Canadian Dollar is having a notable rebound in early US session, fueled by unexpectedly robust Canadian retail sales data. This data indicated a surprising resurgence in consumer spending, defying the constraints of high interest rates and ongoing inflation.

Despite this uplift, Loonie was overshadowed by New Zealand Dollar, which also saw a lift from its own country’s encouraging retail sales data. Similarly, British Pound is performing well, supported by improvement in UK consumer confidence.

Meanwhile, Japanese Yen is facing renewed pressure following a brief recovery after the release of Japan’s CPI data. Both Dollar and Euro are exhibiting some softness, while Swiss Franc and Aussie are mixed.

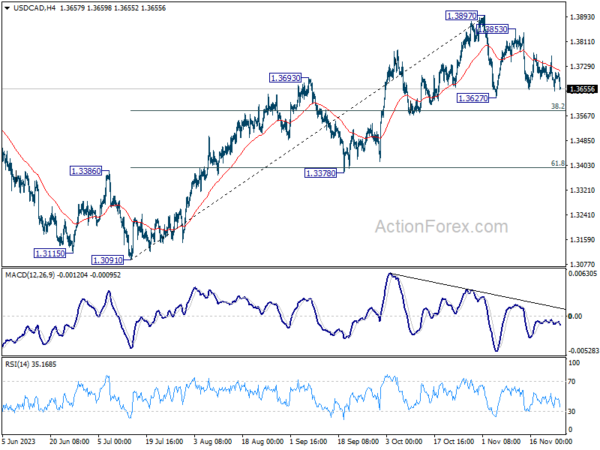

Technically, USD/CAD is possibly extending the third leg of the near term corrective pattern from 1.3897. Deeper fall could be seen to 1.3627 and possibly below. But downside should be contained by 38.2% retracement of 1.3091 to 1.3897 at 1.3589 to bring rebound. Hence, downside potential should be relatively limited based on current outlook.

In Europe, at the time of writing, FTSE is down -0.37%. DAX is up 0.03%. CAC is up 0.08%. Germany 10-year yield is up 0.0175 at 2.638. Earlier in Asia, Nikkei rose 0.52%. Hong Kong HSI fell -1.96%. China Shanghai SSE dropped -1.96%. Singapore Strait Times fell -0.54%. Japan 10-year JGB yield rose 0.0471 to 0.778.

Canada retail sales rose 0.6% mom in Sep, well above expectations

Retail sales in Canada rose 0.6% mom to CAD 66.5B in September, much better than expectation of 0.0% mom. Sales were up in four of nine subsectors and were led by increases at motor vehicle and parts dealers.

Core retail sales—which exclude gasoline stations and fuel vendors and motor vehicle and parts dealers—were down -0.3% mom.

In volume terms, retail sales increased 0.3% mom.

Retail sales were up 0.6% in Q3, while in volume terms, retail sales declined 0.5%.

Advance information suggests that sales rose 0.8% mom in October.

ECB’s Lagarde: We can now observe very attentively

ECB President Christine Lagarde, said at Bundesbank event today that the central bank has “already done a lot” in fighting inflation, referring to the series of rate hikes. Now, given the “amount of ammunition” being deployed, ECB is positioned to “observe very attentively”.

With observations on how tightening have impacted people’s economic life, ECB can decide, “how long we have to stay there and what decision we have to make — up or down, she added.

However, despite these efforts, Lagarde emphasized that “the battle is not over and we’re certainly not declaring victory.”

German Ifo business climate rose to 87.3, economy stabilizing

German Ifo Business Climate rose from 86.9 to 87.3 in November, slightly below expectation of 87.5. But that is still the third consecutive increase. Current Assessment index ticked up from 89.2 to 89.4, matched expectations. Expectations index also rose from 84.8 to 85.2, missed expectation of 85.7.

By sector, manufacturing rose from -15.7 to -13.5. Services fell from -1.5 to -2.5. Construction rose from -30.8 to -29.4. Trade rose from -27.3 to -22.2.

Ifo said: “The German economy is stabilizing, albeit at a low level.”

Japan’s CPI core rises to 2.9%, above BoJ target for 19th mth, services prices surge

Japan’s core CPI, which excludes fresh food prices, rose slightly from 2.8% yoy to 2.9% yoy in October, falling just below expected 3.0% yoy. Notably, this core CPI has stayed above BoJ’s target of 2% for the 19th consecutive month, indicating persistent inflationary pressures.

Headline CPI, which includes all items, accelerated from 3.0% yoy to 3.3% yoy. However, core-core CPI, which excludes both food and energy, showed a slight deceleration, dropping from 4.2% yoy to 4.0% yoy. Despite this decrease, core-core CPI has remained above 4.0% for seven consecutive months, highlighting sustained inflation in areas beyond just the volatile items.

Breaking down the details, energy prices saw a significant decrease of -8.5% yoy. In contrast, food prices continued to climb, recording a 7.6% yoy increase. Durable goods also experienced a price rise of 3.2% yoy. Notably, services prices surged by 2.1% yoy, marking the fastest gain since 1993. This sharp increase in services prices underscores the broadening of inflationary pressures within the Japanese economy.

Japan’s PMIs: Manufacturing contracts, services slightly improve

Japan’s PMI for November shows a continuing contraction in the manufacturing sector and a slight improvement in services.

Manufacturing PMI dropped from 48.7 to 48.1, falling below the expected 48.8 and marking another month below the crucial 50.0 threshold, which separates contraction from expansion. This ongoing contraction has been the trend since June.

Conversely, Services PMI saw a marginal increase, moving up from 51.6 to 51.7, indicating a slight expansion in this sector. However, Composite PMI, which combines both manufacturing and services, edged down from 50.5 to exactly 50.0, highlighting stagnation in overall private sector activity.

Usamah Bhatti, an economist at S&P Global Market Intelligenc said: “Activity at Japanese private sector firms stagnated midway through the fourth quarter of 2023.” This stagnation is further reflected in the demand conditions, which Bhatti noted remained “muted in November and were little-changed from October.”

New Zealand retail sales volume flat in Q3, value up 1.5% qoq

In New Zealand, Q3 2023 saw retail sales volumes remain unchanged at 0.0% qoq, defying expectations of a -0.8% decline.

However, a contrasting trend emerged in the sales value, which increased by 1.5% qoq, indicating a disparity between the number of goods sold and their monetary value.

On an annual basis, there was a -3.4% yoy decrease in sales volume, whereas sales value saw 1.1% yoy increase.

These divergences should be reflective of inflationary pressures and corresponding shift in consumer purchasing patterns.

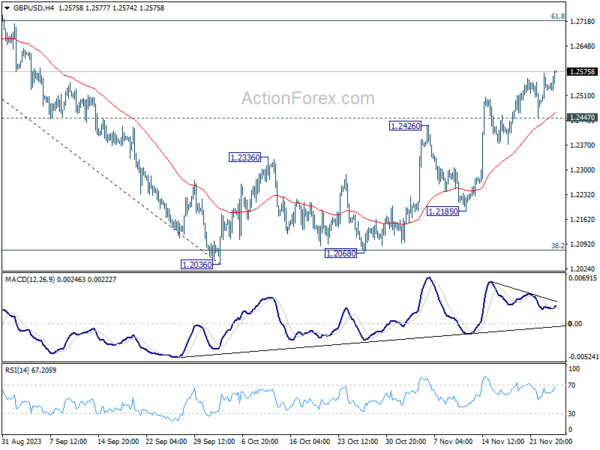

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2494; (P) 1.2529; (R1) 1.2568; More…

GBP/USD’s rally is still in progress and intraday bias stays on the upside. Current rise from 1.2036 should target 61.8% retracement of 1.3141 to 1.2036 at 1.2716 next. On the downside, though, below 1.2447 minor support will turn intraday bias again first, and bring lengthier consolidations.

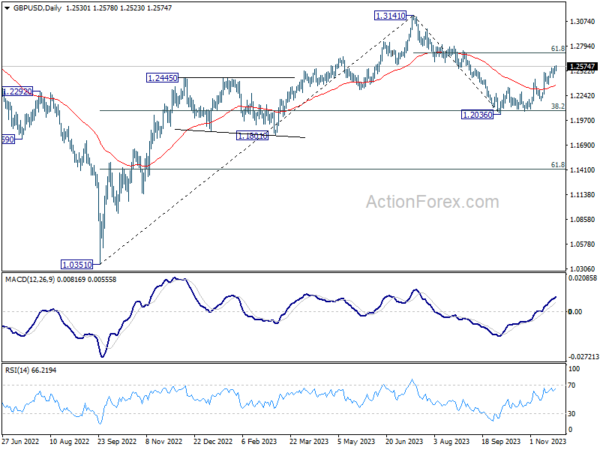

In the bigger picture, price actions from 1.3141 are seen as a corrective pattern to rise from 1.0351 (2022 low). Strong rebound from 38.2% retracement of 1.0351 (2022 low) to 1.3141 at 1.2075 argues that current rise from 1.2036 is the second leg. However, while further rally could be seen, upside should be limited by 1.3141 to bring the third leg of the pattern.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Retail Sales Q/Q Q3 | 0.00% | -0.80% | -1.00% | -0.90% |

| 21:45 | NZD | Retail Sales ex Autos Q/Q Q3 | 1.00% | -1.50% | -1.80% | -1.60% |

| 23:30 | JPY | National CPI Y/Y Oct | 3.30% | 3.00% | ||

| 23:30 | JPY | National CPI ex Fresh Food Y/Y Oct | 2.90% | 3.00% | 2.80% | |

| 23:30 | JPY | National CPI ex Food Energy Y/Y Oct | 4.00% | 4.20% | ||

| 00:01 | GBP | GfK Consumer Confidence Nov | -24 | -27 | -30 | |

| 00:30 | JPY | Manufacturing PMI Nov P | 48.1 | 48.8 | 48.7 | |

| 00:30 | JPY | Services PMI Nov P | 51.7 | 51.6 | ||

| 07:00 | EUR | Germany GDP Q/Q Q3 F | -0.10% | -0.10% | -0.10% | |

| 09:00 | EUR | Germany IFO Business Climate Nov | 87.3 | 87.5 | 86.9 | |

| 09:00 | EUR | Germany IFO Current Assessment Nov | 89.4 | 89.4 | 89.2 | |

| 09:00 | EUR | Germany IFO Expectations Nov | 85.2 | 85.7 | 84.7 | 84.8 |

| 13:30 | CAD | Retail Sales M/M Sep | 0.60% | 0.00% | -0.10% | |

| 13:30 | CAD | Retail Sales ex Autos M/M Sep | 0.20% | -0.30% | 0.10% | |

| 14:45 | USD | Manufacturing PMI Nov P | 49.8 | 50 | ||

| 14:45 | USD | Services PMI Nov P | 50.4 | 50.6 |