Dollar is making a modest recovery in early US session, supported by slightly better-than-expected durable goods orders and recovery in benchmark Treasury yields. However, the overarching direction of the greenback for the near term remains uncertain, largely dependent on shifting risk sentiments. Current stock futures are showing mixed opening, leaving investors watching closely to see how these dynamics unfold throughout the trading day.

In the broader currency market, Australian Dollar and New Zealand Dollar are leading as the strongest performers for the day. Aussie particularly buoyed by stronger than expected CPI data, which are likely to push back the timetable for any rate cuts by RBA. Conversely, Canadian dollar is currently the weakest performer, following disappointing retail sales data, indicating softer consumer spending. Swiss Franc and Euro are also underperforming, while Japanese Yen and British Pound hold middle ground.

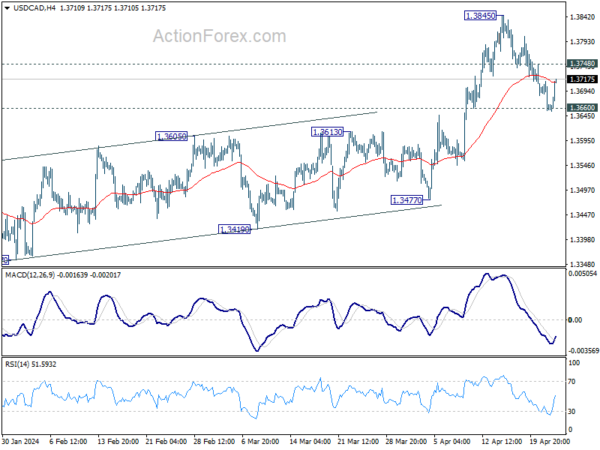

Technically, USD/CAD’s recovery suggests that 1.3660 support is defended for now. Near term bullishness is retained. Break of 1.3748 minor resistance will bring stronger rally back to retest 1.3845. Further break there will resume larger rally from 1.3716.

In Europe, at the time of writing, FTSE is up 0.48%. DAX is up 0.15%. CAC is up 0.46%. UK 10-year yield is up 0.0921 at 4.337. Germany 10-year yield is up 0.066 at 2.575. Earlier in Asia, Nikkei rose 2.42%. Hong Kong HSI rose 2.21%. China Shanghai SSE rose 0.76%. Singapore Strait Times rose 0.62%. Japan 10-year JGB yield rose 0.0045 to 0.891.

US durable goods orders rises 2.6% mom in Mar, ex-transport orders up 0.2% mom

US durable goods orders rose 2.6% mom to USD 283.4B in March, above expectation of 2.5% mom. Ex-transport orders rose 0.2% mom to USD 187.5B, below expectation of 0.3% mom. Ex-defense orders rose 2.3% mom to USD 268.1B, above expectation of 2.0% mom. Transportation equipment orders rose 7.7% to USD 95.9B.

Canada’s retail sales down -0.1% mom in Feb

Canada’s retail sales fell -0.1% mom to CAD 66.7B in February, worse than expectation of 0.1% mom rise. Sales were down in five of nine subsectors and were led by decreases at gasoline stations and fuel vendors (-2.2% mom).

Core retail sales, which exclude gasoline stations and fuel vendors and motor vehicle and parts dealers, were unchanged for the month.

Advance estimate indicates that retail sales was unchanged in March.

German Ifo business climate rises to 89.4, economy stabilizing thanks to service providers

German Ifo Business Climate rose from 87.8 to 89.4 in April, above expectation of 88.5. Current Assessment Index rose from 88.1 to 88.9, above expectation of 88.7. Expectations Index also improved from 87.5 to 89.9, above expectation of 88.9.

By sector, manufacturing rose from -9.9 to -8.5. Services rose from 0.4 to 3.2. Trade rose from -22.9 to -22.0. Construction rose from -33.2 to -28.5.

If said, “Companies were more satisfied with their current business. Their expectations also brightened. The economy is stabilizing, especially thanks to service providers.”

ECB’s Nagel cautions: June rate cut may not lead to further easing

At a conference today, Joachim Nagel, Bundesbank President and ECB Governing Council member, said that if data in the next six weeks bolster confidence in achieving ECB’s 2% inflation target, he would support a reduction in interest rates in June. However, he emphasized that “such a step would not necessarily be followed by a series of rate cuts.”

He stressed the current climate of uncertainty, noting, “Given the current uncertainty, we cannot pre-commit to a particular rate path.” This approach underscores ECB’s strategy of making decisions “meeting by meeting and based on incoming data.”

Further, Nagel admitted of his reservations and expressed that he is “not fully convinced yet” that price growth is firmly on a path toward target. Core inflation, particularly within the services sector, remains elevated, driven by persistent strong wage growth, which tends to be more durable than goods inflation.

Nevertheless, by June “we will know a lot more,” about the inflation path, he added.

Australia CPI slows less than expected in Q1, accelerates in Mar

In Q1, Australia’s CPI slowed from 4.1% yoy to 3.6% yoy, exceeding market expectations of 3.4% yoy. Similarly, trimmed mean CPI, which excludes volatile price items and provides a clearer view of underlying inflation trends, also decelerated less than expected, moving from 4.2% yoy to 4.0% yoy, against predictions of 3.8% yoy.

The breakdown by category shows a general slowdown across the board. Goods inflation decreased from 3.8% yoy to 3.1% yoy, while services inflation eased from 4.6% yoy to 4.3% yoy. Tradeable inflation, which includes items that can be imported or exported, slowed more significantly from 1.5% yoy to 0.9% yoy. Non-tradeable inflation, representing goods and services not exposed to international markets, also saw a reduction from 5.4% yoy to 5.0% yoy.

However, on a quarterly basis, CPI rose by 1.0% qoq in Q1, marking an acceleration from the previous quarter’s 0.6% qoq and outpacing expectations of a 0.8% rise. This quarterly increase suggests that, despite the annual slowdown, price pressures within the economy intensified at the start of the year. Trimmed mean CPI on a quarterly basis mirrored this trend, rising 1.0% qoq compared to the previous 0.8% qoq, also surpassing the expected 0.8% qoq.

Monthly figures reinforce the notion of persistent inflationary pressures, with CPI ticking up from 3.4% yoy to 3.5% yoy, again exceeding expectations.

New Zealand’s goods exports rises 3.8% yoy in Mar, imports fell -25% yoy

New Zealand’s goods exports rose 3.8% yoy to NZD 6.5B in March. Goods imports fell -25% yoy to NZD 5.9B. Monthly trade balance was a surplus of NZD 588m, versus expectation of NZD -505m deficit.

Exports to US and EU showed increases of 8.0% yoy and 3.6% yoy respectively. However, exports to major trading partners like China (-1.9% yoy), Australia (-3.7% yoy), and Japan (-15% yoy) declined.

On the import side, there were significant reductions across all major partners. Imports from EU saw the sharpest decline at -43% yoy, followed closely by US at -42% yoy. Imports from China, Australia, and South Korea were down -20% yoy, -13% yoy, and -21% yoy respectively.

EUR/USD Mid-Day Outlook

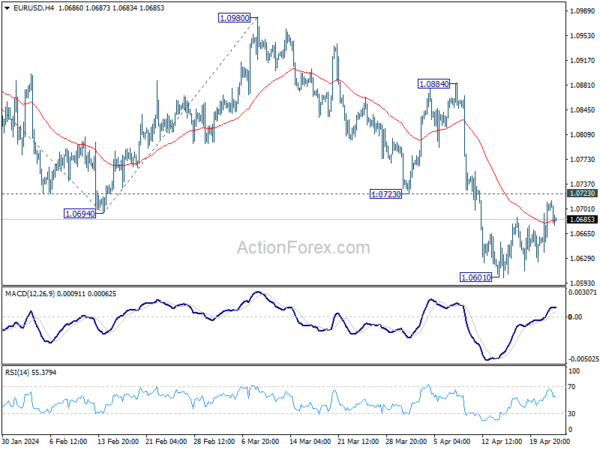

Daily Pivots: (S1) 1.0656; (P) 1.0684; (R1) 1.0729; More…

EUR/USD is still bounded in range trading above 1.0601 and intraday bias remains neutral. Strong resistance should be seen from 1.0723 to complete the corrective rise from 1.0601. Break of 1.0601 will resume the fall from 1.1138 to 100% projection of 1.1138 to 1.0694 from 1.0980 at 1.0536 next. Nevertheless, firm break of 1.0723 will bring stronger rebound to 55 D EMA (now at 1.0786) instead.

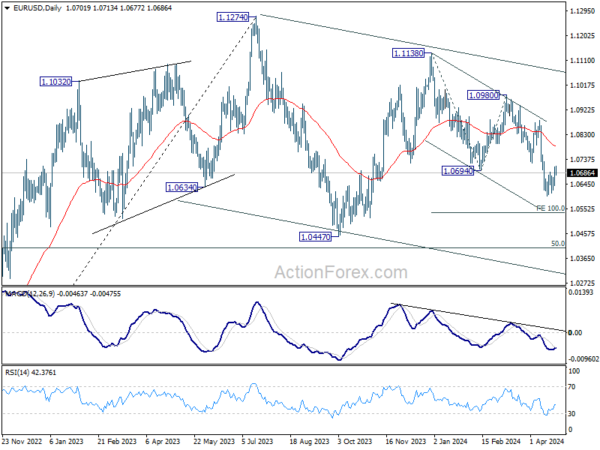

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern to rise from 0.9534 (2022 low). Current fall from 1.1138 is seen as the third leg. While deeper decline is would be seen to 1.0447 and possibly below, Strong support should emerge from 61.8% retracement of 0.9534 to 1.1274 at 1.0199 to complete the correction.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Trade Balance (NZD) Mar | 588M | -505M | -218M | -315M |

| 23:50 | JPY | Corporate Service Price Index Y/Y Mar | 2.30% | 2.10% | 2.10% | 2.20% |

| 01:30 | AUD | Monthly CPI Y/Y Mar | 3.50% | 3.40% | 3.40% | |

| 01:30 | AUD | CPI Q/Q Q1 | 1.00% | 0.80% | 0.60% | |

| 01:30 | AUD | CPI Y/Y Q1 | 3.60% | 3.40% | 4.10% | |

| 01:30 | AUD | RBA Trimmed Mean CPI Q/Q Q1 | 1.00% | 0.80% | 0.80% | |

| 01:30 | AUD | RBA Trimmed Mean CPI Y/Y Q1 | 4.00% | 3.80% | 4.20% | |

| 08:00 | CHF | Credit Suisse Economic Expectations Apr | 17.6 | 11.5 | ||

| 08:00 | EUR | Germany IFO Business Climate Apr | 89.4 | 88.5 | 87.8 | |

| 08:00 | EUR | Germany IFO Current Assessment Apr | 88.9 | 88.7 | 88.1 | |

| 08:00 | EUR | Germany IFO Expectations Apr | 89.9 | 88.9 | 87.5 | |

| 12:30 | USD | Durable Goods Orders Mar | 2.60% | 2.50% | 1.30% | |

| 12:30 | USD | Durable Goods Orders ex Transportation Mar | 0.20% | 0.30% | 0.50% | |

| 12:30 | USD | Durable Goods Orders ex Defense Mar | 2.30% | 2.00% | 2.20% | |

| 12:30 | CAD | Retail Sales M/M Feb | -0.10% | 0.10% | -0.30% | |

| 12:30 | CAD | Retail Sales ex Autos M/M Feb | -0.30% | 0.00% | 0.50% | 0.40% |

| 14:30 | USD | Crude Oil Inventories | 1.7M | 2.7M | ||

| 17:30 | CAD | BoC Summary of Deliberations |