Yen continues to stand out as the strongest currency in today’s relatively subdued markets, supported by anticipations of an imminent rate hike by BoJ next week. Swiss Franc and US Dollar are trailing behind in strength, indicating a preference for safer assets. Conversely, Australian Dollar, New Zealand Dollar, and Sterling find themselves at the lower end of the performance spectrum, with Canadian Dollar also showing signs of weakness. This currency alignment hints at a cautious risk-off sentiment prevailing in the market, awaiting confirmation from developments in the US.

With no significant economic announcements scheduled for North America today and Fed ongoing blackout period, the forex market’s direction seems to be at the mercy of overarching risk sentiments. However, the overall picture is set to become more dynamic tomorrow with a lineup of economic data releases. The agenda begins with Japan’s PPI and Australia’s NAB business confidence index during Asian session, followed by the spotlight shifting to UK’s employment data and wages growth, and culminating with US CPI. Investors and traders are advised to maintain calm and secure their seatbelts in anticipation of market-moving data on Tuesday.

Technically, Nikkei’s break of 38876.80 support today should confirm short term topping at 40472.10. Investors could be taking profits now in anticipation of next week’s BoJ meeting. Deeper pull back is in favor to 38.2% retracement of 32205.38 to 40472.10 at 37314.21. But strong support should be seen around 55 D EMA (now at 36922.87) to bring rebound.

In Europe, at the time of writing, FTSE is down -0.37%. DAX is down -0.55%. CAC is down -0.19%. UK 10-year yield is down -0.0149 at 4.045. Germany 10-year yield is up 0.019 at 2.285. Earlier in Asia, Nikkei fell -2.19%. Hong Kong HSI rose 1.43%. China Shanghai SSE rose 0.74%. Singapore Strait Times fell -0.28%. Japan 10-year JGB yield rose 0.0325 to 0.767.

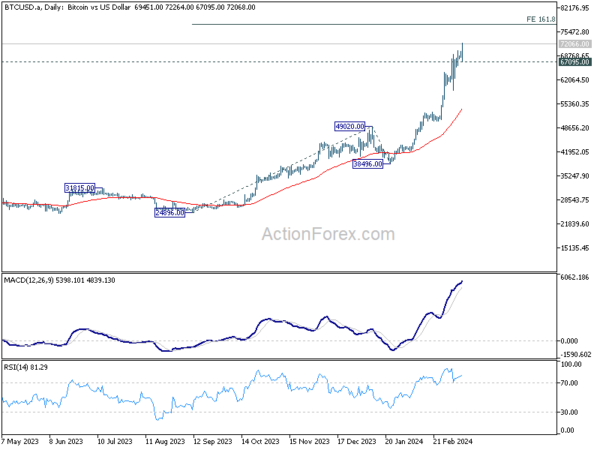

Bitcoin breaks 72k, regulatory nod and ETF inflows propel

Bitcoin’s bullish momentum has once again captured the market’s attention as it makes new record high above 72k mark today. This surge follows the UK Financial Conduct Authority decision to greenlight the creation of cryptocurrency debt instruments on financial exchanges, albeit limited to professional investors.

In addition to regulatory developments, investment flows into ETFs continue to demonstrate strong market interest. Despite slight deceleration, the 10 largest US spot Bitcoin ETFs attracted almost USD 2B in capital for the week ending March 8, according to LSEG data. This continued influx of institutional money into Bitcoin products highlights the growing confidence and interest from investors seeking exposure to digital assets.

Technically, current rally in Bitcoin is expected to target 161.8% projection of 24896 to 49020 from 38496 at 77572 first. Firm break there will target 200% projection at 86798 next. Meanwhile, break of 67095 support will indicate short term topping and bring consolidations first, before staging another rise.

ECB’s Kazimir advocates for June rate cut, citing alive and kicking inflation risks

ECB Governing Council member Peter Kazimir said today he favors June for the first rate cut because upside inflation risks are still “alive and kicking”.

“Rushing isn’t smart and beneficial,” warning that a premature move would risk undermining the ECB’s credibility.

“Only in June, with new forecast at hand, will the level of confidence reach the threshold,” he said, adding that he favors “a smooth and steady cycle of policy easing.”

“Upside inflation risks are alive and kicking,” Kazimir said, listing factors including workers’ pay, energy prices, fiscal policy and the green transition.

“The current picture clearly favors staying calm for the coming weeks and delivering the first-rate cut in summer,” he said. “The slowdown in inflation remains fragile — we can’t take it for granted.”

Japan’s Q4 GDP finalized at 0.1% qoq, a narrow escape from recession

Japan’s economy has narrowly avoided a recession, as shown in the final GDP figures for Q4. The revised data indicates a modest growth of 0.1% qoq, a positive swing from the preliminary estimate of -0.1% qoq contraction. On annualized basis, GDP expanded by 0.4%, contrasting sharply with initial reports of -0.4% decline.

The main driver behind this upward revision was significant increase in capital expenditure, which surged by 2% qoq, deviating markedly from the initially estimated -0.1% qoq drop. However, private consumption, accounting for approximately 60% of Japan’s economy, presented a less optimistic picture, declining by -0.3% qoq, a slight deterioration from the provisional figure of -0.2% qoq.

This latest economic data comes at a crucial time, but it does not seem to deter BoJ from considering an interest rate hike for the first time since 2007, scheduled for March 19. The anticipation builds around the annual Spring wage negotiations, which have so far shown strong momentum. Positive outcomes are also expected from the forthcoming results from Rengo, Japan’s largest union group, on March 15.

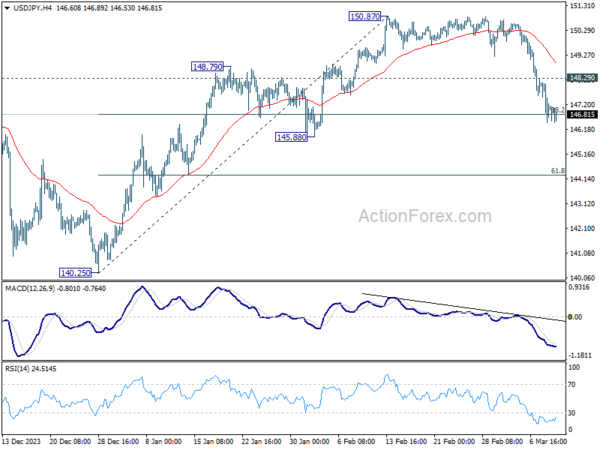

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 146.33; (P) 147.23; (R1) 147.96; More…

Intraday bias in USD/JPY remains on the downside and outlook is unchanged. Sustained break of 38.2% retracement of 140.25 to 150.87 at 146.81 will argue that fall from 150.87 is reversing the whole rally from 140.25. In this case, deeper decline would be seen to 61.8% retracement at 144.30 and below. Nevertheless, strong support from 146.81, followed by break of 148.29 minor resistance resistance, will argue that fall from 150.87 is merely a correction, which has completed already.

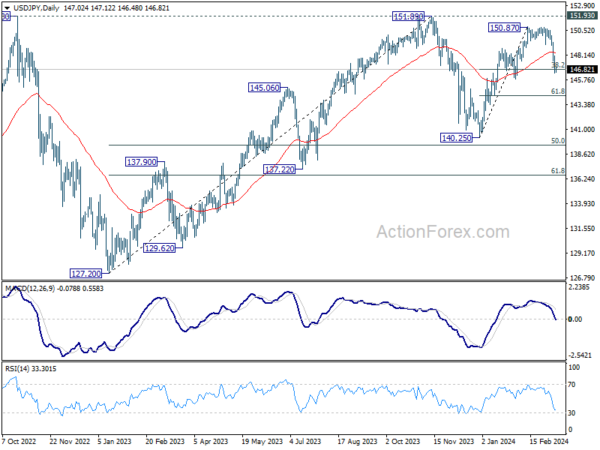

In the bigger picture, no change in the view that price action from 151.89 (2023 high) are correction to up trend from 127.20 (2023 low). The question is whether this correction has completed at 140.25, or extending with fall from 150.87 as the third leg. Sustained break of above mentioned 146.81 fibonacci level will favor the latter case. But even so, downside should be contained by 50% retracement of 127.20 to 151.89 at 139.54.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | GDP Q/Q Q4 F | 0.10% | 0.30% | -0.10% | |

| 23:50 | JPY | GDP Deflator Y/Y Q4 F | 3.90% | 3.80% | 3.80% | |

| 23:50 | JPY | Money Supply M2+CD Y/Y Feb | 2.50% | 2.40% | 2.40% | |

| 06:00 | JPY | Machine Tool Orders Y/Y Feb P | -8.0% | -14.10% | -14.0% |