50bps cut had been considered during the meeting. While the central bank’s projections indicate one more 25bps cut by the end of the year, participants are now bracing for even more aggressive easing, with two additional cuts expected—one in October and another in November.

Market focus is now shifting towards crucial consumer inflation data from both the UK and the US. In the UK, July CPI report is highly anticipated, especially as there are concerns that inflation could reaccelerate from 2.0% to 2.3%. Such an outcome would likely tie BoE’s hands, making it difficult to justify further rate cuts in the near term. The situation could be even more delicate if core CPI doesn’t slow as forecasted to 3.4%. It’s worth noting that BoE’s decision to cut rates by 25bps this month was a narrow one, passing with a 5-4 vote. Any inflationary surprises today could push BoE to delay its next move.

In the US, the focus is on the July CPI report, where the headline inflation rate is expected to hold steady at 3.0%, while core inflation is projected to slow slightly to 3.2%. The market is already fully pricing in a 25bps rate cut by Fed in September, with more than 50% chance of a 50bps cut. However, most Fed officials have made it clear that they want to see more consistent disinflation before easing policy. Still, the picture remains fluid, with another non-farm payroll report and CPI release due before Fed’s September meeting, which could sway the central bank’s decision.

Overall in the currency markets, Kiwi is the worst performer for the day so far, followed by Aussie and Loonie. Dollar is the strongest, followed by Yen, and then Euro. Swiss Franc and Sterling are positioning in the middle. However, barring Kiwi pairs, all major pairs and crosses are stuck inside yesterday’s range.

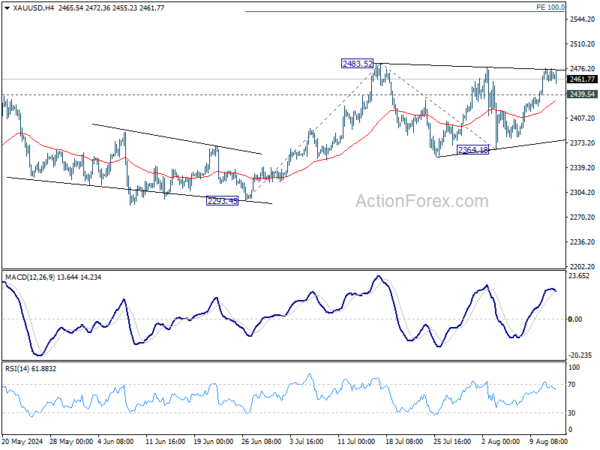

Technically, Gold looks ready to resume recent up trend to new record high. Firm break of 2483.52 will target 100% projection of 2293.45 to 2483.52 from 2364.18 at 2554.25. On the downside, break of 2439.54 minor support will delay the bullish case and bring more consolidations first. But an eventual upside breakout is expected as long as 2364.18 support holds.

In Asia, at the time of writing, Nikkei is down -0.06%. Hong Kong HSI is down -0.36%. China Shanghai SSE is down -0.35%. Singapore Strait Times is up 0.46%. Japan 10-year JGB yield is down -0.0308 at 0.816. Overnight, DOW rose 1.04%. S&P 500 rose 1.68%. NASDAQ rose 2.43%. 10-year yield fell -0.057 to 3.852.

RBNZ surprises with rate cut, signals another reduction this year

In an unexpected move, RBNZ lowered its Official Cash Rate by 25bps to 5.25% today, catching markets off guard. The central bank also unveiled new economic projections, which indicate the possibility of another rate cut later this year, followed by a total of 100bps in cuts throughout 2025.

RBNZ emphasized that the “pace of further easing” will hinge on confidence that pricing behavior remains aligned with a low-inflation environment and that inflation expectations stay anchored around the 2% target.

The minutes of the meeting reveal that “recent indicators give confidence that inflation will return sustainably to target within a reasonable time frame.” The Committee agreed that with headline CPI inflation expected to return to the target band by the September quarter and growing excess capacity supporting a continued decline in domestic inflation, there was room to “temper the extent of monetary policy restraint.”

The new economic projections suggest that OCR could drop further to 4.9% by Q4 2024, 3.8% by the end of 2025, and eventually reach 3.0% by mid-2027. Annual CPI inflation is forecasted to hover between 2.2% and 2.4% before settling at 2.0% by Q2 2026.

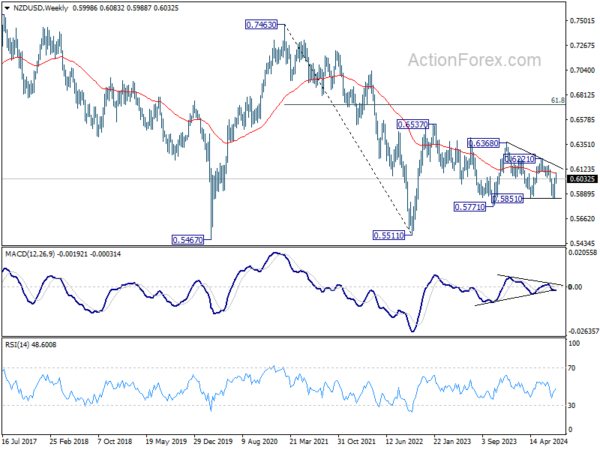

NZD/USD falls after RBNZ cut, but downside limited so far

NZD/USD fell notably after RBNZ’s surprised rate cut but loss is so far limited. Some consolidations would be seen below 0.6083 temporary top first. But further rally would remain in favor as long as 0.5976 support holds. Above 0.6083 will resume the rise from 0.5849 towards falling trend line resistance (now at around 0.6165).

Overall, NZD/USD is seen as trading in converging range since hitting 0.5511 (2022 low) and rebounding to 0.6537 (2023 high). Outlook will be neutral until break at least a breakout from 0.5851/6221 range.

Fed’s Bostic needs a little more data before supporting rate cuts

Atlanta Fed President Raphael Bostic emphasized a cautious approach regarding interest rate cuts, stating that he needs “a little more data” before supporting such a move. Bostic stressed the importance of ensuring that Fed doesn’t prematurely lower rates, saying, “We want to be absolutely sure.” He warned that it would be problematic if Fed cut rates and then had to reverse course by raising them again.

While Bostic acknowledged being encouraged by recent inflation readings, he reiterated that he might be ready to support a rate cut “by the end of the year.” However, he remains watchful of labor market dynamics, expressing concern over the rise in unemployment. Bostic clarified that this increase is largely due to a growing labor force rather than a decline in demand, which he considers a “good problem to have.”

GBP/USD Daily Outlook

Daily Pivots: (S1) 1.2792; (P) 1.2833; (R1) 1.2903; More…

GBP/USD’s extended rebound and break of 1.2839 resistance argues that pull back from 1.3043 has completed at 1.2664 already. Intraday bias is back on the upside for retesting 1.3043. firm break there will resume whole rally from 1.2998 to 61.8% projection of 1.2298 to 1.3043 from 1.2664 at 1.3124, which is close to 1.3141 high. For now, risk will stay on the upside as long as 1.2664 support holds, in case of retreat.

In the bigger picture, as long as 1.3141 resistance holds (2023 high), medium term corrective pattern from there could still extend with another falling leg. But even in that case, downside should be contained by 1.2036/2298 support zone. Meanwhile, decisive break of 1.3141 will confirm resumption of whole up trend from 1.0351 (2022 low).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 02:00 | NZD | RBNZ Rate Decision | 5.25% | 5.50% | 5.50% | |

| 03:00 | NZD | RBNZ Press Conference | ||||

| 06:00 | GBP | CPI M/M Jul | 0.10% | |||

| 06:00 | GBP | CPI Y/Y Jul | 2.30% | 2.00% | ||

| 06:00 | GBP | Core CPI Y/Y Jul | 3.40% | 3.50% | ||

| 06:00 | GBP | RPI M/M Jul | 0.20% | |||

| 06:00 | GBP | RPI Y/Y Jul | 3.30% | 2.90% | ||

| 06:00 | GBP | PPI Input M/M Jul | -0.40% | -0.80% | ||

| 06:00 | GBP | PPI Input Y/Y Jul | -0.40% | |||

| 06:00 | GBP | PPI Output M/M Jul | 0.20% | -0.30% | ||

| 06:00 | GBP | PPI Output Y/Y Jul | 1.20% | 1.40% | ||

| 06:00 | GBP | PPI Core Output M/M Jul | 0.10% | |||

| 06:00 | GBP | PPI Core Output Y/Y Jul | 1.10% | 1.10% | ||

| 09:00 | EUR | Eurozone GDP Q/Q Q2 P | 0.30% | 0.30% | ||

| 09:00 | EUR | Eurozone Employment Change Q/Q Q2 P | 0.20% | 0.30% | ||

| 09:00 | EUR | Eurozone Industrial Production M/M Jun | 0.70% | -0.60% | ||

| 12:30 | USD | CPI M/M Jul | 0.20% | -0.10% | ||

| 12:30 | USD | CPI Y/Y Jul | 3.00% | 3.00% | ||

| 12:30 | USD | CPI Core M/M Jul | 0.20% | 0.10% | ||

| 12:30 | USD | CPI Core Y/Y Jul | 3.20% | 3.30% | ||

| 14:30 | USD | Crude Oil Inventories | -1.9M | -3.7M |