Dollar softens slightly in today’s Asian session, as the global markets await forthcoming US consumer inflation data. Headline CPI is anticipated to show a modest deceleration to 3.2% in November, while core CPI is expected to remain stubbornly high at 4%. Fed’s mandate to bringing inflation down to its 2% target necessitates a persistent slowdown in core inflation through the tough “last mile”. Absent this, interest rates will either be maintained at their current elevated levels “for longer” or potentially be increased further. This context amplifies the importance of today’s data as well as tomorrow’s FOMC rate decision and the accompanying economic projections, which are poised to be major catalysts in the financial markets.

In stark contrast, Yen, Australian Dollar, and New Zealand Dollar have emerged as the stronger currencies in the session, each buoyed by distinct factors. Japanese Yen has halted its recent pullback from last week’s strong rally, seemingly unaffected by data showing continued slowdown in Japan’s wholesale inflation. The near-term trading range for Yen seems to be established, with future movements to be influenced by BoJ’s policy decision scheduled for next week.

Australian Dollar, meanwhile, received a boost from positive trade news. China’s decision to lift suspensions on three Australian abattoirs, part of a broader easing of trade sanctions, has been interpreted as a sign of further thawing in the previously tense economic relations due to political disagreements. However, it’s crucial to note that restrictions still apply to several other Australian abattoirs and key exports like red wine, lobster, and meat, indicating that some trade challenges persist.

European major currencies display mixed performance in today’s session. Euro and Swiss Franc are showing signs of softness, whereas Sterling is gaining a little strength. These currencies are currently positioned in a holding pattern, awaiting the outcome of this week’s pivotal policy decisions by ECB, SNB and BoE.

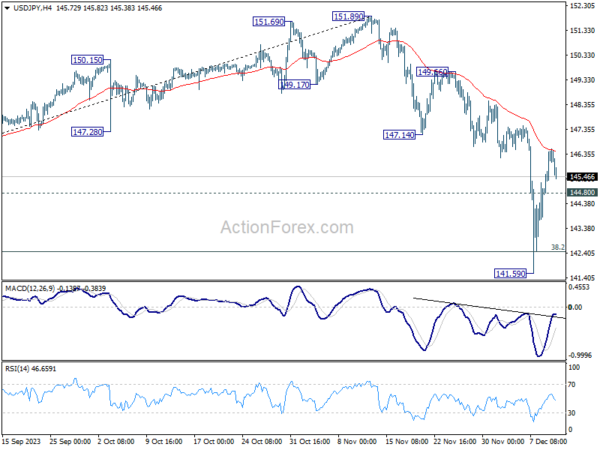

From a technical analysis standpoint, after initial rejection by 55 4H EMA (now at 146.46) focus is back on 144.80 minor support in USD/JPY. Break there will bring deeper decline towards 141.59, as the second leg of a near term consolidation pattern.

In Asia, at the time of writing, Nikkei is up 0.26%. Hong Kong HSI is up 0.62%. China Shanghai SSE is up 0.03%. Singapore Strait Times is up 0.36%. Japan 10-year JGB yield is down -0.0408 at 0.738. Overnight, DOW rose 0.43%. S&P 500 rose 0.39%. NASDAQ rose 0.20%. 10-year yield fell -0.006 to 4.239.

Australia’s Westpac consumer sentiment rose to 82.1, still far from upbeat

The latest release from Australia reveals a modest uptick in Westpac Consumer Sentiment Index, which rose by 2.7% mom to 82.1 in December. Despite this increase, Westpac’s analysis describes the sentiment as “still very weak,” emphasizing that “consumers remain far from upbeat.”

Regarding RBA’s next meeting on February 5-6, Westpac said, the “there is now a higher bar” to further tightening. It highlights the “subdued growth profile” and a “particularly weak household sector” underscored by the recent consumer sentiment results, suggesting that these factors might raise the threshold for another rate hike.

However, it’s important to note the central bank’s stance towards inflation. RBA has expressed a “very low tolerance for any upside surprises” in inflation rates, making the upcoming inflation data and the detailed quarterly release, due in late January, pivotal for February policy decision.

Australia’s NAB business confidence and conditions decline, signaling continued soft growth

Australia NAB Business Confidence fell from -3 to -9 in November. Business Conditions fell from 13 to 9. Trading conditions fell from 19 to 13. Profitability conditions fell from 11 to 6. Employment conditions were unchanged at 8.

NAB Chief Economist Alan Oster remarked, “Both confidence and conditions declined in the month and after a period of relative stability through mid-2023 appear to be softening further.” He pointed out that, excluding the pandemic period, business confidence is at its weakest since around 2012. This was a time characterized by significantly weaker conditions and slowing growth in advanced economies.

Despite these declines, Oster noted that business conditions remain above average, reflecting their strong starting point. He emphasized the importance of monitoring whether this drop in confidence continues and if a trend develops in business conditions. For the moment, these indicators suggest “ongoing soft growth in Q4”.

Japan’s PPI slows to weakest pace since February 2021

Japan’s PPI slowed notably from 0.9% yoy to 0.3% yoy in November, but beat expectation of 0.1% yoy. That’s nonetheless still the weakest pace since February 2021. November marked the 11th straight month in which the pace slowed.

Export prices was unchanged at 0.9% yoy. Import price decline slowed from -12.7% yoy to -9.7% yoy, staying negative for the eighth month.

During the month, PPI rose 0.2% mom. Import prices rose 0.7% mom. Export prices fell -0.2 %Mom.

Producer price growth stayed below the most recent consumer inflation reading for a third month. Growth in consumer prices excluding fresh food inched up to 2.9% in October.

Looking ahead

UK employment data and Germany ZEW economic sentiment are the main focus in European session. US CPI will take center stage later in the day.

AUD/USD Daily Report

Daily Pivots: (S1) 0.6551; (P) 0.6567; (R1) 0.6584; More…

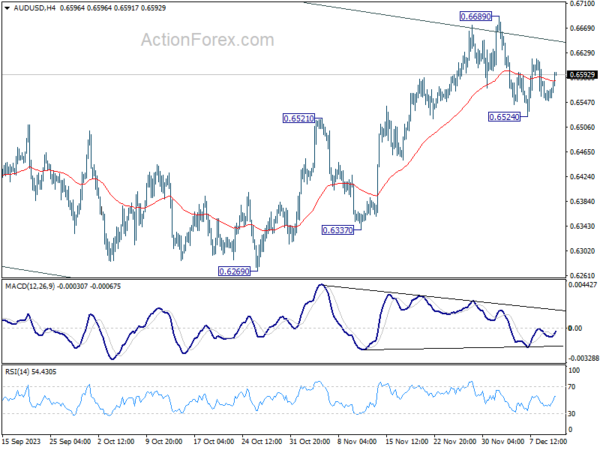

AUD/USD recovers today but stays inside range below 0.6689. Intraday bias remains neutral for the moment, and risk stays mildly on the downside. Break of 0.6524 will affirm the case of rejection by channel resistance, and resume the fall from 0.6689 short term top to 55 D EMA (now at 0.6500) and below. Nevertheless, firm break of 0.6689 will resume the rise from 0.6269 instead.

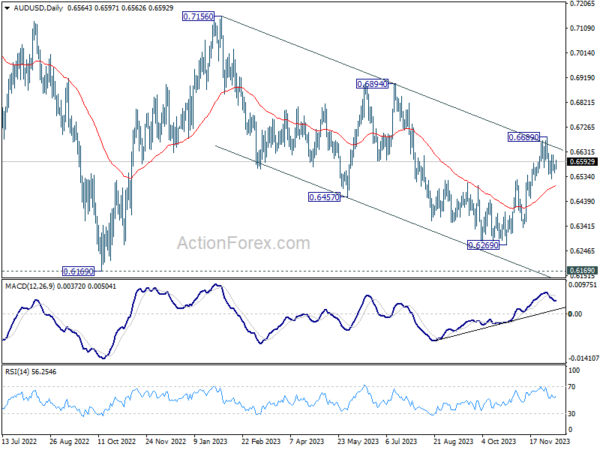

In the bigger picture, there is no confirmation that down trend from 0.8006 (2021 high) has completed. Price actions from 0.6169 (2022 low) could be just a medium term corrective pattern, with fall from 0.7156 as the second leg. For now, range trading should be seen between 0.6169 and 0.7156 (2023 high), until further developments.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | AUD | Westpac Consumer Confidence Dec | 2.70% | -2.60% | ||

| 23:50 | JPY | PPI Y/Y Nov | 0.30% | 0.10% | 0.80% | 0.90% |

| 00:30 | AUD | NAB Business Confidence Nov | -9 | -2 | -3 | |

| 00:30 | AUD | NAB Business Conditions Nov | 9 | 13 | ||

| 07:00 | GBP | Claimant Count Change Nov | 20.3K | 17.8K | ||

| 07:00 | GBP | ILO Unemployment Rate (3M) Oct | 4.20% | 4.20% | ||

| 07:00 | GBP | Average Earnings Including Bonus 3M/Y Oct | 7.70% | 7.90% | ||

| 07:00 | GBP | Average Earnings Excluding Bonus 3M/Y Oct | 7.40% | 7.70% | ||

| 10:00 | EUR | Germany ZEW Economic Sentiment Dec | 8.8 | 9.8 | ||

| 10:00 | EUR | Germany ZEW Current Situation Dec | -75.5 | -79.8 | ||

| 10:00 | EUR | Eurozone ZEW Economic Sentiment Dec | 11.2 | 13.8 | ||

| 11:00 | USD | NFIB Business Optimism Index Nov | 90.7 | 90.7 | ||

| 13:30 | USD | CPI M/M Nov | 0.10% | 0.00% | ||

| 13:30 | USD | CPI Y/Y Nov | 3.10% | 3.20% | ||

| 13:30 | USD | CPI Core M/M Nov | 0.30% | 0.20% | ||

| 13:30 | USD | CPI Core Y/Y Nov | 4.00% | 4.00% |