The US stock market rebounded notably overnight, with all three major indexes closing higher. However, this positive momentum didn’t carry over to the Asian session, where major markets are trading mixed. Despite the gains in the US, the price actions this week still appear more corrective than not, indicating that selling pressure has only temporarily eased rather than fully dissipated. With no major US events scheduled for today, this consolidative mood is likely to persist, potentially extending until next week’s CPI release.

In the currency markets, Australian Dollar is currently the strongest performer for the week, followed by New Zealand Dollar and Canadian Dollar. On the other hand, Swiss Franc is the weakest, with British Pound and Japanese Yen also lagging. Euro and Dollar are positioned in the middle.

Today’s focus will be on Canadian employment data. Earlier this week, BoC’s July meeting minutes revealed concerns among some members that further labor market weakness could delay the rebound in consumption, exerting downward pressure on both growth and inflation. Such developments might push the BoC to consider normalizing interest rates from the current restrictive levels to a more neutral stance.

Technically, USD/CAD is worth some attention today. Fall from 1.3946 slowed after hitting 1.3720, as seen in 4H MACD. Rebound from current level, followed by break of 1.3790 minor resistance will suggest that the corrective pullback is over, and kept the rise from 1.3716 intact. However, downside re-acceleration from there would indicate that deeper correction is underway, probably through 1.3588 support.

In Asia, at the time of writing, Nikkei is down -0.65%. Hong Kong HSI is up 1.41%. China Shanghai SSE is down -0.01%. Singapore Strait Times is up 0.37%. Japan 10-year JGB yield is up 0.0276 at 0.860. Overnight, DOW rose 1.76%. S&P 500 rose 2.30%. NASDAQ rose 2.87%. 10-year yield rose 0.029 to 3.997.

Fed’s Barkin: Disinflation trend positive, economy offers time for deliberate rate decisions

Richmond Fed President Tom Barkin expressed optimism about the ongoing disinflation trend during a virtual event overnight.

Barkin noted that recent data has been encouraging, both in overall levels and across various inflation components, stating that “all the elements of inflation seem to be settling down.” He remains “relatively hopeful” that this trend will persist.

Barkin also highlighted that the current economic environment provides some leeway to assess whether the economy is gradually normalizing, which would allow for a steady and deliberate approach to rate adjustments. He pointed out the importance of determining if further aggressive action is necessary, depending on how the economy evolves.

Goolsbee: Fed’s focus on economy, not stock market or elections

Chicago Fed President Austan Goolsbee reiterated concerns about the current stance of monetary policy in a Fox interview, warning that maintaining high borrowing costs, even as inflation declines, could further tighten financial conditions and potentially harm the labor market. Goolsbee stressed the importance of balancing monetary policy to avoid unnecessary damage to employment.

He also made it clear that Fed’s decisions are driven solely by economic considerations, not by the stock market or political factors. Goolsbee stated, “The Fed’s out of the election business. The Fed is in the economic business,” emphasizing that the focus remains on maximizing employment and stabilizing prices.

Fed’s Schmid: Further labor market cooling needed before rate cut

Kansas City Fed President Jeff Schmid acknowledged that while inflation is nearing the Fed’s 2% target, currently at around 2.5%, “we are still not quite there.”

Nevertheless, “if inflation continues to come in low, my confidence will grow that we are on track to meet the price stability part of our mandate, and it will be appropriate to adjust the stance of policy,” Schmid said at a bankers’ event overnight.

Despite fears sparked by a weak jobs report, Schmid pushed back against the notion that Fed would need to take aggressive action to avoid a recession. He described the economy as resilient, with strong consumer demand and a labor market that, although cooling, remains “quite healthy.”

Schmid noted that Fed’s current policy stance “is not that restrictive” and suggested that further cooling in the labor market may be necessary to achieve additional declines in inflation.

China’s CPI rises to 0.5% in Jul, driven by surging food prices

China’s CPI rose by 0.5% yoy in July, up from June’s 0.2% yoy surpassing expectations of 0.4% yoy and marking the highest increase since February. This uptick was driven in part by a significant 20.4% yoy surge in pork prices, the highest since December 2022. Core CPI, which excludes food and energy prices, saw a slower rise of 0.4% yoy, down from 0.6% yoy in June.

On a month-over-month basis, CPI rebounded with a 0.5% increase, reversing the -0.2% decline seen in June and exceeding expectation of 0.3% rise. The rise in food prices, driven by high temperatures and heavy rainfall in some regions, contributed significantly to this monthly growth, according to NBS statistician Dong Lijuan.

Meanwhile, China’s PPI as unchanged at -0.8% yoy, slightly better than the expected -0.9%.

Looking ahead

Germany CPI final and Swiss SECO consumer climate will be released in European session. Canada employment data is the main focus later in the day.

AUD/USD Daily Report

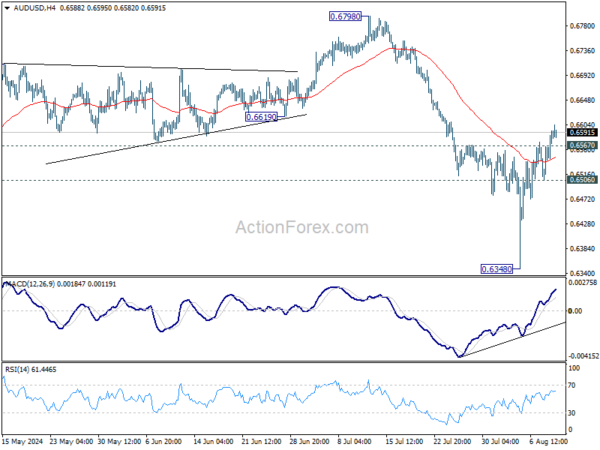

Daily Pivots: (S1) 0.6535; (P) 0.6565; (R1) 0.6622; More...

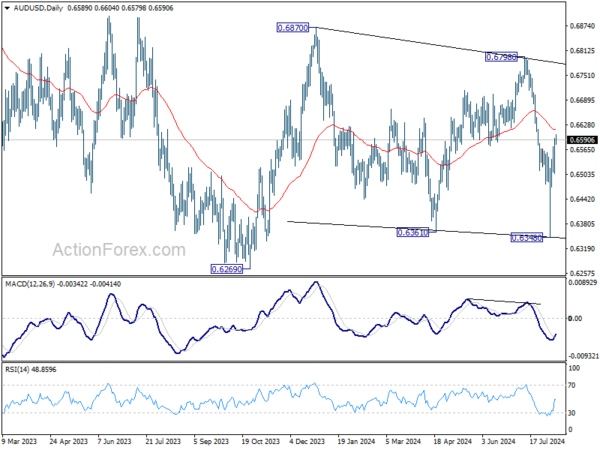

AUD/USD’s break of 0.6567 resistance confirms short term bottoming at 0.6348 and stronger rebound is underway. Intraday bias is back on the upside for 55 D EMA (now at 0.6614). Sustained break there will target 0.6798 resistance. On the downside, break of 0.6506 minor support will turn bias back to the downside for retesting 0.6348 instead.

In the bigger picture, overall, price actions from 0.6169 (2022 low) are seen as a medium term corrective pattern, with fall from 0.6798 as another falling leg. Deeper fall could be seen to the lower side of the range between 0.6169/6361. But strong support should be seen there to contain downside. For now, risk will stay on the downside as long as 55 D EMA (now at 0.6614) holds, in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | CNY | CPI Y/Y Jul | 0.50% | 0.40% | 0.20% | |

| 01:30 | CNY | PPI Y/Y Jul | -0.80% | -0.90% | -0.80% | |

| 06:00 | EUR | Germany CPI M/M Jul F | 0.30% | 0.30% | ||

| 06:00 | EUR | Germany CPI Y/Y Jul F | 2.30% | 2.30% | ||

| 07:00 | CHF | SECO Consumer Climate Q3 | -36 | -37 | ||

| 12:30 | CAD | Net Change in Employment Jul | 26.9K | -1.4K | ||

| 12:30 | CAD | Unemployment Rate Jul | 6.50% | 6.40% |