Quick update: Dollar softens mildly as ISM manufacturing index missed expectation and dropped to 58.7 in October. Price paid dropped to 68.5 but beat expectation. Also, employment component dropped slightly to 59.8, from 60.3, but stayed strong.

Dollar strengthens mildly in early US after after stronger than expected job data. ADP report shows 235k growth in private sector jobs in October, above expectation of 200k. But upside is limited at the time of writing. There a number of key events for the rest of the week. Fed is widely expected to keep interest rate unchanged today and save the move for December. US President Donald Trump will announce his nomination for the next Fed chair tomorrow. Republicans will also reveal the details of the tax plan tomorrow after a day of delay. Finally, non-farm payroll report will be released on Friday.

Trump will not visit the border of North and South Korean during his visit to the latter as were traditionally done by US presidents. The visit to Asia will begin with Japan on Sunday. And the schedule of the 12-day trip is too tight, according to an unnamed official. South Korean President Moon Jae-in said today that "according to the joint denuclearization declaration made by North and South Korea, we cannot tolerate or recognize North Korea as a nuclear state. We too, will not develop nuclear (weapons) or own them." And he emphasized that "our government was launched in the most serious of times in terms of security. The government is making efforts to stably manage the situation it faces as well as to bring about peace on the Korean peninsula."

UK PMI manufacturing add to expectations of BoE hike

UK PMI manufacturing rose to 56.3 in October, up from 55.9 and above expectation of 55.9. Markit noted that

"the UK manufacturing sector continued to expand at a solid clip during September, with production and new orders both rising at above long-run average rates." However, "latest survey signalled that cost inflationary pressures surged higher" reflection "combination of rising commodity prices, the exchange rate and increased supply-chain pressures." Markit director Rob Dobson said in the release that "on balance, the continued solid progress of manufacturing and export growth is unlikely to offset concerns about a wider economic slowdown, but the upward march of price pressures will add to expectations that the Bank of England may soon decide that the inflation outlook warrants a rate hike." Also from UK, BRC shop price index dropped -0.1% yoy in October.

Sterling is also supported by expectation of some kind of breakthrough in Brexit negotiations. UK Brexit Secretary David Davis told a House of Lords committee yesterday that "the withdrawal agreement, on balance, will probably favour the [European] Union in terms of things like money and so on. Whereas the future relationship will favour both sides and will be important to both of us." This is taken as an signal that the UK team is finally ready to clear out all the smokescreens to move on quickly with the talks. And that would likely raise the chance of making sufficient progress by EU summit in December to move on to trade talks afterwards.

Also from Europe, Swiss PMI manufacturing rose to 62.0 in October, above expectation of 61.4.

China Caixin PMI manufacturing unchanged

China Caixin PMI manufacturing was unchanged at 51.0 in October, meeting expectation. Zhengsheng Zhong, director of macroeconomic analysis at CEBM Group, a Caixin subsidiary, noted in the release that "the stringent production curbs imposed by the government to reduce pollution and relatively low inventory levels have added to cost pressures on companies in midstream and downstream industries, which could have a negative impact on production in the coming months."

Kiwi rebounds after solid job data

New Zealand Dollar rebounds notably today after solid job data. Employment rose 2.2% qoq in Q3, well above expectation of 0.8% qoq. Unemployment dropped to 4.6%, down from 4.8%, better than expectation of 4.7%. That’s also the lowest level since 2008. Nonetheless, the support to Kiwi could be temporary as there shouldn’t be any change in RBNZ’s neutral stance. The central bank is far from hiking interest rate from the current 1.75% level.

USD/CHF Mid-Day Outlook

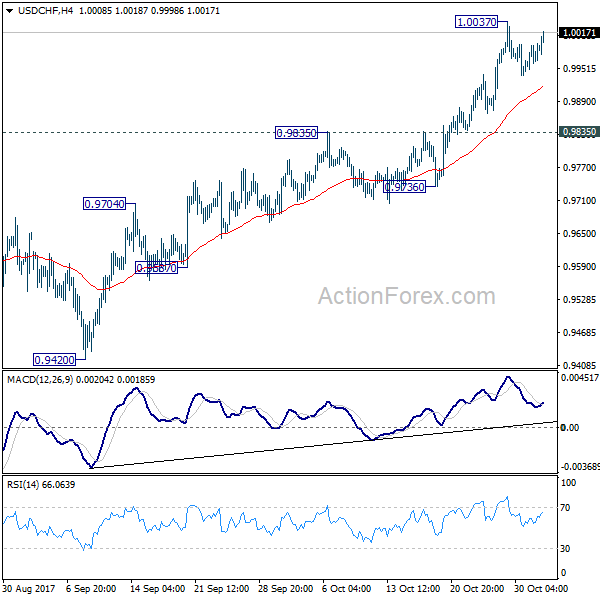

Daily Pivots: (S1) 0.9945; (P) 0.9969; (R1) 1.0001; More….

USD/CHF recovers further in early US session but stays below 1.0037 temporary top. Intraday bias remains neutral and more consolidation could be seen. In case of another retreat, downside should be contained above 0.9835 resistance turned support and bring rally resumption. Since 61.8% retracement of 1.0342 to 0.9420 at 0.9990 is already met, break of 1.0037 will turn bias to the upside for 1.0342 key resistance next.

In the bigger picture, current development suggests that USD/CHF has defended 0.9443 (2016 low) key support level again. Rise from 0.9420 could is a medium term up move and should target a test on 1.0342 high. This represents the upper end of a long term range that started back in 2015. On the downside, break of 0.9736 support is now needed to indicate completion of the rise from 0.9420. Otherwise, further rally will remain in favor in medium term.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Unemployment Rate Q3 | 4.60% | 4.70% | 4.80% | |

| 21:45 | NZD | Employment Change Q/Q Q3 | 2.20% | 0.80% | -0.20% | -0.10% |

| 00:01 | GBP | BRC Shop Price Index Y/Y Oct | -0.10% | -0.10% | ||

| 00:30 | JPY | PMI Manufacturing Oct F | 52.8 | 52.5 | 52.5 | |

| 01:45 | CNY | Caixin PMI Manufacturing Oct | 51 | 51 | 51 | |

| 08:30 | CHF | PMI Manufacturing Oct | 62 | 61.4 | 61.7 | |

| 09:30 | GBP | PMI Manufacturing Oct | 56.3 | 55.9 | 55.9 | |

| 12:15 | USD | ADP Employment Change Oct | 235K | 200K | 135K | 110K |

| 13:30 | CAD | Manufacturing PMI Oct | 54.3 | 55 | ||

| 13:45 | USD | Manufacturing PMI Oct F | 54.6 | 54.5 | 54.5 | |

| 14:00 | USD | ISM Manufacturing Oct | 58.7 | 59.4 | 60.8 | |

| 14:00 | USD | ISM Prices Paid Oct | 68.5 | 67.3 | 71.5 | |

| 14:00 | USD | Construction Spending M/M Sep | 0.30% | -0.20% | 0.50% | 0.10% |

| 14:30 | USD | Crude Oil Inventories | 0.9M | |||

| 18:00 | USD | FOMC Rate Decision | 1.25% | 1.25% |