Dollar is trying to regain upside momentum in early US session after positive economic data. But it’s being overwhelmed by Sterling and struggles against Euro. US Employment cost index rose 0.7% in Q3, in line with expectation. Meanwhile, in annualized term, employment cost rose 2.5%, hitting a nine-year high. Wages as 70% of employment cost rose 0.7% in Q3 while benefits rose 0.8%. Steady rise in labor costs and wage is supportive to more rate hike by Fed to prevent the economy from being overheating. S&P Case-Shiller 20 cities house price rose 5.9% yoy in August.

The greenback is also supported by talks that US President Donald Trump will announce, on Thursday, to nominate current Fed Governor Jerome Powell to succeed Janet Yellen as Fed chair after next February. Powell is seen as a more hawkish policy maker than Yellen and could speed up Fed’s tightening pace.

On the other hand, Canadian Dollar weakens again after GDP showed -0.1% mom in August, below expectation of 0.1% mom rise. IPPI dropped -0.3% mom in September versus expectation of 0.5% mom. RMPI dropped -0.1% mom versus expectation of 0.4% mom rise.

Eurozone growth strong, but inflation sluggish

Euro lacks a clear direction today after mixed economic data that show solid growth but sluggish inflation. Eurozone GDP growth slowed to 0.6% qoq in Q3, down from upwardly revised 0.7% qoq, beating expectation of 0.5% qoq. Annualized, Eurozone economic expanded by 2.5%, highest since 2011. Unemployment rate dropped to 8.9% in September, beating expectation of 9.0%. That’s the lowest level in nearly 9 years since January 2009.

However, headline CPI slowed to 1.4% yoy in October, down from 1.5% yoy and missed expectation of 1.5% yoy. Core CPI slowed to 0.9% yoy, down from 1.1% yoy and below expectation of 1.1% yoy. The set of data gives a nod to ECB’s plan in tapering asset purchase. But sluggish inflation also supports ECB’s cautious stance in keeping options open for extending and expanding asset purchases again.

BOJ left stimulus unchanged, downgraded inflation forecasts

BoJ again voted 8-1 to leave the monetary policies unchanged today. The targets for short- and long-term interest rates stay at -0.1% and around 0%, respectively while the guideline for JGB purchases remains at an annual pace of about 80 trillion yen. Again, BoJ revised lower its inflation forecasts for FY 2017 and FY 2018 but maintained that for FY 2019. The central bank upgraded the GDP growth outlook for FY 2017 while leaving others unadjusted.

The new member Goushi Kataoka was the lone dissent as he voted against the yield curve control measure for two meetings in a row. He judged that ‘monetary easing effects gained from the current yield curve were not enough for 2% inflation to be achieved around fiscal 2019’.

At the press conference, Governor Kuroda defended the yield curve control policy and the 2% target. As he suggested, the "main objective is to achieve 2% inflation and stably maintain price growth at that level. There’s no change to our view that monetary policy must be guided to achieve this objective’ and there is no need to change the yield targets".

More in BOJ Left Stimulus Unchanged, Downgraded Inflation Forecasts

Also released from Japan, household spending dropped -0.3% yoy in September versus expectation of 0.7% yoy. Industrial production dropped -1.1% mom versus expectation of -1.6% mom. Housing starts dropped -2.9% yoy versus expectation of -2.9% yoy.

China and South Korea to normalize relationship

China and South Korea agreed to restore normal diplomatic relationship, after a year of stand-off on South Korea’s deployment of the so called Terminal High Altitude Area Defense (THAAD) system of the US. China disputed on it on worries that the powerful radar of THAAD could penetrate into its territory. South Korean Foreign Minister said in a statement today that "both sides shared the view that the strengthening of exchange and cooperation between Korea and China serves their common interests and agreed to expeditiously bring exchange and cooperation in all areas back on a normal development track."

Chinese Foreign Ministry maintained the opposition and reiterated that "China’s position on the THAAD issue is clear, consistent and has not changed. But it also softened the stance and bit and hoped that South Korea would handle the issue appropriately. Overall, the news is seen as positive signal that China and South Korea are interested in improving their relationship, days before US President Donald Trump travel across the Pacific to visit the region.

China PMIs disappoint

The official China manufacturing PMI dropped to 51.6 in October, down from 52.4 and missed expectation of 52.1. Non-manufacturing PMI dropped to 54.3, down from 55.4. Overall, the data suggests that China’s growth is on track to meet the government’s target of 6.5% this year. Mild slowdown in manufacturing activity is seen as partly due to tighter environmental supervision, in particular in the north-eastern regions. While the stricter regulations will dampen growth in manufacturing sector, the overall impact should be negligible in the near term.

EUR/USD Mid-Day Outlook

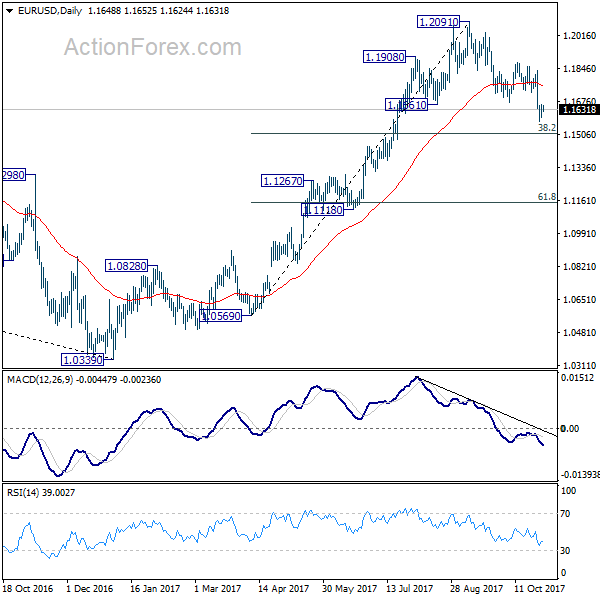

Daily Pivots: (S1) 1.1610; (P) 1.1634 (R1) 1.1675; More…

Intraday bias in EUR/USD remains neutral for consolidation above 1.1574 temporary low. Some consolidations could be seen. But still, break of 1.1879 resistance is needed to confirm completion of the decline from 1.2091. Otherwise, near term outlook will stay bearish. Below 1.1574 will target 38.2% retracement of 1.0569 to 1.2091 at 1.1510.

In the bigger picture, rise from 1.0339 medium term bottom is seen as a corrective move for the moment. Therefore, in case of another rally, we’d be cautious on 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516 to limit upside and bring reversal. Meanwhile, sustained trading below 55 week EMA will suggest that such medium term rebound is completed and could then bring retest of 1.0339 low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Building Permits M/M Sep | -2.30% | 10.20% | 5.90% | |

| 23:30 | JPY | Unemployment Rate Sep | 2.80% | 2.80% | 2.80% | |

| 23:30 | JPY | Household Spending Y/Y Sep | -0.30% | 0.70% | 0.60% | |

| 23:50 | JPY | Industrial Production M/M Sep P | -1.10% | -1.60% | 2.00% | |

| 00:01 | GBP | GfK Consumer Confidence Oct | -10 | -10 | -9 | |

| 01:00 | CNY | Manufacturing PMI Oct | 51.6 | 52.1 | 52.4 | |

| 01:00 | CNY | Non-manufacturing PMI Oct | 54.3 | 55.4 | ||

| 03:05 | JPY | BoJ Policy Balance Rate | -0.10% | -0.10% | -0.10% | |

| 05:00 | JPY | Housing Starts Y/Y Sep | -2.90% | -3.20% | -2.00% | |

| 06:30 | EUR | French GDP Q/Q Q3 A | 0.50% | 0.50% | 0.50% | 0.60% |

| 06:30 | EUR | French GDP Y/Y Q3 A | 2.20% | 2.10% | 1.80% | |

| 10:00 | EUR | Eurozone Unemployment Rate Sep | 8.90% | 9.00% | 9.10% | 9.00% |

| 10:00 | EUR | Eurozone GDP Q/Q Q3 A | 0.60% | 0.50% | 0.60% | 0.70% |

| 10:00 | EUR | Eurozone CPI Estimate Y/Y Oct | 1.40% | 1.50% | 1.50% | |

| 10:00 | EUR | Eurozone CPI Core Y/Y Oct A | 0.90% | 1.10% | 1.10% | |

| 12:30 | CAD | GDP M/M Aug | -0.10% | 0.10% | 0.00% | |

| 12:30 | CAD | Industrial Product Price M/M Sep | -0.30% | 0.50% | 0.30% | 0.40% |

| 12:30 | CAD | Raw Materials Price Index M/M Sep | -0.10% | 0.40% | 1.00% | 0.90% |

| 12:30 | USD | Employment Cost Index Q3 | 0.70% | 0.70% | 0.50% | |

| 13:00 | USD | S&P/CS Composite-20 Y/Y Aug | 5.90% | 5.90% | 5.80% | |

| 13:45 | USD | Chicago PMI Oct | 60 | 65.2 | ||

| 14:00 | USD | Consumer Confidence Oct | 121 | 119.8 |