PMI data are the main drivers in the forex markets today, particularly lifting Sterling and, to some degree, Euro to higher positions. The bounce in Sterling is chiefly attributed to UK services sector bouncing back into expansion territory, a sign of economic resilience. Additionally, the severity of manufacturing recession in UK seems to be diminishing, offering further support to the currency.

Eurozone has also witnessed a slight improvement in its PMI data, with Germany showing relatively more substantial progress. Despite these positive developments, both UK and Eurozone continue to grapple with the looming risks of recession and noticeable increase in inflation pressures.

In other market areas, there is a prevailing sense of consolidation. Canadian Dollar, despite being the weakest performer of the day, is showing resilience by staying above the previous day’s low against major currencies. Swiss Franc, ranking as the second weakest, appears to be impacted by the relative strength of Euro and Sterling. Dollar, ranking as the third weakest for the day, exhibits vulnerability to further declines.

On the stronger side of the market, Australian and New Zealand Dollars are performing well, following closely behind Sterling as the second and third strongest currencies. Euro, while experiencing gains, is not leading the pack.

Technically, GBP/USD is taking the lead by breaching 1.2557 temporary top to resume its near term rally. Focuses are now on 1.0964 resistance in EUR/USD, 0.6588 resistance in AUD/USD, and 0.8818 support in USD/CHF. Simultaneous break of these levels should confirm that Dollar selling is back. a

In Europe, at the time of writing, FTSE is down -0.05%. DAX is up 0.19%. CAC is up 0.23%. Germany 10-year yield is up 0.035 at 2.602. Earlier in Asia, Japan was on holiday. Hong Kong HSI rose 0.99%. China Shanghai SSE rose 0.60%. Singapore Strait Times dropped -0.10%.

UK PMI composite rose to 50.1, but recession risks and inflation concerns linger

UK PMI data for November reflects a significant improvement in economic activity. Manufacturing PMI rose from 44.8 to a six-month high of 46.7, exceeding the anticipated 45.0. Services PMI increased from 49.5 to a four-month high of 50.5, signaling a return to expansion and surpassing expectations of 49.5. Composite PMI, which amalgamates both sectors, also achieved a four-month high at 50.1, up from 48.7.

Tim Moore, Economics Director at S&P Global Market Intelligence, observed that the UK economy showed signs of stabilization. He noted, “The service sector arrested a three-month sequence of decline and manufacturers began to report less severe cutbacks to production schedules.” Moore attributed this recovery in part to a halt in interest rate hikes and a decrease in headline inflation rates. However, he cautioned that the data indicates a likely flat trend for GDP in Q4 2023.

Despite the uptick in PMI figures, Moore highlighted continuing recession risks. He pointed out that new order volumes decreased for the fifth consecutive month, reflecting limited sales opportunities. Additionally, business activity expectations remained low, close to October’s recent nadir, and significantly weaker compared to earlier in the year.

Inflation concerns are also evident, especially in the service sector. Moore mentioned that input cost pressures have risen for the first time in four months, with service providers particularly impacted by the need to pass increased staff costs onto customers.

ECB accounts: All agree to hold, yet open to further hike

ECB’s October meeting accounts reveal a consensus among “all members” to maintain the three key ECB interest rates unchanged. This decision reflects a shared confidence that current monetary stance was “sufficiently restrictive” for allowing the governing council to assess the “inflation outlook”, “dynamics of underlying inflation”, and “strength of monetary policy transmission”.

The minutes also noted a shift in market expectations, indicating that policy rates are anticipated to remain high for a longer period than previously predicted. Market expectations are transitioning from a “hump-shaped” interest rate path, typically recommended by macroeconomic models, to a “flatter” profile with a delayed first cut in the deposit facility rate.

A key point of discussion was the importance of avoiding an unwarranted loosening of financial conditions. In line with this, some members argued for “keeping the door open for a possible further rate hike”, emphasizing the commitment to data-dependence in its decision-making process.

In conclusion, ECB emphasized the need to remain “both persistent and vigilant.”

Eurozone PMI composite rose to 47.1, technical recession ongoing

Eurozone’s PMI data for November shows marginal improvement but continues to indicate broader recessionary trends. Manufacturing PMI increased slightly from 43.1 to a six-month high of 43.8, exceeding expectations of 43.4. Similarly, Services PMI rose from 47.8 to 48.2, marginally above the predicted 48.0. Consequently, Composite PMI, which combines both sectors, climbed from 46.5 to 47.1.

Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, summarized the situation as, “The Eurozone economy is stuck in the mud.” Their nowcast model suggests the likelihood of a second consecutive quarter of GDP contraction, meeting the technical criteria for a recession.

Inflation remains a significant issue, particularly in the services sector, where price increases have accelerated due to “astonishingly rapid and even accelerating” rising input costs. De la Rubia attributes these cost increases primarily to higher wages.

The employment situation is also expected to worsen. Initially impacting industrial sector jobs, the economic downturn is poised to affect employment in services sector as well. This could lead to an uptick in Eurozone’s unemployment rate, which has so far been relatively stable.

Region-specific dynamics show contrasting trends within Eurozone. Germany’s composite index has improved, signaling some positive movement, whereas France continues to show a weakening trend. De la Rubia also points out the challenges faced by Germany, particularly in public investments due to restrictions imposed by the constitutional court’s debt brake, which relegate Germany’s economy “to the back seat in 2024”.

Germany PMI Manufacturing rose from 40.8 to 42.3 in November, a 6-month high. PMI Services rose from 48.2 to 48.7. PMI COmposite rose from 45.9 to 47.1, a 4-month high.

France PMI Manufacturing fell from 42.8 to 42.6 in November, a 42-month low. PMI Services ticked up from 45.2 to 45.3. PMI Composite ticked down from 44.6 to 44.5.

Australia PMI composite fell to 27-mth low at 46.4, but no real signs of hard landing

Australia’s manufacturing and services sectors showed continued contraction in November, reaching multi-month lows. PMI Manufacturing index fell from 48.2 to a 42-month low of 47.7, while PMI Services index dropped from 47.9 to a 26-month low of 46.3. PMI Composite also decreased from 47.6 to a 27-month low of 46.4.

Warren Hogan, Chief Economic Advisor at Judo Bank, interpreted these figures as evidence of a further slowdown in Australian economic activity. He commented that the data “all but confirms that the economy is experiencing a soft landing,” aligning with RBA’s expectations. However, Hogan also noted that there are “no real signs of a hard landing” in the survey, indicating a more controlled economic deceleration.

Despite the overall softness in manufacturing, Hogan observed that the sector “does not appear to be slipping into recession” at this stage. Additionally, an improvement in the employment index in the services sector was seen as indicative of “continued strong demand for labour.” This sustained high demand for labour, despite lower activity indexes, points to a persistent imbalance between labour demand and supply.

For RBA, the slowdown in business activity is a welcome development. Still, the strong employment index and an increase in price indexes signal ongoing inflation risks into 2024.

Hogan cautions that it is “still too early to think about rate cuts” in Australia.

GBP/USD Mid-Day Outlook

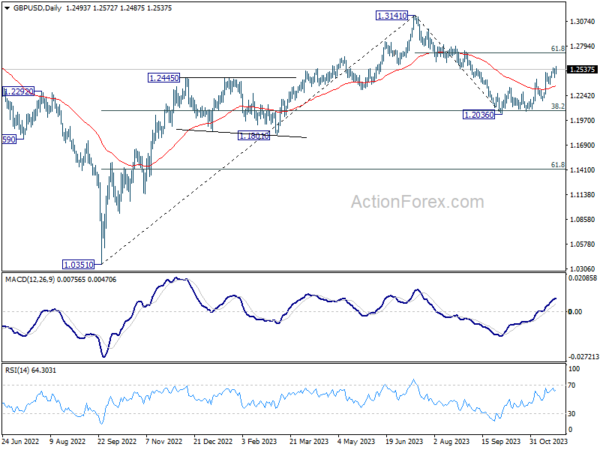

Daily Pivots: (S1) 1.2445; (P) 1.2498; (R1) 1.2546; More…

Intraday bias in GBP/USD is back on the upside with break of 1.2557 temporary top. Rise from 1.2036 is resuming for 61.8% retracement of 1.3141 to 1.2036 at 1.2716 next. On the downside, though, below 1.2447 minor support will turn intraday bias again first, and probably bring lengthier consolidations.

In the bigger picture, price actions from 1.3141 are seen as a corrective pattern to rise from 1.0351 (2022 low). Strong rebound from 38.2% retracement of 1.0351 (2022 low) to 1.3141 at 1.2075 argues that current rise from 1.2036 is the second leg. However, while further rally could be seen, upside should be limited by 1.3141 to bring the third leg of the pattern.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:00 | AUD | Manufacturing PMI Nov P | 47.7 | 48.2 | ||

| 22:00 | AUD | Services PMI Nov P | 46.3 | 47.9 | ||

| 08:15 | EUR | France Manufacturing PMI Nov P | 42.6 | 43.2 | 42.8 | |

| 08:15 | EUR | France Services PMI Nov P | 45.3 | 45.7 | 45.2 | |

| 08:30 | EUR | Germany Manufacturing PMI Nov P | 42.3 | 41.3 | 40.8 | |

| 08:30 | EUR | Germany Services PMI Nov P | 48.7 | 48.5 | 48.2 | |

| 09:00 | EUR | Eurozone Manufacturing PMI Nov P | 43.8 | 43.4 | 43.1 | |

| 09:00 | EUR | Eurozone Services PMI Nov P | 48.2 | 48 | 47.8 | |

| 09:30 | GBP | Manufacturing PMI Nov P | 46.7 | 45 | 44.8 | |

| 09:30 | GBP | Services PMI Nov P | 50.5 | 49.5 | 49.5 | |

| 12:30 | EUR | ECB Meeting Accounts |