Asian markets began the week with a cautious tone, as weaker-than-expected GDP growth from China dampened investor sentiment, even though the selloff in stocks has been limited. Today’s set of data, coupled with recent weak PMI readings, points to broader deceleration in China’s recovery momentum, as both consumer and business sentiment are struggling. Markets are now keenly awaiting the Third Plenum in Beijing this week, hoping for new measures to stimulate the economy.

In the currency markets, Dollar is attempting to recover from last week’s losses, although there hasn’t been a clear follow-through in buying yet. Yen remains firm, also lacking strong follow-through buying, while Sterling ranks as the third strongest currency of the day at this point. Conversely, New Zealand Dollar continues to decline, driven lower by disappointing services data that strengthen the case for an earlier RBNZ rate cut. Canadian and Australian Dollars are also softer, while Euro and Swiss Franc are trading in the middle.

Technically, AUD/CAD’s uptrend from 0.8562 is still in progress. Near term outlook will remain bullish as long as 0.9172 support holds. Next target is 100% projection of 0.8562 to 0.9063 from 0.8779 at 0.9280. Decisive break there could prompt further upside acceleration to 161.8% projection at 0.9590. The next move would hinge on this week’s CPI from Canada and employment data from Australia.

In Asia, Japan is on holiday. Hong Kong HSI is down -1.27%. China Shanghai SSE is up 0.01. Singapore Strait Times is up 0.02%.

NZ BNZ services falls to 40.2, weakness accelerating

New Zealand BusinessNZ Performance of Services Index fell from 42.6 to 40.2 in June, marking the lowest level for the sector outside a COVID lockdown month since the survey began in 2007.

BusinessNZ chief executive Kirk Hope noted that after a poor May result, June’s figures “simply got worse”. Activity/Sales dropped to 35.6 and New Orders/Business fell to 38.3, both hitting record lows for non-lockdown months. Employment decreased to 45.6, the lowest since February 2022, while Supplier Deliveries declined to 41.6, the lowest since March 2022.

Negative comments rose to 67.0% in June, up from 65.4% in May and 66.3% in April, with respondents citing recessionary pressures.

BNZ Senior Economist Doug Steel observed, “The Performance of Services Index has been well below average for more than a year. Moreover, the weakness appears to be accelerating.”

China’s Q2 GDP growth slows to 4.7% amid weak domestic demand

China’s GDP grew 4.7% yoy in Q2, down from 5.3% in Q1 and missing expectations of 5.1%. For the first half of the year, GDP growth stood at 5% year-on-year.

The National Bureau of Statistics noted, “The current external environment is complicated, while domestic demand remains insufficient. We still need to consolidate the foundation for economic recovery.”

June’s industrial production increased by 5.3% yoy, exceeding expectations of 5.0% yoy. However, retail sales grew only 2.0% yoy, well below the forecasted 3.3% yoy.

Fixed asset investment in the first six months rose by 3.9% ytd yoy, meeting expectations. Property investment saw a -10.1% yoy decline, consistent with May’s fall. Additionally, home sales by floor area dropped by -19.0% yoy.

BoE’s Dhingra advocates for rate normalization now

In a podcast today, BoE MPC member Swati Dhingra emphasized that “now is the time” to start normalizing interest rates and to “stop squeezing living standards” as the central bank has been doing to curb inflation.

Dhingra pointed out that demand in the UK is too weak for inflation to surge again, noting that inflation returned to 2% in May. She stated, “I don’t see some kind of consumption boom and if we’re going to start moderating from the very high level of interest rate that we are at now… it is going to take some time for that to happen, for us to moderate it as well as for that to then feed into the real economy.”

Known as a dove within the MPC, Dhingra has consistently voted since February to cut the Bank Rate from its 16-year high of 5.25%.

ECB to hold and more global inflation data awaited

This week, financial markets are set to focus on ECB’s monetary policy decision and a wave of crucial global inflation reports.

ECB is widely expected to keep its deposit rate at 3.75% and its main refinancing rate at 4.25%. President Christine Lagarde is anticipated to maintain the central bank’s data-dependent, meeting-by-meeting approach. While she is likely to assure that further policy easing is underway, the central bank wouldn’t commit to any forward guidance.

A Reuters poll conducted between July 4-11 indicated that 69 out of 85 economists predict ECB will cut the deposit rate twice more this year, in September and December, bringing it down to 3.25% by the end of the year. Additionally, nearly two-thirds of respondents believe the end-2024 deposit rate is more likely to be higher than their current expectations, suggesting that there is risk that ECB might opt for fewer cuts.

Global inflation data will also dominate the headlines this week, with CPI reports due from Canada, New Zealand, the UK, and Japan.

In Canada, BoC the chance of another rate cut by BoC on July 14 increased following weaker-than-expected June job data, which showed unemployment rising by 0.2% to 6.4%. Any downside surprises in the June CPI data could solidify this dovish case.

RBNZ left rates unchanged last week but surprisingly indicated that policy restriction “will be tempered” as inflation declines. Sharper-than-expected slowdown in Q2 CPI could bring forward the anticipated timing of the first rate cut from February next year to this November.

In the UK, hopes for an August BoE rate cut were dashed by hawkish comments from Chief Economist Huw Pill. Nonetheless, the decision will still hinge on the inflation outlook. Known hawk Catherine Mann cautioned that May’s CPI hitting 2% was just a “touch and go”. But this view will need backup from the upcoming June CPI release.

Meanwhile, in Japan, BoJ is expected to outline plans to taper its bond purchases at its late July meeting, though opinions vary on the extent of the reduction. Governor Kazuo Ueda has indicated that a rate hike is possible, but the recent strong rebound in Yen, allegedly due to intervention, adds complexity to the decision. But after all, the set of core and core-core CPI data would need to go up in June, rather than down, for BoJ to act again on interest rate.

Other key data to watch this week include retail sales figures from Canada, the US, and the UK, employment data from the UK and Australia, and German ZEW economic sentiment index.

Here are some highlights for the week:

- Monday: New Zealand BusinessNZ services index; China GDP, industrial production, retail sales, fixed asset investment; Swiss PPI; Eurozone industrial production; Canada manufacturing sales, wholesale sales; US Empire State manufacturing.

- Tuesday: Japan tertiary industry index; Eurozone trade balance; Germany ZEW; Canada housing starts, CPI; US retail sales, import prices, business inventories, NAHB housing index.

- Wednesday: New Zealand CPI; UK CPI, PPI; Eurozone CPI final; US building permits, housing starts, industrial production, Fed’s Beige Book report.

- Thursday: Japan trade balance; Australia employment; Swiss trade balance; UK employment; ECB rate decision; US jobless claims.

- Friday: UK Gfk consumer confidence; Japan CPI; Germany PPI; UK retail sales, public sector net borrowing; Eurozone current account; Canada retail sales, IPPI and RMPI.

GBP/USD Daily Outlook

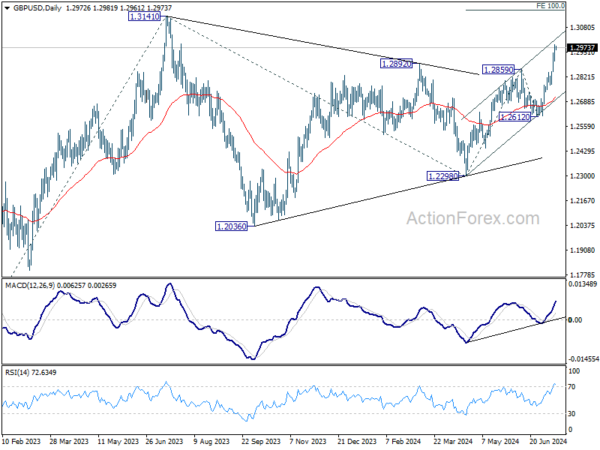

Daily Pivots: (S1) 1.2930; (P) 1.2960; (R1) 1.3019; More…

Intraday bias in GBP/USD remains on the upside despite current retreat. Rise fro 1.2298 is in progress for 100% projection of 1.2298 to 1.2859 from 1.2612 at 1.3173, which is slightly above 1.3141 key medium term resistance. On the downside, below 1.2898 minor support will turn bias neutral and bring consolidations first, before staging another rally.

In the bigger picture, corrective pattern from 1.3141 medium term top (2023 high) could have completed with three waves to 1.2298 already. This will now remain the favored case as long as 1.2612 support holds. Firm break of 1.3141 will target 61.8% projection of 1.0351 (2022 low) to 1.3141 from 1.2298 at 1.4022.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | NZD | Business NZ PSI Jun | 40.2 | 43 | 42.6 | |

| 23:01 | GBP | Rightmove House Price Index M/M Jul | -0.40% | 0.00% | ||

| 02:00 | CNY | GDP Y/Y Q2 | 4.70% | 5.10% | 5.30% | |

| 02:00 | CNY | Industrial Production Y/Y Jun | 5.30% | 5.00% | 5.60% | |

| 02:00 | CNY | Retail Sales Y/Y Jun | 2.00% | 3.30% | 3.70% | |

| 02:00 | CNY | Fixed Asset Investment YTD Y/Y Jun | 3.90% | 3.90% | 4.00% | |

| 06:00 | EUR | Germany Retail Sales M/M May | 0.00% | -1.20% | ||

| 06:30 | CHF | PPI M/M Jun | 0.10% | -0.30% | ||

| 06:30 | CHF | PPI Y/Y Jun | -1.80% | |||

| 09:00 | EUR | Eurozone Industrial Production M/M May | -1.00% | -0.10% | ||

| 12:30 | USD | Empire State Manufacturing Index Jul | -8 | -6 | ||

| 12:30 | CAD | Manufacturing Sales M/M May | 0.20% | 1.10% | ||

| 12:30 | CAD | Wholesale Sales M/M May | 2.00% | 2.40% | ||

| 14:30 | CAD | BoC Business Outlook Survey |