Dollar surged across the board overnight and stayed firm in Asian session, fueled by the strong rally in benchmark US Treasury yields. This rally is partly attributed to rising expectations of a Donald Trump victory in the upcoming presidential election. Analysts suggest that a Trump win would likely lead to heightened tariffs and expanded fiscal policies, both of which could stimulate inflation. Trump’s performance in the recent debate against President Joe Biden has boosted these expectations, prompting some economists to recommend hedging against inflation as a precautionary measure.

Conversely, Kiwi faced substantial selling pressure following release of sharply deteriorated business confidence report for Q2. RBNZ had projected the timing for the first rate cut to be in Q3 next year, but the worsening business confidence and economic outlook have led some analysts to speculate that this cut could be brought forward to as early as Q1. There is even speculation that the first rate cut might occur as soon as Q4 of this year.

Across the broader currency markets, Euro is following closely behind Dollar as the second strongest currency of the day. However, it remains volatile due to ongoing political developments in France, where uncertainty is still high. Canadian Dollar is currently the third strongest currency. Conversely, Aussie is the second weakest, following Kiwi, despite hawkish minutes from RBA that highlighted significant concerns over upside inflation risks. Swiss Franc, British Pound, and Japanese Yen are mixed, occupying middle positions in the currency rankings.

Technically, the surprisingly strong rally in US 10-year yield overnight argues that fall from 4.737 has completed with three waves down to 4.188. That came just ahead of 61.8% retracement of 3.785 to 4.737 at 4.148. More importantly, this development suggest that rise from 3.785 is not over and could be seen to resume. Further rise is now expected as long as 55 D EMA (now at 4.376) holds. Next target is a retest on 4.737 resistance.

In Asia, at the time of writing, Nikkei is up 1.03% and back above 40k handle. Hong Kong HSI is up 0.40%. China Shanghai SSE is up 0.13%. Singapore Strait Times is up 0.52%. Japan 10-year JGB yield is up 0.0193 at 1.084. Overnight, DOW rose 0.13%. S&P 500 rose 0.27%. NASDAQ rose 0.83%. 10-year yield jumped sharply by 0.136 to 4.479.

RBA minutes: The narrow path is becoming narrower

Minutes of RBA’s June meeting emphasize the need to remain “vigilant to upside risks to inflation”. The RBA noted that the information received since the previous meeting reinforced this need, underscoring the “extent of uncertainty” in the current economic environment, which makes it “difficult either to rule in or rule out” future changes in interest rates.

Concerns were raised about the “narrow path” to bringing inflation back to target within a reasonable timeframe without significantly deviating from full employment. This path, according to the minutes, is “becoming narrower.”

The decision to keep the cash rate target unchanged at 4.35% was deemed the stronger option compared to another rate hike. Data received since May meeting “had not been sufficient” to alter RBA’s assessment that inflation would return to target by 2026, despite “some elevated upside risk” surrounding the forecast. Moreover, the minutes revealed that the members felt there was “not enough evidence” to suggest that the outlook for aggregate demand had strengthened.

NZIER survey shows rising pessimism among New Zealand firms

The NZIER Quarterly Survey of Business Opinion for Q2 reveals increasing pessimism among New Zealand firms. A net 44% of firms are now pessimistic about the economy’s outlook over the next six months, up from 25% in Q1. Additionally, a net 28% reported a deterioration in their own trading during the three months through March, marking the weakest reading since mid-2020 during the COVID-19 pandemic.

Employment figures are equally concerning. A net 25% of firms laid off workers in Q2, the highest level since the global financial crisis in 2009. Furthermore, a net 10% expect to reduce staff numbers in the three months through September. Profit expectations are also bleak, with a net 34% of firms anticipating weaker profits in the third quarter, accompanied by falling investment intentions.

On a slightly more positive note, only a net 23% of firms expect to increase prices in Q3, the lowest since 2021. Additionally, companies are finding it easier to recruit workers, signaling reduced wage pressure. Fewer companies also reported rising costs, suggesting some relief from inflationary pressures.

ECB’s Lagarde: No rush for further rate cuts as data-dependent approach prevails

At the ECB Forum on Central Banking overnight, ECB President Christine Lagarde hinted that the central bank is not in a hurry to cut interest rates again following its initial rate cut in June.

She highlighted that the central bank is facing “several uncertainties” concerning future inflation. These uncertainties primarily revolve around the dynamics of profits, wages, and productivity, and the potential impact of new supply-side shocks.

Lagarde emphasized that it will take time to accumulate sufficient data to be confident that the “risks of above-target inflation have passed.”

The “strong labor market” was noted as a positive factor, allowing the ECB to “take time” to gather more information before making further decisions. However, Lagarde also acknowledged that “growth outlook remains uncertain,” indicating that the ECB must remain vigilant and adaptable to changing economic conditions.

She reiterated, “All of this underpins our determination to be data-dependent and to take our policy decisions meeting by meeting.”

Looking ahead

Eurozone CPI flash is the main focus of the day while unemployment rate will be released too. Canada will publiah PMI manufacturing.

USD/CHF Daily Outlook

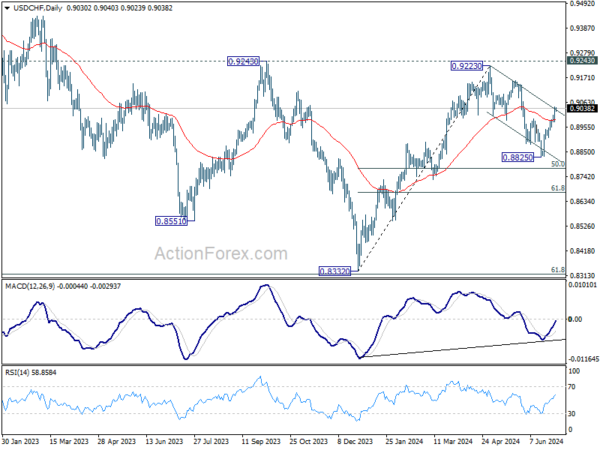

Daily Pivots: (S1) 0.8986; (P) 0.9016; (R1) 0.9057; More…

Intraday bias in USD/CHF remains on the upside for the moment. Fall from 0.9223 might have completed as a three-wave corrective move to 0.8825. Sustained trading above the near term falling channel resistance will bring further rally to 0.9157 resistance next. On the downside, below 0.8977 minor support will turn intraday bias neutral gain first.

In the bigger picture, focus remains is now on 0.9223/9243 resistance zone. Decisive break there would complete a head and shoulder bottom pattern (ls: 0.8551; h: 0.8332; rs: 0.8825). That would indicate larger bullish trend reversal. Nevertheless, rejection by 0.9223/43 will keep medium term outlook neutral at best, for more range trading between 0.8332/9243 first.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Building Permits M/M May | -1.70% | -1.90% | -2.10% | |

| 01:30 | AUD | RBA Meeting Minutes | ||||

| 09:00 | EUR | Eurozone Unemployment Rate May | 6.40% | 6.40% | ||

| 09:00 | EUR | Eurozone CPI Y/Y Jun P | 2.50% | 2.60% | ||

| 09:00 | EUR | Eurozone CPI Core Y/Y Jun P | 2.80% | 2.90% | ||

| 13:30 | CAD | Manufacturing PMI Jun | 50.2 | 49.3 |