Dollar took a nosedive overnight as investors were apparently relieved that Fed is still on track to cut interest rates three times this year. The odds for a June cut as indicated by fed fund futures also jumped back to above 70%. The positive sentiment shoot major US stocks indexes to new record highs. The greenback’s weakness persisted into Asian session, and it could continue face more downside pressure ahead.

In contrast, Australian Dollar staged a robust recovery, buoyed by exceptionally strong employment data. Additionally latest PMI figures Indicate both economic revival and heightened price pressures. These developments cast doubts on the likelihood of RBA cutting rates in the near future. Indeed, the possibility for another hike doesn’t vanish, reaffirming RBA’s “not ruling anything in or out” stance.

The spotlight now shifts to BoE and SNB as the week’s central bank bonanza continues. No change in interest rate is expected from BoE, and the main focus is on voting. Last time, Jonathan Haskel and Catherine Mann voted for a hike while Swati Dhingra voted for a cut. Any hawkish or dovish tilt in the voting could trigger volatility in Pound.

Meanwhile, the Swiss Franc finds itself under pressure as the worst performer of the week at this point, partly due to speculation around an imminent SNB rate cut. Despite June being considered a more probable timeline for such a move, current market odds suggest a 30% chance of a cut taking place today. Additionally, SNB’s stance on currency intervention, given recent vocal concerns from Swiss businesses about the economic impact of a strong Franc, adds another layer of intrigue to their upcoming policy announcement.

Technically, Gold’s up trend resumed on the back of Dollar’s selloff, and hits new record high above 2200 handle. Near term outlook will remain bullish as long as 2145.87 support holds, next target is cluster projection level at 2260 (100% projection of 1810.26 to 2088.24 from 1984.05 at 2262.03 and 100% projection of 1614.60 to 2062.95 from 1810.26 at 2259.15). Strong resistance could be seen there to limit upside, at least on first attempt, on overbought condition.

However, decisive break of this level will pave the way to (161.8% projection of 1810.26 to 2088.24 from 1984.05 at 2262.03 at 2433.82. If this bullish scenario realizes, that could mean Dollar’s sell-off is also generally intensifying.

In Asia, at the time of writing, Nikkei is up 1.95% after hitting new record high. Hong Kong HSI is up 2.33%. China Shanghai SSe is up 0.06%. Singapore Strait Times is up 1.51%. Japan 10-year JGB yield is up 0.0127 at 0.744. Overnight, DOW rose 1.03%. S&P 500 rose 0.89%. NASDAQ rose 1.25%. 10-year yield fell -0.024 to 4.273.

DOW hits new record as Fed holds course on three cuts, despite hawkish undertones

US stocks surged sharply higher overnight, with DOW and S&P 500 closing at new record highs. Market participants expressed relief and optimism as Fed’s maintained forecast of three rate cuts for the year. Fed Chair Jerome Powell’s remarks during the press conference further buoyed investor sentiment, emphasizing that the recent inflation data “haven’t really changed the overall story”. He affirmed that inflation is “moving down gradually”, albeit via a “somewhat bumpy road.”

Despite positive reactions from the stock markets, it’s crucial to acknowledge that Fed’s has shifted to a slightly more hawkish tone, in particular compared to December meeting. The updated dot plot revealed a narrower margin, with nine out of nineteen members now anticipating just two rate cuts for the year. Moreover, future easing path is envisioned to be more gradual than previously projected. Interest rate is expected to settle at 3.75-4.00% by the end of 2025—a slight increase from December’s forecast of 3.50-3.75%. For the end of 2026, the projection was raised to 3.00-3.25%, up from the previous 2.75-3.00%.

Technically, DOW’s up trend is now extending to 40k psychological level, and then 138.2% projection of 28660.94 to 34712.28 from 32327.20 at 40690.15. Outlook will stay bullish as long as 38483.25 support holds, in case of pullback.

BoJ’s Ueda assures continued accommodative monetary stance following rate hike

Addressing the parliament today, BoJ Governor Kazuo Ueda articulated the rationale behind this week’s exit from the long-standing negative interest rate policy and the subsequent rate hike. This move marks a significant shift for Japan’s monetary policy, which had been entrenched in a negative interest rate environment for eight years.

Ueda pointed out, “We could have waited until inflation is completely at 2% for a long period of time. But if we did so, it’s unclear whether inflation would have stayed at 2%. We might have seen a sharp increase in upside price risks,” highlighting the preemptive nature of the BoJ’s action.

The decision was influenced by recent trends in service prices and substantial wage increases resulting from annual wage negotiations, indicating a strengthening cycle of wage growth and inflation in Japan.

Despite this historical step, Ueda underscored that Japan’s inflation expectations for the medium and long term are “still in the process of accelerating towards 2%”. He assured that BoJ remains committed to supporting the economy and prices “by maintaining accommodative monetary conditions for the time being”.

He also hinted at future adjustments, stating, “As we exit our massive stimulus program, we will gradually shrink the size of our balance sheet and at some point reduce the size of our government bond buying.”

Japan’s PMI composite rises to 52.3, strengthening activity and intensifying price pressures

Japan’s PMI Manufacturing saw a modest increase from 47.2 to 48.2 in March, while PMI Services surged to from 52.9 to 54.9, its highest level since last May. Composite PMI, which combines both sectors, also climbed from 50.6 to 52.3, reaching its peak since last August.

Usamah Bhatti, Economist at S&P Global Market Intelligence, underscored the private sector’s regained momentum at the end of Q1. The expansion was predominantly driven by service providers, while manufacturers experienced a continued, though less severe, contraction.

Alongside this economic revival, Japan is facing a “renewed intensification of price pressures,” with the rate of input price inflation hitting a five-month high. This uptick was particularly pronounced among service providers, although manufacturers also reported “stubbornly high input prices”. Many firms opted to pass these increased costs onto customers, leading to the highest output charge inflation since last August.

Australia employment surges 116.5k, unemployment rate dives to 3.7%

Australia employment grew strongly by 116.5k in February, well above expectation of 40.2k. Full-time jobs rose 78.2k while part-time jobs rose 38.3k.

Unemployment rate fell sharply from 4.1% to 3.7%, below expectation of 4.0%. Participation rate rose 0.1% to 66.7%. Monthly hours worked also rose 2.8% mom.

Australia PMI composite rises to 11-month, another blow to RBA rate cut expectations

Australia PMI Manufacturing PMI dropped to a 46-month low of 46.8. Conversely, PMI Services climbed to an 11-month peak of 53.5, with the Composite PMI also reaching an 11-month high at 52.4.

Warren Hogan, Chief Economic Advisor at Judo Bank, highlighted that Composite Output Index’s increase for the fourth consecutive month signifies the economy’s rebound from the cyclical slowdown experienced in 2023. Meanwhile However, inflation remains a concern, with service sector readings indicating persistently high producer and consumer prices.

Hogan noted that the results are “another blow to rate-cut expectations” for RBA. The rebound in economic activity, coupled with inflation exceeding targets, not only diminishes the likelihood of rate reductions, but also raises the possibility of further monetary tightening in 2024. This aligns with recent warnings from RBA.

New Zealand in technical recession as Q4 GDP contracts -0.1% qoq

New Zealand’s economy has officially entered technical recession, with GDP contracting by -0.1% qoq in Q4, below expectation of 0.0% qoq. This decline follows -0.3% contraction in Q4, marking two consecutive quarters of negative growth.

GDP per capita declined decline of -0.7% qoq, while real gross national disposable income saw a -1.4% qoq drop.

The contraction was not uniformly felt across all sectors. Of the sixteen industries analyzed, eight experienced growth, notably the rental, hiring, and real estate services sector, alongside public administration, safety, and defense.

Looking ahead

SNB and BoE rate decisions are the main events in European session. Eurozone will release PMI s while ECB will publish monthly economic bulletin. UK will also release PMIs.

Later in the day, US will release jobless claims, Philly Fed surve, PMIs and existing home sales.

AUD/USD Daily Report

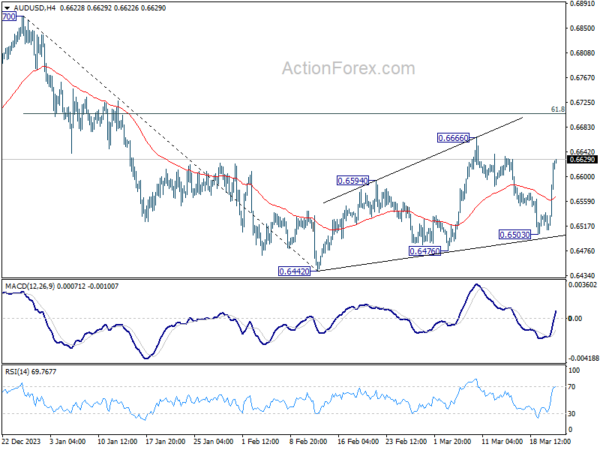

Daily Pivots: (S1) 0.6537; (P) 0.6562; (R1) 0.6612; More…

AUD/USD’s strong rebound suggests that fall from 0.6666 has completed at 0.6503 already. But upside is kept below this resistance for now and intraday bias stays neutral. On the upside, break of 0.6666 will resume the rise from 0.6442 to 61.8% retracement of 0.6870 to 0.64420 at 0.6707. On the downside, break of 0.6503 will argue that fall from 0.6870 is ready to resume through 0.6442 low.

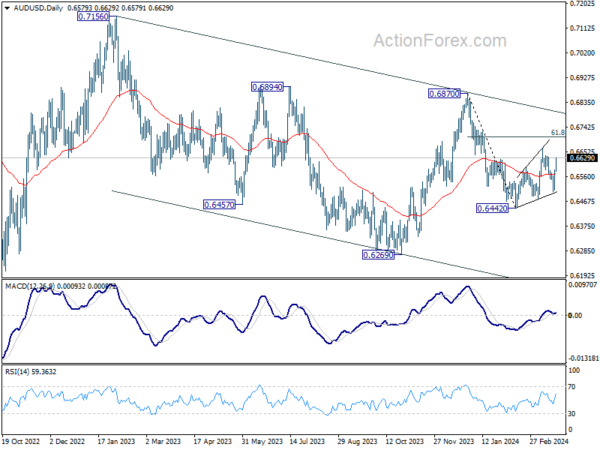

In the bigger picture, price actions from 0.6169 (2022 low) are seen as a medium term corrective pattern to the down trend from 0.8006 (2021 high). Fall from 0.7156 (2023 high) is seen as the second leg, which might still be in progress. Overall, sideway trading could continue in range of 0.6169/7156 for some more time. But as long as 0.7156 holds, an eventual downside breakout would be mildly in favor.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | GDP Q/Q Q4 | -0.10% | 0.00% | -0.30% | |

| 22:00 | AUD | Manufacturing PMI Mar P | 46.8 | 47.8 | ||

| 22:00 | AUD | Services PMI Mar P | 53.5 | 53.1 | ||

| 23:50 | JPY | Trade Balance (JPY) Feb | -0.45T | -0.85T | 0.24T | 0.01T |

| 00:30 | JPY | Manufacturing PMI Mar P | 48.2 | 47.5 | 47.2 | |

| 00:30 | AUD | Employment Change Feb | 116.5K | 40.2K | 0.5K | 15.3K |

| 00:30 | AUD | Unemployment Rate Feb | 3.70% | 4.00% | 4.10% | |

| 07:00 | GBP | Public Sector Net Borrowing (GBP) Feb | 5.2B | -17.6B | ||

| 08:15 | EUR | France Manufacturing PMI Mar P | 47.3 | 47.1 | ||

| 08:15 | EUR | France Services PMI Mar P | 48.6 | 48.4 | ||

| 08:30 | EUR | Germany Manufacturing PMI Mar P | 43.5 | 42.5 | ||

| 08:30 | EUR | Germany Services PMI Mar P | 48.9 | 48.3 | ||

| 08:30 | CHF | SNB Interest Rate Decision | 1.75% | 1.75% | ||

| 09:00 | CHF | SNB Press Conference | ||||

| 09:00 | EUR | Eurozone Current Account (EUR) Jan | 32.3B | 31.9B | ||

| 09:00 | EUR | ECB Economic Bulletin | ||||

| 09:00 | EUR | Eurozone Manufacturing PMI Mar P | 47 | 46.5 | ||

| 09:00 | EUR | Eurozone Services PMI Mar P | 50.5 | 50.2 | ||

| 09:30 | GBP | Manufacturing PMI Mar P | 47.8 | 47.5 | ||

| 09:30 | GBP | Services PMI Mar P | 53.8 | 53.8 | ||

| 12:00 | GBP | BoE Interest Rate Decision | 5.25% | 5.25% | ||

| 12:00 | GBP | MPC Official Bank Rate Votes | 0–1–8 | 2–1–6 | ||

| 12:30 | CAD | New Housing Price Index M/M Feb | 0.10% | -0.10% | ||

| 12:30 | USD | Initial Jobless Claims (Mar 15) | 210K | 209K | ||

| 12:30 | USD | Philadelphia Fed Manufacturing Survey Mar | 0.2 | 5.2 | ||

| 12:30 | USD | Current Account (USD) Q4 | -209B | -200B | ||

| 13:45 | USD | Manufacturing PMI Mar P | 51.9 | 52.2 | ||

| 13:45 | USD | Services PMI Mar P | 52 | 52.3 | ||

| 14:00 | USD | Existing Home Sales Feb | 3.94M | 4.00M | ||

| 14:30 | USD | EIA Natural Gas Storage Change (Mar 15) | 5B | -9B |