Yen and Dollar strengthened notably in Asian session today, amid a backdrop of risk aversion that’s reflected in the continued downturn in Hong Kong’s stock market and softness in Japan. A key factor impacting market sentiment is the unexpected slump in China’s imports, including the decline in crude oil imports – the first such annual decrease since April. This drop is a significant indicator of China’s waning domestic demand, raising alarm bells about the health of one of the world’s largest economies.

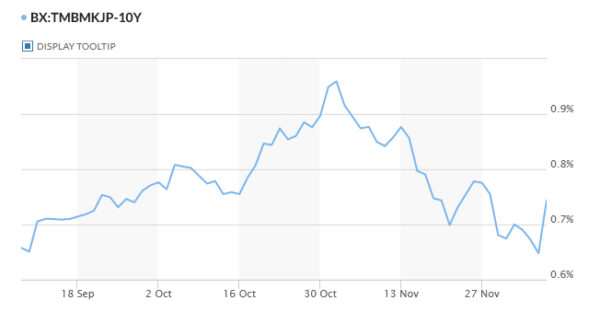

At the same time, Yen received additional boost following remarks by BoJ Governor Kazuo Ueda in parliament. While Ueda maintained BoJ’s dovish position and emphasized the necessity of continuing ultra-loose monetary policy, his mere discussion about exiting negative interest rates caught the attention of traders. This mention, despite not indicating an immediate policy shift, has resonated within the financial markets, leading to a sharp rise in 10-year JGB yield , which surpassed 0.75% mark.

Conversely, Australian and New Zealand Dollars are facing increased selling pressure, possibly due to the regional impact of China’s economic slowdown. Canadian Dollar’s performance remains mixed, even in the face of an ongoing decline in oil prices. Among European currencies, Swiss Franc continues to outperform Euro and Sterling, following suit with the recent downtrend in European benchmark treasury yields.

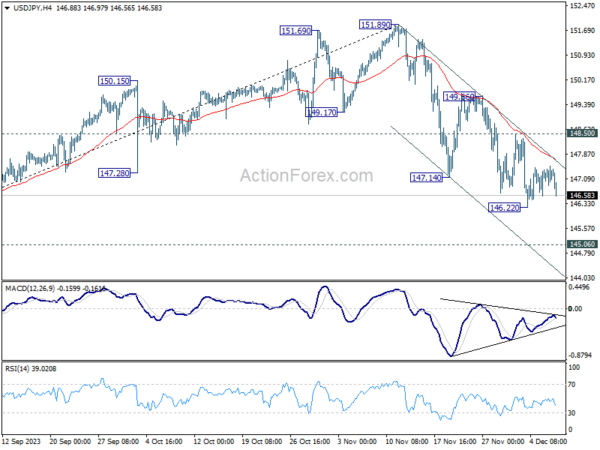

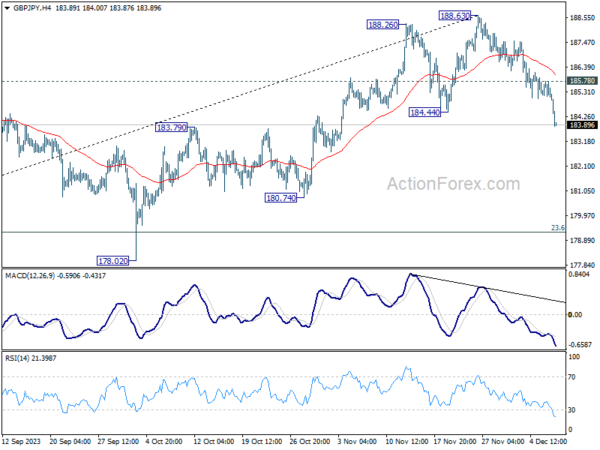

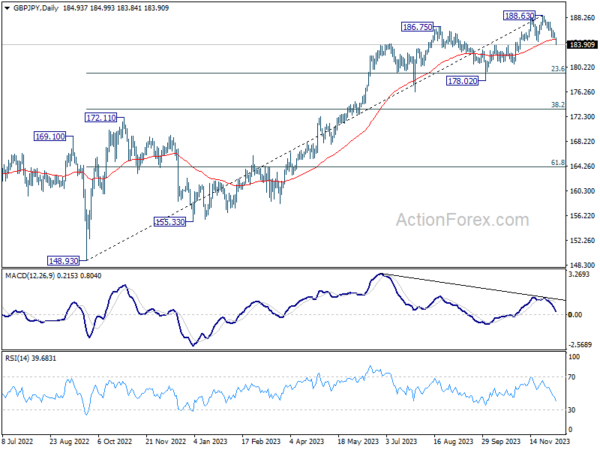

From a technical analysis standpoint, Yen’s strength is evident across various crosses. GBP/JPY has broken below 184.44 support level. Similarly, AUD/JPY and NZD/JPY have breached their respective support levels at 96.01 and 90.06. A focus is now on when USD/JPY would break through 146.22 to temporary low to resume the whole fall from 151.89 to 145.06 key medium term support level.

In Asia, at the time of writing, Nikkei is down -1.79%. Hong Kong HSI is down -1.19%. China Shanghai SSE is down -0.21%. Singapore Strait Times is down -0.81%. Japan 10-year JGB yield is up 0.1016 at 0.750. Overnight, DOW fell -0.19%. S&P 500 fell -0.39%. NASDAQ fell -0.58%. 10-year yield fell -0.050 to 5.121.

China’s Exports Rebound in November While Import Slump

China’s export figures for November 2023 showed an unexpected rise, growing by 0.5% yoy to USD 291.9B, surpassing the anticipated -0.8% yoy decline. This increase marks the first growth in exports China has seen in seven months.

Notably, exports to US rose by 7% yoy. However, exports to EU and ASEAN experienced declines, falling by -14.5% yoy and -7.0% yoy, respectively.

Conversely, imports decreased by -0.6% yoy to USD 223.5B, significantly underperforming against the expected rise of 3.0% yoy. This decline in imports contributed to widening of trade surplus, which expanded from USD 56.5B to USD 68.4B, exceeding the forecasted USD 58.1B surplus.

Looking at the broader January to November period, China’s exports contracted by -5.2% yoy, while imports declined by -6.0% yoy. The cumulative trade balance for this period stood at a surplus of USD 748.13B.

BoJ’s Ueda sees multiple options for target interest rates post-negative rate era

BoJ Governor Kazuo Ueda noted there are various options for its interest rate targets once it transitions away from negative short-term borrowing costs. However, he emphasized that no decision has been made yet regarding this shift. Ueda reiterated BoJ’s commitment to continuing its monetary easing under Yield Curve Control to support economic activity and foster a cycle of wage growth.

Speaking to the parliament, Governor Ueda noted the economy is to continue recovering moderately. But there is “extremely high” uncertainty surrounding the outlook. He emphasized, “We have not yet reached a situation in which we can achieve [our] price target sustainably and stably and with sufficient certainty.”

Regarding shifts in BoJ’s monetary policy, Ueda outlined that once the central bank moves away from its negative interest rate policy, it could consider various options for its interest rate targets. These include continuing to target the interest rate applied to reserves that financial institutions hold with the central bank or reverting to a policy that focuses on the overnight call rate. He clarified, “We have not made a decision yet on which interest rate to target once we end our negative interest rate policy.”

ECB’s Villeroy foresees 2024 rate cut possibility, dismisses immediate action

ECB Governing Council member Francois Villeroy de Galhau indicated that the central bank will not pursue further interest rate hikes. In an interview with the French newspaper La Depeche du Midi, Villeroy stated, “Our decisions to increase interest rates are fully playing their role as a remedy against the disease that is inflation.”

He added, “This is why, barring any shock, there will be no further increase in our rates — the question of a reduction may arise in 2024, but not now.”

Villeroy expressed confidence in the progress made in the fight against inflation, noting that “we are well on our way… even if we are not yet finished.” He urged patience with the duration of these measures, reiterating the ECB’s commitment to bringing inflation back toward 2% by 2025 at the latest.

Furthermore, he pointed out that disinflation is occurring faster than anticipated due to two main factors: slowdown in energy prices, unaffected by conflicts in the Middle East, and deceleration of other prices, including services and manufactured products, as a result of ECB’s monetary policy.

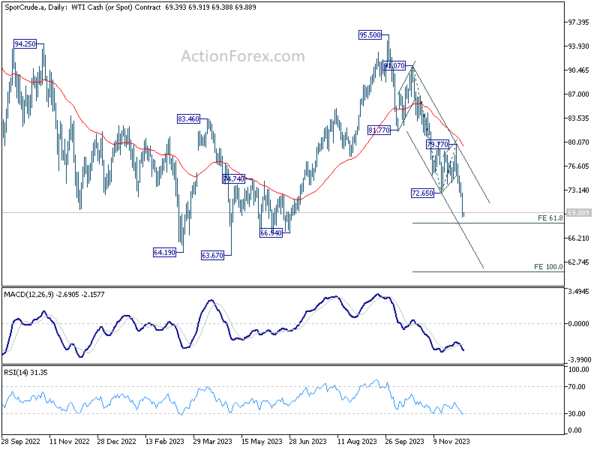

WTI oil breaks 70, focus shits to 63/67 support zone

WTI crude oil fell sharply overnight, breaking 70 psychological level for the first time since June. Further decline is expected in the short-term from technical perspective. But 63/67 support zone is expected to provide a floor to contain this downtrend.

This selloff is driven by several key factors. The primary concern is demand destruction in the fuel market, underscored by EIA reporting a larger-than-expected increase in US gasoline inventories. Additionally, persistent worries about China’s economic health are adding to the bearish sentiment in the oil market. This concern is exacerbated by Moody’s downgrade of China’s A1 rating outlook from stable to negative. Market skepticism regarding the effectiveness of OPEC+’s production cuts also plays a role.

Technically, WTI’s strong break of 72.65 support confirms resumption of the fall from 95.50. Further decline is expected as long as 74.23 resistance holds. Break of 61.8% projection of 91.07 to 72.65 from 79.77 at 68.38 is envisaged.

Strong support is expected from 63.67/66.94 zone to contain downside to complete the five wave sequence from 95.50, and bring sustainable rebound. Even if 63.67 is breached, 100% projection at 61.35 should provide the floor, preventing further substantial drops in oil price.

Looking ahead

Germany industrial production, France trade balance, Eurozone GDP revision, and Swiss foreign currency reserves will be released in European session. Later in the day, US will release Challenger job cuts and jobless claims.

GBP/JPY Daily Outlook

Daily Pivots: (S1) 184.74; (P) 185.27; (R1) 185.56; More…

GBP/JPY’s fall from 188.63 accelerates lower today and breaks through 184.44 support. Current development argues that a medium term is in place on bearish divergence condition in D MACD. Fall from 188.63 is likely corrective whole rise from 148.93. Intraday bias is now on the downside for 23.6% retracement of 148.93 to 188.63 at 173.46 next. On the upside, above 185.78 minor resistance will turn intraday bias neutral and bring consolidations first. But risk will now stay on the downside as long as 188.63 resistance holds.

In the bigger picture, while a medium term top is in place at 188.63, there is no clear sign of long term bearish trend reversal yet. As long as 172.11 resistance turned support holds, price actions from 188.63 are seen as a corrective move only. Larger up trend from 123.94 (2022 low) could resume at a later stage.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | Trade Balance (AUD) Oct | 7.13B | 7.45B | 6.79B | 6.18B |

| 03:00 | CNY | Trade Balance (USD) Nov | 68.4B | 58.1B | 56.5B | |

| 05:00 | JPY | Leading Economic Index Oct P | 108.7 | 108.2 | 108.2 | 108.9 |

| 07:00 | EUR | Germany Industrial Production M/M Oct | -0.20% | -1.40% | ||

| 07:45 | EUR | France Trade Balance (EUR) Oct | -8.5B | -8.9B | ||

| 08:00 | CHF | Foreign Currency Reserves (CHF) Nov | 658B | |||

| 09:00 | EUR | Italy Industrial Output M/M Oct | -0.60% | 0.00% | ||

| 10:00 | EUR | Italy Retail Sales M/M Oct | 0.10% | -0.30% | ||

| 10:00 | EUR | Eurozone GDP Q/Q Q3 | -0.10% | -0.10% | ||

| 10:00 | EUR | Eurozone Employment Change Q/Q Q3 F | 0.30% | 0.30% | ||

| 12:30 | USD | Challenger Job Cuts Nov | 8.80% | |||

| 13:30 | USD | Initial Jobless Claims (Dec 1) | 226K | 218K | ||

| 13:30 | CAD | Building Permits M/M Oct | 1.10% | -6.50% | ||

| 15:00 | USD | Wholesale Inventories Oct F | -0.20% | -0.20% | ||

| 15:30 | USD | Natural Gas Storage | 8.3B | 10B |