The forex markets are showing relatively limited movement today, remaining mostly within established ranges. Yen is having a slight uptick, supported by the dips in US and European benchmark treasury yields. But the Japanese currency’ gains are modest and insufficient to reverse recent declines. Meanwhile, Swiss Franc is charting a notable course as the day’s second-strongest performer, showing some progress in its near-term recovery against the Euro and Sterling.

Conversely, Euro and Sterling are trailing today, marked as the weaker performers, with Dollar also lagging slightly behind. Commodity currencies are finding themselves in a middling position, with New Zealand Dollar slightly outperforming its peers.

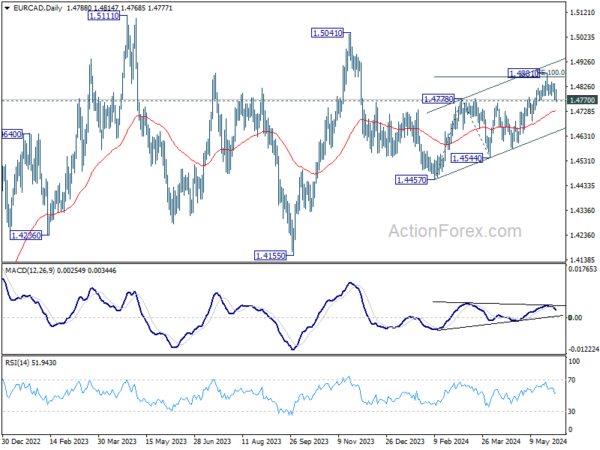

Technically, focus stays on 1.4770 minor support in EUR/CAD. Firm break there will argue that corrective rise from 1.4457 has completed with three waves up to 1..4881. Further break of 55 D EMA (now at 1.4731) will affirm this bearish case and target 1.4554 support first. Nevertheless, firm break of 1.4881 will resume the rise from 1.4457 towards 1.5041 resistance instead. The upcoming BoC and then ECB rate decisions would be be pivotal in determining the next significant movement in EUR/CAD.

In Europe, at the time of writing, FTSE is up 0.34%. DAX is up 0.93%. CAC is up 0.50%. UK 10-year yield is down -0.0504 at 4..271. Germany 10-year yield is down -0.060 at 2.612. Earlier in Asia, Nikkei rose 1.13%. Hong Kong HSI rose 1.79%. China Shanghai SSE fell -0.27%. Singapore Strait Times rose 0.37%. Japan 10-year JGB yield fell -0.0062 to 1.068.

UK PMI manufacturing finalized at 51.2, a solid revival

UK PMI Manufacturing index was finalized at 51.2 in May, up from April’s 49.1, marking the highest reading since July 2022. S&P Global noted that output increased across all main sub-sectors and size categories, and business optimism soared to a 27-month high.

Rob Dobson, Director at S&P Global Market Intelligence, described May’s performance as a “solid revival” of activity in the UK manufacturing sector. Production and new business levels both rose at their fastest rates since early 2022. The recovery’s breadth was notable, with concurrent output and new order growth across all main sub-industries—consumer, intermediate, and investment goods—and all company size categories for the first time in over two years.

However, the latest PMI survey data presented a mixed picture for price pressures. Output charge inflation at the factory gate strengthened for the fifth consecutive month, reaching its highest level in a year. Despite this, there was a solid easing in the rate of increase in input costs, which should help prevent price pressures from becoming entrenched.

Eurozone PMI manufacturing finalized at 47.3, a turning point?

Eurozone PMI Manufacturing index was finalized at 47.3 in May, up from April’s 45.7 and reaching a 14-month high. This improvement suggests a potential turning point for the manufacturing sector, which has been declining since April 2023.

Country-specific data reveals that Greece led with a PMI of 54.9, although this marked a 4-month low. Spain followed with 54.0, hitting a 26-month high, while the Netherlands posted a 21-month high of 52.5. France recorded a 3-month high at 46.4, and Austria saw a 15-month high at 46.3. Italy and Germany, however, showed lower figures with PMIs of 45.6 and 45.4, respectively, though both countries achieved multi-month highs.

Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, highlighted this as a potential “turning point” for the sector, noting that the industry is nearing the end of its production decline. He pointed out that business confidence regarding future production is at its highest level since early 2022.

Germany, despite having the lowest PMI among the four major Eurozone economies, is close to overtaking Italy, which has recently seen its performance deteriorate. France’s industrial sector has improved but still lags behind, while Spain remains the only Euro-4 country with a growing industrial sector.

Japan’s PMI manufacturing, finalized at 50.4, above neutral mark for first time in a year

Japan’s PMI Manufacturing index was finalized at 50.4 in May, up from 49.6 in April, crossing the 50 neutral mark for the first time in a year. S&P Global noted that both output and new orders remained broadly stable, while employment and input stocks saw expansion.

Pollyanna De Lima at S&P Global Market Intelligence highlighted the “encouraging trends” in the manufacturing industry, noting that new orders and output were stable, and businesses were optimistic about the year ahead. She mentioned that input stocks increased as materials ordered in recent months arrived, which bodes well for production and suggests a gradual near-term recovery.

Factory employment also rose but continued to be affected by retirements and difficulties in finding suitable replacements. Another challenge faced by manufacturers was the intensification of cost pressures due to yen depreciation, which strained the prices of imported items. This, along with rising wage costs, led to the sharpest increase in output charges in a year. De Lima pointed out that this is concerning given the subdued domestic and external demand.

China’s Caixin PMI manufacturing rises to 51.7, production picks up

China’s Caixin PMI Manufacturing index edged up from 51.4 to 51.7 in May, surpassing expectations of 51.5. Caixin reported that production expanded at its most pronounced pace since June 2022, with the fastest growth in purchasing activity in three years. Meanwhile, input price inflation reached a seven-month high.

Wang Zhe, Senior Economist at Caixin Insight Group, highlighted that the manufacturing sector continued to improve, with gains in supply, domestic demand, and exports. Logistics and transportation remained efficient, and businesses increased their purchase quantities and inventories, reflecting a positive outlook.

Despite these positive developments, Wang noted persistent challenges, particularly low price levels on the sales side. Additionally, employment continued to shrink as businesses remained cautious about hiring.

USD/JPY Mid-Day Outlook

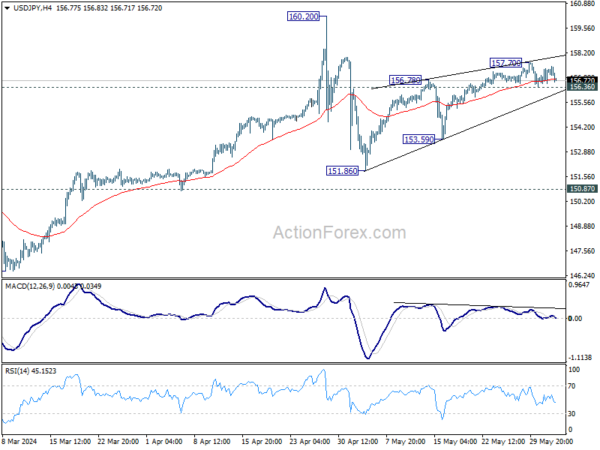

Daily Pivots: (S1) 156.77; (P) 157.07; (R1) 157.58; More….

USD/JPY dips mildly today but stays in range of 156.36/157.70. Intraday bias remains neutral for the moment. On the downside, decisive break of 156.36 minor support will confirm short term topping at 157.70, on bearish divergence condition in 4H MACD. Intraday bias will be back on the downside for 153.59 support. Firm break there will target 151.86 and below as the third leg of the corrective pattern from 160.20. However, break of 157.70 will extend the rally from 151.86 towards 160.20.

In the bigger picture, a medium term top might be formed at 160.20. But as long as 150.87 resistance turned support holds, fall from there is seen as correcting rise from 150.25 only. However, decisive break of 150.87 will argue that larger correction is possibly underway, and target 146.47 support next.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Capital Spending Q1 | 6.80% | 12.20% | 16.40% | |

| 00:30 | JPY | Manufacturing PMI May F | 50.4 | 50.5 | 50.5 | |

| 01:45 | CNY | Caixin Manufacturing PMI May | 51.7 | 51.5 | 51.4 | |

| 07:30 | CHF | Manufacturing PMI May | 46.4 | 45.4 | 41.4 | |

| 07:45 | EUR | Italy Manufacturing PMI May | 46.4 | 48 | 47.3 | |

| 07:50 | EUR | France Manufacturing PMI May F | 46.4 | 46.7 | 46.7 | |

| 07:55 | EUR | Germany Manufacturing PMI May F | 45.4 | 45.4 | 45.4 | |

| 08:00 | EUR | Eurozone Manufacturing PMI May F | 47.3 | 47.4 | 47.4 | |

| 08:30 | GBP | Manufacturing PMI May F | 51.2 | 51.3 | 51.3 | |

| 13:30 | CAD | Manufacturing PMI May | 49.4 | |||

| 13:45 | USD | Manufacturing PMI May F | 50.9 | 50.9 | ||

| 14:00 | USD | ISM Manufacturing PMI May | 49.8 | 49.2 | ||

| 14:00 | USD | ISM Manufacturing Prices Paid May | 60 | 60.9 | ||

| 14:00 | USD | ISM Manufacturing Employment Index May | 48.6 | |||

| 14:00 | USD | Construction Spending M/M Apr | 0.20% | -0.20% |