Sterling shines today in rather dull trading as lifted by strong production data. Industrial production rose 0.7% mom, 2.5% yoy in September versus expectation of 0.3% mom, 1.9% yoy. Manufacturing production rose 0.7% mom, 2.7% yoy versus expectation of 0.3% mom, 2.4% yoy. Trade deficit also narrowed to GBP -11.3. But construction output dropped more than expected by -1.6% mom. Over the week, the Pound will also likely end as the strongest one. Canadian Dollar follows closely as supported by surge in oil price. Meanwhile, Dollar is set to end as the weakest as traders are dissatisfied with Senate’s plan to delay corporate tax cut by a year.

ECB Nowotny: Should signal intention to end asset purchase

ECB Governing Council member Ewald Nowotny expressed his "absolute agreement" with Bundesbank head Jens Weidmann. Nowotny said "this new purchasing program is valid until September 2018 and in my view we should then go about bringing it to an end if the economy develops as we currently expect it to." Weidmann made a similar point the day after ECB announced to half asset purchase to EUR 30b a month and extend the program till September next year. Another Governing Council member Philip Lane said that "if we have enough signals, we can get active and move on" with monetary policy. And he emphasized that "our monetary policy does not always have to follow such a gradual and incremental approach as it is currently the case." And, "inflation doesn’t have to reach our goal before we discuss changing our policy." Nonetheless, he also acknowledged that "inflation must be clearly on the way towards this goal. At the moment this is not the case."

Senate propose to delay corporate tax cuts to 2019

As noted in their vision for the tax reform plan, Senate Republicans propose to implement a corporate tax rate cut to 20% on January 1, 2019, one year later than the House proposal released last week. On other aspects, the members retain the seven income tax brackets but the tax rates are slightly different from the House proposal, whilst they propose to preserve existing mortgage-interest deduction for home purchases with up to USD 1m of debt. Senate Republicans also propose to maintain the estate tax while doubling the current USD 5.49m exemption for individuals.

The House Ways and Means committee passed its tax bill yesterday, setting it up for a full House vote as soon as next week. Senate will hold hearings on the bill next week. And the Senators are targeting to pass it a week after Thanksgiving. After passing the bill in Senate, the two chambers will try to close the gaps in a process known as a conference committee.

RBA revised lower GDP forecasts

RBA in its Statement of Monetary Policy revised lower the GDP growth outlook. It now expects growth to reach 2.5% this year, compared with 2-3% projected in August, before rising to 3.25% in 2018, down from previous forecast of 3.75%. As the central bank noted, "the drag on growth from the end of the mining boom has eased and is likely to end some time in the next year or so". On inflation RBA forecasts headline CPI to rise to 2% by the end of this year. Inflation is not expected to reach 2.25% until end- 2018.

China CPI and PPI beat expectations

China inflation, both upstream (PPI) and downstream (CPI), surprised to the upside in October. Headline CPI accelerated to 1.9% yoy, from 1.6% in September, beating consensus of 1.7%. Food deflation improved to -1.4% yoy in October, from September’s -1.4%, whilst non-food price steadied at 2.4% yoy. Core CPI also steadied at 2.3% last month. PPI stayed unchanged at 6.9%, beating expectations of a slowdown to 6.9%. The set of data indicates gradual but smooth pass-through of inflation (from PPI to CPI), thanks to stable wage growth and improved capacity utilization. Headline CPI has a chance of rising to 2% by year-end and exceeding it in 2018. Note, however, that the upper bound of PBOC’s inflation target is 3%. More in China: Strong Inflation Unlikely Alter Monetary Policy Outlook, Trade Surplus With US Second On Record.

GBP/USD Mid-Day Outlook

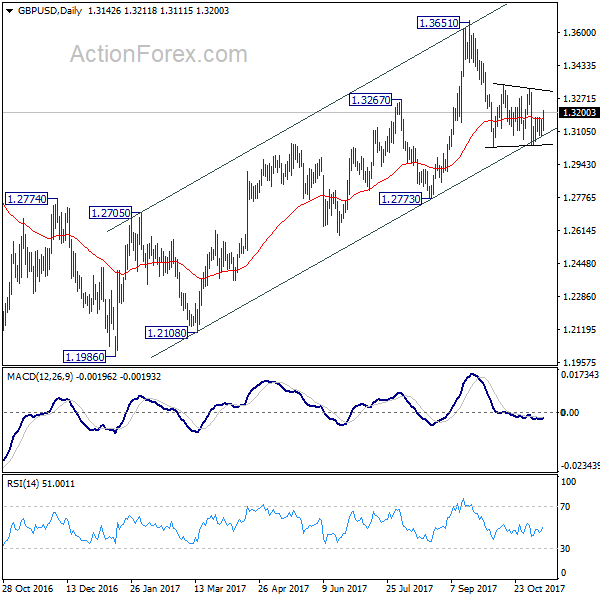

Daily Pivots: (S1) 1.3097; (P) 1.3131; (R1) 1.3178; More….

GBP/USD rebounds notably today but it’s still staying in range of 1.3038/3337. Intraday bias remains neutral and outlook is unchanged. Upside of recovery should be limited below 1.3337 resistance to bring fall resumption. Break of 1.3038 will now resume decline from 1.3651 to 1.2773 key support level. However, decisive break of 1.3337 will indicate that pull back from 1.3651 is completed and medium term rise from 1.1946 is resuming.

In the bigger picture, as noted before, GBP/USD hit strong resistance from the long term falling trend line. Current development is starting to favor that corrective rebound from 1.1946 low has completed at 1.3651. Decisive break of 1.2773 will confirm this bearish case and target a test on 1.1946 low next, with prospect of resuming the low term down trend. Nonetheless, break of 1.3320 resistance will restore the rise from 1.1946 for 38.2% retracement of 2.1161 (2007 high) to 1.1946 (2016 low) at 1.5466.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Japan Money Stock M2+CD Y/Y Oct | 4.10% | 4.10% | 4.10% | 4.00% |

| 0:30 | AUD | RBA Monetary Policy Statement | ||||

| 4:30 | JPY | Tertiary Industry Index M/M Sep | -0.20% | -0.10% | -0.20% | -0.10% |

| 9:30 | GBP | Industrial Production M/M Sep | 0.70% | 0.30% | 0.20% | 0.30% |

| 9:30 | GBP | Industrial Production Y/Y Sep | 2.50% | 1.90% | 1.60% | 1.80% |

| 9:30 | GBP | Manufacturing Production M/M Sep | 0.70% | 0.30% | 0.40% | |

| 9:30 | GBP | Manufacturing Production Y/Y Sep | 2.70% | 2.40% | 2.80% | |

| 9:30 | GBP | Construction Output M/M Sep | -1.60% | -0.90% | 0.60% | 0.80% |

| 9:30 | GBP | Visible Trade Balance (GBP) Sep | -11.3B | -12.9B | -14.2B | -12.4B |

| 15:00 | USD | U. of Mich. Sentiment Nov P | 100.6 | 100.7 |