Yen continues to underperform as the worst for the week at this point, even in face of Japan’s verbal interventions. As Yen breached 155 mark against Dollar again, Japanese Finance Minister Shunichi Suzuki reiterated his concerns over the detrimental impacts of a weakening Yen and promised a “thorough response” in the forex markets. Despite these efforts and a hawkish shift in BoJ’s Summary of Opinions, Yen has seen no significant support.

On the other hand, Dollar remains the strongest performer for the week, albeit without enough momentum to break through key technical levels against other major currencies. Traders appear cautious, likely awaiting next week’s US CPI data before making significant moves. FOMC is united on the need for more favorable data before considering interest rate cuts. However, there is a clear division among its members regarding the timing and extent of rate reductions this year.

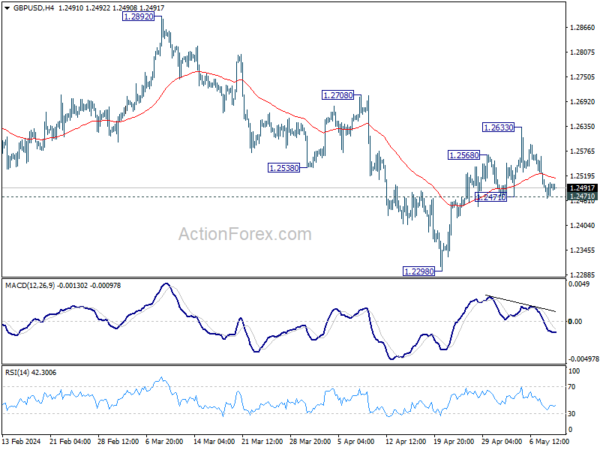

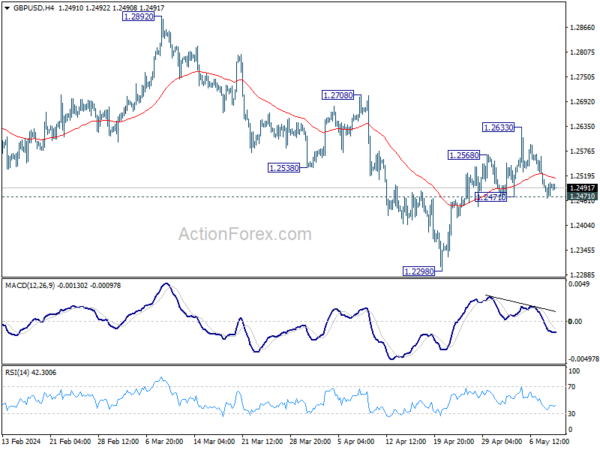

British Pound slightly on the softer side as the market anticipates BoE’s upcoming interest rate decision. All eyes are on the voting dynamics and the new economic forecasts for any indications that the central bank might initiate rate cuts sooner than August. From a technical perspective, GBP/USD is pressing 1.2471 support at this point. Strong rebound from current level will retain near term bullishness, and bring further rally through 1.2633 at a later stage. However, firm break of 1.2471 will argue that the rebound from 1.2298 has completed already. More importantly, larger fall from 1.2892 might be ready to resume in this case.

In Asia, at the time of writing, Nikkei is up 0.24%. Hong Kong HSI is up 1.23%. China Shanghai SSE is up 0.91%. Singapore Strait Times is up 0.05%. Japan 10-year JGB yield is up 0.0287 at 0.912. Overnight, DOW rose 0.44%. S&P 500 fell -0.00%. NASDAQ fell -0.18%. 10-year yield rose 0.0290 to 4.492.

Record high for FTSE as markets eye BoE for rate cut clues

As BoE meets today, expectations are set for interest rate to remain unchanged at 5.25%. The focal point for investors, however, is any signal from regarding rate cuts. Financial markets have already fully priced in a first 25bps by August, with a 40% probability assigned to such a move occurring as soon as June. Additional reductions are expected later in November or December, lowering the Bank Rate to 4.75% by year-end, with further cuts anticipated in 2025.

The likelihood of BoE providing clear indication today about the timing of these rate cuts remains low. Any hints will be subtly embedded within the voting outcomes and the newly updated economic forecasts. Market predictions suggest an 8-1 voting split, with Swati Dhingra expected to maintain her stance for a rate cut. Meanwhile, hawks like Catherine Mann and Jonathan Haskel are not predicted to shift their positions drastically and return to vote for hike. A significant variable in this equation is whether Deputy Governor Dave Ramsden will align with Dhingra, adding weight to the dovish side.

FTSE surged to new record high yesterday, partly supported by a weaker Pound, and more importantly as the UK economy is clear out of last year’s shallow recession, with strong momentum in the services sector. Technically, near term outlook in FTSE will stay bullish as long as 8111.37 support holds. Next target is 100% projection of 6707.62 to 8047.06 from 7404.08 at 8743.52.

BoJ meeting summary indicates hawkish shift

Summary of Opinions from BoJ’s April meeting revealed a notable hawkish tilt among its board members, with significant dialogue concerning further rate hikes. This development reflects a growing concern over inflationary pressures and the impact of a weaker yen, which could hasten monetary policy normalization.

One board member highlighted that if the economic activity and price forecasts from April are realized, future policy interest rates might be “higher than the path that is factored in by the market.”

Further discussions emphasized the necessity of managing transitions carefully to mitigate shocks from sudden and substantial policy changes once price stability target is achieved. One approach proposed involves “moderate policy interest rate hikes”.

Another critical point raised was the impact of a weakening yen on inflation. A board member warned that if underlying inflation continues to rise above the baseline scenario due to the currency’s depreciation, “it is quite possible that the pace of monetary policy normalization will increase”.

Japan’s real wages fall -2.5% yoy, declining for 24th consecutive month

In Japan, real wages fell notably by -2.5% yoy in March, marking a worsening trend from the previous month’s -1.8% yoy. It also extended the streak of declines to 24 consecutive months—the longest since such data was first recorded in 1991.

Nominal wages, which include total cash earnings, grew modestly by 0.6% yoy in March, a deceleration from February’s 1.4% yoy increase. Although regular pay saw a rise of 1.7% yoy , this was offset by -1.5% yoy decline in overtime pay, which has fallen for four consecutive months. Furthermore, special payments, which encompass bonuses and other benefits, saw a sharp decrease of -9.4% yoy.

The persistence of wage declines occurs despite a seemingly favorable outcome from Japan’s annual labor-management wage talks this spring, which were described as the most beneficial for workers at major companies in three decades.

However, a labor ministry official noted that the results of the “shunto” wage negotiations were not reflected in the March data. With these results expected to influence the figures from April onwards, there is a focus on whether real wages will show an improvement and turn positive for the first time in two years.

China’s exports rises 1.5% yoy in Apr, imports surges 8.% yoy

China’s trade figures for April showcased significant recovery, with exports increasing by 1.5% yoy to USD 292.5 B, exceeding the expected 1.0% yoy growth. This rebound is particularly noteworthy given the -7.5% yoy decline observed in March.

On the import side, there was a notable surge of 8.4% yoy to USD 210.1B, substantially higher than the forecasted 5.4% yoy. This rise marks a recovery from the -1.9% decline in March. The significant increase in imports, driven partly by a weaker comparison base from the previous year, also reflects an uptick in economic activity as domestic conditions improve.

Trade surplus for April stood at USD 72.4B, smaller than the expected USD 81.4B but still an improvement from USD 58.6B recorded in March.

Fed’s Collins: Bringing down inflation will require more time

Boston Fed President Susan Collins described current monetary policy as “well positioned” to adapt based on new economic data and the evolving economic outlook. She is “optimistic” that Fed can achieve 2% inflation target in a “reasonable amount of time” while maintaining a robust labor market. However, she now anticipates that reaching this goal will “take more time than previously thought.”

Collins highlighted “recent upward surprises to activity and inflation”. This has led her to suggest that maintaining the current policy level might be necessary for a longer period than initially expected. She emphasized the importance of ensuring that inflation moves “sustainably toward 2%” before considering any policy adjustments.

GBP/JPY Daily Outlook

Daily Pivots: (S1) 193.59; (P) 194.05; (R1) 194.83; More..

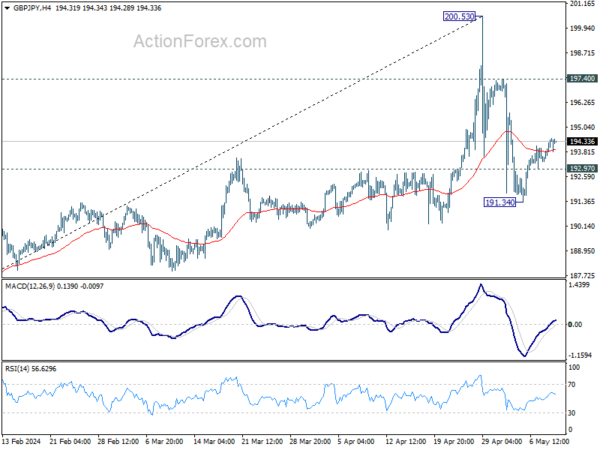

Intraday bias in GBP/JPY is mildly on the upside with break of 55 4H EMA. Pull back from 200.53 should have completed at 191.34. Rebound from there is seen as the second leg of the corrective pattern. Further rise would be seen back to 197.40 resistance. On the downside, however, break of 192.97 minor support will turn intraday bias neutral again first.

In the bigger picture, a medium term top could be in place at 200.53 after breaching 199.80 long term fibonacci level. As long as 55 W EMA (now at 183.34) holds, fall from there is seen as correcting the rise from 178.32 only. However, sustained break of 55 W EMA will argue that larger scale correction is underway and target 178.32 support.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | RICS Housing Price Balance Apr | -5% | 4% | -4% | -5% |

| 23:50 | JPY | BoJ Summary of Opinions | ||||

| 03:00 | CNY | Trade Balance (USD) Apr | 72.4B | 81.4B | 58.6B | |

| 05:00 | JPY | Leading Economic Index Mar P | 111.3 | 111.8 | ||

| 11:00 | GBP | BoE Interest Rate Decision | 5.25% | 5.25% | ||

| 11:00 | GBP | MPC Official Bank Rate Votes | 0–0–9 | 0–1–8 | ||

| 12:30 | USD | Initial Jobless Claims (May 3) | 210K | 208K | ||

| 14:30 | USD | Natural Gas Storage | 87B | 59B |