The US financial markets were enveloped in a wave of risk aversion that continued into Asian session, primarily driven by the notable surge in Treasury yields. This uptick in yields followed an auction of seven-year debt that closed with higher than anticipated yields, raising alarms about weakening demand for US Treasuries. This concern was compounded by similar outcomes from auctions of two-year and five-year notes on Tuesday, suggesting a broader hesitation among investors.

The currency markets responded to these developments with significant movements, where traditional safe-haven currencies such as Yen, Swiss Franc, and Dollar strengthen broadly, indicating a clear shift towards safer assets. Conversely, Australian Dollar, New Zealand Dollar, Canadian Dollar, and British Pound were all notably weaker, while Euro also saw a slight decline.

This market behavior underscores a heightened sense of caution among investors, who are now keenly awaiting the upcoming US PCE inflation data. The outcome of this report could reinforce Fed’s current stance on interest rates, leading to an even longer period of elevated rates if inflation pressures do not ease. Such a scenario would likely exacerbate the current risk-off sentiment in the markets.

Technically, 10-year yield’s strong rally this week confirms that corrective pull back from 4.730 has completed at 4.318 already. Retest of 4.730 should be seen next. Firm break there will resume the rise from 3.780, as the second leg of the corrective pattern from 4.997). Next target is 61.8% projection of 3.780 to 4.730 from 4.318 at 4.906. Should this rise in Treasury yields persist, it could place further pressure on stock markets while bolstering Dollar.

In Asia, at the time of writing, Nikkei is down -1.26%. Hong Kong HSI is down -1.29%. China Shanghai SSE is down -0.53%. Singapore Strait Times is down -0.20%. 10-year JGB yield is down -0.006 at 1.075. Overnight, DOW fell -1.06%. S&P 500 fell -0.74%. NASDAQ fell -0.58%. 10-year yield rose 0.082 to 4.624.

Fed Beige Book: Modest economic growth amid heightened uncertainty

Fed’s Beige Book indicates that most Federal Reserve Districts experienced “slight or modest” economic growth, while two Districts saw no change in activity. The overall economic outlook has become more “pessimistic” due to increased uncertainty and greater downside risks.

Employment across the country grew at a slight pace, with eight Districts reporting “minimal to modest” job gains and the remaining four seeing no changes. Wage growth was generally moderate, with some Districts noting that wage increases have returned to pre-pandemic levels or are moving towards those rates.

Prices rose modestly over the reporting period, and this trend is expected to continue in the near future.

Fed’s Bostic eyes rate cuts by year-end

Atlanta Fed President Raphael Bostic indicated that interest rate cuts might be on the table by the fourth quarter of this year, provided economic conditions align with his expectations.

“My outlook is that if things go according to what I expect — inflation goes slowly, the labor market slowly and orderly moves back into a sort of a weaker stance, but a stable-growth stance — I’m looking at the end of the year, the fourth quarter, as the time where we might actually think about and be prepared to reduce rates,” Bostic said.

While acknowledging that the breadth of inflation remains high, Bostic noted that a reduction in this breadth would increase his confidence in making rate cuts. He mentioned that many of the inflation measures “are moving back into the target range,” suggesting progress towards Fed’s goals.

SNB’s Jordan identifies minor inflation risk due to weakening franc

SNB Chairman Thomas Jordan highlighted at an event in Seoul today a “small upward risk” to the current inflation forecasts, which could mean a “more accommodative than intended” monetary policy if realized.

Jordan pointed out that such inflationary pressures are likely tied to declines in Swiss franc. To mitigate this, the central bank might consider engaging in foreign exchange sales to bolster the currency.

Moreover, Jordan noted that the natural rate of interest—which serves as a crucial benchmark for setting monetary policies—has shown signs of increasing and may continue to rise in the foreseeable future.

Despite these concerns, Jordan reassured that the current policy settings are expected to remain effective in maintaining price stability, even if the natural rate of interest edges higher.

RBA’s Hunter cautious on persistent inflation despite wage trends

At a conference today, RBA Chief Economist Sarah Hunter highlighted the central bank’s intense focus on inflation, which continues to exceed the target band.

Discussing the latest CPI data, Hunter noted, “Yesterday’s data did confirm that there’s still strength in a number of categories that we’ve seen up until this point that’s still there.” The latest CPI figures, which show a slight increase from 3.5% to 3.6% in April, underline ongoing inflationary pressures across various sectors.

“So clearly there’s still some strength in inflation, and that’s a key consideration for the board in their decision-making,” Hunter added.

While wage growth appears to have peaked, Hunter expressed concerns about productivity which remains weak: “We can see some components of wages growth coming off already, particularly individual agreements,” she said. However, she also pointed out, “But equally, we are seeing that there’s a bit of a productivity challenge over the last few years.”

Looking ahead

Swiss trade balance, KOF economic barometer and GDP will be release in European session. Eurozone will publish economic sentiment indicator and unemployment rate. Later in the day, US will release jobless claims, goods trade balance and Q1 GDP revision.

EUR/CHF Daily Outlook

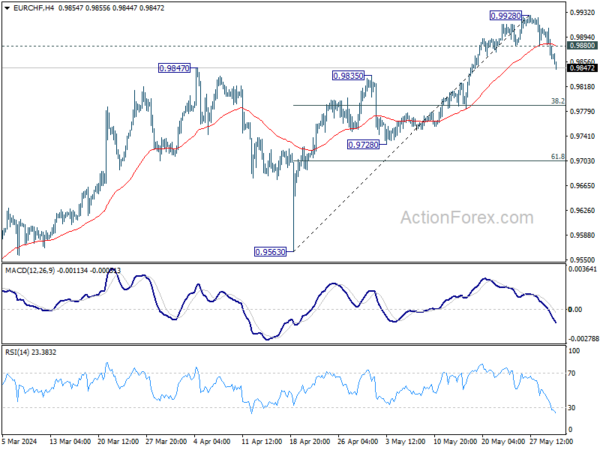

Daily Pivots: (S1) 0.9847; (P) 0.9879; (R1) 0.9894; More….

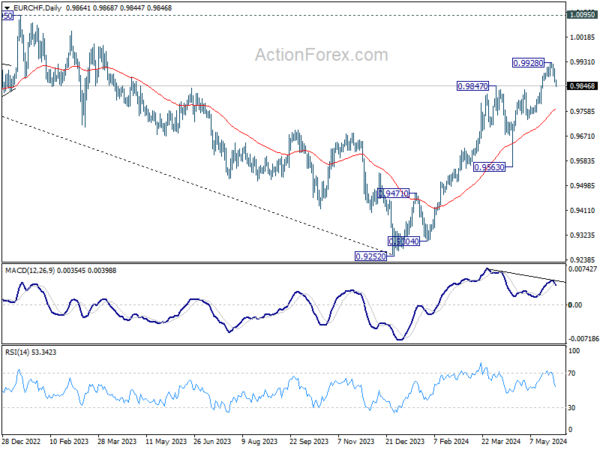

EUR/CHF’s break of 0.9880 support confirms short term topping at 0.9928. Intraday bias is back on the downside. Deeper fall would be seen to 38.2% retracement of 0.9563 to 0.9928 at 0.9789. On the upside, break of 0.9880 minor resistance will turn intraday bias neutral first. But risk will now stay mildly on the downside as long as 0.9928 resistance holds, in case of recovery.

In the bigger picture, as long as 0.9728 support holds, rise from 0.9252 medium term bottom is still in favor to continue. Next target is 38.2% retracement of 1.2004 (2018 high) to 0.9252 (2023 low) at 1.0303, even just as a correction to the down trend from 1.2004. However, firm break of 0.9728 will raise the chance of bearish reversal and turn focus to 0.9563 support for confirmation.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Building Permits M/M Apr | -1.90% | -0.20% | ||

| 01:30 | AUD | Private Capital Expenditure Q1 | 1.00% | 0.60% | 0.80% | |

| 06:00 | CHF | Trade Balance (CHF) Apr | 3.54B | |||

| 07:00 | CHF | KOF Economic Barometer May | 102.2 | 101.8 | ||

| 07:00 | CHF | GDP Q/Q Q1 | 0.30% | 0.30% | ||

| 08:00 | EUR | Italy Unemployment Apr | 7.30% | 7.20% | ||

| 09:00 | EUR | Eurozone Unemployment Rate Apr | 6.50% | 6.50% | ||

| 09:00 | EUR | Eurozone Economic Sentiment Indicator May | 96 | 95.6 | ||

| 09:00 | EUR | Eurozone Industrial Confidence May | -10.5 | |||

| 09:00 | EUR | Eurozone Services Sentiment May | 6 | |||

| 09:00 | EUR | Eurozone Consumer Confidence May F | -14.3 | -14.3 | ||

| 12:30 | CAD | Current Account (CAD) Q1 | -5.68B | -1.62B | ||

| 12:30 | USD | Initial Jobless Claims (May 24) | 218K | 215K | ||

| 12:30 | USD | GDP Annualized Q1 P | 1.50% | 1.60% | ||

| 12:30 | USD | GDP Price Index Q1 P | 3.10% | 3.10% | ||

| 12:30 | USD | Goods Trade Balance (USD) Apr P | -91.8B | -91.8B | ||

| 12:30 | USD | Wholesale Inventories Apr P | -0.10% | -0.40% | ||

| 14:00 | USD | Pending Home Sales M/M Apr | -0.60% | 3.40% | ||

| 14:30 | USD | Natural Gas Storage | 77B | 78B | ||

| 15:00 | USD | Crude Oil Inventories | -2.0M | 1.8M |