Dollar is having a broad upswing today as investors and traders brace for the latest US non-farm payroll data. With the recent pullback in stock markets and noticeable recovery in treasury yields, the prevailing sentiment indicates that traders are increasingly skeptical about the likelihood of an early Fed rate cut. Consequently, any upside surprises in NFP data could further cement this view, bolstering the case for Fed to maintain high interest rates for longer duration. Such an outcome would likely benefit Dollar and yields but could exert downward pressure on stocks.

Prior to the NFP release, Eurozone’s CPI flash report is another pivotal event that’s closely being monitored by the markets. Euro appears vulnerable against its European peers. Should CPI data fall short of market expectations, it could trigger renewed wave of selling on Euro, at least against Sterling and Swiss Franc. Meanwhile, Canadian employment data also stands out as another key focus.

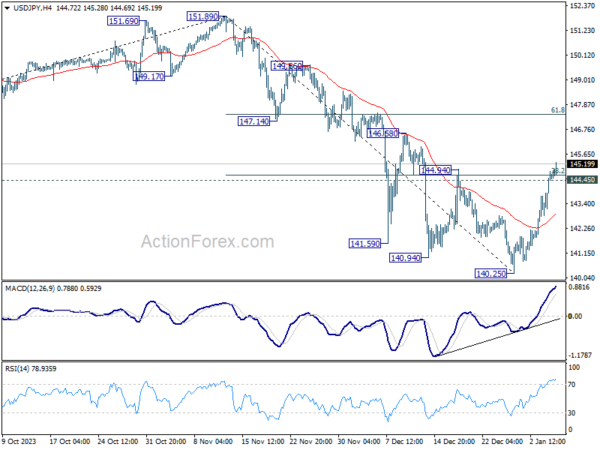

Technically, USD/JPY’s break of 144.94 resistance argues that fall from 151.89 has completed. While rebound from 140.25 could still be a corrective move, further rally is now in favor to 61.8% retracement of 151.89 to 140.25 at 147.44. At the same time, EUR/JPY’s break of 158.55 resistance suggests that whole rebound from 153.15 is resuming. Now, one focus is on whether GBP/JPY would follow by breaking through 184.15 resistance decisively too.

In Asia, Nikkei closed up 0.27%. Hong Kong HSI is down -0.61%. China Shanghai SSE is down -0.73%. Singapore Strait times is up 0.42%. Japan 10-year JGB yield is down -0.0125 at 0.614. Overnight, DOW rose 0.03%. S&P 500 fell -0.34%. NASDAQ fell -0.56%. 10-year yield rose 0.084 to 3.991.

Japan’s PMI services finalized at 51.5, steeper increase in inflationary pressures

Japan’s PMI Services was finalized at 51.5 in December, up slightly from November’s 50.8, signaling a modest but positive growth in the sector. Composite PMI also improved, reaching the neutral mark at 50.0, up from 49.6 in the previous month.

Usamah Bhatti of S&P Global Market Intelligence attributed this growth to an increase in new orders and customer numbers. This uptick in business activity led firms to end the year with a more positive outlook. Service providers also expressed confidence about future activity, driven by expectations of economic recovery and plans for long-term business expansion.

However, Bhatti noted “steeper increase in inflationary pressures”, mainly from escalated costs for raw materials, fuel, and labor. This resulted in the highest increase in service output charges since August.

10-year yield could break above 4% on strong NFP

As financial markets await December US non-farm payroll data, remains the strongest major currency for the week. 10-year treasury yield continues its attempt to breach break 4% psychological level, as its near-term recovery is still intact. Concurrently, NASDAQ leads pullback in the stock markets, reflecting cautious investor sentiment.

The current market mood suggests recalibration of expectations regarding Fed’s policy loosening path. Traders are increasingly skeptical about Fed starting rate cuts as early as March, with the likelihood now estimated around 65% according to Fed funds futures. A robust set of NFP numbers could further solidify this sentiment shift, potentially boosting Dollar and treasury yields while exerting pressure on stocks.

Markets expect NFP to show 168k job growth in December. Unemployment rate is expected to tick up from 3.7% to 3.8%. Average hourly earnings are expected to grow 0.3% mom.

Recent released job market data suggest the possibility of an upside surprise in the NFP report. ADP private employment report showed 164k new jobs in the same month, exceeding expectations and showing an increase from the previous month’s 101k. ISM Manufacturing PMI’s employment component also improved, rising to 48.1 from 45.8, though it remains in contraction territory. Furthermore, 4-week moving average of initial unemployment claims decreased to 208k, down from previous month’s 221k.

Market response to NFP data could particularly impact 10-year treasury yield. Technically, a short-term bottom appears to be in place at 3.785 with the current recovery, and D MACD crossed above signal line. Firm break above 4% level could provide momentum for TNX to target the 55 D EMA, currently at 4.212. While a break through 38.2% retracement of 4.997 to 3.785 at 4.247 seems unlikely at present, even a moderate rebound in TNX should lend near-term support to Dollar, especially against Yen.

EUR/CHF on edge: Will Eurozone CPI trigger downside breakout?

Euro is currently trading weaker against its European peers and Dollar as market anticipates the release of Eurozone CPI flash data for December. Expectations are set for the headline CPI to increase from 2.4% yoy to 3.0% yoy, ending a six-month streak of consecutive declines. Meanwhile, core CPI is expected to slow down from 3.6% yoy to 3.4% yoy.

The jump in headline inflation shouldn’t be a surprise to ECB officials. Executive Board member Isabel Schnabel had acknowledged last month that a temporary uptick in inflation was possible. But she also expected it to “gradually” fall to ECB’s 2% target by 2025. The anticipated continued decline in core inflation could reinforce the ECB’s confidence that the trend of disinflation is still ongoing.

Currently, swap markets are factoring in approximately 1.6 percentage points of rate cuts by ECB this year, with 60% probability of these cuts commencing as early as March. The critical consideration now is the pace of disinflation: whether it is rapid enough to justify earlier rate cuts, or slow enough to warrant maintaining the current restrictive policy stance for a longer duration.

Today’s Eurozone CPI data could be pivotal for the Euro’s performance. Any results that fall short of expectations might trigger another wave of selling pressure. Specifically, break of 0.9252 support will resume EUR/CHF’s down trend from 1.0095, and target 100% projection of 0.9995 to 0.9416 from 0.9683 at 0.9104 next.

Looking ahead

Germany retail sales, UK PMI construction, Eurozone CPI and PPI will be released in European session. Later in the day, US will release non-farm payrolls, ISM services and factory orders. Canada will also publish employment data and Ivey PMI.

USD/CAD Daily Outlook

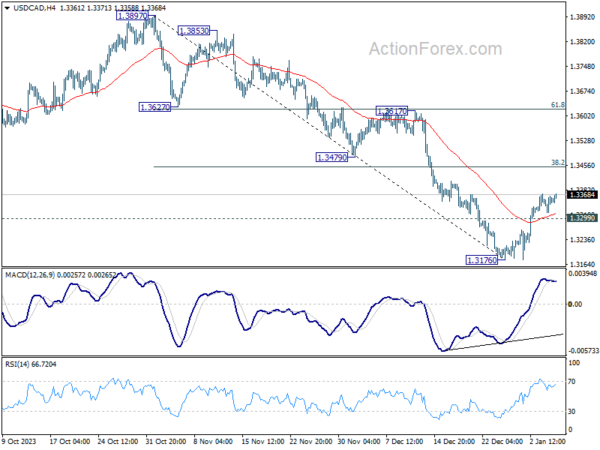

Daily Pivots: (S1) 1.3322; (P) 1.3344; (R1) 1.3371; More…

Intraday bias in USD/CAD remains on the upside at this point. Rebound from 1.3176 short term bottom is in progress for 38.2% retracement of 1.3897 to 1.3176 at 1.3451. Firm break there will pave the way to 61.8% retracement at 1.3622. On the downside, however, break of 1.3299 minor support will turn bias back to the downside for retesting 1.3176 low instead.

In the bigger picture, outlook is mixed up by deeper then expected fall from 1.3897. But after all, price actions from 1.3976 (2022 high) are viewed as a corrective pattern that’s in progress. Larger up trend from 1.2005 (2021 low) is still expected to resume at a later stage as long as 1.2947 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Monetary Base Y/Y Dec | 7.80% | 9.00% | 8.90% | |

| 05:00 | JPY | Consumer Confidence Index Dec | 37.2 | 36.6 | 36.1 | |

| 07:00 | EUR | Germany Retail Sales M/M Nov | -0.50% | 1.10% | ||

| 09:30 | GBP | Construction PMI Dec | 46.1 | 45.5 | ||

| 10:00 | EUR | Eurozone CPI Y/Y Dec P | 3.00% | 2.40% | ||

| 10:00 | EUR | Eurozone CPI Core Y/Y Dec P | 3.40% | 3.60% | ||

| 10:00 | EUR | Eurozone PPI M/M Nov | -0.10% | 0.20% | ||

| 10:00 | EUR | Eurozone PPI Y/Y Nov | -8.70% | -9.40% | ||

| 13:30 | USD | Nonfarm Payrolls Dec | 168K | 199K | ||

| 13:30 | USD | Unemployment Rate Dec | 3.80% | 3.70% | ||

| 13:30 | USD | Average Hourly Earnings M/M Dec | 0.30% | 0.40% | ||

| 13:30 | CAD | Net Change in Employment Dec | 13.2K | 24.9K | ||

| 13:30 | CAD | Unemployment Rate Dec | 5.90% | 5.80% | ||

| 15:00 | USD | ISM Services PMI Dec | 52.7 | 52.7 | ||

| 15:00 | USD | Factory Orders M/M Nov | 2.30% | -3.60% | ||

| 15:00 | CAD | Ivey PMI Dec | 55 | 54.7 |