Euro rebounded notably today despite the absence of substantial news from Europe. Sterling followed suit, shrugging off poor UK retail sales data. Conversely, Dollar ignored upbeat durable goods data and weakened alongside Yen and Swiss Franc. Commodity currencies displayed mixed performance. It appears that traders are lightening up their positions ahead of the long weekend in the UK and the US.

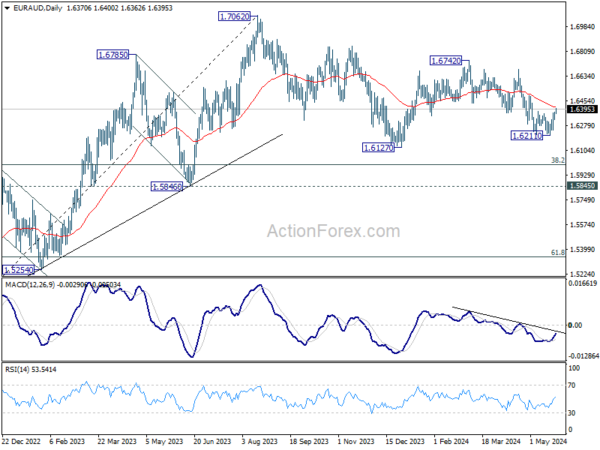

Technically, EUR/AUD is a focus as Euro is trying to strengthen broadly. Sustained break of 55 D EMA (now at 1.6412) will argue that fall from 1.6742, as the third leg of the corrective pattern from 1.7062, has completed. In this case, stronger rally would be seen back towards 1.6742 resistance. This development if realized, might be accompanied by strengthen in EUR/USD and weakness in AUD/USD simultaneously.

In Europe, at the time of writing, FTSE is down -0.38%. DAX is down -0.39%. CAC is down -0.26%. UK 10-year yield is up 0.030 at 4.291. Germany 10-year yield is up 0.019 at 2.619. Earlier in Asia, Nikkei fell -1.17%. Hong Kong HSI fell -1.38%. China Shanghai SSE fell -0.88%. Singapore Strait Times fell -0.18%. Japan 10-year JGB yield rose 0.0071 to 1.010.

US durable goods orders rise 0.7% mom, ex-transport orders up 0.4% mom

US durable goods orders rose 0.7% mom to USD 284.1B in April, above expectation of 0.5% mom. Ex-transport orders rose 0.4% mom to USD 187.9B, above expectation of 0.1% mom. Ex-defense orders was flat at 268.0B. Transportation equipment rose 1.2% mom to USD 96.2B.

Canada’s retail sales falls -0.2% mom in Mar, slightly worse than expectations

Canada’s retail sales value fell -0.2% mom to CAD 66.4B in March, slightly worse than expectation of -0.1% mom. Sales were down in seven of nine subsectors and were led by decreases at furniture, home furnishings, electronics and appliances retailers.

Core retail sales—which exclude gasoline stations and fuel vendors and motor vehicle and parts dealers—were down -0.6% om.

Advance estimate suggests that that sales increased 0.7% mom in April.

ECB’s Schnabel warns against hasty moves following likely June cut

ECB Executive Board member Isabel Schnabel indicated in an interview that if inflation outlook and upcoming data support a sustainable convergence towards 2% target, “a rate cut in June will be likely.”

However, Schnabel emphasized the need for caution regarding further rate cuts. She advised giving the situation “sufficient time” and warned against “moving too quickly”, noting the risk of cutting interest rates too fast. Schnabel stressed that it is crucial to avoid such premature actions.

Regarding the broader economic context, Schnabel observed a “gradual recovery” in Eurozone economy, alongside a continuing decline in inflation. She expressed optimism, stating that these trends justify the hope of “returning to price stability without a recession.”

UK retail sales falls -2.3% mom in Apr, vs exp -0.6% mom

UK retail sales volume fell sharply by -2.3% mom in April, much worse than expectation of -0.6% mom. Sales volumes fell across most sectors, with clothing retailers, sports equipment, games and toys stores, and furniture stores doing badly as poor weather reduced footfall. More broadly, sales volumes rose by 0.7% in the three months to April 2024 when compared with the previous three months

Japan’s core CPI eases to 2.2% in Apr, marking second month of slowdown

Japan’s CPI core, which excludes food, decelerated from 2.6% yoy to 2.2% yoy in April. This aligns with market expectations and marks the second consecutive month of decline from February’s 2.8%. Despite the slowdown, core inflation has remained at or above BoJ’s 2% target for the 25th straight month.

CPI core-core, which strips out both food and energy costs, also showed signs of easing, slowing from 2.9% yoy to 2.4% yoy. This is the slowest pace of increase since September 2022. Meanwhile, headline CPI, which includes all items, fell from 2.7% yoy to 2.5% yoy.

A closer look at the major components reveals varied trends. Food prices rose by 3.5% yoy, but this was a moderation from 4.6% yoy increase seen in March. The surge in accommodation fees, up 18.8% yoy, was driven by a revival in inbound tourism. Energy prices edged up slightly by 0.1% yoy, with increases in kerosene and gasoline prices leading the way. Service prices also showed a deceleration, rising by 1.7% yoy compared to 2.1% yoy increase in the previous month.

RBNZ stresses vigilance on inflation, prepared to raise rates if necessary

In an interview today, RBNZ Assistant Governor Karen Silk highlighted the central bank’s readiness emphasized that there are “risks still to the upside in the near term” regarding inflation. She stated that RBNZ is “absolutely” prepared to raise interest rates if necessary, adding, “Right now we are saying that the level of restrictiveness is there, but we are awake at the wheel.”

Silk pointed out that the central bank’s primary concern is domestic inflation, particularly noting the significant miss last quarter when non-tradables inflation hit 5.8%, compared to RBNZ’s forecast of 5.3%. “Our concern is in that near term, around what are we really seeing in terms of domestic aligned inflation,” she explained.

Separately, Deputy Governor Christian Hawkesby reinforced the cautious stance, stating that “cutting interest rates is not part of near-term discussion.” He acknowledged the near-term inflation risks are to the upside but expressed confidence that medium-term inflation is returning to target.

Hawkesby emphasized that no single data point will trigger a rate hike, but the bank is closely watching domestic inflation pressures and expectations. He also noted the significant uncertainty surrounding tradable inflation moving forward.

RBNZ’s central projection is for headline inflation to fall back into its 1-3% target band by the fourth quarter of this year. However, the bank now projects that it won’t achieve its 2% goal until mid-2026.

New Zealand’s exports falls -2.6% yoy in Apr, imports down -0.7% yoy

In April, New Zealand’s goods exports fell by -2.6% yoy to NZD 6.4B, while goods imports decreased by -0.7% yoy to NZD 6.3B. Contrary to expectations of a NZD -202m deficit, trade balance recorded a surplus of NZD 92m.

Examining the top monthly export movements by country, exports to China decreased by NZD -206m (-11% yoy), and exports to Australia fell by NZD -17m (2.4% yoy). In contrast, exports to the US increased by NZD 35m (4.9% yoy), exports to EU rose by NZD 62m (13% yoy), and exports to Japan surged by NZD 91m (26% yoy).

On the import side, imports from China increased by NZD 120m (10% yoy), and imports from South Korea soared by NZD 371m (119% yoy). However, imports from the EU decreased by NZD -79m (-8.1% yoy), and imports from the US dropped by NZD -154m (24% yoy). Imports from Australia grew modestly by NZD 9.8m (1.4% yoy).

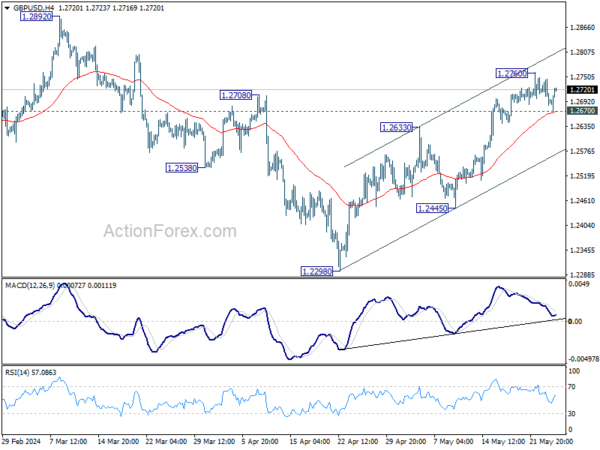

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2674; (P) 1.2710; (R1) 1.2736; More…

Intraday bias in GBP/USD is turned neutral as it recovered ahead of 55 4H EMA (now at 1.2671). On the upside, break of 1.2760 will resume the rally fro 1.2290 towards 1.2892 resistance. On the downside, break of 1.2670 will resume the pull back from 1.2760 to near term channel support (now at 1.2573).

In the bigger picture, price actions from 1.3141 medium term top are seen as a corrective pattern. Fall from 1.2892 is seen as the third leg which might have completed already. Break of 1.2892 resistance will argue that larger up trend from 1.0351 (2022 low) is ready to resume through 1.3141. Meanwhile, break of 1.2298 support will extend the corrective pattern instead.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Trade Balance (NZD) Apr | 91M | -202M | 588M | 476M |

| 23:01 | GBP | GfK Consumer Confidence May | -17 | -18 | -19 | |

| 23:30 | JPY | National CPI Y/Y Apr | 2.50% | 2.70% | ||

| 23:30 | JPY | National CPI ex Fresh Food Y/Y Apr | 2.20% | 2.20% | 2.60% | |

| 23:30 | JPY | National CPI ex Food & Energy Y/Y Apr | 2.40% | 2.90% | ||

| 06:00 | GBP | Retail Sales M/M Apr | -2.30% | -0.60% | 0.00% | |

| 06:00 | EUR | Germany GDP Q/Q Q1 F | 0.20% | 0.20% | 0.20% | |

| 12:30 | CAD | Retail Sales M/M Mar | -0.20% | -0.10% | -0.10% | |

| 12:30 | CAD | Retail Sales ex Autos M/M Mar | -0.60% | -0.20% | -0.30% | |

| 12:30 | USD | Durable Goods Orders Apr | 0.70% | 0.50% | 2.60% | 0.90% |

| 12:30 | USD | Durable Goods Orders ex Transportation Apr | 0.40% | 0.10% | 0.20% | 0.00% |

| 14:00 | USD | Michigan Consumer Sentiment May | 67.4 | 67.4 |