Euro recovers broadly today, as lifted by GDP data that indicated the Eurozone economy has narrowly averted a technical recession. This positive development has also led to a notable rebound in Germany’s benchmark treasury yields. Meanwhile selling pressure has shifted Sterling and Swiss Franc, both of which are ceding some of their recent gains against Euro. The upcoming CPI flash release on Thursday is now set to the next focal point for the common currency.

In contrast, Australian Dollar faces notable weakness today amid the steep pullback in the stock markets of China and Hong Kong. The initial optimism surrounding rescue package by the Chinese government for the markets seems to be waning, with analysts suggesting that more action is needed to restore confidence. Additionally, Aussie traders are also adopting a cautious stance ahead of the upcoming release of quarterly CPI data and PMI reports from China.

In other currency market developments, Japanese Yen and Dollar are following Euro as the second and third strongest currencies of the day so far, respectively. Swiss Franc and Sterling find themselves on the weaker end, with Canadian and New Zealand Dollar showing mixed performances.

Technically, AUD/JPY demands attention in the upcoming Asian session. Rebound from 93.70 continued to lose momentum as seen in 4H MACD. Such rebound is seen as the second leg of the pattern from 98.56. While another rise cannot be ruled out, upside should be limited by 98.56. Decisive break of 96.89 support will argue that the third leg has already started, back towards 93.70 support.

In Europe, at the time of writing, FTSE is up 0.57%. DAX is up 0.09%. CAC is up 0.33%. UK 10-year yield is up 0.009 at 3.884. Germany 10-year yield is up 0.026 at 2.265. Earlier in Asia, Nikkei rose 0.11%. Hong Kong HSI fell -2.32%. China Shanghai SSE fell -1.83%. Singapore Strait Times rose 0.31%. Japan 10-year yield fell -0.0139 to 0.712.

In Europe, at the time of writing, FTSE is up 0.57%. DAX is up 0.09%. CAC is up 0.33%. UK 10-year yield is up 0.009 at 3.884. Germany 10-year yield is up 0.026 at 2.265. Earlier in Asia, Nikkei rose 0.11%. Hong Kong HSI fell -2.32%. China Shanghai SSE fell -1.83%. Singapore Strait Times rose 0.31%. Japan 10-year yield fell -0.0139 to 0.712.

ECB’s Vujcic emphasizes gradual transition in monetary policy, downplays recession risks

ECB Governing Council member Boris Vujcic emphasizing that a “smooth transition” in monetary policy is more important then the timing of the first rate cut. Also, he’d prefer to move in smaller steps.

“April or June doesn’t really make much of a difference for the economy,” he stated, “I think it’s more important that we achieve a kind of smooth transition.”

Vujcic also expressed a preference for gradual rate adjustments, favoring 25 basis point moves as opposed to larger steps. Additionally, there would be some “pauses” in between every rate move.

Regarding the economy, Vujcic said, “the risk of a recession in the euro zone is getting smaller and smaller”, projecting an upcoming phase characterized by modest economic growth coupled with further disinflation.

Eurozone GDP stable in Q4, avoids contraction

Eurozone GDP was stable in Q4, better than expectation of -0.1% qoq contraction. Compared with the same quarter of the previous year, GDP increased by 0.1% yoy. EU GDP was also stable in Q4, and increased 0.2% yoy.

Among the Member States for which data are available, Portugal (+0.8%) recorded the highest increase compared to the previous quarter, followed by Spain (+0.6%), Belgium and Latvia (both +0.4%). Declines were recorded in Ireland (-0.7%), Germany and Lithuania (both -0.3%). The year on year growth rates were positive for six countries and negative for five.

Ifo: German economy to contract -0.2% in Q1, restrictive monetary policy taking full effect

Germany’s economy is bracing for a challenging first quarter, with ifo Institute projecting a contraction in GDP by -0.2%. Timo Wollmershäuser, Head of Forecasts at ifo, indicated that this decline would “tip the German economy into recession.”

Wollmershäuser explained, “Companies in almost all sectors of the economy are complaining about falling demand”. In the manufacturing and construction sectors, where once robust order backlogs have significantly “melted away”. A concerning trend of decreasing incoming orders has been observed for several months, with residential construction experiencing a notable surge in cancellations.

“It appears that restrictive monetary policy in Europe and North America, with its aim of stabilizing prices through sharp rises in key interest rates, is now taking full effect,” Wollmershäuser added

Unique factors further aggravate the situation. Wollmershäuser notes, “High illness levels, rail strikes at Deutsche Bahn, and an unusually cold and snowy January,” are additional burdens on the economy. Despite these factors, he finds a silver lining in private consumption, which shows some positive trends.

Swiss KOF rises to 101.5, signaling imminent economic recovery

Swiss KOF Economic Barometer rose from 98.0 to 101.5 in January, above expectation of 98.2. That was the third consecutive month of increase, and the first instance since March of the previous year that the barometer has exceeded its medium-term average. This development is being interpreted as “increasing signs that the Swiss economy will soon recover”.

The improvement is particularly noticeable in the accommodation industry and other service sectors. The combined indicators for manufacturing, construction, and foreign demand are also “develop slightly positive”. Consumer demand, however, is “virtually unchanged”. The only sector that appears to be facing challenges is the financial and insurance activities, where the outlook has deteriorated.

RBNZ’s Conway: We still have a way to go on inflation

RBNZ Chief Economist Paul Conway struck a hawkish tone in a speech today, tempering market expectations for imminent policy easing. Conway acknowledged the effectiveness of current monetary policy in slowing the economy and reducing inflation. But he emphasized noted that the journey to achieving the target midpoint is far from over. His remarks also indicated that recent weaker GDP data would not automatically lead to a dovish shift in RBNZ’s approach.

Conway stated, “Monetary policy is working, with the economy slowing and inflation falling. But we still have a way to go to get inflation back to the target midpoint.” He added that the upcoming February Statement would offer more insights, grounded in comprehensive data analysis.

Furthermore, Conway pointed out recent GDP revisions don’t necessarily imply a significant reduction in the economy’s capacity pressures. He highlighted that private demand, which is more responsive to interest rate changes, has seen upward revisions, particularly in consumption and business investment.

Conway also pointed out that annual non-tradable inflation at 5.9% was higher than RBNZ’s forecasts, even though headline CPI slowed to 4.7% in Q4 while core inflation have also fallen.

Australia’s retail sales falls -2.7% mom, spending remains subdued

Australia retail sales turnover fell -2.7% mom to AUD 35.19B in December, worst than expectation of -1.9% mom. Annually, sales fell -0.8% yoy.

Ben Dorber, ABS head of retail statistics, said: “The large fall in retail turnover in December was caused by a fall in discretionary spending. Consumers brought forward some of their usual December spending to November to take advantage of Black Friday sales.

“While there was a large seasonally adjusted fall in December, retail turnover rose 0.1 per cent in trend terms. This shows that underlying retail spending remains subdued when we look through the volatile movements over recent months in the lead up to Christmas.”

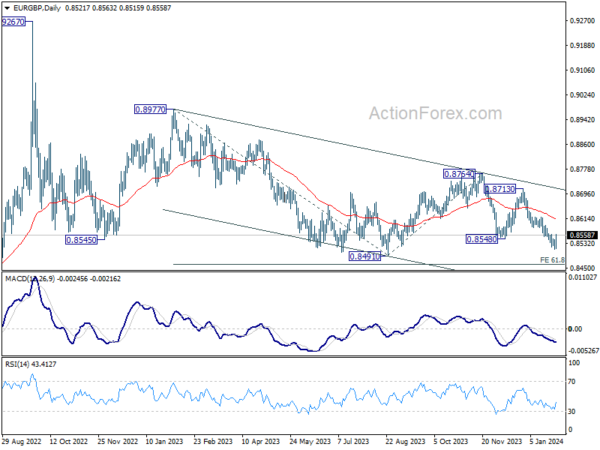

EUR/GBP Mid-Day Outlook

Daily Pivots: (S1) 0.8510; (P) 0.8527; (R1) 0.8542; More…

Intraday bias in EUR/GBP is turned neutral first with today’s strong recovery. Immediate focus is now on 0.8563 minor resistance. Firm break there will suggest short term bottoming, on bullish convergence condition in 4H MACD. Intraday bias will be turned to the upside for stronger rebound to 55 D EMA (now at 0.8613). On the downside, break of 0.8512 will resume the fall from 0.8764 to retest 0.8491 support instead.

In the bigger picture, fall from 0.8764 is seen as another leg in the whole down trend from 0.9267 (2022 high). Outlook will stay bearish as long as 0.8713 resistance holds. Break of 0.8491 will target 61.8% projection of 0.8977 to 0.8491 from 0.8764 at 0.8464.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Unemployment Rate Dec | 2.40% | 2.50% | 2.50% | |

| 00:30 | AUD | Retail Sales M/M Dec | -2.70% | -1.90% | 2.00% | 1.60% |

| 06:30 | EUR | France Consumer Spending M/M Dec | 0.30% | 0.00% | 0.70% | 0.60% |

| 06:30 | EUR | France GDP Q/Q Q4 P | 0.00% | 0.00% | -0.10% | |

| 07:00 | CHF | Trade Balance (CHF) Dec | 1.25B | 2.55B | 3.71B | 3.83B |

| 08:00 | CHF | KOF Leading Indicator Jan | 101.5 | 98.2 | 97.8 | 98.0 |

| 09:00 | EUR | Italy GDP Q/Q Q4 P | 0.20% | 0.00% | 0.10% | |

| 09:00 | EUR | Germany GDP Q/Q Q4 P | -0.30% | -0.30% | -0.10% | |

| 09:30 | GBP | M4 Money Supply M/M Dec | 0.50% | 0.20% | -0.10% | |

| 09:30 | GBP | Mortgage Approvals Dec | 50K | 53K | 50K | |

| 10:00 | EUR | Eurozone GDP Q/Q Q4 P | 0.00% | -0.10% | -0.10% | |

| 10:00 | EUR | Eurozone Economic Sentiment Jan | 96.2 | 96.2 | 96.4 | |

| 10:00 | EUR | Eurozone Industrial Confidence Jan | -9.4 | -9.0 | -9.2 | -9.6 |

| 10:00 | EUR | Eurozone Services Confidence Jan | 8.8 | 8.0 | 8.4 | |

| 10:00 | EUR | Eurozone Consumer Confidence Jan F | -16.1 | -16.1 | -16.1 | |

| 14:00 | USD | S&P/CS Composite-20 HPI Y/Y Nov | 4.80% | 4.90% | ||

| 14:00 | USD | Housing Price Index M/M Nov | 0.20% | 0.30% | ||

| 15:00 | USD | Consumer Confidence Jan | 113.2 | 110.7 |