Dollar weakens broadly in early US session after July’s PPI came in lower than expected, signaling easing in inflationary pressures. This development was well-received by investors, with stock futures ticking up slightly and 10-year Treasury yield dipping in response. While the softer PPI readings provide some relief to those hoping for monetary easing from Fed, the real test comes tomorrow with the release of CPI, which will play a decisive role in determining whether Fed moves towards a rate cut in September.

Kiwi is currently the strongest one for the day, as traders await tomorrow’s RBNZ rate decision. The majority of the markets are expecting OCR to be unchanged out of the meeting. The central bank would use the new economic projections to lay down the groundwork for policy easing later in the year, either in November or earlier in October if needed. But that’s not a total consensus. A significant minority have been betting on a rate cut. Kiwi could be given a pop should RBNZ deliver even a neutral hold.

Elsewhere in the currency markets, Sterling is following as the second strongest, as lifted slightly by today’s job data. Swiss Franc is the worst performer, followed by Yen, and the Dollar. Euro and Canadian are positioning in the middle.

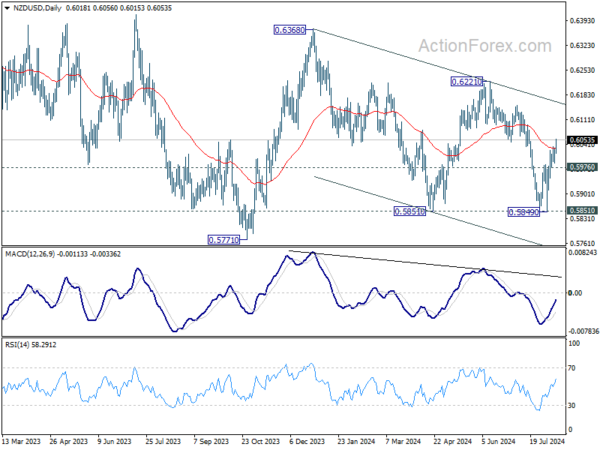

Technically, NZD/USD’s strong break of 55 D EMA today should confirm that fall from 0.6221 has completed at 0.9849. Further rise is expected as long as 0.5976 support holds. Even just as a corrective move, NZD/USD should target falling trend line resistance (now at 0.6165) next.

In Europe, at the time of writing, FTSE is up 0.11%. DAX is up 0.26%. CAC is down -0.03%. UK 10-year yield is down -0.0203 at 3.900. Germany 10-year yield is down -0.032 at 2.201. Earlier in Asia, Nikkei rose 3.45%. Hong Kong HSI rose 0.36%. China Shanghai SSE rose 0.34%. Singapore Strait Times rose 0.72%. Japan 10-year JGB yield fell -0.0105 to 0.847.

US PPI at 0.1% mom, 2.2% yoy in Jul, below expectations

US PPI for final demand rose 0.1% mom in July, below expectation of 0.2% mom. PPI goods rose 0.6% while PPI services fell -0.2% mom. PPI less foods, energy, and trade services rose 0.3% mom.

For the 12 months ended in July, PPI rose 2.2% yoy, slowed from 2.7% yoy, below expectation of 2.3% yoy. PPI less foods, energy, and trade services rose 3.3% yoy.

German ZEW plummets to 19.2, economy breaking down

Germany’s ZEW Economic Sentiment index took a significant hit in August, falling sharply from 41.8 to 19.2, well below the expected 30.6. This marks the steepest monthly decline since July 2022. Current Situation Index also worsened, dropping from -68.9 to -77.3.

Similarly, Eurozone’s ZEW Economic Sentiment index fell from 43.7 to 17.9, missing expectations of 35.4. However, Current Situation Index for Eurozone showed a slight improvement, rising by 3.7 points to -32.4, although it remains in negative territory.

ZEW President Achim Wambach noted that the economic outlook for Germany is “breaking down.” He highlighted that this month’s survey revealed the sharpest decline in economic expectations over the past two years, not just for Germany, but also for the Eurozone, the US, and China.

Wambach pointed out that expectations for “export-intensive” sectors in Germany are particularly bleak. He attributed this deterioration to ongoing high uncertainty, driven by unclear monetary policy directions, disappointing business data from the US, and escalating concerns about the Middle East conflict.

UK payrolled employment grows 24k in Jul, unemployment rate falls to 4.2% in Jun

UK payrolled employment rose 24k or 0.1% mom in July. Median monthly pay increased by 5.6% up sharply from June’s 3.8% yoy, but below May’s 6.0% yoy. Claimant count jumped 135k versus expectation of 14.5k.

In the three months to June, unemployment fell from 4.4% to 4.2%, versus expectation of a rise to 4.5%. Average earnings including bonus rose 5.4% yoy, slowed from 5.7% but beat expectation of 4.6%. Average earnings excluding bonus slowed to 4.5% yoy, down from 5.7%, below expectation of 4.6%.

Japan’s PPI rises to 3% yoy as Yen weakness fuels import costs surge

Japan’s Producer Price Index rose by 3.0% yoy in July, aligning with market expectations and slightly up from June’s 2.9% yoy increase. This marks the sixth consecutive month of acceleration and the fastest rate of increase in 11 months.

A significant driver of this rise was the 10.8% yoy increase in yen-denominated costs for imported materials, which accelerated from a revised 10.6% yoy rise in June. This highlights the ongoing impact of the weak Yen on import prices, contributing to higher overall production costs.

On a month-over-month basis, PPI rose by 0.3%, again matching consensus estimates.

Australia’s wage growth slows in 0.8% qoq in Q2, with private sector lagging

Australia’s wage price index rose by 0.8% qoq in Q2, slightly down from the previous quarter’s 0.9% qoq increase and falling short of expectations for another 0.9% qoq rise. On an annual basis, wage growth remained steady at 4.1%, unchanged from Q1.

In the private sector, wage growth slowed to 0.7% qoq, down from 0.9% in the previous quarter. This marks the lowest increase for a second quarter since 2021 and ties for the lowest growth for any quarter since Q4 2021.

On the other hand, public sector wages grew by 0.9% qoq, up from 0.6% previously, making it the strongest June quarter increase since 2012. This stronger rise in the public sector was attributed to the newly synchronized timing of Commonwealth public sector agreement increases.

Australia’s Westpac consumer sentiment edges up amid small relief over steady rates

Australia’s Westpac Consumer Sentiment Index saw a modest increase of 2.8% mom in August, rising from 82.7 to 85.0. Westpac attributed this uptick to a “small sigh of relief” from consumers after RBA decided to keep interest rates unchanged, coupled with the positive effects of tax cuts and other fiscal measures.

However, despite the rise, the index remains historically weak, hovering within the 78–86 range that has persisted for over two years. Westpac’s analysis highlighted ongoing concerns among consumers about the cost of living and potential future rate hikes, which continue to “weigh heavily” on sentiment.

Looking ahead to RBA’s next meeting on September 23-24, Westpac noted that data flow leading up to the meeting is unlikely to provide significant new insights into inflation trends. With RBA having already ruled out near-term rate cuts, it is expected that the central bank will maintain its current interest rate at the upcoming meeting.

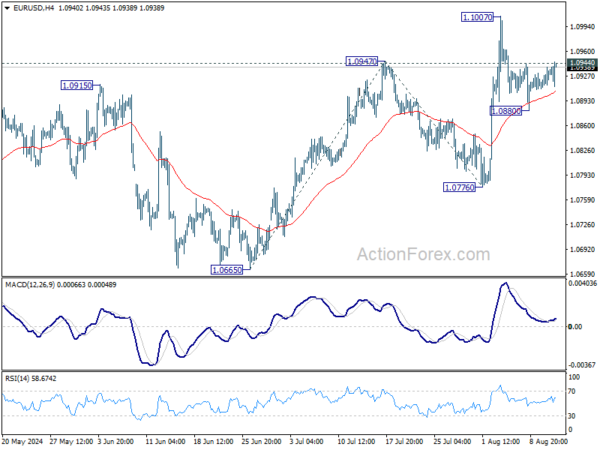

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0915; (P) 1.0927; (R1) 1.0944; More…..

Immediate focus is on 1.0944 minor resistance in EUR/USD. Firm break there will indicate that pullback from 1.1007 has completed at 1.0880 already. Retest of 1.1007 should be seen first. Further break there will resume rally from 1.0665 to 100% projection of 1.0665 to 1.0947 from 1.0776 at 1.1056 next. However, break of 1.0880 will bring another decline towards 1.0776 support instead.

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern that’s still be in progress. Break of 1.1138 resistance will be the first signal that rise from 0.9534 (2022 low) is ready to resume through 1.1274 (2023 high). However, break of 1.0776 support will extend the correction with another falling leg back towards 1.0447 support.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | PPI Y/Y Jul | 3.00% | 3.00% | 2.90% | |

| 00:30 | AUD | Westpac Consumer Confidence Aug | 2.80% | -1.10% | ||

| 01:30 | AUD | Wage Price Index Q/Q Q2 | 0.80% | 0.90% | 0.80% | 0.90% |

| 01:30 | AUD | NAB Business Conditions Jul | 1.00% | 4 | ||

| 01:30 | AUD | NAB Business Confidence Jul | 6 | 4 | ||

| 06:00 | JPY | Machine Tool Orders Y/Y Jul | -2.10% | 9.70% | ||

| 06:00 | GBP | Claimant Count Change Jul | 135.0K | 14.5K | 32.3K | 36.2K |

| 06:00 | GBP | ILO Unemployment Rate (3M) Jun | 4.20% | 4.50% | 4.40% | |

| 06:00 | GBP | Average Earnings Including Bonus 3M/Y Jun | 5.40% | 4.60% | 5.70% | |

| 06:00 | GBP | Average Earnings Excluding Bonus 3M/Y Jun | 4.50% | 4.60% | 5.70% | |

| 09:00 | EUR | Germany ZEW Economic Sentiment Aug | 19.2 | 30.6 | 41.8 | |

| 09:00 | EUR | Germany ZEW Current Situation Aug | -77.3 | -68.9 | ||

| 09:00 | EUR | Eurozone ZEW Economic Sentiment Aug | 17.9 | 35.4 | 43.7 | |

| 10:00 | USD | NFIB Business Optimism Index Jul | 93.7 | 91.7 | 91.5 | |

| 12:30 | USD | PPI M/M Jul | 0.10% | 0.20% | 0.20% | |

| 12:30 | USD | PPI Y/Y Jul | 2.20% | 2.30% | 2.60% | 2.70% |

| 12:30 | USD | PPI ex Food & Energy M/M Jul | 0.00% | 0.20% | 0.40% | 0.30% |

| 12:30 | USD | PPI ex Food & Energy Y/Y Jul | 2.40% | 2.70% | 3.00% |