Euro drops sharply after ECB announced the tapering plan as the markets expected. But traders seem to be unhappy with the cautious tone in the statement. Meanwhile, Dollar remains generally firm, as supported by solid job data. Also, markets are getting more convinced that either Powell or Taylor will be taken as the next Fed chair. Elsewhere, Canadian and Australian Dollar are both trying to recovery yesterday’s losses. But not much strength is seen against Dollar yet.

ECB halves asset purchase, extends 9 months

ECB left main refinancing rate unchanged at 0.00% as widely expected. The marginal lending facility rate and deposit facility rate are held at 0.25% and -0.40% respectively. The key in the announcement is that starting January 2018, the next asset purchases will be halved to EUR 30B a month, down from current EUR 60B a month. The asset purchase program will be extended by nine months until end of September 2018, or beyond.

ECB left the options open for itself and noted that "if the outlook becomes less favorable, or if financial conditions become inconsistent with further progress towards a sustained adjustment in the path of inflation, the Governing Council stands ready to increase the APP in terms of size and/or duration."

Euro dives after the release. While the halving of the size and 9 months of extensions are in line with expectation, traders seem to be unhappy with the cautious tone in the accompanying statement.

House to vote on budget plan

In US, the House is set to vote on the Senate’s version of budget plan today, to pave way for finishing the tax plan by year end. This will be closely watched as some House Republicans vowed to vote against it. They believe that the plan that eliminate state and local income taxes deduction would hit middle-class votes in regions like New York, New Jersey and California.

Regarding US President Donald Trump’s decisions on who to succeed Janet Yellen as Fed chair, it’s reported that decisions will be made very soon. White House advisor Gary Cohn was out of the race as he’s central to the tax plan. Former Fed Governor Kevin Warsh was also eliminated. Latest news say that Yellen is finally out. That leaves current Fed Governor Jerome Powell and Stanford University economist John Taylor as front runners. And a regularly cited option is for both of them to take the chair and vice place.

Jobless claims rose to 233k, continuing claims hit lowest since 1973

Initial jobless claims rose 10K to 233K in the week ended October 21, slightly below expectation of 236K. The four week moving average dropped to 239.5K, down from 248.5K. Continuing claims dropped -3K to 1.89M in the week ended October 14, lowest since December 1973. Also from US, trade deficit widened slightly to USD -64.1B in September, versus consensus of USD -63.8B.

Release earlier today

Eurozone M3 rose 5.1% yoy in September, above expectation of 4.0% yoy. German Gfk consumer sentiment dropped 0.1 to 10.7 in November. UK CBI reported sales dropped to -36 in October. New Zealand trade deficit narrowed slightly to NZD 1143M in September. Australia import price index dropped -1.6% qoq in Q3. Japan corporate service price index rose 0.9% yoy in September.

EUR/USD Mid-Day Outlook

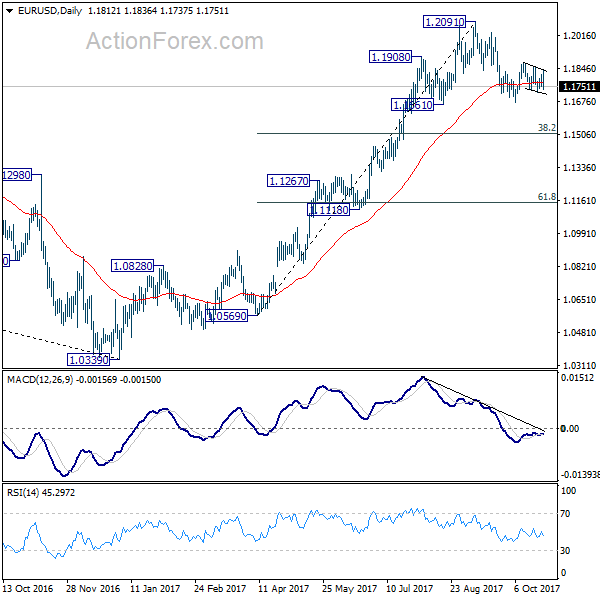

Daily Pivots: (S1) 1.1770; (P) 1.1794 (R1) 1.1835; More…

EUR/USD drops sharply after ECB announcement. But it’s staying in range of 1.1669/1879 and intraday bias remains neutral at this point. On the downside, break of 1.1669 will resume the corrective fall from 1.2091 to 38.2% retracement of 1.0569 to 1.2091 at 1.1510. We’d expect strong support from there to complete the correction. On the upside, break of 1.1879 will revive the case that pull back from 1.2091 has already completed at 1.1669. In such case, intraday bias will be turned back to the upside for retesting 1.2091 high.

In the bigger picture, rise from medium term bottom at 1.0339 is not finished yet. It’s expected to continue after pull back from 1.2091 completes. And, next target will be 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516. However, it should be noted that there is no confirmation of trend reversal yet. That is, such rebound from 1.0399 could be a correction. And the long term fall from 1.6039 (2008 high) could resume. Hence, we’d be cautious on strong resistance from 1.2516 to limit upside.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Trade Balance (NZD) Sep | -1143M | -900M | -1235M | -1179M |

| 23:50 | JPY | Corporate Service Price Y/Y Sep | 0.90% | 0.80% | 0.80% | |

| 00:30 | AUD | Import Price Index Q/Q Q3 | -1.60% | -1.50% | -0.10% | |

| 06:00 | EUR | German GfK Consumer Confidence Nov | 10.7 | 10.8 | 10.8 | |

| 08:00 | EUR | Eurozone M3 Y/Y Sep | 5.10% | 5.00% | 5.00% | |

| 10:00 | GBP | CBI Realized Sales Oct | -36 | 14 | 42 | |

| 11:45 | EUR | ECB Rate Decision | 0.00% | 0.00% | 0.00% | |

| 12:30 | EUR | ECB Press Conference | ||||

| 12:30 | USD | Wholesale Inventories Sep P | 0.30% | 0.40% | 0.90% | 0.80% |

| 12:30 | USD | Initial Jobless Claims (OCT 21) | 233K | 236K | 222K | 223K |

| 12:30 | USD | Advance Goods Trade Balance (USD) Sep | -64.1B | -63.8B | -62.9B | -63.3B |

| 14:00 | USD | Pending Home Sales M/M Sep | 0.60% | -2.60% | ||

| 14:30 | USD | Natural Gas Storage | 51B |