The Japanese Yen traders mildly firmer this week and maintains gains after BoJ stands pat and lowers inflation forecast. Risk appetite recedes as traders are preparing for big events like BoE and NFP later in the week. Also, markets could be a bit disappointed by news that US will adopt a phased approach in the tax cuts. Meanwhile, disappointing Germany inflation is weighing down global yield slightly, and bond traders turned a bit more cautious ahead of Eurozone CPI today. Meanwhile, Sterling remains firm as markets await BoE rate hike. Aussie, Kiwi, Euro ad Swiss Franc are the softer ones.

BoJ stands left, lowers inflation forecast

BoJ left monetary policy unchanged today as widely expected. Short term interest rate was held at -0.1%. The target for 10 year JGB yield was also kept at 0%. The decision was made by 8-1 vote. New comer Goushi Kataoka dissented and urged that "if there were a delay in the timing of achieving the price target due to domestic factors, the BOJ should take additional easing measures." Kataoka also proposed that BoJ should also target to keep 15 year yield at "less than 0.2%", comparing to market pricing at 0.307%.

Meanwhile, BOJ lowered inflation forecast but slightly raised growth forecast:

- For fiscal 2017, core inflation is projected to be at 0.8%, down from prior forecast at 1.1%

- For fiscal 2018, core inflation is projected to be at 1.4%, down from prior forecast at 1.5%

- For fiscal 2019, core inflation is projected to be at 1.8%, unchanged.

- For fiscal 2017, GDP is projected to be at 1.9%, down from prior forecast at 1.8%

- For fiscal 2018, GDP is projected to be at 1.4%, unchanged

- For fiscal 2019, GDP is projected to be at 0.7%, unchanged.

Also released from Japan, household spending dropped -0.3% yoy in September versus expectation of 0.7% yoy. Industrial production dropped -1.1% mom versus expectation of -1.6% mom. Housing starts dropped -2.9% yoy versus expectation of -2.9% yoy.

Trump to nominate Powell on Thursday

It’s reported that US President Donald Trump will announce, on Thursday, to nominate current Fed Governor Jerome Powell to succeed Janet Yellen as Fed chair after next February. Comparing to another front runner Stanford economist John Taylor, Powell is generally seen as a safer pick for his experience with monetary policies and Fed. Besides, he is seen as some as a diplomat with good relationship with others. Also, it’s well known that Treasury Secretary Steven Mnuchin supports Powell. While Powell shared Yellen’s concern on slowdown in inflation this year, he is generally seen as a less dovish one and could speed up Fed’s tightening pace.

US tax cuts could be gradual and phased in

Staying in the US, ahead of the released of a drafted tax bill on Wednesday, there are reports suggesting that the Ways and Means Panel is considering a phased approach to cut the corporate tax rate from 35% in 2018 to 20% by 2022. Treasury Secretary Steven Mnuchin suggested that "the objective is not to have that phase in". Yet he did not deny any possibility. While the bill is not finalized, the market is already disappointed by the possibility of the "gradual" approach of the corporate tax cut. The sentiment was also weighed down by the formal charging of former Trump campaign manager Paul Manafort, together with two others, of accepting payments from Ukrainian political leaders and parties. The money was then laundered back into the US. This has raised concerns that the scandal would not delay the tax reform debate in the Congress.

China PMIs disappoint

The official China manufacturing PMI dropped to 51.6 in October, down from 52.4 and missed expectation of 52.1. Non-manufacturing PMI dropped to 54.3, down from 55.4. Overall, the data suggests that China’s growth is on track to meet the government’s target of 6.5% this year. Mild slowdown in manufacturing activity is seen as partly due to tighter environmental supervision, in particular in the north-eastern regions. While the stricter regulations will dampen growth in manufacturing sector, the overall impact should be negligible in the near term.

Elsewhere, New Zealand building permits dropped -2.3% mom in September. UK Gfk consumer confidence dropped to -10 in October.

Looking ahead

Eurozone data will be the key to focus in European session. Q3 GDP is expected to grow 0.5% qoq. The closely watched CPI is expected to be unchanged at 1.50% yoy in October. Core CPI is expected to be unchanged at 1.1% yoy. There is some risk for a downside surprise in consumer inflation data. And Euro could be weighed down by a miss there. Eurozone unemployment rate is expected to drop 0.1% to 9.0% in September.

Later in the data, Canada GDP, IPPI and RPMI are featured. US will release employment cost index, S&P Case-Shiller house price, Chicago PMI and Conference Board consumer confidence.

USD/JPY Daily Outlook

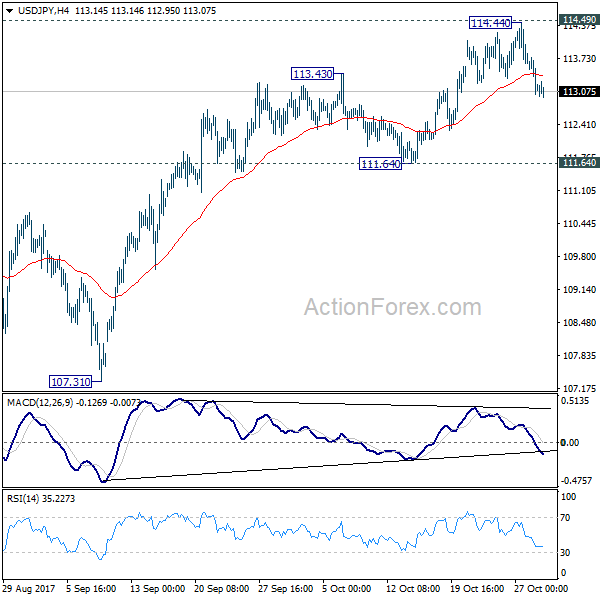

Daily Pivots: (S1) 113.39; (P) 113.91; (R1) 114.20; More…

USD/JPY’s pull back from 114.44 is still in progress and could dip further lower. But still, outlook will stays cautiously bullish as long as 111.64 support holds. Decisive break of 114.49 key resistance will confirm that correction pattern from 118.65 has completed at 107.31 already. And USD/JPY should then target a test on 118.65. However, sustained break of 111.64 will argue that rebound from 107.31 has completed and bring retest of this low.

In the bigger picture, medium term rise from 98.97 (2016 low) is not completed yet. It should resume after corrective fall from 118.65 completes. Break of 114.49 resistance will likely resume the rise to 61.8% projection of 98.97 to 118.65 from 107.31 at 119.47 first. Firm break there will pave the way to 100% projection at 126.99. This will be the key level to decide whether long term up trend is resuming.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Building Permits M/M Sep | -2.30% | 10.20% | 5.90% | |

| 23:30 | JPY | Unemployment Rate Sep | 2.80% | 2.80% | 2.80% | |

| 23:30 | JPY | Household Spending Y/Y Sep | -0.30% | 0.70% | 0.60% | |

| 23:50 | JPY | Industrial Production M/M Sep P | -1.10% | -1.60% | 2.00% | |

| 0:01 | GBP | GfK Consumer Confidence Oct | -10 | -10 | -9 | |

| 1:00 | CNY | Manufacturing PMI Oct | 51.6 | 52.1 | 52.4 | |

| 1:00 | CNY | Non-manufacturing PMI Oct | 54.3 | 55.4 | ||

| 3:05 | JPY | BoJ Policy Balance Rate | -0.10% | -0.10% | -0.10% | |

| 5:00 | JPY | Housing Starts Y/Y Sep | -2.90% | -3.20% | -2.00% | |

| 6:30 | EUR | French GDP Q/Q Q3 A | 0.5% | 0.50% | 0.50% | |

| 6:30 | EUR | French GDP Y/Y Q3 A | 2.2% | 2.10% | 1.80% | |

| 10:00 | EUR | Eurozone Unemployment Rate Sep | 9.00% | 9.10% | ||

| 10:00 | EUR | Eurozone GDP Q/Q Q3 A | 0.50% | 0.60% | ||

| 10:00 | EUR | Eurozone CPI Estimate Y/Y Oct | 1.50% | 1.50% | ||

| 10:00 | EUR | Eurozone CPI Core Y/Y Oct A | 1.10% | 1.10% | ||

| 12:30 | CAD | GDP M/M Aug | 0.10% | 0.00% | ||

| 12:30 | CAD | Industrial Product Price M/M Sep | 0.50% | 0.30% | ||

| 12:30 | CAD | Raw Materials Price Index M/M Sep | 0.40% | 1.00% | ||

| 12:30 | USD | Employment Cost Index Q3 | 0.70% | 0.50% | ||

| 13:00 | USD | S&P/CS Composite-20 Y/Y Aug | 5.90% | 5.80% | ||

| 13:45 | USD | Chicago PMI Oct | 60 | 65.2 | ||

| 14:00 | USD | Consumer Confidence Oct | 121 | 119.8 |