Yen is trading as the runaway leader in today’s market, dominating traders’ focus. This rally was initially triggered by comments from BoJ Governor Kazuo Ueda regarding the central bank’s potential strategies upon exiting negative interest rates. Buying momentum for then intensified further following Ueda’s meeting with Japanese Prime Minister Fumio Kishida to discuss his monetary policy stance.

While the specifics of the conversation between Ueda and Kishida were not disclosed, some market observers perceive this as strategic “staged” move to signal potential policy shift by BoJ. This speculation is reflected in the overnight-indexed swaps, which now price in over 40% chance of BoJ ending its negative rate policy at the upcoming meeting on December 18-19. This represents a significant increase from just a 3% probability two days ago.

It is important to note that, logically, BoJ is not poised to exit negative rates soon. The central bank has communicated clearly that its next move will depend heavily on wage negotiations in Spring. Updated price forecasts expected in January and April could support a case for policy change, making these meetings more critical for adjustments. However, the possibility of a minor tweak at this month’s meeting can’t be dismissed, and traders are positioning themselves for this potential outcome.

For now, Swiss Canadian Dollar is the worst performer of the day, followed by Swiss Franc and then Dollar. Australian Dollar is the second strongest, for RBA is still having a chance to hike again next year. Euro is the third strongest, followed by Sterling.

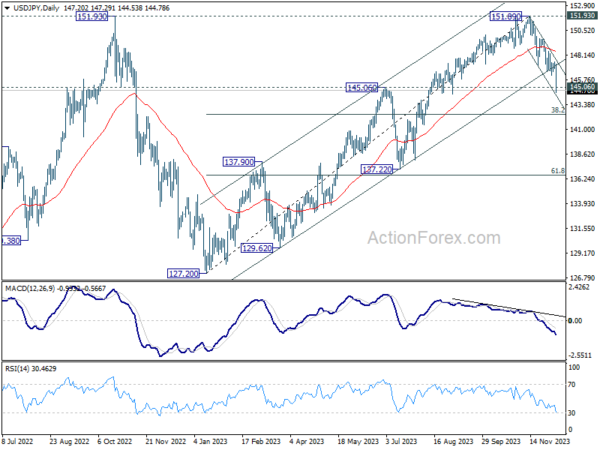

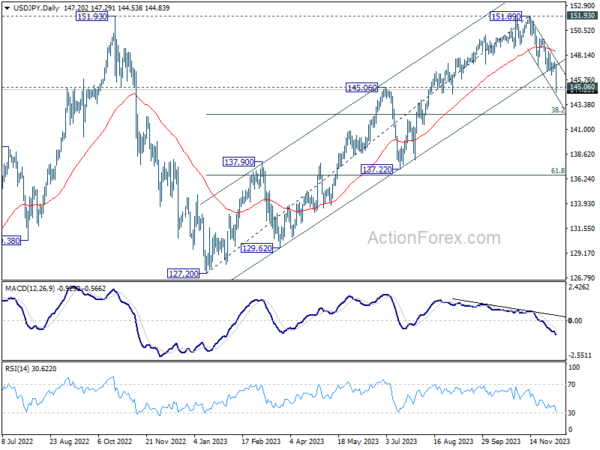

Technically, the case of bearish trend reversal in USD/JPY is building up further with today’s break of 145.06 resistance turned support. Sustained trading below this level should pave the way to 38.2% retracement of 127.20 to 151.89 at 142.45, or even further to 61.8% retracement at 136.63.

Additionally, judging from today’s price actions, the downside acceleration in USD/JPY is dragging down Dollar against others. This pattern will be closely monitored to assess its continuation and implications on currency markets.

In Europe, at the time of writing, FTSE is up 0.04%. DAX is down -0.18%. CAC is down -0.19%. Germany 10-year yield is up 0.006 at 2.207. UK 10-year yield is up 0.031 at 3.976. Earlier in Asia, Nikkei fell -1.76%. Hong Kong HSI dropped -0.71%. China Shanghai SSE fell -0.09%. Singapore Strait Times fell -0.42%. Japan 10-year JGB yield rose sharply by 0.1082 to 0.756.

US initial jobless claims rose to 220k, vs exp 226k

US initial jobless claims rose 1k to 220k in the week ending December 2, below expectation of 226k. Four-week moving average of initial claims rose 500 to 220.75k.

Continuing claims fell -64k to 1861k in the week ending November 25. Four-week moving average of continuing claims rose 7kk to 1872k, highest since December 11 2021.

Eurozone GDP growth finalized at 0.1% qoq in Q3

Eurozone GDP growth in Q3 was finalized at 0.1% qoq. Household final consumption expenditure increased by 0.3%. Government final consumption expenditure increased by 0.3% Gross fixed capital formation remained stable. Exports decreased by -1.1%. Imports decreased by -1.2%.

EU GDP was flat qoq. Malta (+2.4%) recorded the highest increase of GDP compared to the previous quarter, followed by Poland (+1.5%) and Cyprus (+1.1%). The highest decreases were observed in Ireland (-1.9%), Estonia (-1.3%) and Finland (-0.9%).

China’s Exports Rebound in November While Import Slump

China’s export figures for November 2023 showed an unexpected rise, growing by 0.5% yoy to USD 291.9B, surpassing the anticipated -0.8% yoy decline. This increase marks the first growth in exports China has seen in seven months.

Notably, exports to US rose by 7% yoy. However, exports to EU and ASEAN experienced declines, falling by -14.5% yoy and -7.0% yoy, respectively.

Conversely, imports decreased by -0.6% yoy to USD 223.5B, significantly underperforming against the expected rise of 3.0% yoy. This decline in imports contributed to widening of trade surplus, which expanded from USD 56.5B to USD 68.4B, exceeding the forecasted USD 58.1B surplus.

Looking at the broader January to November period, China’s exports contracted by -5.2% yoy, while imports declined by -6.0% yoy. The cumulative trade balance for this period stood at a surplus of USD 748.13B.

BoJ’s Ueda sees multiple options for target interest rates post-negative rate era

BoJ Governor Kazuo Ueda noted there are various options for its interest rate targets once it transitions away from negative short-term borrowing costs. However, he emphasized that no decision has been made yet regarding this shift. Ueda reiterated BoJ’s commitment to continuing its monetary easing under Yield Curve Control to support economic activity and foster a cycle of wage growth.

Speaking to the parliament, Governor Ueda noted the economy is to continue recovering moderately. But there is “extremely high” uncertainty surrounding the outlook. He emphasized, “We have not yet reached a situation in which we can achieve [our] price target sustainably and stably and with sufficient certainty.”

Regarding shifts in BoJ’s monetary policy, Ueda outlined that once the central bank moves away from its negative interest rate policy, it could consider various options for its interest rate targets. These include continuing to target the interest rate applied to reserves that financial institutions hold with the central bank or reverting to a policy that focuses on the overnight call rate. He clarified, “We have not made a decision yet on which interest rate to target once we end our negative interest rate policy.”

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 146.97; (P) 147.23; (R1) 147.57; More…

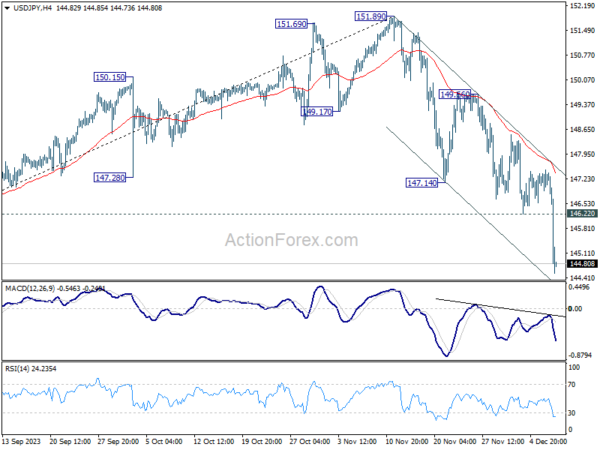

USD/JPY’s decline accelerates to as low as 144.53 so far and there is no sign of bottoming yet. Intraday bias remains on the downside. Sustained trading below 145.06 will carry larger bearish implication and target 142.45 fibonacci level next. On the upside, break of 146.22 minor resistance will turn intraday bias neutral and bring consolidations first.

In the bigger picture, rise from 127.20 (2023 low) is seen as the second leg of the pattern from 151.93 (2022 high). Decisive break of 145.06 resistance turned support will confirm that this second leg has completed, after rejection by 151.93. Deeper fall would be seen through 38.2% retracement of 127.20 to 151.89 at 142.45 to 61.8% retracement at 136.63. Nevertheless strong bounce from 145.06 will retain medium term bullishness for another test on 151.93 at a later stage.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | Trade Balance (AUD) Oct | 7.13B | 7.45B | 6.79B | 6.18B |

| 03:00 | CNY | Trade Balance (USD) Nov | 68.4B | 58.1B | 56.5B | |

| 05:00 | JPY | Leading Economic Index Oct P | 108.7 | 108.2 | 108.2 | 108.9 |

| 06:45 | CHF | Unemployment Rate Nov | 2.10% | 2.10% | 2.10% | |

| 07:00 | EUR | Germany Industrial Production M/M Oct | -0.40% | -0.20% | -1.40% | |

| 07:45 | EUR | France Trade Balance (EUR) Oct | -8.6B | -8.5B | -8.9B | |

| 08:00 | CHF | Foreign Currency Reserves (CHF) Nov | 642B | 658B | ||

| 09:00 | EUR | Italy Industrial Output M/M Oct | -0.20% | -0.60% | 0.00% | |

| 10:00 | EUR | Italy Retail Sales M/M Oct | 0.40% | 0.10% | -0.30% | |

| 10:00 | EUR | Eurozone GDP Q/Q Q3 F | -0.10% | -0.10% | -0.10% | |

| 10:00 | EUR | Eurozone Employment Change Q/Q Q3 F | 0.20% | 0.30% | 0.30% | |

| 12:30 | USD | Challenger Job Cuts Nov | -40.80% | 8.80% | ||

| 13:30 | USD | Initial Jobless Claims (Dec 1) | 220K | 226K | 218K | 219K |

| 13:30 | CAD | Building Permits M/M Oct | 2.30% | 1.10% | -6.50% | |

| 15:00 | USD | Wholesale Inventories Oct F | -0.20% | -0.20% | ||

| 15:30 | USD | Natural Gas Storage | 8.3B | 10B |