Dollar continues its struggle to find direction, and stay in familiar range against most major currencies except against Swiss Franc. Markets shift their focus to the upcoming release of April US PCE data for guidance. Currently Fed fund futures are indicating a 50/50 chance of a rate cut by September. Recent comments from Fed officials hinted at the unlikelihood of further rate hikes. However, Fed’s outlook and market sentiment could shift dramatically if today’s data suggests re-acceleration of inflation. But absent significant surprises, attention is likely to turn to next week’s employment figures.

Euro is currently trading as as this week’s weakest performer amidst anticipations for Eurozone CPI flash report. Forecasts suggest slight increase in headline CPI to 2.5% a steady core CPI at 2.7%. With ECB nearly set to introduce the first rate cut of this cycle next week, a subsequent rate cut in July seems improbable, as the central bank aims to manage market expectations carefully. Traders are poised to look beyond today’s figures, focusing on next week’s rate decision and forthcoming economic projections.

Overall in the markets, Swiss Franc is maintaining its position as the strongest for the week, followed by Yen and Australian Dollar. Euro ranks as the weakest, trailed by British Pound and Canadian Dollar, with Dollar and New Zealand Dollar mixed in the middle.

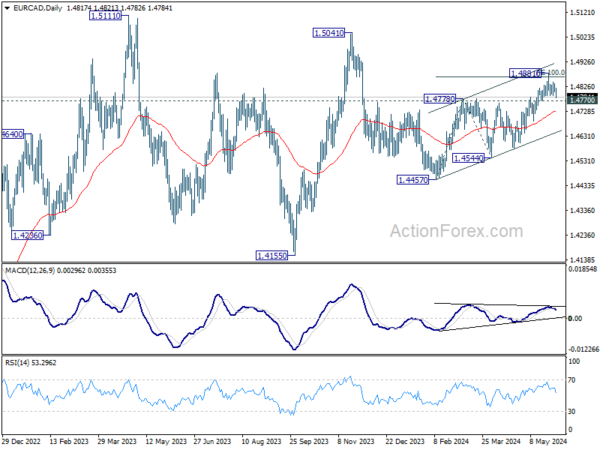

Given that Canada will release GDP data, EUR/CAD would be an interesting one to watch today. Break of 1.4770 support would confirm short term topping at 1.4881. More importantly, in this case, corrective rebound from 1.4457 could have completed too after hitting 100% projection of 1.4457 to 1.4478 from 1.4544. Deeper fall would be seen to 55 D EMA (now at 1.4729). Sustained break there will raise the chance that fall from 1.5041 is ready to resume through 1.4457.

In Asia, at the time of writing, Nikkei is up 1.11%. Hong Kong HSI is up 1.06%. China Shanghai SSE is up 0.04%. Singapore Strait Times is up 0.27%. Japan 10-year JGB yield is up 0.0115 is up 1.071. Overnight, DOW fell -0.86%. S&P 500 fell -0.60%. NASDAQ fell -1.08%. 10-year yield fell -0.070 to 4.554.

Fed’s Williams: Policy well-positioned, unlikely to see further rate hikes

New York Fed President John Williams told CNBC overnight that current monetary policy is “well-positioned” and “restrictive” enough to help bring inflation down to target levels. He added that further rate hikes are unlikely, stating, “I don’t see that as the likely case.”

Williams highlighted that interest rates in the US will “eventually need to come down” based on data analysis, but the timing will depend on how effectively the Fed achieves its goals. He expects inflation to moderate in the second half of this year as the economy finds better balance and global inflationary pressures ease.

However, Williams emphasized, “Inflation is still above our 2% longer-run target, and I am very focused on ensuring we achieve both of our dual mandate goals.”

Fed’s Bostic: No rate hikes expected, but inflation risks remain

Atlanta Fed President Raphael Bostic told Fox Business overnight that he does not expect further rate hikes to be necessary to bring inflation down to the target. However, he cautioned that if inflation were to reaccelerate, “I’d have to take on board the likelihood that a rate increase is appropriate.”

Bostic emphasized the need for economic data to show the economy is “sufficiently strong” and that inflation is moving closer to Fed’s 2% target before supporting any rate cuts, but he clarified, “That’s not my outlook today.” He anticipates that inflation will decrease “very slowly” over the year, reaching 2% target by 2025 or later.

Fed’s Logan: Interest rates may be less restrictive than anticipated

Dallas Fed President Lorie Logan suggested at an event overnight that interest rates might not be “as restrictive as” policymakers had anticipated.

Emphasizing the need for flexibility, she added, “It’s really important to keep all options on the table and that we continue to be flexible.”

Nevertheless, Logan also noted there are “good reasons” to believe that inflation is heading back to 2%, ” perhaps a bit slower and a little bit clunkier maybe than we thought at the beginning of the year.”

Japan’s Tokyo CPI core rises in May, industrial production weakens in Apr

In May, Japan’s Tokyo CPI core (excluding fresh food) increased from 1.6% yoy to 1.9% yoy, matching expectations. This rise was primarily driven by higher electricity costs. However, CPI core-core (excluding food and energy) slowed slightly from 1.8% yoy to 1.7% yoy. Private sector service inflation also decreased from 1.6% yoy to 1.4% yoy. The headline CPI saw an uptick from 1.8% yoy to 2.2% yoy.

April’s industrial production declined by -0.1% mom, falling short of the anticipated 1.5% mom rise. The Ministry of Economy, Trade, and Industry maintained its assessment that industrial production “showed weakness while fluctuating indecisively.” Among the 15 industrial sectors surveyed, seven reported lower output, while eight saw increases. Manufacturers expect output to rise by 6.9% in May before falling by -5.6% in June.

Additionally, April’s retail sales jumped by 2.4% yoy, surpassing the expected 1.9% increase. Unemployment rate remained steady at 2.6%.

China’s manufacturing PMI falls back into contraction in May

China’s official PMI Manufacturing index fell from 50.4 to 49.5 in May, below the expected 50.5, indicating contraction after two months of expansion. The new manufacturing export order subindex also dropped significantly to 47.2 from 50.6 in April, highlighting weakening external demand.

PMI Non-Manufacturing index ticked down slightly from 51.2 to 51.1, missing the expectation of 51.5. Within this sector, the construction new order subindex decreased to 44.1 from 45.3, and the service sector business activity subindex declined to 47.4 from 50.3, showing reduced activity.

PMI Compositewhich combines manufacturing and non-manufacturing data, fell from 51.7 to 51.0, indicating a slowdown in overall economic activity.

Looking ahead

Eurozone CPI flash is the main focus in EUropean session. Germany import prices and retail sales, Swiss retail sales, France consumer spending, UK mortgage approvals will also be released. Later in the day, Canada will publish GDP. US will release personal income and spending, PCE inflation, and Chicago PMI.

AUD/USD Daily Report

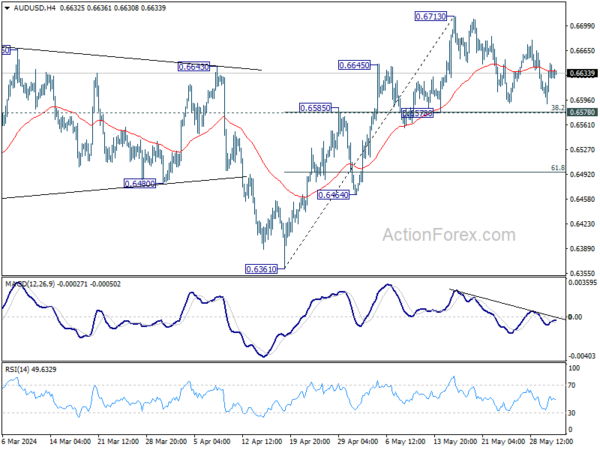

Daily Pivots: (S1) 0.6599; (P) 0.6624; (R1) 0.6656; More...

AUD/USD is staying in consolidation from 0.6714 and intraday bias remains neutral. Further rally is in favor with 0.6578 cluster support (38.2% retracement of 0.6361 to 0.6713 at 0.6579) intact. On the upside, firm break of 0.6713 will resume whole rise from 0.6361 to 0.6870 resistance next. However, sustained break of 0.6578 will dampen this bullish view, and bring deeper fall to 61.8% retracement at 0.6495.

In the bigger picture, price actions from 0.6169 (2022 low) are seen as a medium term corrective pattern to the down trend from 0.8006 (2021 high). Fall from 0.7156 (2023 high) is seen as the second leg, which could have completed at 0.6269 already. Rise from there is seen as the third leg which is now trying to resume through 0.6870 resistance.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Tokyo CPI Y/Y May | 2.20% | 1.80% | ||

| 23:30 | JPY | Tokyo CPI ex Fresh Food Y/Y May | 1.90% | 1.90% | 1.60% | |

| 23:30 | JPY | Tokyo CPI ex Food & Energy Y/Y May | 1.70% | 1.80% | ||

| 23:30 | JPY | Unemployment Rate Apr | 2.60% | 2.60% | 2.60% | |

| 23:50 | JPY | Industrial Production M/M Apr P | -0.10% | 1.50% | 4.40% | |

| 23:50 | JPY | Retail Trade Y/Y Apr | 2.40% | 1.90% | 1.20% | 1.10% |

| 01:30 | AUD | Private Sector Credit M/M Apr | 0.50% | 0.40% | 0.30% | 0.40% |

| 01:30 | CNY | NBS Manufacturing PMI May | 49.5 | 50.5 | 50.4 | |

| 01:30 | CNY | NBS Non-Manufacturing PMI May | 51.1 | 51.5 | 51.2 | |

| 05:00 | JPY | Housing Starts Y/Y Apr | 13.9% | -0.20% | -12.80% | |

| 06:00 | EUR | Germany Import Price Index M/M Apr | 0.50% | 0.40% | ||

| 06:00 | EUR | Germany Retail Sales M/M Apr | 0.10% | 1.80% | ||

| 06:30 | CHF | Real Retail Sales Y/Y Apr | 0.20% | -0.10% | ||

| 06:45 | EUR | France GDP Q/Q Q1 | 0.20% | 0.20% | ||

| 08:30 | GBP | Mortgage Approvals Apr | 62K | 61K | ||

| 08:30 | GBP | M4 Money Supply M/M Apr | 0.40% | 0.70% | ||

| 09:00 | EUR | Eurozone CPI Y/Y May P | 2.50% | 2.40% | ||

| 09:00 | EUR | Eurozone CPI Core Y/Y May P | 2.70% | 2.70% | ||

| 12:30 | CAD | GDP M/M Mar | 0.00% | 0.20% | ||

| 12:30 | USD | Personal Income M/M Apr | 0.30% | 0.50% | ||

| 12:30 | USD | Personal Spending Apr | 0.30% | 0.80% | ||

| 12:30 | USD | PCE Price Index M/M Apr | 0.30% | 0.30% | ||

| 12:30 | USD | PCE Price Index Y/Y Apr | 2.70% | 2.70% | ||

| 12:30 | USD | Core PCE Price Index M/M Apr | 0.30% | 0.30% | ||

| 12:30 | USD | Core PCE Price Index Y/Y Apr | 2.80% | 2.80% | ||

| 13:45 | USD | Chicago PMI May | 40 | 37.9 |