Swiss Franc and Japanese Yen are currently the weakest performers for the week on a couple of interrelated factors. Firstly, global central bankers are tempering expectations for early rate cuts, suggesting rate difference between SNB/BoJ and other central banks would remain large for longer.

This stance has been further compounded by a significant rebound in benchmark treasury yields and a prevailing risk-on sentiment in US and Japan, impacting these traditionally safe-haven currencies.

S&P 500 reached new record high above 5000 handle overnight, driven by optimism regarding the resilience of US economy. Meanwhile, Nikkei achieved fresh 34-year highs in Asian session, following assurances from BoJ Governor Kazuo Ueda about continuation of easy monetary conditions, even in the after exit of negative interest rate policy.

Conversely, New Zealand Dollar stands out as the strongest currency this week, demonstrating resilience against the robust Dollar. It has been additionally buoyed by significant buying interest against Australian Dollar, which has found little support from hawkish comments by RBA Governor Michele Bullock.

Canadian Dollar follows closely as the second strongest, with the market’s attention now turning to Canada’s employment data. Meanwhile, Dollar maintains its position as the third strongest, as it continues to consolidate recent gains, with Euro and Sterling displaying mixed performance.

From a technical standpoint, CAD/JPY is currently in the spotlight, eyeing 111.14 key resistance level following yesterday’s upside breakout. Decisive break there will confirm resumption of whole up trend from 94.04 and target 61.8% projection of 94.04 to 111.14 from 104.19 at 114.75 in short-to-medium term. For now, outlook will stay bullish as long as 108.80 support holds, in case of retreat. Today’s Canadian employment data could potentially catalyze the anticipated break.

In Asia, Nikkei closed up 0.31%. Hong Kong HSI is down -0.83%. Singapore Strait Times is down -0.15%. China is on holiday. Japan 10-year JGB yield rose 0.0194 to 0.719. Overnight, DOW rose 0.13%. S&P 500 rose 0.06%. NASDAQ rose 0.24%. 10-year yield rose 0.060 to 4.170.

Fed’s Collins anticipates 75bps in rate cuts this year as baseline

In an interview overnight, Boston Fed President Susan Collins described her “baseline” expectation for rate path as being “similar” to Fed’s latest projection, which anticipates a total of 75 basis points cut in interest rates within the year.

She highlighted the importance of additional data to support the decision for the timing of the first rate cut. “I will need more, additional evidence” to confirm that inflation is consistently trending towards Fed’s 2% goal, she stated.

Nevertheless, Collins noted that waiting for inflation to reach the target before acting “would be waiting too long,” suggesting a proactive yet measured stance in adjusting policy.

ECB’s Lane anticipates March projections for comprehensive update

ECB Chief Economist Philip Lane highlighted in a speech that recent data suggest the disinflation process “may run faster than previously expected” in the near term. However, he was quick to note that the implications for medium-term inflation remain “less clear”.

The economic recovery’s strength, fiscal policy paths, wage developments, firms’ capacity to absorb higher input costs, and ongoing geopolitical tensions are all pivotal factors that Lane identified as having an “important bearing” on the inflation trajectory.

Lane also emphasized the significance of March 2024 ECB staff macroeconomic projections as a critical juncture for providing a “comprehensive update” of medium-term inflation outlook.

In terms of policy approach, Lane reaffirmed ECB’s commitment to a “firmly data-dependent approach,” stressing the importance of striking a delicate balance between the risks of overtightening and prematurely easing monetary policy.

“Monetary policy needs to carefully balance the risk of overtightening by keeping rates too high for too long against the risk of prematurely moving away from the hold-steady position,” he stated.

Furthermore, Lane stressed the importance being “further along in the disinflation process” before gaining confidence that inflation will consistently meet ECB’s target in a timely and sustainable manner.

BoE’s Mann skeptical of continuing decline in UK inflation

BoE MPC member Catherine Mann expressed skepticism about the continuation of the recent deceleration in headline inflation, challenging the prevailing market sentiment anticipating imminent rate cuts by the central bank. “I am not convinced that the near-term deceleration in headline inflation will continue,” Mann stated.

As financial markets are expecting rate reductions from the current 5.25%, her concern is that financial conditions have “eased too much already,” complicating BoE’s efforts to anchor inflation expectations and stabilize price growth.

Mann also highlighted “upside risks” to inflation stemming from geopolitical tensions in the Red Sea, noting that increased shipping and insurance costs could exacerbate the UK’s inflation challenges. ”

Against a backdrop of sluggish supply growth and possible upside shocks, I see risks of continued inflation momentum and embedded persistence,” she remarked.

Comparing UK’s inflation dynamics with its international peers, Mann expressed reservations about the optimistic view that the UK is merely trailing slightly behind in its efforts to return inflation to target. “A look at the data suggests to me that the ‘bit later’ might be quite a while later,” she cautioned.

In the latest MPC meeting, Mann, alongside fellow external member Jonathan Haskel, stood out for advocating an additional interest rate hike. Mann described her decision as “finely balanced,” attributing her stance to UK’s slower progress in reducing inflation compared to US and Eurozone.

RBA’s Bullock: Another hike neither ruled out nor ruled in

In an appearance before a parliamentary economics committee in Canberra today, RBA Governor Michele Bullock acknowledged the presence of “some encouraging signs” in Australia’s economic landscape, yet cautioned that the nation’s battle against inflation is “not over”.

RBA’s stance remains deliberately balanced, with Bullock stating, “At this stage, the Board hasn’t ruled out a further increase in interest rates but neither has it ruled it in.” Interest rate path will “depend upon the data and the evolving assessment of risks”.

Bullock further elaborated on the dynamics of demand and supply within the Australian economy, indicating that demand levels continue to outstrip the economy’s supply capacity. This imbalance, coupled with persistently tight labor market conditions, suggests that while the observed slowdown in demand is contributing to a moderation of inflationary pressures, the desired equilibrium has yet to be reached.

Goods price inflation has shown a softer trend than anticipated, mirroring patterns observed in international markets, Bullock noted. However, services price inflation remains elevated, driven by significant increases in both labor and non-labor input costs.

“Indeed, while inflation was lower than we were expecting in November, this is largely attributable to softer-than-expected goods inflation – services inflation was pretty much where we had forecast it to be.”

USD/CHF Daily Outlook

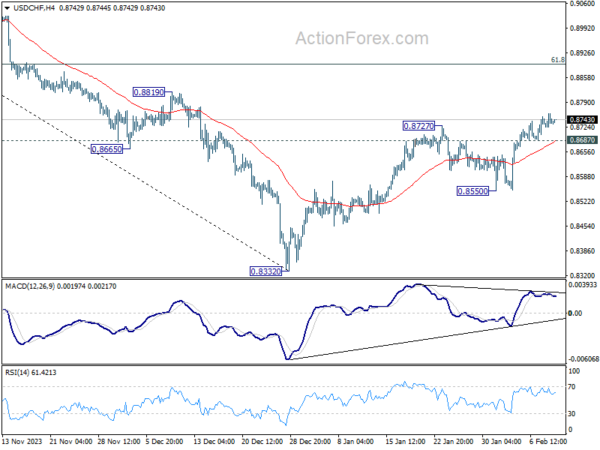

Daily Pivots: (S1) 0.8721; (P) 0.8741; (R1) 0.8757; More….

USD/CHF’s rally is in progress despite some loss of upside momentum. Intraday bias stays on the upside. Current rise from 0.8332 would target 61.8% retracement of 0.9243 to 0.8332 at 0.8995 next. On the downside, below 0.8687 minor support will turn intraday bias neutral first. But near term outlook will stay cautiously bullish as long as 0.8550 support holds.

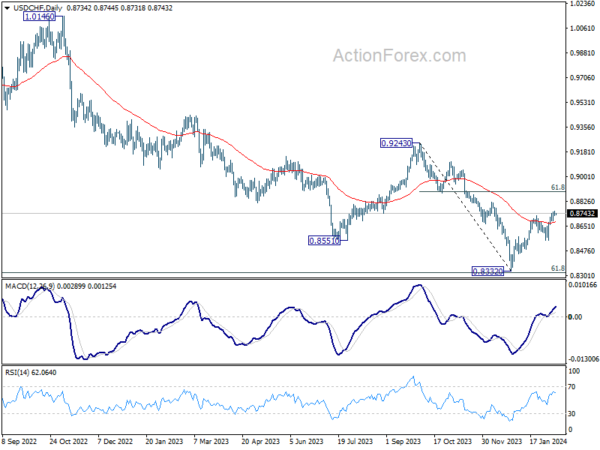

In the bigger picture, there is prospect of medium term bottoming at 0.8332 considering possible bullish convergence condition in W MACD, and the support from 0.8317 long term fibonacci support. Sustained trading above 55 D EMA (now at 0.8677) will affirm this case, and bring stronger rise back towards 0.9243 resistance, even as a corrective move.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Money Supply M2+CD Y/Y Jan | 2.40% | 2.20% | 2.30% | |

| 07:00 | EUR | Germany CPI M/M Jan F | 0.20% | 0.20% | ||

| 07:00 | EUR | Germany CPI Y/Y Jan F | 2.90% | 2.90% | ||

| 09:00 | EUR | Italy Industrial Output M/M Dec | 0.50% | -1.50% | ||

| 13:30 | CAD | Net Change in Employment Jan | 15.0K | 0.1K | ||

| 13:30 | CAD | Unemployment Rate Jan | 5.90% | 5.80% |