New Zealand Dollar surged sharply higher following RBNZ’s unexpectedly hawkish rate decision. While OCR was left unchanged, the central bank signaled the increased possibility of another rate hike this year and delayed projected timing of the first rate cut to the second half of 2025. However, Kiwi quickly gave back some of its gains after RBNZ Governor Adrian Orr tempered expectations in his press conference. Orr emphasized that the OCR track is a only central projection, not a guaranteed outcome, and expressed satisfaction that inflation expectations are declining.

Market attention now turns to the upcoming UK inflation data. Headline CPI is anticipated to drop significantly from 3.2% to 2.1% in April, while core CPI is expected to decrease from 4.2% to 3.6%. BoE has indicated that a rate cut this summer is possible, but the timing will depend on the data. Currently, markets are pricing in almost a 100% chance of a rate cut in August and a 50/50 chance in June. Any upside surprises in today’s inflation figures would strengthen the case for a later rate cut.

In other currency movements, all major pairs and crosses are trading within yesterday’s ranges, except for Kiwi pairs. For the week, Sterling is currently the strongest, followed by Dollar and Euro. Yen is the weakest, followed by Aussie and then Kiwi. Swiss Franc and Canadian are positioning in the middle.

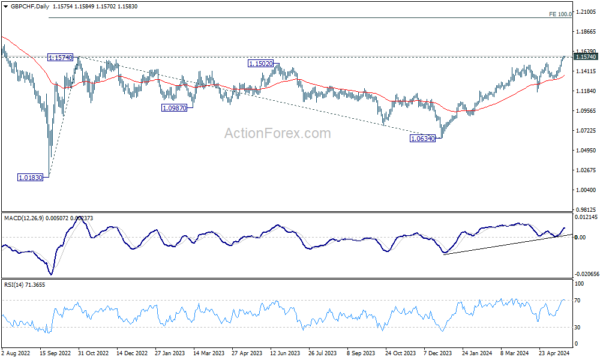

Technically, GBP/CHF’s breach of 1.1574 resistance suggests that larger rise from 1.0183 (2022 low) is trying to resume. Sustained trading above this will confirm this bullish case, and target 100% projection of 1.0183 to 1.1574 from 1.0634 at 1.2025 in the medium term. In case of retreat, outlook will remain bullish as long as 55 D EMA (now at 1.1361) holds.

In Asia, at the time of writing, Nikkei is down -0.72%. Hong Kong HSI is up 0.18%. China Shanghai SSE is up 0.02%. Singapore Strait Times is down -0.19%. Japan 10-year JGB yield is up 0.0084 at 0.993. Overnight, DOW rose 0.17%. S&P 500 rose 0.25%. NASDAQ rose 0.22%. 10-year yield fell -0.023 to 4.414.

RBNZ holds steady at 5.50% but signals potential hike later in 2024

RBNZ kept Official Cash Rate unchanged at 5.50%, as widely anticipated. However, RBNZ surprised markets by raising its projected rate path, suggesting the possibility of another rate hike later this year. Additionally, the timeline for rate cuts has been pushed further into the latter half of 2025. According to key forecast variables, the OCR is expected to rise from the current 5.5% to 5.7% in Q4 2024 before declining to 5.4% in Q3 2025.

Minutes of the meeting highlighted that members agreed on the “significant upside risk” posed by persistent non-tradable inflation. They noted that the influence of recent inflation outcomes on future inflation expectations is critical for price setting, wage expectations, and the stance of monetary policy. Moreover, slower output growth than currently assumed could reduce the pace at which spending can grow without increasing inflationary pressures.

“Monetary policy may need to tighten and/or remain restrictive for longer if wage and price setters do not align with weaker productivity growth rates,” the minutes stated.

NZD/USD bounces after hawkish RBNZ hold, AUD/NZD dives

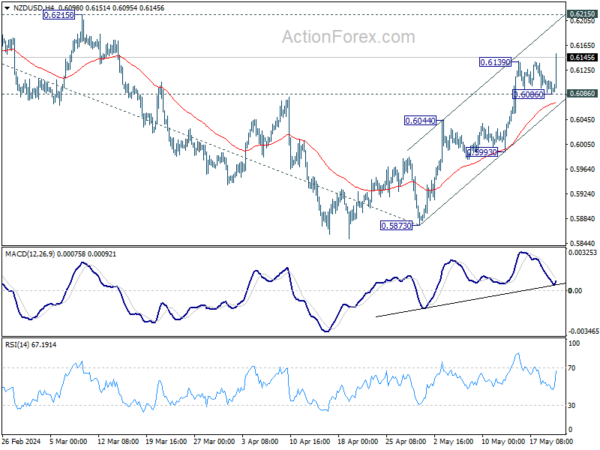

NZD/USD rises sharply after the hawkish RBNZ hold today. Break of 0.6139 confirms resumption of rally from 0.5873. Further rise is now expected as long as 0.6086 support holds. Next near term target is 0.6215 resistance.

Current development also affirms the view that NZD/USD’s corrective fall from 0.6368 has completed with three waves down to 0.5870. Decisive break of 0.6215 should pave the way through 0.6368 to resume the rise from 0.5771 (2023 low).

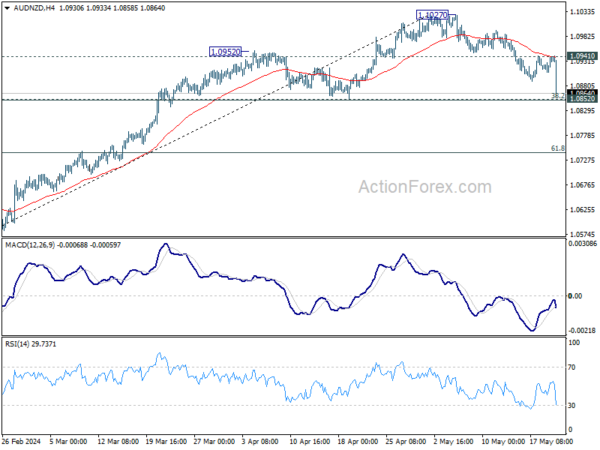

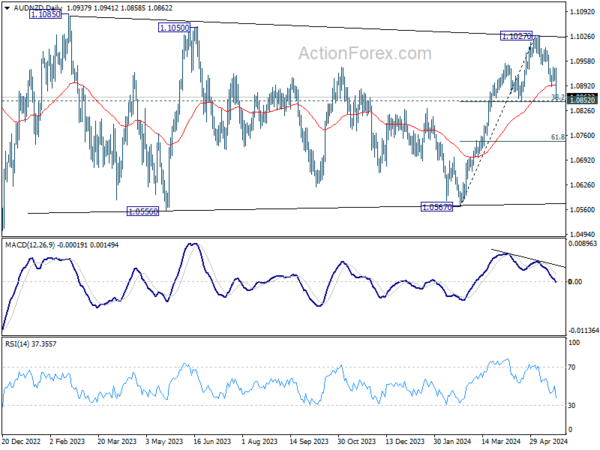

AUD/NZD dives in tandem with broad based Kiwi strength. Immediate focus is now on 1.0852 cluster support (3872% retracement of 1.0567 to 1.1027 at 1.0851. Sustained break there should confirm that whole rise from 1.0567 has completed. Decline from 1.1027 is another falling leg in the medium term range pattern from 1.1085, and should target 61.8% retracement at 1.0743 and below. This will remain the favored case as long as 1.0941 resistance holds.

Japan’s exports rise 8.3% yoy in Apr, imports up 8.3% yoy

In April, Japan’s exports increased by 8.3% yoy to JPY 8981B, falling short of expected 11.1% growth. Nonetheless, this marks the fifth consecutive month of export growth and sets a record for April. Key contributors to this growth included hybrid cars, semiconductor-making equipment, and chips.

Imports also rose by 8.3% yoy to JPY 9443B, slightly below expected 9.0% increase, and set a record for the month. The weak Ten continues to inflate import costs for resource-scarce Japan, with crude oil prices jumping 17.7% yoy, compared to a 2.6% yoy increase in Dollar terms. This resulted in a trade balance deficit of JPY -463B.

On a seasonally adjusted basis, exports rose 0.9% mom to JPY 8843B, while imports decreased by -0.5% mom to JPY 9403B, leading to a trade balance deficit of JPY -561B.

ECB’s Nagel: June cut plausible, not on autopilot afterwards

In a newspaper interview, ECB Governing Council member Joachim Nagel expressed optimism about the current economic outlook, noting that “wage growth is expected to moderate as inflation continues to recede.” He highlighted that recent developments are “heading in the right direction.”

Nagel suggested that a first rate reduction in three weeks is “plausible,” provided that incoming data and new projections align with policymakers’ expectations. However, he cautioned against rushing into additional monetary easing, emphasizing, “We should not cut rates hastily and jeopardize what we have achieved.”

He also underscored the high level of uncertainty, stating, “Even if rates are lowered for the first time in June, that does not mean we will cut rates further” in subsequent meetings. Nagel stressed that ECB’s approach is not automatic, saying, “We are not on auto-pilot.”

BoE’s Bailey signals next move as rate cut amid expected drop in inflation

BoE Governor Andrew Bailey indicated overnight that he anticipates the next move in monetary policy will be a rate cut. He expects a significant decline in April’s UK inflation data, but questions remain about how long the current level of monetary policy restriction will need to be maintained.

Bailey addressed the IMF’s suggestion to hold a press conference after each rate-setting meeting, rather than just four times a year. He stated, “We will roll that question that the IMF have given to us into our thinking about implementing Ben Bernanke’s changes.”

Fed’s Waller: Several months of data needed before supporting rate cuts

Fed Governor Christopher Waller emphasized in a speech yesterday that “several more months” of favorable inflation data are necessary before he would consider supporting interest rate cuts.

While the latest CPI data was a “reassuring signal” indicating that inflation is not accelerating, Waller noted that the progress shown was “small.”

Waller highlighted that current data on spending and labor market suggest that monetary policy is at an “appropriate setting” to exert downward pressure on inflation.

However, “in the absence of a significant weakening in the labor market, I need to see several more months of good inflation data before I would be comfortable supporting an easing in the stance of monetary policy,” he said.

Looking ahead

UK CPI, PPI are the main focus in European session. Later in the day, US will release existing home sales and FOMC minutes.

AUD/USD Daily Report

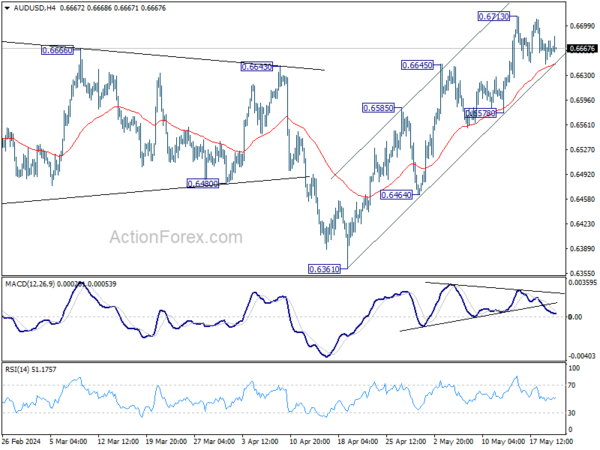

Daily Pivots: (S1) 0.6649; (P) 0.6664; (R1) 0.6681; More...

AUD/USD is staying in consolidation from 0.6713 and intraday bias remains neutral. Further rally is expected as long as 0.6578 support holds. As noted before, fall from 0.6870 has probably completed with three waves down to 0.6361 already. Above 0.6713 will target 0.6870 resistance next.

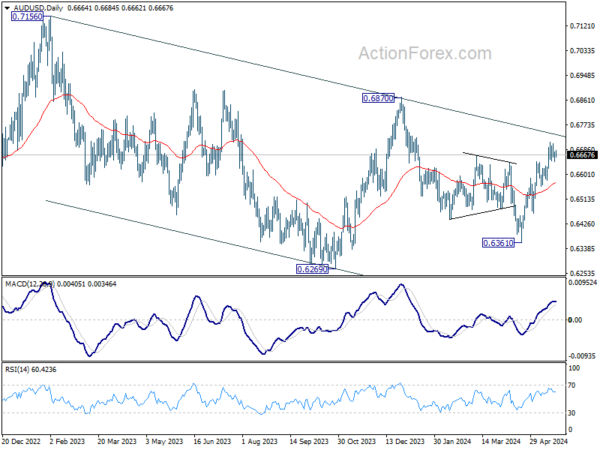

In the bigger picture, price actions from 0.6169 (2022 low) are seen as a medium term corrective pattern to the down trend from 0.8006 (2021 high). Fall from 0.7156 (2023 high) is seen as the second leg, which could have completed at 0.6269 already. Rise from there is seen as the third leg which is now trying to resume through 0.6870 resistance.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Trade Balance (JPY) Apr | -0.56T | -0.73T | -0.70T | -0.68T |

| 23:50 | JPY | Machinery Orders M/M Mar | 2.90% | -1.80% | 7.70% | |

| 02:00 | NZD | RBNZ Interest Rate Decision | 5.50% | 5.50% | 5.50% | |

| 06:00 | GBP | CPI M/M Apr | 0.20% | 0.60% | ||

| 06:00 | GBP | CPI Y/Y Apr | 2.10% | 3.20% | ||

| 06:00 | GBP | Core CPI Y/Y Apr | 3.60% | 4.20% | ||

| 06:00 | GBP | RPI M/M Apr | 0.50% | 0.50% | ||

| 06:00 | GBP | RPI Y/Y Apr | 3.30% | 4.30% | ||

| 06:00 | GBP | PPI Input M/M Apr | 0.40% | -0.10% | ||

| 06:00 | GBP | PPI Input Y/Y Apr | -1.20% | -2.50% | ||

| 06:00 | GBP | PPI Output M/M Apr | 0.40% | 0.20% | ||

| 06:00 | GBP | PPI Output Y/Y Apr | 1.20% | 0.60% | ||

| 06:00 | GBP | PPI Core Output Y/Y Apr | 0.10% | |||

| 06:00 | GBP | PPI Core Output M/M Apr | 0.30% | |||

| 06:00 | GBP | Public Sector Net Borrowing(GBP) Apr | 18.5B | 11.0B | ||

| 14:00 | USD | Existing Home Sales Apr | 4.18M | 4.19M | ||

| 14:30 | USD | Crude Oil Inventories | -2.4M | -2.5M | ||

| 18:00 | USD | FOMC Minutes |