Dollar tries to recover today but momentum is weak. The greenback is still trading as the weakest major currency for the week, as weighed down by concerns over the tax plan. But the picture could be cleared up as Senate is set to unveil their version of the bill. Released from US, initial jobless claims rose 10k to 239k in the week ended November 4, higher than expectation of 231K. Nonetheless, the four week moving average dropped -1.25k to 231.25k, lowest since March 1973. Continuing claims rose 17k to 1.9m in the week ended October 28. From Canada, new housing price index rose 0.2% mom in September.

Elsewhere, German trade surplus was largely unchanged at EUR 21.8b in September. UK RICS house price balance rose 1.0% in October. Swiss unemployment rate was unchanged at 3.1% in October. Japan machine orders dropped -8.1% mom in September, current account surplus narrowed to JPY 1.84T. Australia home loans dropped -2.3% mom in September. China CPI accelerated to 1.9% yoy in October, PPI was unchanged at 6.9% yoy.

Republicans to unveil their tax plan

In the US, House Ways and Means Committee are spending the last efforts in hammering out the tax bill for a vote today. Meanwhile, Senator Republicans are set to brief and publish their own version of the bill today too. A key point of focus for the financial markets is the corporate tax cut from 35% to 20%. There are talks that Senators would opt for delaying the cut to comply with the budget rule. But Senator Orrin Hatch, chairman of the tax-writing finance committee, said he would prefer not to delay. Other than that, economists will scrutinize the plans to see how far the versions are apart. Thus, there would be a more realistic sense on whether the final version could be. Dollar could have a strong reaction once the Senate tax bill is released.

Cleveland Fed Mester: Gradual rate path is best strategy

Cleveland Fed President Loretta Mester said in a television interview that "a gradual path is the best strategy we have for prolonging the expansion." She added that "obviously we want to be responsible to changes in the economic outlook and as data comes in we are always revising the outlook." WTI oil price surged to 2 year high at 57.96 yesterday on Middle East political uncertainty. But that doesn’t worry Mester and she said "the key thing will be, does it upset inflation expectations? Will they arise? Will they respond to those oil price increases?"

Powell’s confirmation hearing scheduled on November 28

US Senate Banking Committee schedules a confirmation hearing for Jerome Powell as Fed Chair on November 28. Fed Governor has already got quick endorsement from Republicans after Trump’s nomination. Senate Majority Leader Mitch McConnell met with Powell on Tuesday and said he looked forward to "supporting his nomination". Meanwhile chair of the Banking Committee, Republican Senator Mike Crapo, also hailed that Powell was "well-equipped to lead our economy and the country in a positive direction." Powell is generally seen as a safe choice by the markets and would likely continue with the policy path laid by Janet Yellen. That is, Fed will continue with rate hikes, likely three, next year, as well as the plan to shrink the USD 4.5T balance sheet.

ECB could delay and improve bad loan rules

ECB’s plan to implement tougher rules on bad loans is a hot topic this week. Chair of the Supervisory Board at the European Central Bank Danièle Nouy told EU Parliament in Brussels that the "the drafting can be improved, for sure, and it will be improved." And, she proposed to "give us a bit more time". Originally, the rules would be consulted until December 8. Daniele said that could be pushed back to January 1. The plan drew heavy criticism from EU Parliament and Italy. In particular, Italian Economy Minister Pier Carlo Padoan said the plan "goes beyond the supervisory limits" of the bloc’s SSM mechanism.

Brexit negotiation restarts

Brexit negotiations restart in Brussels today. A sticky point of the deadlock is the amount of the divorce bill. It’s believed that EU would require UK to pay as much as EUR 60b in financial obligations But so far, UK has refused to clearly state how much it’s willing to pay. Ahead of the negotiations, European Commissions released new economic forecasts. EC projects UK economy to grow 1.5% in 2017, 1.3% in 2018 and slows further to 1.1% in 2019, the year Brexit happens. The figures would be second lowest among EU nations.

BoJ opinions show debate on extreme steps

In the summary of opinions in the October BoJ meeting, there were debates on the call from new comer Goushi Kataoka to increase stimulus. Kataoka proposed to target 15 year bond yields to below 0.2% through the bond purchases. That is, he either wanted to expand the targeting from 10 year yields to include 15 year yields. Or, he wanted to switch to target 15 year yield. But the proposal met with oppositions as one board member described by one member as "extreme steps" that could destabilize financial markets. The member added that "the current policy is the most appropriate one to lay the grounds for companies to boost productivity, with the smallest degree of uncertainty over its effect on the economy." Nonetheless, it’s consensus that there were concerns over inflation outlook and another member noted "it may take some time before inflation reaches 2 percent."

At this point, there is no confirmation on whether BoJ Governor Haruhiko Kuroda would be renewed for another term next year. The outspoken economic advisor to Prime Minister Shinzo Abe reiterated his call for changes in BoJ. Etsuro Honda said that "The leaders of the central bank must conduct a comprehensive review and then take responsibility." And, "it’s impossible to end deflation without bringing in a new regime." Meanwhile, Honda also warned that BoJ has to meet the 2% inflation target before sales tax hike in 2019. Otherwise, "Japan’s economy will be in critical danger."

RBNZ turned slightly more hawkish

While keeping the OCR unchanged at 1.75%, the tone of November RBNZ statement has turned slightly more hawkish than previous ones. The central bank upgraded inflation forecasts, while describing core inflation as ‘subdued’ and reiterating ‘uncertainties’ in the new government’s policies. The growth outlook remained largely unchanged from August’s, as weaker growth in the housing and construction sector would be offset by greater fiscal spending promised by the new government and higher terms of trade, thanks to NZD depreciation and the rise in oil prices. RBNZ slightly pushed ahead the rate hike schedule. However, given the minimal change, we believe this is rather a symbolic move. The central bank expects more material interest rate movements by 2020. We believe the monetary policy would stay unchanged for the rest of 2018. More in RBNZ Upgraded Inflation Forecasts, Ambivalent About New Government Policies

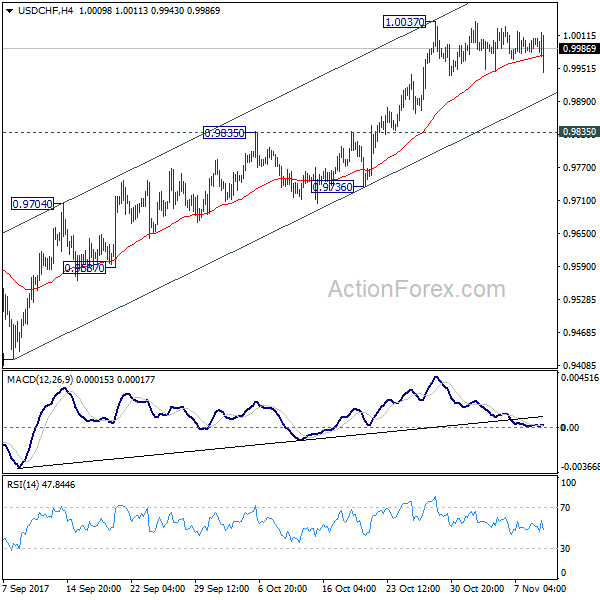

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.9986; (P) 0.9996; (R1) 1.0012; More….

USD/CHF spikes lower today but quickly recovers. The pair is staying in consolidation from 1.0037 and intraday bias remains neutral. We’d continue to expect downside of retreat to be contained above 0.9835 resistance turned support and bring rally resumption. On the upside break of 1.0037 will resume whole rally from 0.9420. And with sustained trading above 61.8% retracement of 1.0342 to 0.9420 at 0.9990, USD/CHF should then target a test on 1.0342 key resistance.

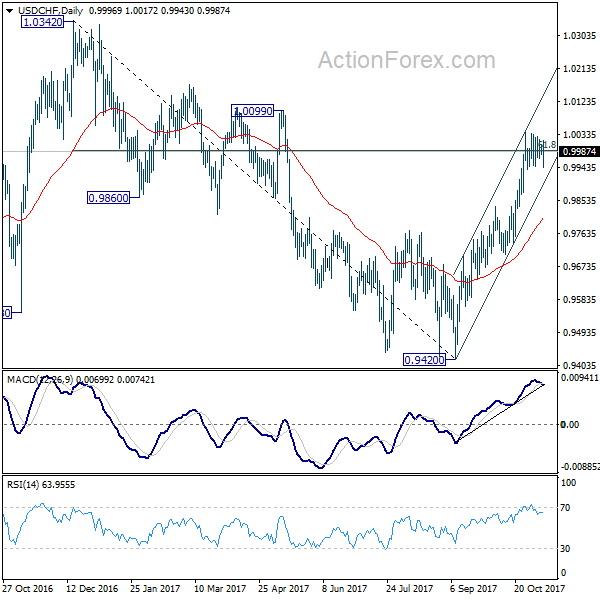

In the bigger picture, current development suggests that USD/CHF has defended 0.9443 (2016 low) key support level again. Rise from 0.9420 could is a medium term up move and should target a test on 1.0342 high. This represents the upper end of a long term range that started back in 2015. On the downside, break of 0.9736 support is now needed to indicate completion of the rise from 0.9420. Otherwise, further rally will remain in favor in medium term.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 20:00 | NZD | RBNZ Rate Decision | 1.75% | 1.75% | 1.75% | |

| 23:50 | JPY | BOJ Summary of Opinions Oct Meeting | ||||

| 23:50 | JPY | Machine Orders M/M Sep | -8.10% | -2.00% | 3.40% | |

| 23:50 | JPY | Current Account (JPY) Sep | 1.84T | 2.05T | 2.27T | |

| 00:01 | GBP | RICS House Price Balance Oct | 1.00% | 4.00% | 6.00% | |

| 00:30 | AUD | Home Loans M/M Sep | -2.30% | 2.00% | 1.00% | 1.50% |

| 01:30 | CNY | CPI Y/Y Oct | 1.90% | 1.70% | 1.60% | |

| 01:30 | CNY | PPI Y/Y Oct | 6.90% | 6.60% | 6.90% | |

| 05:00 | JPY | Eco Watchers Survey Current Oct | 52.2 | 50.5 | 51.3 | |

| 06:45 | CHF | Unemployment Rate Oct | 3.10% | 3.10% | 3.10% | |

| 07:00 | EUR | German Trade Balance Sep | 21.8B | 23.1B | 21.6B | |

| 09:00 | EUR | ECB Economic Bulletin | ||||

| 10:00 | EUR | EU Economic Forecasts | ||||

| 13:30 | CAD | New Housing Price Index M/M Sep | 0.20% | 0.20% | 0.10% | |

| 13:30 | USD | Initial Jobless Claims (NOV 04) | 239K | 231K | 229K | |

| 15:00 | USD | Wholesale Inventories M/M Sep F | 0.30% | 0.30% | ||

| 15:30 | USD | Natural Gas Storage | 15B | 65B |