Dollar’s decline finally takes off again overnight, following dovish comments from some Fed officials. In particular, Fed Governor Christopher Waller, typically known for his hawkish views, softened his stance and expressed a level of satisfaction with the current interest rate policy. Chicago Fed President Austan Goolsbee’s even raised concerns about the risks of maintaining overly restrictive monetary policy for an extended period. Fed Governor Michelle Bowman, maintaining a hawkish stance, was the only one expecting another rate hike.

One significant technical development to note is that 10-year yield is now pressing an important fibonacci level of 38.2% retracement of 3.253 to 4.997 at 4.330. Sustained break of this level would open up deeper decline through 4% handle to 61.8% retracement at 3.919. This development, if realized, would exert additional broad based pressure on the greenback.

As for the week, Dollar remains the weakest performer, followed by Euro and Swiss Franc by a distance.

On the other hand, New Zealand Dollar emerged as the strongest performer, rallying significantly after RBNZ’s (RBNZ) hawkish hold. The central bank’s new economic projections suggest another rate hike in the first half of the next year.

Japanese Yen also gained strength, benefiting from the lower Treasury yields in the US and Europe and the ongoing expectations of a policy shift by BoJ away from negative interest rates.

Australian Dollar has shown resilience too, maintaining strength despite lower-than-expected CPI data. Sterling and Canadian Dollar exhibit mixed performance, however.

In Asia, at the time of writing, Nikkei is up 0.30%. Hong Kong HSI is down -1.84%. China Shanghai SSE is down -0.27%. Singapore Strait Times is up 0.46%. Japan 10-year JGB yield is down -0.052 at 0.703. Overnight, DOW rose 0.24%. S&P 500 rose 0.10%. NASDAQ rose 0.29%. 10-year yield fell -0.053 to 4.336.

RBNZ raises rate track, signaling additional rate hike

RBNZ decided to keep the Official Cash Rate steady at 5.50%, aligning with market expectations. However, a significant aspect of their announcement is the upward revision of their “rate track.”

According to the bank’s forecasts in the Monetary Policy Statement, OCR is expected to peak at 5.70% in Q2 of 2024 and maintain this level throughout the year. Looking ahead, RBNZ anticipates a rate cut in Q2 of 2025, bringing it down to 5.4%.

In the accompanying statement, RBNZ noted, “ongoing excess demand and inflationary pressures are of concern, given the elevated level of core inflation.”

RBNZ also emphasized its readiness to hike again. “If inflationary pressures were to be stronger than anticipated, the OCR would likely need to increase further.”

Moreover, RBNZ underlined the necessity of maintaining interest rates at a restrictive level for a sustained period, aiming at ensuring consumer price inflation returns to target level and to support maximum sustainable employment.

NZD/USD soars, AUD/NZD dives after RBNZ hawkish hold

New Zealand Dollar surges sharply after hawkish RBNZ holds, which hints at another rate hike in Q2 next year.

From a technical standpoint, NZD/USD’s rally from 0.5771 accelerates to as high as 0.6206 so far today. The development strengthen the case that whole corrective fall from 0.6537 (Feb high), has completed with three waves down to 0.5771 (Oct low).

Near term outlook will stay bullish as long as 0.6078 support holds. Next target is trend line resistance at around 0.6300. Sustained break there would pave the way through 0.6537 to resume the rise from 0.5511 (2022 low).

In gauging Kiwi’s strength, AUD/NZD is always a reference. Today’s sharp decline suggests that fall from 1.0942 is in progress. Near term outlook remains bearish as long as 1.0859 resistance holds, next target is 1.0620 support.

More importantly, it’s possible that the triangle consolidation pattern from 1.0469 (2022 low) has completed at 1.0942. Firm break of 1.0620 will argue that whole fall from 1.1489 (2022 high) is ready to resume through 1.0469 in the medium term.

Australia’s monthly CPI slowed to 4.9% in Oct, below exp 5.2%

Australia monthly CPI slowed from 5.6% you to 4.9% yoy in October, below expectation of 5.20%. Excluding volatile items and holiday travel, CPI slowed from 5.5% yoy to 5.1% yoy. Annual trimmed mean CPI also slowed from 5.4% yoy to 5.3% yoy.

The most significant contributors to the October annual increase were Housing (+6.1%), Food and non-alcoholic beverages (+5.3 per cent) and Transport (+5.9%).

BoJ’s Adachi: Not at a stage to discuss exit from ultra-loose policy

BoJ board member Seiji Adachi acknowledged that while there are early indications of a positive wage-inflation cycle emerging, these are not yet sufficient to consider exiting ultra-loose monetary policy.

He emphasized the importance of continuing with monetary easing approach, stating today, “For now, it’s appropriate to patiently continue with our monetary easing.”

Adachi specifically pointed out the challenges posed by China’s slowing growth and the potential impacts of aggressive US interest rate hikes, noting that these factors make it difficult to predict whether Japanese firms will substantially increase wages next year.

He also addressed the disparity in wage increase capabilities between large and small companies. While some big companies seem prepared to continue raising wages, many smaller firms, particularly in regional areas, are struggling to do so due to challenging business conditions.

He emphasized, “We’re not at a stage yet where we can discuss an exit” from ultra-loose policy.

Fed’s Waller increasingly confident that policy is well positioned

Fed Governor Christopher Waller, in his speech at the American Enterprise Institute think tank overnight, stated that inflation rates “moving along pretty much like” he expected and expressed increasing confidence in Fed’s policy’s effectiveness in slowing the economy and steering inflation back towards 2% target.

Waller’s confidence also extends to managing this economic slowdown without significantly impacting the unemployment rate, which currently stands at 3.9%.

Furthermore, Waller discussed the possibility of lowering the policy rate in the future, conditional on the continued decline of inflation.

He suggested that if the downward trend in inflation persists for several months – “three months, four months, five months” – Fed could consider “lowering the policy rate just because inflation is lower.”

This approach, he clarified, is not aimed at “trying to save the economy” but is consistent with established “policy rules”. Waller emphasized that there is no rationale for maintaining excessively high rates if inflation consistently decreases.

Fed’s Bowman still prepared for another rate hike

Fed Governor Michelle Bowman, in a speech overnight, noted that her baseline economic outlook anticipates the “need to increase the federal funds rate further”, to bring inflation down to 2% target in a “timely way”.

Bowman also mentioned her willingness to support a rate hike at a future meeting if data suggests that progress on inflation has stalled or is not sufficient.

Yet she added that “monetary policy is not on a preset course,” and she will continue to closely watch the incoming data.

Importantly, Bowman cautioned against “prematurely declaring victory in the fight against inflation”. She stressed the historical lessons and risks associated with such premature actions.

Fed’s Goolsbee on monetary policy: Pull out the turkey early for residual heat

Chicago Fed President Austan Goolsbee, in an interview with Marketplace overnight, expressed concerns about the risks of maintaining high interest rates for an extended period. Goolsbee emphasized the importance of adjusting the level of restrictiveness in monetary policy as the economy moves closer to inflation target.

He likened this to cooking a turkey, suggesting that just as a turkey should be removed from the oven before it’s fully done to account for “residual heat”, similarly, monetary policy should be eased before inflation hits the target to prevent overshooting.

Goolsbee noted that “once you believe that you are on the path to get inflation to target, then the amount of restrictiveness that you need to apply needs to be less.”

Additionally, Goolsbee highlighted the progress made in controlling inflation, particularly outside the food sector. He pointed out that inflation has been coming down, and although it hasn’t reached the target level yet, 2023 is on track to see the largest drop in the inflation rate in 71 years.

USD/JPY Daily Outlook

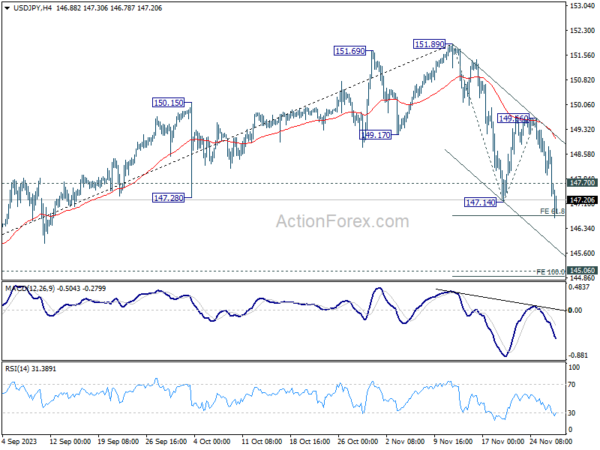

Daily Pivots: (S1) 146.92; (P) 147.87; (R1) 148.43; More…

USD/JPY’s decline continues today and break of 147.14 support confirms resumption of whole fall from 151.89. Intraday bias stays on the downside at this point. Sustained break of 61.8% projection of 151.89 to 147.14 from 149.66 at 146.72 will pave the way to 100% projection at 149.91, which is close to 145.06 key resistance turned support. On the upside, above 147.70 minor resistance will turn intraday bias neutral first. But risk will stay on the downside as long as 149.66 resistance holds.

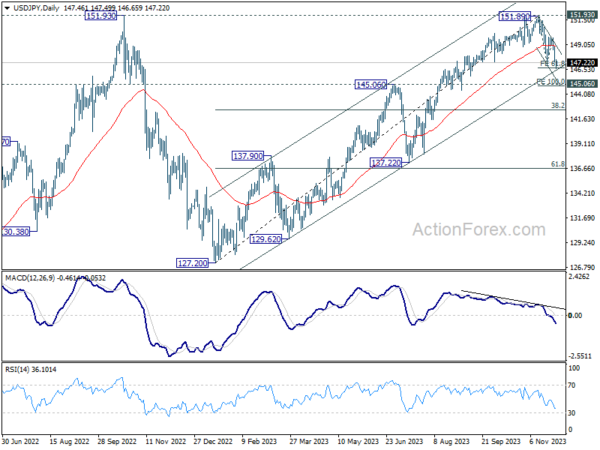

In the bigger picture, rise from 127.20 (2023 low) is seen as the second leg of the pattern from 151.93 (2022 high). Decisive break of 145.06 resistance turned support will confirm that this second leg has completed, after rejection by 151.93. Deeper fall would be seen through 38.2% retracement of 127.20 to 151.89 at 142.45 to 61.8% retracement at 136.63. Nevertheless strong bounce from 145.06 will retain medium term bullishness for another test on 151.93 at a later stage.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | Monthly CPI Y/Y Oct | 4.90% | 5.20% | 5.60% | |

| 01:00 | NZD | RBNZ Rate Decision | 5.50% | 5.50% | 5.50% | |

| 07:00 | EUR | Germany Import Price M/M Oct | 0.10% | 1.60% | ||

| 09:00 | CHF | Credit Suisse Economic Expectations Nov | -37.8 | |||

| 09:30 | GBP | M4 Money Supply M/M Oct | -0.20% | -1.10% | ||

| 09:30 | GBP | Mortgage Approvals Oct | 44K | 43K | ||

| 10:00 | EUR | Eurozone Economic Sentiment Indicator Nov | 93.7 | 93.3 | ||

| 10:00 | EUR | Eurozone Industrial Confidence Nov | -9.3 | |||

| 10:00 | EUR | Eurozone Services Sentiment Nov | 4.5 | |||

| 10:00 | EUR | Consumer Confidence Nov F | -16.9 | -16.9 | ||

| 13:00 | EUR | Germany CPI M/M Nov P | -0.10% | 0% | ||

| 13:00 | EUR | Germany CPI Y/Y Nov P | 3.50% | 3.80% | ||

| 13:30 | CAD | Current Account (CAD) Q3 | 0.7B | -6.6B | ||

| 13:30 | USD | GDP Annualized Q3 P | 5.00% | 4.90% | ||

| 13:30 | USD | GDP Price Index Q3 P | 3.50% | 3.50% | ||

| 13:30 | USD | Goods Trade Balance (USD) Oct P | -86.7B | -86.8B | ||

| 13:30 | USD | Wholesale Inventories Oct P | 0.10% | 0.20% | ||

| 15:30 | USD | Crude Oil Inventories | -0.1M | 8.7M | ||

| 19:00 | USD | Fed’s Beige Book |