The US markets responded negatively overnight as Senate’s version of tax plan confirmed they wanted to delay corporate tax cut by a year. But considering intraday price actions, the reactions were not disastrous. DOW dropped initially to 23310.02 before paring much losses to close at 23461.91, down -101.42 pts or -0.43%. That’s close to open at 23492.09. S&P 500 dropped as low as 2566.33 before closing at 2584.62, down -9.76 pts or -0.38%. That’s even slightly higher than open at 2584.00. NASDAQ dropped to as low as 6687.28 then closed at 6750.05, down -39.07 pts or -0.58%. That’s notably higher than open at 6737.45. After all, US equities has now entered into a consolidation phase after recent record runs. 10 year yield tried to recovery and ended up 0.006 at 2.331. Dollar, on the other hand, stays pressured and is set to end as the weakest one for the week.

Senate tax plan confirms corporate cut delay

The Senate’s version of tax plan was finally released yesterday. And it’s confirmed that Senators proposed to delay the corporate tax cut from 35% to 20% in 2019. That’s a year later than what the House proposed, that is 2018. There are also differences in some key aspect. To name a few, Senate prefers to set up a top individual rate of 38.2%, instead of House’s 39.6% which is unchanged. This carries symbolic meaning of lowering taxes for the richer. Senate’s version also repeals the deductions for state and local taxes. Some see the differences as significant and could set up a long process of reconciliation.

The House Ways and Means committee passed its tax bill yesterday, setting it up for a full House vote as soon as next week. Senate will hold hearings on the bill next week. And the Senators are targeting to pass it a week after Thanksgiving. After passing the bill in Senate, the two chambers will try to close the gaps in a process known as a conference committee.

ECB officials optimistic on economic outlook

ECB Executive Board member Benoit Coeure acknowledged that the expansion in Eurozone economy is becoming more balanced and robust. But he noted that "this recovery is carried in no small part by monetary policy and the exchange rate and equally by low commodity prices." And, he emphasized that "these factors won’t last forever" and "if we accept this, the states of the euro zone will find themselves unarmed when the next crisis arrives." He urged to "build up new firepower and for that we need reforms."

Separately, Governing Council member Francois Villeroy de Galhau said that "Euro-area growth will be sustained in the next two years thanks to strong investment and thanks to increased convergence among countries." And, "this forecast, including a positive but still subdued inflation, confirms the adequacy of the gradual normalization of our monetary policy we are engaged in." He referred to the European Commission forecast that growth is accelerating to 2.2% this year.

Another Governing Council member Philip Lane said that "if we have enough signals, we can get active and move on" with monetary policy. And he emphasized that "our monetary policy does not always have to follow such a gradual and incremental approach as it is currently the case." And, "inflation doesn’t have to reach our goal before we discuss changing our policy." Nonetheless, he also acknowledged that "inflation must be clearly on the way towards this goal. At the moment this is not the case."

Brexit to take place at 11 p.m. GMT, on March 29, 2019

In UK, Brexit Secretary David Davis is going to propose an amendment to the EU Withdrawal Bill in the Parliament next week. He suggests to making "crystal clear" that the departure will take place at 11 p.m. GMT, on March 29, 2019. Davis said that "we’ve listened to members of the public and Parliament and have made this change to remove any confusion or concern about what ‘exit day’ means". And, "this important step demonstrates our pragmatic approach to this vital piece of legislation — where MPs can improve the Bill, whatever their party, we will work with them."

RBA sees accelerating growth, sluggish inflation ahead

RBA’s Statement of Monetary Policy showed that the central bank is expecting accelerating growth but sluggish inflation ahead. Thus, it’s likely to maintain a neutral stance to keep the cash rate unchanged at record low at 1.5%. Here is a summary of changes in projections:

- GDP growth at 2.5% in Dec 2017, 3.25% in Dec 2018, 3.25% in Dec 2019. Prior forecast at 2-3%, 2.75-3.75%, 3-4% respectively

- CP inflation at 2% in Dec 2017, 2.25% in Dec 2018, 2.25% in Dec 2019. Prior forecast at 1.5-2.5%, 1.75-2.75%, 2-3% respectively.

- Underlying inflation at 1.75% in Dec 2017, 1.75% in Dec 2018, 2% at Dec 2019. Prior forecast at 1.5-2.5%, 1.5-2.5%, 2-3% respectively.

On the data front

Japan M2 rose 4.1% yoy in October. UK productions will be the main focus in European session. Trade balance and construction output will also be released. US will release U of Michigan sentiment.

USD/CAD Daily Outlook

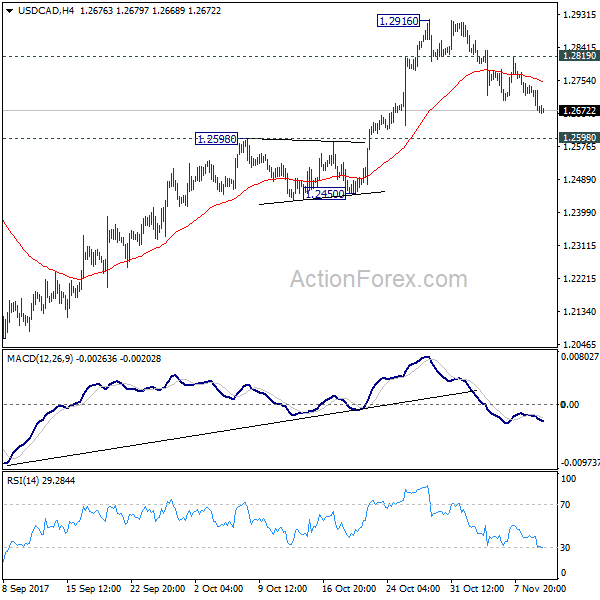

Daily Pivots: (S1) 1.2652; (P) 1.2696; (R1) 1.2725; More….

USD/CAD’s corrective pull back from 1.2916 is still in progress and could extend lower. But still, as long as 1.2598 resistance turned support holds, near term outlook stays bullish. Further rise is expected in the pair. Above 1.2819 minor resistance will turn bias back to the upside for 1.2916 high first. Break there will extend the rise from 1.2061 to 38.2% retracement of 1.4689 to 1.2061 at 1.3065. However, sustained break of 1.2598 will argue that rebound from 1.2061 has completed after hitting 55 week EMA (now at 1.2916). Near term outlook will be turned bearish in this case.

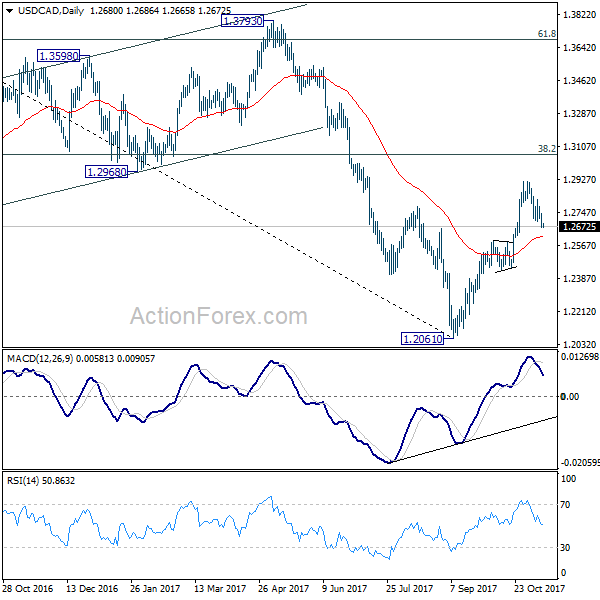

In the bigger picture, USD/CAD should have defended 50% retracement of 0.9406 (2011 low) to 1.4689 (2016 high) at 1.2048. And with 1.2048 intact, we’d favor the case that fall from 1.4689 is a correction. Rise from 1.2061 medium term bottom should now target 38.2% retracement of 1.4689 to 1.2061 at 1.3065. Firm break there will target 1.3793 key resistance next (61.8% retracement at 1.3685). We’ll now hold on to this bullish view as long as 1.2450 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Japan Money Stock M2+CD Y/Y Oct | 4.10% | 4.10% | 4.10% | 4.00% |

| 0:30 | AUD | RBA Monetary Policy Statement | ||||

| 4:30 | JPY | Tertiary Industry Index M/M Sep | -0.2% | -0.10% | -0.20% | |

| 9:30 | GBP | Industrial Production M/M Sep | 0.30% | 0.20% | ||

| 9:30 | GBP | Industrial Production Y/Y Sep | 1.90% | 1.60% | ||

| 9:30 | GBP | Manufacturing Production M/M Sep | 0.30% | 0.40% | ||

| 9:30 | GBP | Manufacturing Production Y/Y Sep | 2.40% | 2.80% | ||

| 9:30 | GBP | Construction Output M/M Sep | -0.90% | 0.60% | ||

| 9:30 | GBP | Visible Trade Balance (GBP) Sep | -12.9B | -14.2B | ||

| 15:00 | USD | U. of Mich. Sentiment Nov P | 100.6 | 100.7 |