Dollar is having a notable rebound in early US trading session, buoyed by comments from New York Fed President John Williams. Speaking on CNBC’s “Squawk Box,” Williams stated, “we aren’t really talking about rate cuts right now,” adding that it is “premature” to consider rate cuts as early as March. This assertion by a key Fed official appears to have provided a boost to the Dollar, which had been under pressure in recent times.

Williams further emphasized Fed’s focus on determining if the current monetary policy is “sufficiently restrictive” to bring inflation back down to the 2% target. He also highlighted the unpredictable nature of economic data, suggesting Fed must be prepared to “tighten the policy further, if the progress of inflation were to stall or reverse.”

Meanwhile, the Euro began trading lower earlier in the day, influenced by weaker-than-expected PMI data that indicated ongoing contraction in both manufacturing and services sectors of Eurozone. Sterling also softened slightly, along with Swiss Franc. Australian Dollar, however, remained resilient, supported by encouraging production data from China. Japanese Yen continued to trade steadily firm within range.

As the week draws to a close, the focus is on whether Dollar can maintain its rebound and shed its position as the week’s worst performer. With a few hours still left in the trading day, the currency market awaits to see if this upward momentum can be sustained amidst the broader economic backdrop and evolving market sentiments.

In Europe, at the time of writing, FTSE is down -0.75%. DAX is down -0.03%. CAC is up 0.42%. Germany 10-year yield is down -0.0506 at 2.066. UK 10-year yield is down -0.016 at 3.769.Earlier in Asia, Nikkei rose 0.87%. Hong Kong HSI rose 2.38%. China Shanghai SSE fell -0.56%. Singapore Strait Times fell -0.21%. Japan 10-year JGB yield rose 0.0337 to 0.710.

UK services sector boosts PMI composite, averting recession, BoE cut premature

UK PMI Manufacturing fell from 47.2 to 46.4, below the expected 47.5. Conversely, PMI Services rose from 50.9 to 52.7, exceeding expectations of 51.0 and reaching a six-month high. This surge in services also lifted PMI Composite from 50.7 to 51.7, marking another six-month high.

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, commented, “The UK economy continues to dodge recession, with growth picking up some momentum at the end of the year to suggest that GDP stagnated over the fourth quarter as a whole.” He added that while employment fell for a fourth consecutive month, the decline was marginal and did not significantly impact unemployment.

Williamson also highlighted the dual-speed nature of the UK economy, with manufacturing contracting sharply while services, particularly financial services, showed signs of growth. This growth in services was partly attributed to expectations of lower interest rates in 2024.

The divergence between the two sectors is also evident in inflation pressures. While goods-producing sector showed falling prices, service providers reported persistent and elevated inflationary pressures, often linked to wage growth. Williamson indicated that this could keep inflation above 3% in the coming months.

He added, “The service sector’s resilience and sticky inflation picture will add to speculation that it’s too early for the Bank of England to be talking about cutting interest rates.” However, he also cautioned that the tentative nature of December’s growth and the impact of looser financial conditions could raise fears of further policy tightening, potentially leading to economic decline.

ECB Villeroy: Rate hikes are over, but that doesn’t mean a quick cut

ECB Governing Council member Francois Villeroy de Galhau said Friday in an Ecorama radio interview. “Barring shocks or surprises, rate hikes are over — but that doesn’t mean a quick rate cut.” “We are not guided by a calendar, we are guided by data.” He also urged “confidence and patience” .

“Disinflation is a little quicker than expected, notably because the transmission of monetary policy is a little faster than expected,” Villeroy said. “In other words, monetary policy is effective.”

Separately, another Governing Council member Madis Muller said the markets are “a bit optimistic” regarding early rate cuts. Robert Holzmann said there were no discussions about rate cuts among policymakers and added that a majority saw upside risks to inflation.

Eurozone PMI composite fell to 47.0, prolonged economic contraction

Eurozone PMI Manufacturing remained unchanged at 44.2 in December, falling short of anticipated 44.5. PMI Services index also declined from 48.7 to 48.1, below expected 49.0. Consequently, PMI Composite index decreased from 47.6 to 47.0.

Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, provided a critical analysis of these figures. He noted, “Once again, the figures paint a disheartening picture as the Eurozone economy fails to display any distinct signs of recovery. On the contrary, it has contracted for six straight months.”

This ongoing contraction underscores the challenges facing the Eurozone economy, with a high likelihood that it has been in a recession since the third quarter.

De la Rubia also observed, “A closer look at the top two economies in the Eurozone reveals a positive comparison for Germany in relation to France, particularly within the service sector.” Germany is experiencing a slower contraction in services compared to the more pronounced downturn in France. The manufacturing sector exhibits similar trends, with France facing a faster pace of output decline than Germany.

However, De la Rubia cautioned against any sense of satisfaction from Germany’s comparatively better performance, emphasizing, “Obviously, there’s no room for ‘Schadenfreude’ on the German side… the positive comparison does not change the fact that Germany’s economy is in a bad shape, in absolute terms.”

Also released, France PMI Manufacturing fell from 42.9 to 42.0 in December, a 43-month low. PMI Services fell from 45.4 to 44.3, a 37-month low. PMI Composite fell from 44.6 to 43.7, also a 37-month low. Germany PMI Manufacturing rose from 42.6 to 43.1, a 7-month. PMI Services fell from 49.6 to 48.4. PMI Composite fell from 47.8 to 46.7.

Japan’s PMI Composite up to 50.4, expansion resumes with inflation resurgence

Japan’s PMI data for December presents a mixed picture of the country’s economic The PMI Manufacturing index fell to 47.7 from 48.3, underperforming the market expectation of 48.2 and indicating contraction in the sector. In contrast, PMI Services index rose from 50.8 to 52.0. Consequently, PMI Composite index, moved back into expansion territory, rising from 49.6 to 50.4.

Annabel Fiddes, Economics Associate Director at S&P Global Market Intelligence, noted, “The December PMI surveys indicate that Japan’s private sector experienced a renewed, albeit mild increase in overall business activity as the year came to a close.”

Fiddes further elaborated, “The overall performance of the private sector remained subdued.” This is evident in the composite new business, which declined for the second consecutive month. Although there was modest sales growth in the service sector, it was not sufficient to offset the sharp and accelerated drop in manufacturing orders.

Another critical aspect highlighted in the PMI report is the resurgence of inflationary pressures. Fiddes noted, “The latest survey also indicated a renewed pick up in inflationary pressures amid reports that a weaker exchange rate and higher labor and raw material costs had pushed up expenses.” As a result, the prices charged by Japanese firms increased at the fastest pace since August.

China’s industrial output Surges, retail sales and investment miss expectations

China’s economic data for November 2023 presented a mixed picture, with industrial output exceeding expectations while retail sales and fixed asset investment fell short.

Industrial output saw a significant increase of 6.6% yoy, surpassing the expected 5.6% yoy and marking the strongest expansion since February 2022.

However, retail sales, rose by 10.1% yoy, which was below the anticipated 12.5%. It’s important to note that this increase was influenced by a low base effect from the previous year, when China’s stringent coronavirus pandemic control measures significantly impacted consumer activities.

Fixed asset investment, a key driver of economic growth, increased by 2.9% ytd yoy, slightly missing the expected 3.0%.

National Bureau of Statistics of China commented on the overall economic situation, stating: “There are still a lot of external instabilities and uncertainties, and the domestic demand appears insufficient.” The NBS emphasized the need to solidify the foundation of the economy’s recovery.

Australia PMI composite climbs to 47.4, aligning with soft landing scenario

Australia’s manufacturing and service sectors showed marginal improvements in December, as indicated by the latest PMI data. PMI Manufacturing index inched up slightly from 47.7 to 47.8, while PMI Services index rose from 46.0 to 47.6. PMI Composite, which combines both manufacturing and services, also increased from 46.2 to 47.4. Despite these increases, all indices remained below 50.0 threshold that separates expansion from contraction, suggesting that both sectors are still facing challenges.

Warren Hogan, Chief Economic Advisor at Judo Bank, noted: “For the RBA and Treasury, these results are consistent with the soft landing view of the economic outlook. There are few signs that the economy is likely to tip into a steeper downturn next year.”

Hogan also emphasized the importance of the employment sector in this context: “Most importantly, the strong employment results suggest the economy may prove resilient in 2024. It is hard to see a sharp downturn in the economy while employment and incomes are expanding.”

NZ BNZ manufacturing improves to 46.7, ninth month in contraction

New Zealand’s manufacturing sector experienced a slight improvement in November, as indicated by the BusinessNZ Performance of Manufacturing Index. The index rose from 42.9 to 46.7, marking its highest level since June. However, it’s important to note that the PMI remained in contraction territory (below 50) for the ninth consecutive month.

Breaking down the index, several components witnessed modest improvements. Production increased from 41.6 to 43.6, employment from 43.8 to 47.9, new orders from 44.5 to 47.7, finished stocks from 45.8 to 50.7, and deliveries from 43.3 to 48.0. Despite these gains, the improvements were not strong enough to push the overall PMI into the expansion zone.

The proportion of negative comments from the manufacturing sector was 58.7%, a decrease from 65.1% in October and 68.8% in September. This indicates a slight shift in sentiment, although a significant portion of feedback remains pessimistic. The predominant concerns cited by manufacturers revolved around a general lack of demand and sales, highlighting the primary challenges facing the industry.

BNZ Senior Economist, Craig Ebert, particularly focused on the production index. He noted that despite a slight improvement in November, the production index remained almost 10 points below its long-term average. Ebert emphasized that “That’s a big undershoot, in historical context”.

EUR/USD Mid-Day Outlook

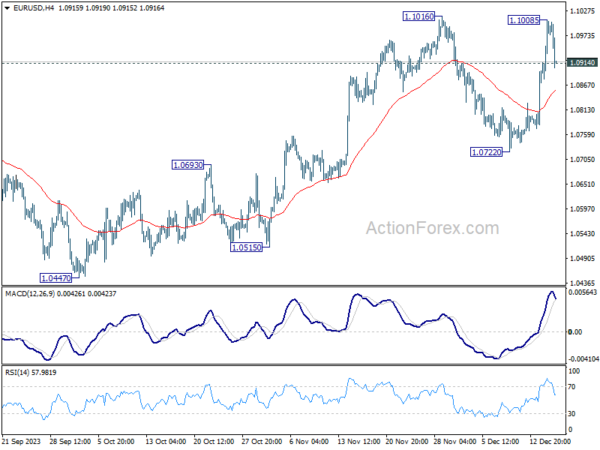

Daily Pivots: (S1) 1.0905; (P) 1.0957; (R1) 1.1044; More…

EUR/USD failed to break through 1.1016 resistance and retreated notably in early US session. Intraday bias is turned neutral first. Some consolidations would be seen. But for now, outlook will stay cautiously bullish as long as 1.0722 support holds. On the upside, decisive break of 1.1016 will confirm resumption of whole rally from 1.0447. Further rise should then be seen to retest 1.1274 high.

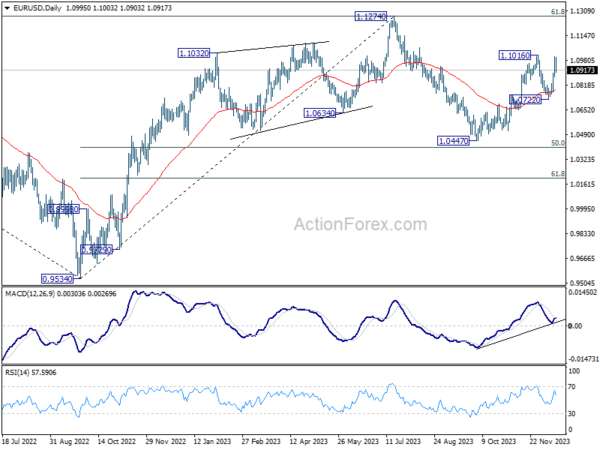

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern to rise from 0.9534 (2022 low). Rise from 1.0447 is seen as the second leg. While further rally could cannot be ruled out, upside should be limited by 1.1274 to bring the third leg of the pattern. Meanwhile, sustained break of 55 D EMA will argue that the third leg has already started for 1.0447 and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | NZD | Business NZ PMI Nov | 46.7 | 42.5 | 42.9 | |

| 22:00 | AUD | Manufacturing PMI Dec P | 47.8 | 47.7 | ||

| 22:00 | AUD | Services PMI Dec P | 47.6 | 46 | ||

| 00:01 | GBP | GfK Consumer Confidence Dec | -22 | -23 | -24 | |

| 00:30 | JPY | Manufacturing PMI Dec P | 47.7 | 48.2 | 48.3 | |

| 00:30 | JPY | Services PMI Dec P | 52 | 50.8 | ||

| 02:00 | CNY | Industrial Production Y/Y Nov | 6.60% | 5.60% | 4.60% | |

| 02:00 | CNY | Retail Sales Y/Y Nov | 10.10% | 12.50% | 7.60% | |

| 02:00 | CNY | Fixed Asset Investment YTD Y/Y Nov | 2.90% | 3.00% | 2.90% | |

| 04:30 | JPY | Tertiary Industry Index M/M Oct | -0.80% | 0.20% | -1.00% | |

| 08:15 | EUR | France Manufacturing PMI Dec P | 42 | 43.2 | 42.9 | |

| 08:15 | EUR | France Services PMI Dec P | 44.3 | 46 | 45.4 | |

| 08:30 | EUR | Germany Manufacturing PMI Dec P | 43.1 | 43.3 | 42.6 | |

| 08:30 | EUR | Germany Services PMI Dec P | 48.4 | 49.8 | 49.6 | |

| 09:00 | EUR | Eurozone Manufacturing PMI Dec P | 44.2 | 44.5 | 44.2 | |

| 09:00 | EUR | Eurozone Services PMI Dec P | 48.1 | 49 | 48.7 | |

| 09:30 | GBP | Manufacturing PMI Dec P | 46.4 | 47.5 | 47.2 | |

| 09:30 | GBP | Services PMI Dec P | 52.7 | 51 | 50.9 | |

| 10:00 | EUR | Eurozone Trade Balance (EUR) Oct | 10.9B | 10.3B | 9.2B | 8.7B |

| 13:15 | CAD | Housing Starts Y/Y Nov | 213K | 260.0K | 274.7K | 272K |

| 13:30 | CAD | Wholesale Sales M/M Oct | -0.50% | 0.50% | 0.40% | -0.60% |

| 13:30 | USD | Empire State Manufacturing Index Dec | -14.5 | 2 | 9.1 | |

| 14:15 | USD | Industrial Production M/M Nov | 0.30% | -0.60% | ||

| 14:15 | USD | Capacity Utilization Nov | 79.20% | 78.90% | ||

| 14:45 | USD | Manufacturing PMI Dec P | 49.1 | 49.4 | ||

| 14:45 | USD | Services PMI Dec P | 50.5 | 50.8 |