The financial markets are relatively quiet in Asian session today, with major currency pairs and crosses trading within yesterday’s range. BoC’s summary of deliberations suggested that the central bank is on track for further policy loosening. Meanwhile, BoJ’s summary of opinions indicated the board is preparing for more rate hikes. Comments from RBA’s Governor reiterated that another rate hike remains possible, while rate cuts are not on the horizon. Additionally, RBNZ’s survey showed a notable decline in inflation expectations, providing room for a rate cut this year. Despite these significant policy signals, the markets have largely ignored them.

Most currency pairs appear to be in consolidation following recent sharp moves, including Yen and Swiss Franc. Sentiment remains fragile, with risk-off behavior likely to resurface at any moment. For the week, Canadian Dollar is currently the strongest, followed by Kiwi and Aussie. Sterling is the weakest, followed by Swiss Franc and Dollar. Euro and Yen are positioned in the middle of the pack.

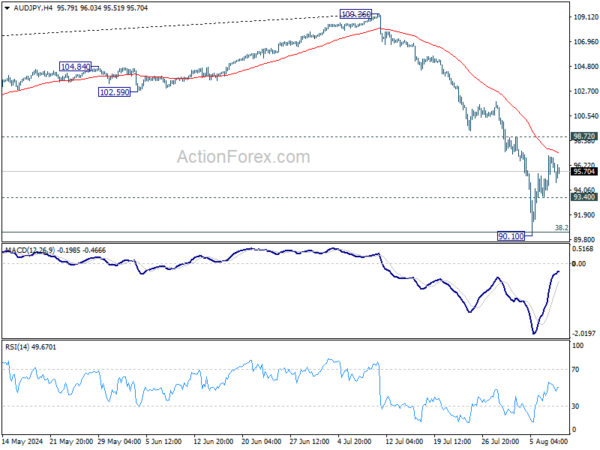

Technically, the recent rebound in Yen crosses is beginning to lose momentum. AUD/JPY is particularly worth watching, as it could be the first to fall on renewed risk-off sentiment. Break of 93.40 minor support will argue that the recovery from 90.10 has completed, and bring retest of this low. Further break there will resume the whole decline from 109.36. While another rise cannot be ruled out, outlook will stay bearish as long as 98.72 resistance holds, and eventual downside breakout is still in favor.

In Asia, Nikkei closed down -0.80%. Hong Kong HSI is up 0.22%. China Shanghai SSE is up 0.16%. Singapore Strait Times is up 0.13%. Japan 10-year JGB fell -0.0317 to 0.849. Overnight, DOW fell -0.60%. S&P 500 fell -0.77%. NASDAQ fell -1.05%. 10-year yield rose 0.080 to 3.968.

One BoJ member suggests gradual rate hike to above 1% neutral rate

BoJ’s Summary of Opinions from the July 30-31 meeting reveals that board members discussed further rate hikes after implementing the second interest rate increase this year at the meeting.

One member’s opinion stood out, suggesting that, assuming the price stability target is achieved in the second half of fiscal 2025, BoJ should raise the policy interest rate to the level of the “neutral interest rate.” This neutral rate is estimated to be “at least around 1 percent.” To avoid rapid hikes, BoJ should increase the policy interest rate in a “timely and gradual manner.”

The consensus among members is that economic activity and prices have been developing generally “in line with the Bank’s outlook.” Consequently, it is deemed appropriate for to raise the policy interest rate and adjust the degree of monetary accommodation.

One opinion highlighted that raising interest rates at a “moderate pace” aligns the adjustment in monetary accommodation with underlying inflation. Such moves “will not have monetary tightening effects.”

RBA’s Bullock: Rate hikes still possible as inflation timeline extends

RBA Governor Michele Bullock revealed in a speech today that the board “explicitly considered” another rate hike during Tuesday’s meeting. Although they decided to hold rates steady, Bullock stressed that RBA “will not hesitate” to hike if necessary.

Bullock highlighted two main points from the meeting. First, despite weak economic growth, the gap between aggregate demand and supply is “larger than previously thought,” leading to “persistent inflation.” Second, demand growth is expected to “pick up over the next year,” though there is significant uncertainty about this outlook.

Due to these factors, the Board’s inflation target timeline has been “pushed out”. “We don’t expect to be back in the 2–3 percent target range until the end of 2025 – over a year away,” Bullock stated. This delay prompted the board to consider another rate hike to ensure inflation continues to decline.

Ultimately, RBA decided to keep interest rates unchanged, believing this would balance their inflation and employment objectives. However, Bullock emphasized that the Board remains vigilant regarding upside inflation risks and “will not hesitate to raise rates if it needs to.”

RBNZ inflation expectations drop across all horizons

RBNZ latest Survey of Expectations showed a notable decline in inflation expectations across all time horizons. One-year-ahead annual inflation expectations fell by 33 basis points, dropping from 2.73% to 2.40%. This marks the sixth consecutive quarterly decline since June 2023.

The two-year-ahead inflation expectations, a closely monitored indicator, also saw a decrease from 2.33% to 2.03%. These expectations are now below the average level observed since 2002, indicating a substantial shift in business outlook regarding future inflation.

Long-term expectations followed a similar trend. Five-year-ahead inflation expectations decreased to 2.07%, while ten-year-ahead expectations dropped to 2.03%.

Survey respondents also provided their outlook on the OCR. On average, they expect OCR to be 5.40% by the end of the September 2024 quarter, with a projected decrease to 4.24% by the end of June 2025. The current OCR stands at 5.50%.

BoC minutes reveal clear consensus for further rate cuts

BoC’s Summary of Deliberations from its July meeting indicates a “clear consensus” on the need for more rate cuts if inflation continues to ease. With inflation “closer to target” and “downside risks” becoming “more prominent,” members agreed that it would be appropriate to “lower the policy rate further” if inflation follows the projected path.

During the meeting, members discussed various risks to the inflation outlook. The focus was on “downside risks” more than in previous meetings. Members acknowledged that weak consumer sentiment is likely to persist, posing a risk that consumer spending could be “significantly weaker” than expected in 2025 and 2026. Additionally, further labor market weakness could “delay the rebound” in consumption, exerting “downward pressure on growth and inflation.”

Conversely, some members highlighted the “stickiness of services price inflation,” which could keep inflation elevated. They noted that price pressures in services, which are “more closely affected by wages,” are unlikely to be offset by the disinflation seen in goods and other services in recent months.

Looking ahead

The European economic calendar is empty. US will release jobless claims and wholesale inventories final.

EUR/CHF Daily Outlook

Daily Pivots: (S1) 0.9321; (P) 0.9395; (R1) 0.9488; More….

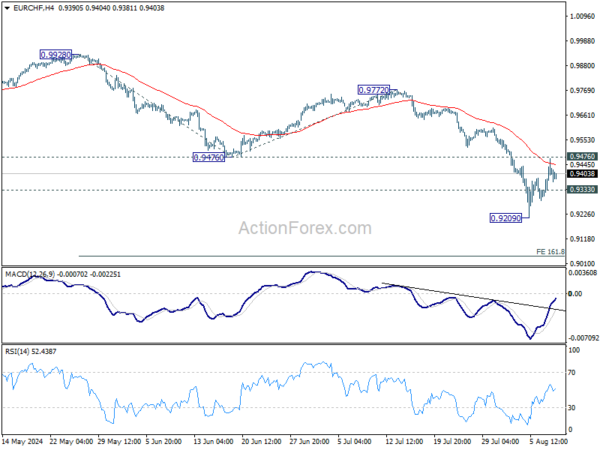

EUR/CHF’s recovery from 0.9209 extended higher but upside is capped below 0.9476 support turned resistance. Intraday bias remains neutral and further decline is still expected. On the downside, below 0.9333 minor support will bring retest of 0.9209 first. Firm break there will resume larger fall from 0.9928 to 161.8% projection of 0.9928 to 0.94767 from 0.9772 at 0.9041 next. However, sustained break of 0.9476 will turn bias back to the upside for stronger rebound.

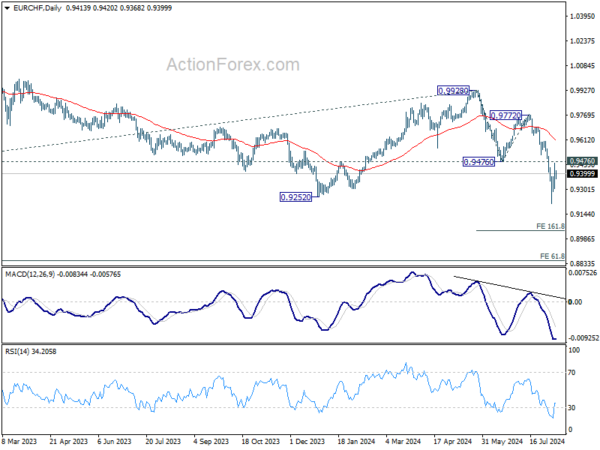

In the bigger picture, current downside acceleration argues that medium term corrective pattern from 0.9407 (2022 low) might have completed with three waves to 0.9928. Decisive break of 0.9252 (2023 low) will confirm long term down trend resumption. Next target will be 61.8% projection of 1.1149 to 0.9407 from 0.9928 at 0.8851. For now, outlook will stay bearish as long as 0.9928 resistance holds, even in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BoJ Summary of Opinions | ||||

| 23:50 | JPY | Bank Lending Y/Y Jul | 3.20% | 3.20% | 3.20% | |

| 23:50 | JPY | Current Account (JPY) Jun | 1.78T | 2.29T | 2.41T | |

| 03:00 | NZD | RBNZ Inflation Expectations Q/Q Q3 | 2.03% | 2.33% | ||

| 05:00 | JPY | Eco Watchers Survey: Current Jul | 47.5 | 47.8 | 47 | |

| 12:30 | USD | Initial Jobless Claims (Aug 2) | 245K | 249K | ||

| 14:00 | USD | Wholesale Inventories Jun F | 0.20% | 0.20% | ||

| 14:30 | USD | Natural Gas Storage | 22B | 18B |