Yen rebounds broadly in today’s Asian trading session, buoyed by optimistic revisions in Japan’s economic growth forecasts. The government, in its semi-annual economic report, upgraded its growth projections for both the current and next fiscal years. Forecast for fiscal 2023 was raised from 1.3% to 1.6%, while projection for fiscal 2024 saw an increase from 1.2% to 1.3%. Furthermore, core inflation in Japan is anticipated to slow down from current fiscal year’s rate of 3.0% to 2.5% in the next fiscal year. That is, core inflation is projected to stay above BoJ’s 2% target.

Despite Yen’s recovery today, it remains the weakest performer for the week. Nevertheless, the currency’s post-BoJ selloff seems to have concluded, setting the stage for a period of consolidation. While a new high for Yen is unlikely, the range for near-term consolidation seems to have been established. Meanwhile, Sterling is the second weakest currency, largely due to the sell-off triggered by the latest UK CPI data yesterday. Dollar follows as the third weakest. On the other end of the spectrum, Swiss Franc has shown remarkable strength, becoming the best performer this week. Australian Dollar and the New Zealand Dollar are also showing firmness, while Euro and Canadian are mixed.

A notable development was observed in the stock market overnight, with DOW having a significant pullback after hitting new record high. This movement may reflect broader trend of position adjustments by investors as the year-end holiday season approaches. If this trend continues, the Aussie could lose its upward momentum and may enter a phase of consolidation as well.

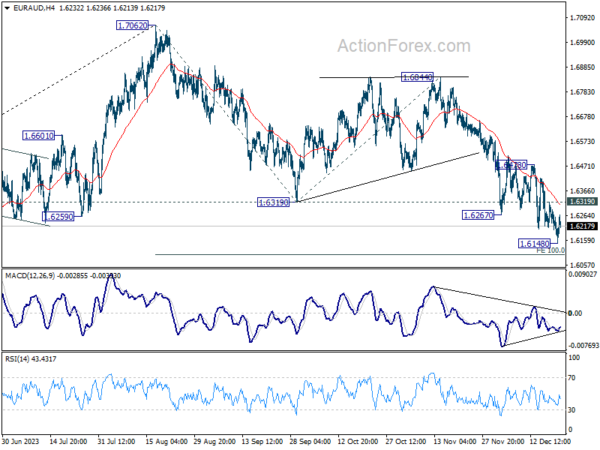

Technically, break of 1.6319 resistance in EUR/AUD would indicate short bottoming just ahead of 100% projection of 1.7062 to 1.6319 from 1.6844 at 1.6106, on bullish convergence condition in 4H MACD. Stronger rebound would then be seen to 1.6478 resistance.

In Asia, at the time of writing, Nikkei is down -1.56%. Hong Kong HSI is down -0.03%. China Shanghai SSE is up 0.34%. Singapore Strait Times is up 0.22%. Overnight, DOW fell -1.27%. S&P 500 fell -1.47%. NASDAQ fell -1.50%. 10-year yield fell -0.045 to 3.877.

Fed’s Harker: Cautious path to future rate cuts, inflation fight continues

Philadelphia Fed President Patrick Harker, in a local radio interview overnight, shared expressed that while there will be a need to lower interest rates eventually, this shift should not happen “right away” or “too fast.”

Harker stated, “I’ve been in the camp of, let’s hold rates where they are for a while, let’s see how this plays out, we don’t need to raise rates anymore.”

Looking ahead, Harker acknowledged the necessity of reducing rates, saying, “it’s important that we start to move rates down.” However, he emphasized a gradual approach: “we don’t have to do it too fast, we’re not going to do it right away, it’s going to take some time.”

Harker also added a note of caution regarding the economic outlook, particularly concerning inflation. “Let me be clear: The job on inflation is not done, but we are moving in the right direction, things are starting to look better and better.”

BoC minutes indicate greater confidence in current monetary policy restrictiveness

Summary of BoC’s December 6 meeting showed members collectively agreed “the likelihood that monetary policy was sufficiently restrictive to achieve the inflation target had increased.”

However, members also unanimously agreed that “risks to the inflation outlook remained.” Hence, BoC did not rule out the possibility of further interest rate hikes.

To effectively assess underlying inflationary pressures, BoC members agreed to focus on several key economic indicators. These include the balance of supply and demand in the economy, wage growth, corporate pricing behavior, and inflation expectations.

It’s clarified that while these indicators are not intermediate targets, they “provided helpful information on where inflation is headed.”

ECB’s Kazaks sees mid-2024 rate cuts, urges caution on early reduction

ECB Governing Council member Martins Kazaks, in an interview overnight, indicated that the most likely period for rate reductions could be around the “middle of next year”, specifically pointing to June or July as probable months.

However, Kazaks expressed caution about reducing rates too soon, stating, “But in the spring at the current moment that’s too early.” He also noted a disparity between his outlook and market expectations, particularly concerning the possibility of an initial rate cut in March, which he views as overly “optimistic”.

Kazaks also noted that interest rates are likely to remain at 4% for a while before any reduction is considered.

GBP/JPY Daily Outlook

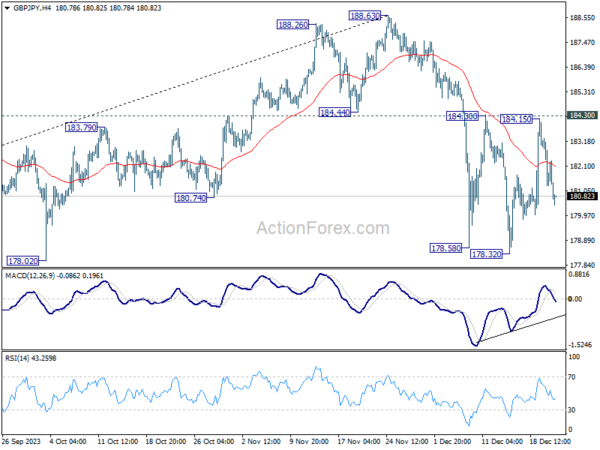

Daily Pivots: (S1) 180.70; (P) 182.02; (R1) 182.76; More…

GBP/JPY’s fall from 184.15 extends lower today but overall it’s staying in range above 178.32. Intraday bias remains neutral and further decline is expected. On the downside, break of will resume the decline from 188.63 and target 38.2% retracement of 148.93 to 188.63 at 173.46. However, decisive break of 184.30 will argue that pull back from 188.63 has completed and bring retest of this high.

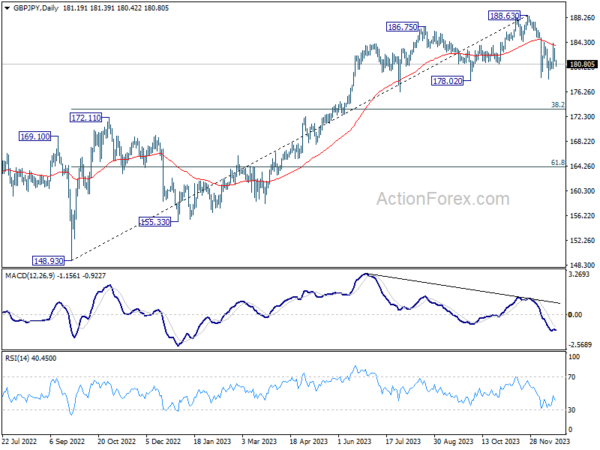

In the bigger picture, price actions from 188.63 medium term top are currently seen as a correction to the up trend from 148.93 (2022 low) only. As long as 172.11 resistance turned support holds, larger up trend from 123.94 (2020 low) is still in favor to resume through 188.63 at a later stage.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 07:00 | GBP | Public Sector Net Borrowing (GBP) Nov | 13.2B | 14.0B | ||

| 13:30 | CAD | Retail Sales M/M Oct | 0.80% | 0.60% | ||

| 13:30 | CAD | Retail Sales ex Autos M/M Oct | 0.50% | 0.20% | ||

| 13:30 | USD | Initial Jobless Claims (Dec 15) | 220K | 202K | ||

| 13:30 | USD | GDP Annualized Q3 | 5.20% | 5.20% | ||

| 13:30 | USD | GDP Price Index Q3 | 3.60% | 3.60% | ||

| 13:30 | USD | Philadelphia Fed Manufacturing Survey Dec | -3 | -5.9 | ||

| 15:30 | USD | Natural Gas Storage | -82B | -55B |