Japanese Yen soars broadly in Asian session today, likely in delayed reactions to comment made by BoJ Governor Kazuo Ueda. Speaking to NHK, Governor Ueda indicated that the chance of moving the short-term interest rate out of negative territory in 2024 was “not zero.”

This remark marks a notable shift in tone from the central bank, even though Ueda also stated that he is “not quite convinced yet” that inflation in Japan can sustainably reach the 2% target. He emphasized the importance of the upcoming Spring wage negotiations as a critical factor in the central bank’s decision-making process. Additionally, he further elaborated that BoJ would like to see wages hikes “broaden” to smaller firms.

Despite Yen’s rally, Swiss Franc has outshone it by reaching multi-year highs against major currencies such as the Dollar, Euro, and Sterling. A significant factor behind the strength of the Franc is the relatively low interest rate of 1.75% set by SNB, which reduces the likelihood of an imminent rate cut. This contrasts with the higher interest rates of other major central banks like Fed at 5.50%, ECB at 4.50%, BoE at 5.25%.

For the week so far, Dollar is positioned at the bottom of the performance chart, influenced a risk-on sentiment that saw DOW reached another record high overnight. However, commodity currencies are not faring much better, with Canadian Dollar ranking as the second weakest. Swiss Franc leads as the top performer, followed by Sterling and Euro, while Yen shows mixed performance.

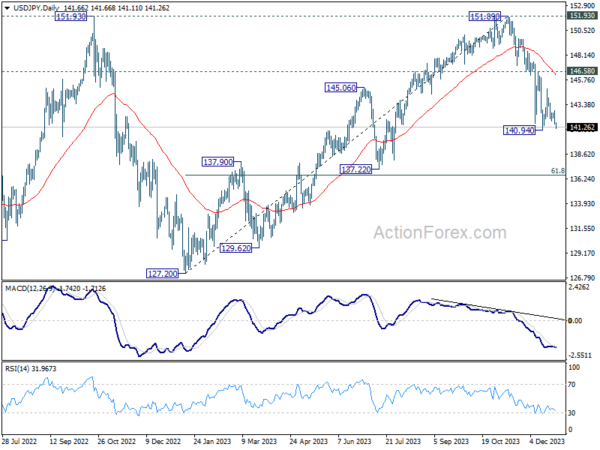

Technically, a key focus for the rest of the week will be on whether USD/JPY could break through 140.94 support to resume the decline from 151.89. Such fall is seen as the third leg of the pattern from 151.93. Break of 140.94 will target 61.8% retracement of 127.20 to 151.89 at 136.63, sustained break there will pave the way to 127.20 support (2022 low).

In Asia, at the time of writing, Nikkei is down -0.38%. Hong Kong HSI is up 2.47%. China Shanghai SSE is up 1.42%. Singapore Strait Times is up 1.77%. Japan 10-year JGB yield is down -0.0069 at 0.592. Overnight, DOW rose 0.30%. S&P 500 rose 0.14%. NASDAQ rose 0.16%. 10-year yield fell -0.097 to 3.789.

Japan’s industrial production down -0.9% mom, continues to seesaw indecisively

Japan’s industrial production fell -0.9% mom in November, marking the first decrease in three months. This drop, however, was less severe than the expected -1.6% mom decline. A notable factor in the contraction was -2.5% mom fall in motor vehicle production. Among the 15 sectors surveyed, 11 reported decreased production, while four sectors experienced increases.

Index of industrial shipments also dropped by -1.3% mom, aligning with overall decline in industrial production. Conversely, Index of inventories saw a marginal increase of 0.1% mom.

The Ministry of Economy, Trade and Industry maintained its assessment of industrial output as “fluctuating indecisively.” Looking ahead, manufacturers expect a rebound in output by 6.0% mom in December, followed by -7.2% mom decrease in January 2023.

An METI official said, “We’ll continue to monitor the impact of the global economic downturn and rising prices”.

In separate release, retail sales data painted a more positive picture. Sales in November rose 5.3% yoy, exceeding forecast of 5.0% yoy, and marked the 21st consecutive month of expansion since March 2022. On a month-on-month basis, retail sales grew 1.0%, following 1.7% growth in October.

Looking ahead

The European economic calendar is empty today. US will release jobless claims, goods trade balance, and pending home sales.

EUR/CHF Daily Outlook

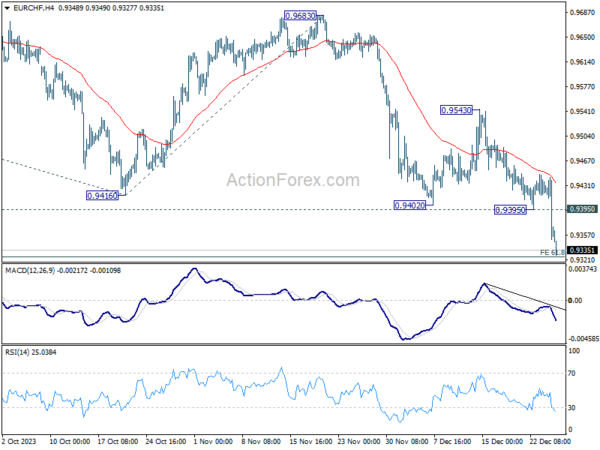

Daily Pivots: (S1) 0.9329; (P) 0.9387; (R1) 0.9421; More…

EUR/CHF’s decline resumed after brief consolidations and hit as low as 0.9327 so far. Intraday bias is back on the downside. Firm break of 61.8% projection of 0.9995 to 0.9416 from 0.9683 at 0.9325, will pave the way to 100% projection at 0.9104 next. On the upside, above 0.9395 minor resistance will turn bias neutral fist. but outlook will stay bearish as long as 0.9543 resistance holds, even in case of strong recovery.

In the bigger picture, medium term outlook remains bearish as long as 0.9683 resistance holds. Current fall from 1.2004 (2018 high) is part of the multi-decade down trend. Next target is 61.8% projection of 1.1149 (2020 high) to 0.9407 from 1.0095 at 0.9018.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Industrial Production M/M Nov P | -0.90% | -1.60% | 1.30% | |

| 23:50 | JPY | Retail Trade Y/Y Nov | 5.30% | 5.00% | 4.20% | 4.10% |

| 13:30 | USD | Initial Jobless Claims (Dec 22) | 204K | 205K | ||

| 13:30 | USD | Goods Trade Balance (USD) Nov P | -89.5B | -89.6B | ||

| 13:30 | USD | Wholesale Inventories Nov P | -0.20% | -0.40% | ||

| 15:00 | USD | Pending Home Sales M/M Nov | 1.10% | -1.50% | ||

| 15:30 | USD | Natural Gas Storage | -80B | -87B | ||

| 15:30 | USD | Crude Oil Inventories | -2.7M | 2.9M |