Australian Dollar is having a modest bounce today after stronger-than-anticipated inflation figures. The data also revealed re-acceleration of inflation for the second consecutive month, with core inflation measures also rising. While most economists still view a further rate hike by RBA as unlikely, today’s surprising data suggests that such a move can no longer be completely ruled out.

The prospect of a near-term rate cut has now significantly diminished. Inflation could remain at elevated levels longer than previously expected, with stubbornly high service inflation and a reversal in goods disinflation trends. Despite the positive move in Aussie, its rally has been limited by a rebounding Dollar driven by mild risk aversion in the markets.

Overall in the currency markets, Dollar and Swiss Franc are also performing well, following Australian Dollar’s lead. New Zealand Dollar is under significant pressure, making it the worst performer, suffering additional selling pressure against Aussie. Canadian Dollar and Euro are also among the weaker currencies. Meanwhile, British Pound and Japanese Yen are trading in a more mixed manner.

Technically, a temporary low should be in place in AUD/ZND with current recovery and some consolidations would be seen. But further decline remains in favor as long as 1.0889 support turned resistance holds. Fall from 1.1027 should be revering whole rally from 1.0567. Below 1.0803 will target 61.8% retracement of 1.0567 to 1.1027 at 1.0743 and below.

In Asia, at the time of writing, Nikkei is down -0.49%. Hong Kong HSI is down -1.48%. China Shanghai SSE is up 0.32%. Singapore Strait Times is down -0.12%. 10-year JGB yield is up 0.0318 at 1.072. Overnight, DOW fell -0.55%. S&P 500 rose 0.02%. NASDAQ rose 0.59%. 10-year yield rose 0.075 to 4.542.

BoJ’s Adachi: Yen depreciation could prompt earlier rate hike

BoJ board member Seiji Adachi has signaled that the central bank could raise interest rate earlier if depreciation of Yen accelerates or persists.

In his speech today, Adachi emphasized the need to avoid premature rate increases. However, he also warned that an excessive focus on downside risks could lead to an inflation spike, necessitating sharp monetary tightening later on.

Adachi highlighted the importance to “gradually adjust” monetary support based on economic, price, and financial developments, as long as underlying inflation trends toward 2% target.

He projected that consumer inflation will re-accelerate from summer through autumn due to rising import costs and sustained wage gains. However, if Yen’s decline accelerates or persists, “consumer inflation could rebound sooner than expected”.

“If this happens at a time when there is a higher chance of inflation durably and stably exceeding 2%, we may need to push forward the timing of an interest rate hike,” Adachi noted.

Australia’s April CPI rises to 3.6%, driven by housing and food costs

Australia monthly CPI rose form 3.5% yoy to 3.6% yoy in April, exceeding the expectation of 3.4%. This marks the second consecutive month of rising inflation. CPI excluding volatile items and holiday travel remained steady at 4.1% yoy, while the trimmed mean CPI also edged up from 4.0% yoy to 4.1% yoy.

Significant price increases were observed in several categories: Housing saw a 4.9% rise, Food and non-alcoholic beverages increased by 3.8%, Alcohol and tobacco prices surged by 6.5%, and Transport costs went up by 4.2%.

Australia’s Westpac Leading Index rises to -0.01%, some signs of stabilization

Australia Westpac Leading Index improved slightly in April, rising from -0.08% to -0.01%. Westpac noted that the index is once again indicating some stabilization in growth momentum. However, the improvement in growth is expected to be modest.

Westpac forecasts GDP to grow at an annual pace of 1.9% in the second half of the year, up from 1.3% in the first half. Despite this uptick, the growth rate remains below Australia’s trend, which is estimated to be around 2.5% per year with some moderation in population growth.

New Zealand ANZ business confidence falls to 11.2, inflation pressures ease

New Zealand’s ANZ Business Confidence index dropped from 14.9 to 11.2 in May, signaling a decline in business sentiment. Outlook for own activity also decreased from 14.3 to 11.8.

Cost expectations saw a reduction 76.7 to 72.6, the lowest since February 2021. Wage expectations ticked down slightly from 75.5 to 75.4. Profit expectations fell sharply, from -9.8 to -15.3, and pricing intentions decreased from 46.9 to 41.6, the lowest level since December 2020. Inflation expectations edged down from 3.76% to 3.59%.

According to ANZ, “This month’s Business Outlook survey makes for grim reading, but it also provides confirmation that inflation pressures are waning.”

They indicated that significant progress in reducing non-tradable inflation is anticipated, which, barring any unforeseen inflationary spikes, should restore RBNZ’s confidence. This would potentially allow for future rate cuts, signaling a cautiously optimistic outlook on inflation control and economic stability.

Fed’s Kashkari: Low odds for rate hike but keeping options open

In an event in London overnight, Minneapolis Fed President Neel Kashkari stated that the likelihood of raising interest rates again is “quite low,” although he emphasized, “I don’t want to take anything off the table.”

Kashkari pointed out that “wage growth is still quite robust relative to ultimately what we think would be consistent with the 2% inflation target,” suggesting that the labor market remains strong. He emphasized the need for a careful assessment of the downward pressure being placed on demand before making any further policy decisions.

When discussing his input for the upcoming dot plot, Kashkari expressed the importance of having comprehensive data before drawing any conclusions. However, he assured that “it certainly won’t be more than two cuts” this year, as he had projected in the last dot plot.

Looking ahead

German Gfk consumer sentiment and CPI flash will be released in European session. Swiss UBS economic expectations and Eurozone M3 money supply will be featured too. Later in the day, Fed will publish Beige Book economic report.

AUD/USD Daily Report

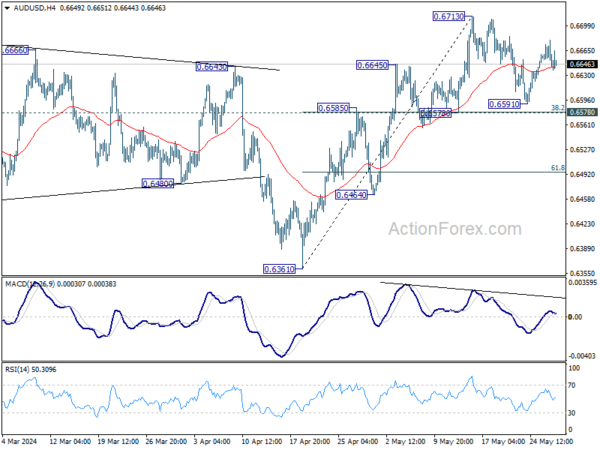

Daily Pivots: (S1) 0.6635; (P) 0.6657; (R1) 0.6672; More...

Intraday bias in AUD/USD remains neutral as range trading continues below 0.6713. Further rally is in favor with 0.6578 cluster support (38.2% retracement of 0.6361 to 0.6713 at 0.6579) intact. On the upside, firm break of 0.6713 will resume whole rise from 0.6361 to 0.6870 resistance next. However, sustained break of 0.6578 will dampen this bullish view, and bring deeper fall to 61.8% retracement at 0.6495.

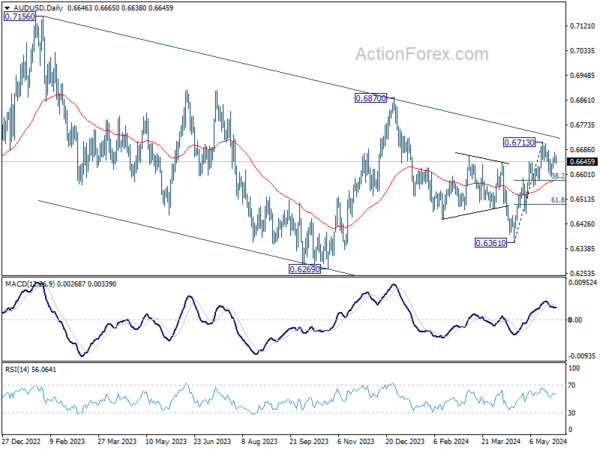

In the bigger picture, price actions from 0.6169 (2022 low) are seen as a medium term corrective pattern to the down trend from 0.8006 (2021 high). Fall from 0.7156 (2023 high) is seen as the second leg, which could have completed at 0.6269 already. Rise from there is seen as the third leg which is now trying to resume through 0.6870 resistance.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:00 | AUD | Westpac Leading Index M/M Apr | 0.00% | -0.10% | ||

| 01:00 | NZD | ANZ Business Confidence May | 11.2 | 14.9 | ||

| 01:30 | AUD | Construction Work Done Q1 | -2.90% | 0.50% | 0.70% | 1.80% |

| 01:30 | AUD | Monthly CPI Y/Y Apr | 3.60% | 3.40% | 3.50% | |

| 05:00 | JPY | Consumer Confidence May | 36.2 | 38.9 | 38.3 | |

| 06:00 | EUR | Germany GfK Consumer Confidence Jun | -22.5 | -24.2 | ||

| 08:00 | CHF | UBS Economic Expectations May | 17.6 | |||

| 08:00 | EUR | Eurozone M3 Money Supply Y/Y Apr | 1.50% | 0.90% | ||

| 12:00 | EUR | Germany CPI M/M May P | 0.20% | 0.50% | ||

| 12:00 | EUR | Germany CPI Y/Y May P | 2.20% | |||

| 18:00 | USD | Fed’s Beige Book |