Dollar’s fleeting post-CPI rally was very short-lived. The greenback quickly reversed its initial gains and has since been trading within a narrow range against other major currencies. Traders appear relatively unfazed by the stronger than expected inflation readings, with markets still pricing in more than 70% chance on Fed cutting interest rate in March.

This scenario reveals a pattern where Dollar briefly reacts to upside surprises in economic data, such as the non-farm payroll and CPI data. It seems likely that this trend of transient responses to Dollar-favorable economic indicators might persist for a while, probably through the rest of the month.

In the broader currency market, Sterling has distinguished itself as the strongest performer of the week, closely followed by Euro. Pound is eyeing today’s UK GDP data as a potential catalyst for further rallying. Dollar, while not leading the pack, still holds its ground as the third strongest currency for the week.

Conversely, Japanese Yen finds itself at the bottom of the performance ladder, emerging as the weakest among its peers. Australian Dollar is the second worst, showing limited responses to economic data from China. Swiss Franc, meanwhile, is under pressure against its European peers, ranking as the third weakest currency.

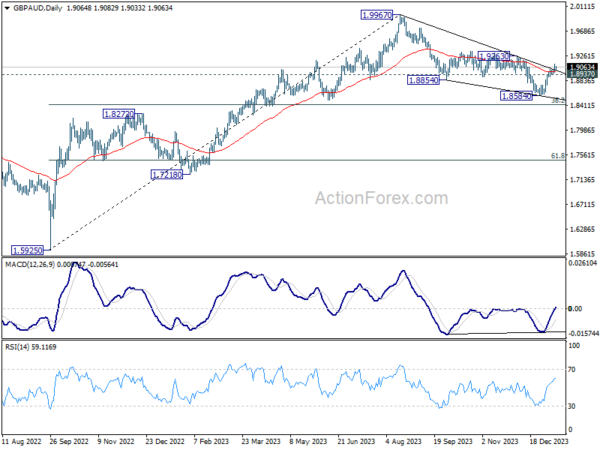

Technically, GBP/AUD’s rebound from 1.8584 extended higher this week. The break of falling trendline resistance strengthen the bullish case that correction from 1.9976 has completed with three waves down to 1.8584. Further rally is expected as long as 1.8937 support holds, to 1.9263 resistance. Decisive break there will pave the way to retest 1.9967 high.

In Asia, at the time of writing, Nikkei is up 1.32%. Hong Kong HSI is down -0.03%. China Shanghai SSE is up 0.14%. Singapore Strait Times is down -0.35%. Japan 10-year JGB yield is down -0.0136 at 0.592. Overnight, DOW rose 0.04%. S&P 500 fell -0.07%. NASDAQ rose 0.00%. 10-year yield fell -0.053 to 3.977.

Fed’s Mester: March too early for rate cut, inflation fight continues

Cleveland Fed President Loretta Mester, in an interview with BloombergTV overnight, emphasized that March might be too soon to consider a rate cut, citing ongoing efforts to combat inflation.

Mester expressed her view that more evidence is needed before considering a reduction in interest rates. “March is probably too early in my estimation for a rate decline because I think we need to see some more evidence,” she stated,

The December CPI report released yesterday, according to her, is a clear indication that “there is more work to do,” necessitating the maintenance of restrictive monetary policy. Nevertheless, she reassured that the CPI report does not suggest progress in inflation stall out.

Mester also pointed out that the risks associated with monetary policy have become more balanced. The primary focus for this year, as she outlined, is to calibrate policy effectively to maintain healthy labor markets while continuing the process of bringing inflation back to the 2% target.

Fed’s Barkin watching goods-services cost divide

Richmond Fed President Thomas Barkin told reporters after a speech overnight that the December CPI report was “about as expected. He noted a deceleration in the price rise for goods, while shelter and services costs continue to escalate at a more robust pace.

Barkin highlighted the growing disparity between the costs of goods versus shelter and services. He expressed caution about this divide, emphasizing the importance of vigilance in this area.

“This gap between services and shelter and goods is one that I am watching carefully,” he stated. His concern is rooted in the potential consequences of a shift from deflationary cycle in goods to a scenario where the economy is predominantly burdened by the rising costs of shelter and services.

“You would not want a goods deflationary cycle to end and find yourself disproportionately bearing the cost of shelter and services,” Barkin said.

Fed’s Goolsbee: January too soon for committing to future rate cuts

Chicago Fed Austan Goolsbee has highlighted the critical role of ongoing inflation data in shaping Fed’s future interest rate decisions. In an interview with Reuters, Goolsbee underlined that it is premature to make definitive decisions about rate adjustments at this juncture.

Goolsbee’s said, “I still think that the primary determinant of when and how much rates should be cut will be driven off what’s happening to the inflation data, and are we meeting the mandate goals.”

He also emphasized the importance of not rushing into policy decisions based on incomplete data sets. “When we have weeks or months of data to come, I don’t like tying our hands … We don’t make decisions about March, June, and whatever, in January,” he remarked.

Regarding the December CPI reading, Goolsbee noted that it was largely in line with expectations. However, he observed some variations within the data, specifically mentioning that services inflation was cooler than anticipated, while housing inflation was slightly higher.

China’s CPI improved to -0.3%, deflation persists for the 3rd month

China’s CPI rose from -0.5% yoy to -0.3% yoy in December, better than expectation of -0.4% yoy. That’s nonetheless the third concective month of negative reading. On a month-on-month basis, the CPI increased by 0.1% , versus -0.5% decline in November. Core CPI, which excludes volatile food and energy prices was at 0.6% yoy, unchanged from November.

NBS said pork prices, the main factor impacting year-on-year CPI, fell -26.1% yoy, narrowed from -31.8% yoyin November. Services inflation, however, rose steadily with tourism and hotel accommodation prices increasing by 6.8% yoy and 5.5% yoy, respectively.

PPI rose from -3.0% yoy to -2.7% yoy, worse than expectation of -2.5% yoy. That’s the 15th straight month of decline. NBS said the PPI decline was affected by factors including declining international prices of oil and insufficient demand for some industrial products.

China’s exports rise 2.3% yoy in Dec, down to US, EU and ASEAN

In December, China’s exports increased by 2.3% yoy to USD 303.6B, surpassing expectation of 1.7%. However, this growth was not uniform across all regions. Notably, shipments to US saw a significant decline of -6.89% yoy. Similarly, exports to EU and ASEAN countries also dropped, by -1.93% yoy and -6.14% yoy respectively.

On the import front, China experienced a marginal increase of 0.2% yoy to USD 228.2B, which was slightly below the expected 0.3% yoy growth. Consequently, trade surplus widened from USD 68.3B to USD 75.3B, which was above the anticipated USD 74.8B.

For the entire year of 2023, China’s trade figures painted a scenario of contraction. Exports decreased by -4.6% to USD 3.38T, while imports saw -5.5% contraction to USD 2.56T.

Looking ahead

UK GDP is a major focus in European session while production and trade balance will be released. Later in the day, US PPI will be featured.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.0936; (P) 1.0967; (R1) 1.1005; More…

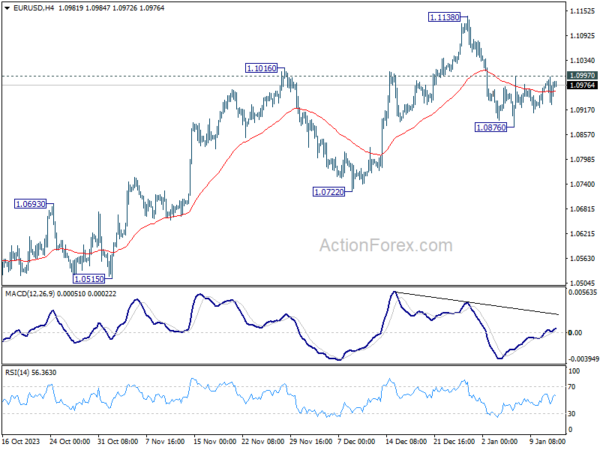

Range trading continues in EUR/USD and intraday bias remains neutral. On the downside break of 1.0876 will resume the fall from 1.1138 short term top to 1.0722 support next. However, break of 1.0997 will turn bias back to the upside for retesting 1.1138 high instead.

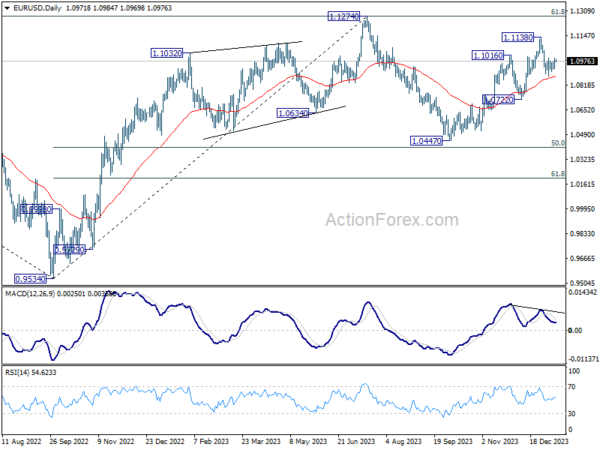

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern to rise from 0.9534 (2022 low). Rise from 1.0447 is seen as the second leg. While further rally could cannot be ruled out, upside should be limited by 1.1274 to bring the third leg of the pattern. Meanwhile, sustained break of 1.0722 support will argue that the third leg has already started for 1.0447 and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Bank Lending Y/Y Dec | 3.10% | 2.70% | 2.80% | |

| 23:50 | JPY | Current Account (JPY) Nov | 1.89T | 2.18T | 2.62T | |

| 01:30 | CNY | CPI Y/Y Dec | -0.30% | -0.40% | -0.50% | |

| 01:30 | CNY | PPI Y/Y Dec | -2.70% | -2.50% | -3.00% | |

| 02:30 | CNY | Trade balance (USD) Dec | 75.34B | 74.75B | 68.39B | |

| 02:30 | CNY | Exports Y/Y Dec | 2.30% | 1.70% | 0.50% | |

| 02:30 | CNY | Imports Y/Y Dec | 0.20% | 0.30% | -0.60% | |

| 05:00 | JPY | Eco Watchers Survey: Current Dec | 50.7 | 49.9 | 49.5 | |

| 07:00 | GBP | GDP M/M Nov | 0.20% | -0.30% | ||

| 07:00 | GBP | Industrial Production M/M Nov | 0.10% | -0.80% | ||

| 07:00 | GBP | Manufacturing Production Y/Y Nov | 1.70% | 0.80% | ||

| 07:00 | GBP | Manufacturing Production M/M Nov | 0.30% | -1.10% | ||

| 07:00 | GBP | Industrial Production Y/Y Nov | 0.70% | 0.40% | ||

| 07:00 | GBP | Goods Trade Balance (GBP) Nov | -15.7B | -17.0B | ||

| 07:45 | EUR | France Consumer Spending M/M Nov | 0.00% | -0.90% | ||

| 13:00 | GBP | NIESR GDP Estimate (3M) Dec | -0.10% | |||

| 13:30 | USD | PPI M/M Dec | 0.10% | 0.00% | ||

| 13:30 | USD | PPI Y/Y Dec | 1.30% | 0.90% | ||

| 13:30 | USD | PPI Core M/M Dec | 0.20% | 0.00% | ||

| 13:30 | USD | PPI Core Y/Y Dec | 2.00% | 2.00% |