Sterling dives sharply as respond to BoE’s dovish rate hike that suggests it’s a one-off. Indeed, selling has already started around 30 minutes ahead of the announcement. At the time of writing, the Pound is still holding above key near term support level against Dollar, Euro and Yen. That is, GBP/USD is holding above 1.3026/68 support zone. GBP/JPY is staying above 148.88 support. EUR/GBP is staying well below 0.9032 resistance. More is needed to confirm underlying weakness in the Pound. For now, while traders will have one eye on Sterling, focus will also turn to US President Donald Trump’s expected nomination of Jerome Powell as Fed chair, as well as Republican’s release of the tax plan.

BoE hikes but statement suggests it’s a one-off

BoE finally delivered the highlight anticipated rate hike as expected. The Bank Rate is raised by 25bps to 0.50%, first hike in a decade. The decision is made by 7-2 vote, with Jon Cunliffe and Dave Ramsden dissented. The asset purchase target was held unchanged at GBP 435b by unanimous vote. In the prior statement, MPC noted that "monetary policy could need to be tightened by a somewhat greater extent over the forecast period than current market expectations." Such language is taken out in the current statement. Instead, "MPC now judges it appropriate to tighten modestly the stance of monetary policy in order to return inflation sustainably to the target." This is taken by the markets that today’s rate hike is a one-off.

Meanwhile, BoE also reiterated that there are "considerable risks" to the outlook including Brexit. And it pledged to "monitor closely the incoming evidence on these and other developments, including the impact of today’s increase in Bank Rate, and stands ready to respond to changes in the economic outlook as they unfold to ensure a sustainable return of inflation to the 2% target."

Regarding the updated economic projections, growth and inflation forecasts are largely unchanged. Inflation is projected to hit 2.2% in three years, slightly above BoE’s 2% target. And the projections are based on market projections on the Bank Rate, which is expected to hit 1% over that period.

More in BOE Increased Policy Rate for First Time in More than A Decade

Japan FM and PM hailed BoJ Kuroda

Japan Finance Minister Taro Aso hailed that BoJ Governor Haruhiko Kuroda has "overhauled the Bank of Japan’s monetary policy and eased policy, as a result the yen has fallen from around 80 yen to some 113 yen, which has improved export conditions for Japanese firms." Also, Aso said that "coordination between fiscal and monetary policies has worked well."

Yesterday, Prime Minister Shinzo Abe expressed his recognition on Kuroda’s achievements. He said that "we have created a situation in a short period of time that Japan is no longer in deflation as a result of strengthening policy coordination between the government and the BOJ." And, "the government and the BOJ have achieved a major result on employment, which is the most important responsibility of politics."

These comments raised the chance that Kuroda will be given another term as the current one expires next April.

On the data front

US initial jobless claims dropped -5k to 229k in the week ended October 28. That’s below market expectation of 235k. The four week moving averaged dropped to 232.5k, hitting the lowest level since 1973. Continuing claims dropped -15k to 1.88m, lowest since 1973. Non-farm productivity surged 3.0% in Q3, above expectation of 2.5%. Unit labor costs rose 0.5%, above expectation of 0.4%.

UK PMI construction rose to 50.8 in October, up from 48.1 and beat expectation of 48.5. Markit noted that "greater house building was the sole bright spot in an otherwise difficult month for the construction sector. Sustained declines in civil engineering and commercial activity meant that large areas of the building industry have become stuck in a rut."

German unemployment dropped -11k in October, larger than expectation of -10k. Unemployment rate was unchanged at 5.6%. Eurozone PMI manufacturing was finalized at 58.5, revised down -0.1. Italy PMI manufacturing rose to 57.8 in October, up from 56.3, above expectation of 56.5. Swiss retail sales dropped -0.4% yoy in September, below expectation of 0.3% yoy. Swiss SECO consumer confidence improved to -2 in October, but missed expectation of 0.

Elsewhere, Australia trade surplus widened to AUD 1.75b in September, above expectation of 1.2b. Building approvals rose 1.5% in October versus expectation of -1.0% fall. Japan monetary base rose 14.5% yoy in October. Japan consumer confidence rose to 44.5 in October, above expectation of 43.6.

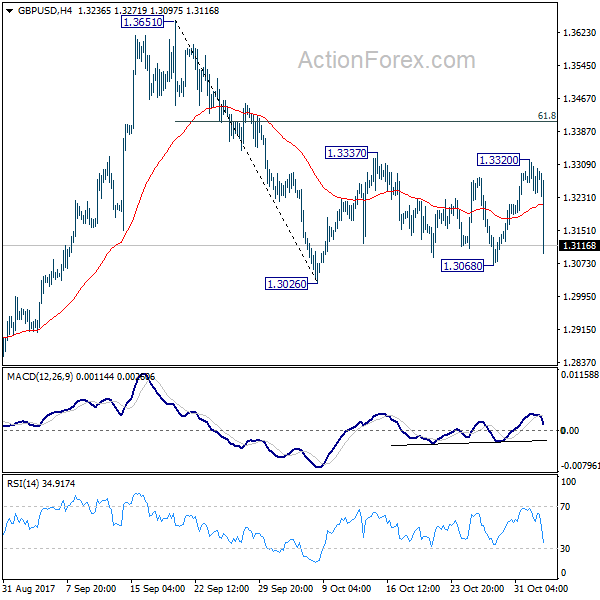

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.3216; (P) 1.3268; (R1) 1.3297; More….

GBP/USD failed to break out 1.3337 resistance, reversed after hitting 1.3320 and drops sharply from there. At this point, it’s staying in consolidation pattern from 1.3026 short term bottom. Intraday bias remains neutral first. Outlook is unchanged that even in case of another rise, upside should be limited by 61.8% retracement of 1.3651 to 1.3026 at 1.3412 to bring fall resumption finally. On the downside, firm break of 1.3026 support will resume the decline from 1.3651 and target 1.2773 key support level. This will also revive the case of medium term reversal. However, sustained break of 1.3412 will turn focus back to 1.3651 high.

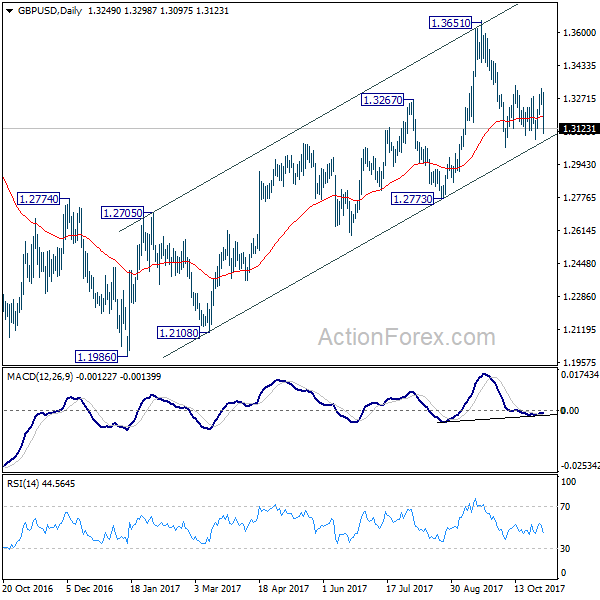

In the bigger picture, while the medium term rebound from 1.1946 was strong, GBP/USD hit strong resistance from the long term falling trend line. Outlook is turned a bit mixed and we’ll stay neutral first. On the downside, decisive break of 1.2773 key support will argue that rebound from 1.1946 has completed. The corrective structure of rise from 1.1946 to 1.3651 will in turn suggest that long term down trend is now completed. Break of 1.1946 low should then be seen. On the upside, break of 1.3835 support turned resistance will revive the case of trend reversal and target 38.2% retracement of 2.1161 (2007 high) to 1.1946 (2016 low) at 1.5466 .

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Monetary Base Y/Y Oct | 14.50% | 15.70% | 15.60% | |

| 00:30 | AUD | Trade Balance Sep | 1.75B | 1.20B | 0.99B | 0.87B |

| 00:30 | AUD | Building Approvals M/M Sep | 1.50% | -1.00% | 0.40% | |

| 05:00 | JPY | Consumer Confidence Oct | 44.5 | 43.6 | 43.9 | |

| 06:45 | CHF | SECO Consumer Confidence Oct | -2 | 0 | -3 | |

| 08:15 | CHF | Retail Sales Real Y/Y Sep | -0.40% | 0.30% | -0.20% | -1.00% |

| 08:45 | EUR | Italy Manufacturing PMI Oct | 57.8 | 56.5 | 56.3 | |

| 08:50 | EUR | France Manufacturing PMI Oct F | 56.1 | 56.7 | 56.7 | |

| 08:55 | EUR | German Unemployment Change Oct | -11K | -10K | -23K | |

| 08:55 | EUR | German Unemployment Claims Rate Oct | 5.60% | 5.60% | 5.60% | |

| 08:55 | EUR | Germany Manufacturing PMI Oct F | 60.6 | 60.5 | 60.5 | |

| 09:00 | EUR | Eurozone Manufacturing PMI Oct F | 58.5 | 58.6 | 58.6 | |

| 09:30 | GBP | Construction PMI Oct | 50.8 | 48.5 | 48.1 | |

| 11:30 | USD | Challenger Job Cuts Y/Y Oct | -3.00% | -27.00% | ||

| 12:00 | GBP | BoE Bank Rate | 0.50% | 0.50% | 0.25% | |

| 12:00 | GBP | BoE Asset Purchase Target | 435B | 435B | 435B | |

| 12:00 | GBP | MPC Official Bank Rate Votes | 7–0–2 | 9–0–0 | 2–0–7 | |

| 12:00 | GBP | MPC Asset Purchase Facility Votes | 0–0–9 | 0–0–9 | 0–0–9 | |

| 12:00 | GBP | Bank of England Inflation Report | ||||

| 12:30 | USD | Initial Jobless Claims (OCT 28) | 229K | 235K | 233K | 234K |

| 12:30 | USD | Nonfarm Productivity Q3 P | 3.00% | 2.50% | 1.50% | |

| 12:30 | USD | Unit Labor Costs Q3 P | 0.50% | 0.40% | 0.20% | 0.30% |

| 14:30 | USD | Natural Gas Storage | 64B |