Trading activity is rather subdued in Asian session today, with most major currency pairs and crosses hovering within yesterday’s range.

Yen is showing a slight recovery, albeit in the context of mixed inflation and PMI data. While Japan’s core CPI remains persistently above BoJ’s target, the latest figures haven’t provided a strong impetus for the central bank to shift away from its negative interest rate policy or to alter its yield curve control strategy. BoJ officials have emphasized the importance of a sustainable wage-price spiral, and they are likely to await the results of wage negotiations early next year before making significant policy decisions.

Throughout the week, New Zealand Dollar has emerged as the strongest currency, additionally supported by much better than expected retail sales data released today. Australian Dollar and British Pound Sterling are following as the second and third strongest.

On the other end of the spectrum, Euro is the weakest, closely followed by Dollar. However, it’s worth noting that Euro’s current position appears to be more about consolidating recent gains against Dollar, and EUR/USD maintains near-term bullish outlook. A reversal in Euro and Dollar’s positions could occur once this consolidation phase concludes.

Yen, currently positioned as the third weakest, is in a phase of digesting its gains from the previous week. However, there is potential for Yen to ascend in the rankings before the week concludes. Canadian Dollar and Swiss Franc are displaying mixed performances.

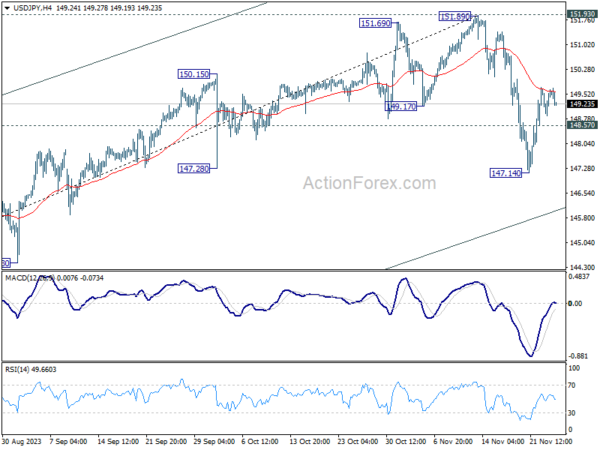

From technical analysis standpoint, USD/JPY’s recovery from 147.14 is so far still capped by 55 4H EMA. Fall from 151.89 is still in favor to continue, and break of 148.57 minor support will bring retest of 147.14 support first. However, sustained trading above the EMA will retain near term bullishness, and bring a test on 151.89 high. Market watchers will be looking to see if this scenario plays out this week or in the next.

In Asia, Nikkei closed up 0.55%. Hong Kong HSI is down -1.48%. China Shanghai SSE is down -0.63%. Singapore Strait Times is down -0.52%. Japan 10-year JGB yield is up 0.0431 at 0.774.

BoE’s Pill stresses persistence in inflation fight

In a Financial Times interview, BoE Chief Economist Huw Pill emphasized the need for the MPC to avoid prematurely “declaring victory” in the fight against inflation, noting that CPI is still considerably above BoE’s 2% target, currently at 4.6%.

Pill acknowledged UK’s economic slowdown, noting “slower growth in activity and employment.” However, he assessed that the current inflation scenario is “more supply-driven rather than demand-driven.” Weakening in economic activity is not necessarily leading to a reduction in inflationary pressures, as might typically be expected.

Analyzing recent economic indicators, Pill observed more evidence of “sort of stubborn, high-level rates of inflation” and and growth that are “stronger” than being compatible with 2% inflation over the medium term.

He also argued that if the slowdown in economic activities and employment growth is linked to a decline in the economy’s supply performance, rather than a drop in demand, it wouldn’t create the necessary slack to ease domestically generated inflation.

Japan’s CPI core rises to 2.9%, above BoJ target for 19th mth, services prices surge

Japan’s core CPI, which excludes fresh food prices, rose slightly from 2.8% yoy to 2.9% yoy in October, falling just below expected 3.0% yoy. Notably, this core CPI has stayed above BoJ’s target of 2% for the 19th consecutive month, indicating persistent inflationary pressures.

Headline CPI, which includes all items, accelerated from 3.0% yoy to 3.3% yoy. However, core-core CPI, which excludes both food and energy, showed a slight deceleration, dropping from 4.2% yoy to 4.0% yoy. Despite this decrease, core-core CPI has remained above 4.0% for seven consecutive months, highlighting sustained inflation in areas beyond just the volatile items.

Breaking down the details, energy prices saw a significant decrease of -8.5% yoy. In contrast, food prices continued to climb, recording a 7.6% yoy increase. Durable goods also experienced a price rise of 3.2% yoy. Notably, services prices surged by 2.1% yoy, marking the fastest gain since 1993. This sharp increase in services prices underscores the broadening of inflationary pressures within the Japanese economy.

Japan’s PMIs: Manufacturing contracts, services slightly improve

Japan’s PMI for November shows a continuing contraction in the manufacturing sector and a slight improvement in services.

Manufacturing PMI dropped from 48.7 to 48.1, falling below the expected 48.8 and marking another month below the crucial 50.0 threshold, which separates contraction from expansion. This ongoing contraction has been the trend since June.

Conversely, Services PMI saw a marginal increase, moving up from 51.6 to 51.7, indicating a slight expansion in this sector. However, Composite PMI, which combines both manufacturing and services, edged down from 50.5 to exactly 50.0, highlighting stagnation in overall private sector activity.

Usamah Bhatti, an economist at S&P Global Market Intelligenc said: “Activity at Japanese private sector firms stagnated midway through the fourth quarter of 2023.” This stagnation is further reflected in the demand conditions, which Bhatti noted remained “muted in November and were little-changed from October.”

New Zealand retail sales volume flat in Q3, value up 1.5% qoq

In New Zealand, Q3 2023 saw retail sales volumes remain unchanged at 0.0% qoq, defying expectations of a -0.8% decline.

However, a contrasting trend emerged in the sales value, which increased by 1.5% qoq, indicating a disparity between the number of goods sold and their monetary value.

On an annual basis, there was a -3.4% yoy decrease in sales volume, whereas sales value saw 1.1% yoy increase.

These divergences should be reflective of inflationary pressures and corresponding shift in consumer purchasing patterns.

Looking ahead

Germany Q3 GDP final and Ifo business climate will be released in European session. Later in the day, Canada retail sales and US PMIs will be featured.

EUR/JPY Daily Outlook

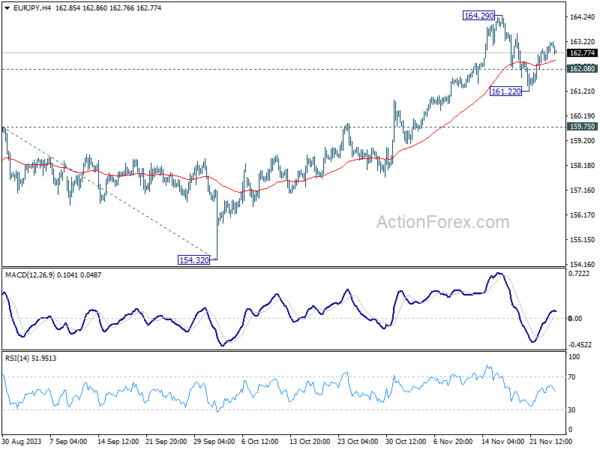

Daily Pivots: (S1) 162.63; (P) 162.91; (R1) 163.38; More….

With 162.08 minor support intact, EUR/JPY’s rebound from 161.22 could extend further to retest 164.29 high. Firm break there will resume larger up trend. On the downside, however, break of 162.08 will turn bias back to the downside, to resume the fall from 164.29 through 161.22 towards 159.75 resistance turned support.

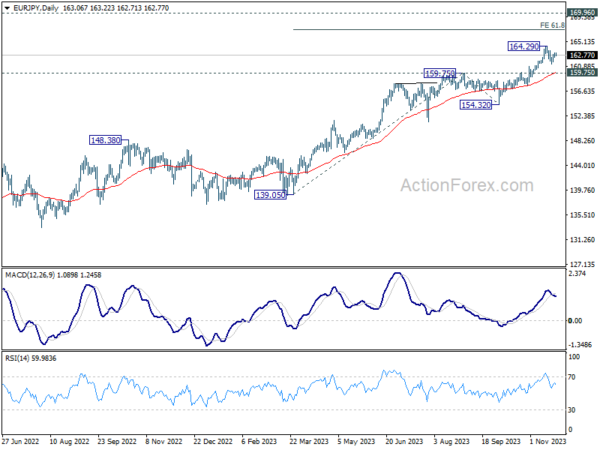

In the bigger picture, rise from 114.42 (2020 low) is in progress. Next target is 169.96 (2008 high). On the downside, break of 159.75 resistance turned support is needed to be the first sign of medium term topping. Otherwise, outlook will remain bullish even in case of deep pullback.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Retail Sales Q/Q Q3 | 0.00% | -0.80% | -1.00% | -0.90% |

| 21:45 | NZD | Retail Sales ex Autos Q/Q Q3 | 1.00% | -1.50% | -1.80% | -1.60% |

| 23:30 | JPY | National CPI Y/Y Oct | 3.30% | 3.00% | ||

| 23:30 | JPY | National CPI ex Fresh Food Y/Y Oct | 2.90% | 3.00% | 2.80% | |

| 23:30 | JPY | National CPI ex Food Energy Y/Y Oct | 4.00% | 4.20% | ||

| 00:01 | GBP | GfK Consumer Confidence Nov | -24 | -27 | -30 | |

| 00:30 | JPY | Manufacturing PMI Nov P | 48.1 | 48.8 | 48.7 | |

| 00:30 | JPY | Services PMI Nov P | 51.7 | 51.6 | ||

| 07:00 | EUR | Germany GDP Q/Q Q3 F | -0.10% | -0.10% | ||

| 09:00 | EUR | Germany IFO Business Climate Nov | 87.5 | 86.9 | ||

| 09:00 | EUR | Germany IFO Current Assessment Nov | 89.4 | 89.2 | ||

| 09:00 | EUR | Germany IFO Expectations Nov | 85.7 | 84.7 | ||

| 13:30 | CAD | Retail Sales M/M Sep | 0.00% | -0.10% | ||

| 13:30 | CAD | Retail Sales ex Autos M/M Sep | -0.30% | 0.10% | ||

| 14:45 | USD | Manufacturing PMI Nov P | 49.8 | 50 | ||

| 14:45 | USD | Services PMI Nov P | 50.4 | 50.6 |