Quick update: Dollar strengthens again after ISM services beat expectation and rose to 60.1 in October.

Dollar weakens mildly in early US session after mixed employment data. Headline job growth as shown in non-farm payrolls report was at 261k in October, below expectation of 310k. But prior months figure was revised up from -33k contraction to 18k rise, roughly makes up the miss. Unemployment rate dropped to 4.1%, below expectation of being unchanged at 4.2%. The biggest disappointment is that average hourly earnings stalled at 0.0% mom, below expectation of 0.2% mom growth. While the greenback is sold off after the report, weakness is so far limited. Also from US, trade deficit widened slightly to USD -43.5b in September.

Canadian Dollar, on the other hand, jumps on strong employment data. Job market grew 35.3k in October, nearly triple of expectation of 15.5k. Unemployment rate, though, rose 0.1% to 6.3%. Trade deficit was unchanged at CAD -3.18b.

Sterling rebounds strongly today after better than expected services data. UK services PMI rose to 55.6 in October, up from 53.6 and beat expectation of 53.3. That’s also the highest level since April and the biggest one month gain since August 2016. However, Markit noted that "while an upturn in business activity growth adds some justification to the Bank of England’ decision to hike interest rates … a deeper dive into the numbers highlights the fragility of the economy." Also, as across the economy as a whole, PMI showed that job growth was weakest since March. And Markit also noted that "squeezed margins and concerns about the economic outlook had led to more cautious hiring strategies."

USD/JPY Mid-Day Outlook

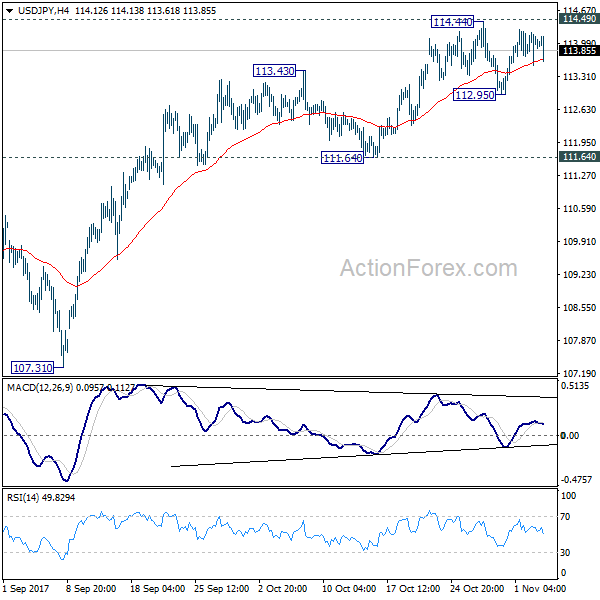

Daily Pivots: (S1) 113.67; (P) 113.94; (R1) 114.35; More…

USD/JPY dips notably in early US session but stays in range of 112.95/114.44. Intraday bias remains neutral first. On the upside, decisive break of 114.49 will confirm that correction pattern from 118.65 has completed at 107.31 already. And USD/JPY should then target a test on 118.65. On the downside, below 112.95 will bring deeper pull back. But strong support should be seen from 111.64 support to maintain bullishness and bring rebound.

In the bigger picture, medium term rise from 98.97 (2016 low) is not completed yet. It should resume after corrective fall from 118.65 completes. Break of 114.49 resistance will likely resume the rise to 61.8% projection of 98.97 to 118.65 from 107.31 at 119.47 first. Firm break there will pave the way to 100% projection at 126.99. This will be the key level to decide whether long term up trend is resuming.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | Retail Sales M/M Sep | 0.00% | 0.40% | -0.60% | |

| 01:45 | CNY | Caixin PMI Services Oct | 51.2 | 50.8 | 50.6 | |

| 09:30 | GBP | Services PMI Oct | 55.6 | 53.3 | 53.6 | |

| 12:30 | CAD | International Merchandise Trade (CAD) Sep | -3.18B | -2.95B | -3.41B | -3.18B |

| 12:30 | CAD | Net Change in Employment Oct | 35.3K | 15.5K | 10.0K | |

| 12:30 | CAD | Unemployment Rate Oct | 6.30% | 6.20% | 6.20% | |

| 12:30 | USD | Trade Balance Sep | -43.5B | -43.5B | -42.4B | -42.8B |

| 12:30 | USD | Change in Non-farm Payrolls Oct | 261K | 310K | -33K | 18K |

| 12:30 | USD | Unemployment Rate Oct | 4.10% | 4.20% | 4.20% | |

| 12:30 | USD | Average Hourly Earnings M/M Oct | 0.00% | 0.20% | 0.50% | |

| 14:00 | USD | ISM Non-Manufacturing/Services Composite Oct | 60.1 | 58.5 | 59.8 | |

| 14:00 | USD | Factory Orders Sep | 1.40% | 1.20% | 1.20% |